Unified State Register of Individual Entrepreneurs (EGRIP). data from the Federal Tax Service of Russia. Egrip (unified state register of individual entrepreneurs) Information on individual entrepreneurs

The Privacy Policy (hereinafter referred to as the Policy) was developed in accordance with the Federal Law of July 27, 2006. No. 152-FZ “On Personal Data” (hereinafter referred to as FZ-152). This Policy defines the procedure for processing personal data and measures to ensure the security of personal data in the vipiska-nalog.com service (hereinafter referred to as the Operator) in order to protect the rights and freedoms of humans and citizens when processing their personal data, including the protection of rights to privacy , personal and family secrets. In accordance with the law, the vipiska-nalog.com service is for informational purposes and does not oblige the visitor to make payments or other actions without his consent. The collection of data is necessary solely to communicate with the visitor at his request and inform him about the services of the vipiska-nalog.com service.

The main provisions of our privacy policy can be formulated as follows:

We do not share your personal information with third parties. We do not transfer your contact information to the sales department without your consent. You independently determine the amount of personal information disclosed.

Information collected

We collect personal information that you have knowingly agreed to disclose to us in order to obtain detailed information about the company's services. Personal information comes to us by filling out a form on the website vipiska-nalog.com. In order to receive detailed information about services, costs and types of payments, you need to provide us with your address Email, name (real or fictitious) and telephone number. This information is provided by you voluntarily and we do not verify its accuracy in any way.

Use of the information received

The information you provide when filling out the questionnaire is processed only at the time of the request and is not saved. We use this information only to send you the information you signed up for.

Providing information to third parties

We take protecting your privacy very seriously. We will never provide your personal information to third parties, except in cases where this may be directly required by Russian legislation (for example, at the request of a court). All contact information you provide to us is disclosed only with your permission. Email addresses are never published on the Site and are used by us only to communicate with you.

Data protection

The Site Administration protects information provided by users and uses it only in accordance with the accepted Privacy Policy on the Site.

All information about entrepreneurs, about their progress economic activity stored in a single database.

This base is called Unified State Register of Individual Entrepreneurs .Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

What is its purpose

The Unified State Register of Individual Entrepreneurs (USRIP) is a unified database that stores all the basic information about individual entrepreneurs.

The registration, re-registration or liquidation of an individual entrepreneur is recorded here.

EGRIP - federal information resource, which is the property of the state.

The Unified State Register of Individual Entrepreneurs contains information that:

- an individual has registered as an individual entrepreneur;

- there have been some changes in the data that were entered during the registration of individual entrepreneurs;

- The IP was liquidated.

The Unified State Register of Individual Entrepreneurs also contains information about the individual who was registered as an individual entrepreneur:

- date of birth and age;

- address of permanent registration;

- passport details.

When registering as an individual entrepreneur, a citizen receives a registration certificate. The details of this certificate are also in the unified register.

In addition, if the activities of an individual entrepreneur require additional permitting documents or licenses, information about these documents is also available in the Unified State Register of Individual Entrepreneurs.

Regulatory regulations

The regulatory framework for individual entrepreneurs does not have a single document, and is included in other laws and regulations.

Therefore, entering information into the unified register is carried out on the basis.

Register of individual entrepreneurs of the Russian Federation

All changes that occur to the individual entrepreneur are also recorded in the registry.

As an individual registered as an individual entrepreneur in the register of certificates of state registration The IP contains the following information:

- Date of Birth;

- permanent registration address;

- passport details;

- citizenship - Russian Federation or another country;

- details of the document confirming the right of this citizen to reside in our country, if the individual entrepreneur is a foreigner.

As a subject of economic activity, an individual entrepreneur contains the following information:

- information about the state registration of individual entrepreneurs - the number of the registration certificate and the date of its issue;

- all details of various permits and licenses;

- about a bank account;

- date of registration of individual entrepreneurs in various funds - Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund;

- date of registration with the tax authority, if the individual entrepreneur uses a preferential tax regime;

- OKVED codes;

- about the changes that have occurred with the individual entrepreneur;

For example, when changing the surname of an individual.

- on the liquidation of an individual entrepreneur as a business entity.

Video: how to get an extract

Where does this information come from in the Unified State Register of Entrepreneurs?

All information contained in the Unified State Register of Individual Entrepreneurs comes from the tax service.

Tax authorities have all the data indicated in the register, since the individual entrepreneur is obliged to provide this information. Without them, registration of an individual entrepreneur or its further activities is impossible.

The exception is the details of permits and licenses. The entrepreneur does not need to independently bring copies of licenses for the Unified State Register of Entrepreneurs. This responsibility rests with the licensing authority.

During 5 days from the moment an individual entrepreneur receives a license for a particular activity, the licensing authority is obliged to submit this information to the Unified State Register of Individual Entrepreneurs. Exactly the same actions must be taken by the licensing authority if the individual entrepreneur’s license has been revoked.

deadline for updating information in the registry

If the individual entrepreneur does not change his passport data, residence address or type of activity, then there is no need to update the information in the register.

As soon as an individual entrepreneur needs to change something, he contacts the tax office where he is registered and submits new information. Entry into the Unified State Register of Entrepreneurs requires a change of citizenship of the entrepreneur, as well as a change or addition of a new type of activity.

To do this, within 3 working days after the change, the individual entrepreneur applies to the tax office with a package of documents, which includes:

- application for amendments to the unified register in the form;

- documents that confirm these changes;

- document confirming payment of the state fee.

During 5 working days After submitting the documents, the information in the Unified State Register of Individual Entrepreneurs will be updated, and the individual entrepreneur will receive a corresponding notification about this.

Provision of information

Sometimes it is necessary to obtain information about a particular entrepreneur. Most often, a request to the Unified State Register of Individual Entrepreneurs is made in order to make sure that this individual entrepreneur is actually carrying out its activities and has not been liquidated.

request for information about IP

An example of a completed receipt for payment of a duty by a legal entity can be seen in the appendix to this article.

restrictions

But not all the information contained in the Unified State Register of Individual Entrepreneurs can be obtained upon request.

Personal information about an individual who is registered as an individual entrepreneur is not covered.

That is, in the Unified State Register of Enterprises you cannot find out:

- IP passport details;

- his place of residence;

- other personal data that may be contained in registration documents.

But if constituent documents Individual entrepreneurs contain this information, then the Unified State Register of Entrepreneurs will issue it to the person who requests the certificate.

service cost

The cost of issuing USRIP information is not free. If the applicant wishes to obtain an extract for himself, then he will not be charged a fee for this service.

When requesting information about a counterparty, the cost of the service will be equal to 200 rubles. Request is being processed 5 working days, and only then the applicant receives the necessary certificate.

If we are talking about an urgent extract from the Unified State Register of Individual Entrepreneurs, the cost of the service will increase by 2 times. The applicant will have to pay 400 rubles, but the document will be ready the next business day.

is it possible to get it for free

You can receive a free extract if the applicant orders information about himself.

To do this, you also need to make a request, but you will need to present your passport to the tax officer to confirm your identity. A copy of your passport will need to be attached to your request.

You can also receive information from the registry for free:

- police;

- investigative authorities;

- prosecutor's office;

- other government bodies;

- tax office;

- off-budget funds.

An individual entrepreneur can also find out for free who requested information about him from the registry.

You will read about the procedure for switching to a single tax on imputed income when opening an enterprise in this article:

The procedure for choosing a taxation system when registering an individual entrepreneur is described in detail

You will find out how individual entrepreneurs register with the State Statistics Service

Request via Internet

You can request information about individual entrepreneurs from the registry using the Internet. This can be done at Federal Tax Service website. To do this you need to register on it.

The login on this site is the TIN of an individual or legal entity. But the password must be obtained from the tax office at the place of registration of the citizen or at the place of registration of the legal entity.

The application is also filled out on the website, the fee is paid using the Internet service.

When all documents are ready, the request must be sent. In this case, information about the individual entrepreneur is obtained from the TIN of this entrepreneur, if it is known.

Individual entrepreneur (IP)(obsolete private entrepreneur (PE), PBOYUL until 2005) is an individual registered as an entrepreneur without forming a legal entity, but in fact possessing many of the rights of legal entities. The rules of the civil code regulating the activities of legal entities apply to individual entrepreneurs, except in cases where separate articles of laws or legal acts are prescribed for entrepreneurs.()

Due to some legal restrictions (it is impossible to appoint full-fledged directors to branches in the first place), an individual entrepreneur is almost always a micro-business or small business.

according to the Code of Administrative Offenses

Fine from 500 to 2000 rubles

At gross violations or when working without a license - up to 8,000 rubles. And, it is possible to suspend activities for up to 90 days.

From RUB 0.9 million for three years, and the amount of arrears exceeds 10 percent of the tax payable;

From 2.7 million rubles.

Fine from 100 thousand to 300 thousand rubles. or in the amount of the culprit’s salary for 1-2 years;

Forced labor for up to 2 years);

Arrest for up to 6 months;

Imprisonment for up to 1 year

If the individual entrepreneur fully pays the amounts of arrears (taxes) and penalties, as well as the amount of the fine, then he is exempt from criminal prosecution (but only if this is his first such charge) (Article 198, paragraph 3 of the Criminal Code)

Evasion of taxes (fees) on an especially large scale (Article 198, paragraph 2. (b) of the Criminal Code)

From 4.5 million rubles. for three years, and the amount of arrears exceeds 20 percent of the tax payable;

From 30.5 million rubles.

Fine from 200 thousand to 500 thousand rubles. or in the amount of the culprit’s salary for 1.5-3 years;

Forced labor for up to 3 years;

Imprisonment for up to 3 years

Fine

If the amounts for criminal prosecution are not reached, then there will only be a fine.

Non-payment or incomplete payment of taxes (fees)

1. Non-payment or incomplete payment of tax (fee) amounts as a result of understatement tax base, other incorrect calculation of a tax (fee) or other unlawful actions (inaction) entail a fine in the amount of 20 percent of the unpaid amount of tax (fee).

3. The acts provided for in paragraph 1 of this article, committed intentionally, entail a fine in the amount of 40 percent of the unpaid amount of tax (fee). (Article 122 of the Tax Code)

Penalty

If you were just late in payment (but did not provide false information), then there will be penalties.

The penalties for everyone are the same (1/300 multiplied by the key rate of the Central Bank per day of the amount of non-payment) and now amount to about 10% per annum (which is not very much in my opinion, taking into account the fact that banks give loans for at least 17-20 %). You can count them.

Licenses

Some types of activities an individual entrepreneur can only engage in after receiving a license, or permissions. To licensed types of activities individual entrepreneurs include: pharmaceutical, private investigation, transportation of goods and passengers by rail, sea, air, as well as others.

An individual entrepreneur cannot engage in closed types of activities. These types of activities include the development and/or sale of military products, trafficking in narcotic drugs, poisons, etc. Since 2006, production and sale have also been prohibited. alcoholic products. An individual entrepreneur cannot engage in: alcohol production, wholesale and retail trade alcohol (except for beer and beer-containing products); insurance (i.e. be an insurer); activities of banks, investment funds, non-state pension funds and pawnshops; tour operator activities (travel agency is possible); production and repair of aviation and military equipment, ammunition, pyrotechnics; production of medicines (sales possible) and some others.

Differences from legal entities

- The state fee for registering individual entrepreneurs is 5 times less. In general, the registration procedure is much simpler and fewer documents are required.

- An individual entrepreneur does not need a charter and authorized capital, but he is liable for his obligations with all his property.

- An entrepreneur is not an organization. It is impossible for an individual entrepreneur to appoint a full and responsible director.

- Individual entrepreneurs do not have cash discipline and can manage the funds in the account as they please. Also, the entrepreneur makes business decisions without recording them. This does not apply to working with cash registers and BSO.

- An individual entrepreneur registers a business only in his name, in contrast to legal entities, where registration of two or more founders is possible. Individual entrepreneurship cannot be sold or re-registered.

- U employee An individual entrepreneur has fewer rights than a mercenary in an organization. And although the Labor Code equates organizations and entrepreneurs in almost all respects, there are still exceptions. For example, when an organization is liquidated, the mercenary is required to pay compensation. When closing an individual entrepreneur, such an obligation exists only if it is specified in the employment contract.

Appointment of director

It is legally impossible to appoint a director in an individual entrepreneur. The individual entrepreneur will always be the main manager. However, you can issue a power of attorney to conclude transactions (clause 1 of Article 182 of the Civil Code of the Russian Federation). Since July 1, 2014, it has been legislatively established for individual entrepreneurs to transfer the right to sign an invoice to third parties. Declarations could always be submitted through representatives.

All this, however, does not make the people to whom certain powers are delegated directors. For directors of organizations, a large the legislative framework about rights and responsibilities. In the case of an individual entrepreneur, one way or another, he himself is responsible under the contract, and with all his property he himself is responsible for any other actions of third parties by proxy. Therefore, issuing such powers of attorney is risky.

Registration

State registration of an individual entrepreneur carried out by the Federal Tax Service of the Russian Federation. The entrepreneur is registered with the district tax office at the place of registration, in Moscow - MI Federal Tax Service of the Russian Federation No. 46 for Moscow.

Individual entrepreneurs can be

- adult, capable citizens of the Russian Federation

- minor citizens of the Russian Federation (from 16 years of age, with the consent of parents, guardians; married; a court or guardianship authority has made a decision on legal capacity)

- foreign citizens living in the Russian Federation

OKVED codes for individual entrepreneurs are the same as for legal entities

Necessary documents for registration of an individual entrepreneur:

- Application for state registration of an individual entrepreneur (1 copy). Sheet B of form P21001 must be filled out by the tax office and given to you.

- A copy of the Taxpayer Identification Number.

- A copy of your passport with registration on one page.

- Receipt for payment of the state fee for registration of an individual entrepreneur (800 rubles).

- Application for switching to the simplified tax system (If you need to switch).

An application for registration of individual entrepreneurs and other documents can be prepared online in a free service.

Within 5 days you will be registered as an individual entrepreneur or you will receive a refusal.

You must be given the following documents:

1) Certificate of state registration of an individual as an individual entrepreneur (OGRN IP)

2) Extract from the Unified State Register of Individual Entrepreneurs (USRIP)

After registration

After registering an individual entrepreneur it is necessary to register with Pension Fund and the Federal Compulsory Medical Insurance Fund, obtain statistics codes.

Also necessary, but optional for an entrepreneur, is opening a current account, making a seal, registering a cash register, and registering with Rospotrebnadzor.

Taxes

Individual entrepreneur pays a fixed payment to the pension fund for the year, 2019 - 36,238 rubles + 1% of income over 300,000 rubles, 2018 - 32,385 rubles + 1% of income over 300,000 rubles. The fixed contribution is paid regardless of income, even if the income is zero. To calculate the amount, use the IP fixed payment calculator. There are also KBK and calculation details.

An individual entrepreneur can apply tax schemes: simplified tax system (simplified), UTII (imputed tax) or PSN (patent). The first three are called special modes and are used in 90% of cases, because they are preferential and simpler. The transition to any regime occurs voluntarily, upon application; if you do not write applications, then OSNO (general taxation system) will remain by default.

Taxation of an individual entrepreneur almost the same as for legal entities, but instead of income tax, personal income tax is paid (under OSNO). Another difference is that only entrepreneurs can use PSN. Also, individual entrepreneurs do not pay 13% on personal profits in the form of dividends.

An entrepreneur has never been obliged to keep accounting records (chart of accounts, etc.) and submit financial statements (this includes only a balance sheet and financial statements). financial results). This does not exclude the obligation to keep tax records: declarations of the simplified tax system, 3-NDFL, UTII, KUDIR, etc.

An application for the simplified tax system and other documents can be prepared online in a free service.

Inexpensive programs for individual entrepreneurs include those with the ability to submit reports via the Internet. 500 rubles/month. Its main advantage is ease of use and automation of all processes.

Help

Credit

It is more difficult for an individual entrepreneur to get a loan from a bank than for a legal entity. Many banks also give mortgages with difficulty or require guarantors.

- An individual entrepreneur does not keep accounting records and it is more difficult for him to prove his financial solvency. Yes, there is tax accounting, but profit is not allocated there. Patent and UTII are especially opaque in this matter; these systems do not even record income. The simplified tax system “Income” is also unclear, because it is not clear how many expenses there are. The simplified tax system "Income-Expenditures", Unified Agricultural Tax and OSNO most clearly reflect the real state of the individual entrepreneur's business (there is an accounting of income and expenses), but unfortunately these systems are used less frequently.

- The individual entrepreneur himself (as opposed to the organization) cannot act as collateral in the bank. After all, he is an individual. The property of an individual can be collateral, but this is legally more complicated than collateral from an organization.

- An entrepreneur is one person - a person. When issuing a loan, the bank must take into account that this person can get sick, leave, die, get tired and decide to live in the country, giving up everything, etc. And if in an organization you can change the director and founders with the click of a finger, then in this case an individual entrepreneur can just close it and terminate the loan agreement or go to court. IP cannot be re-registered.

If a business loan is denied, then you can try to take out a consumer loan as an individual, without even disclosing your plans to spend money. Personal loans usually have high rates, but not always. Especially if the client can provide collateral or has a salary card with this bank.

Subsidy and support

In our country, hundreds of foundations (state and not only) provide consultations, subsidies, and preferential loans for individual entrepreneurs. Different regions have different programs and help centers (you need to search). .

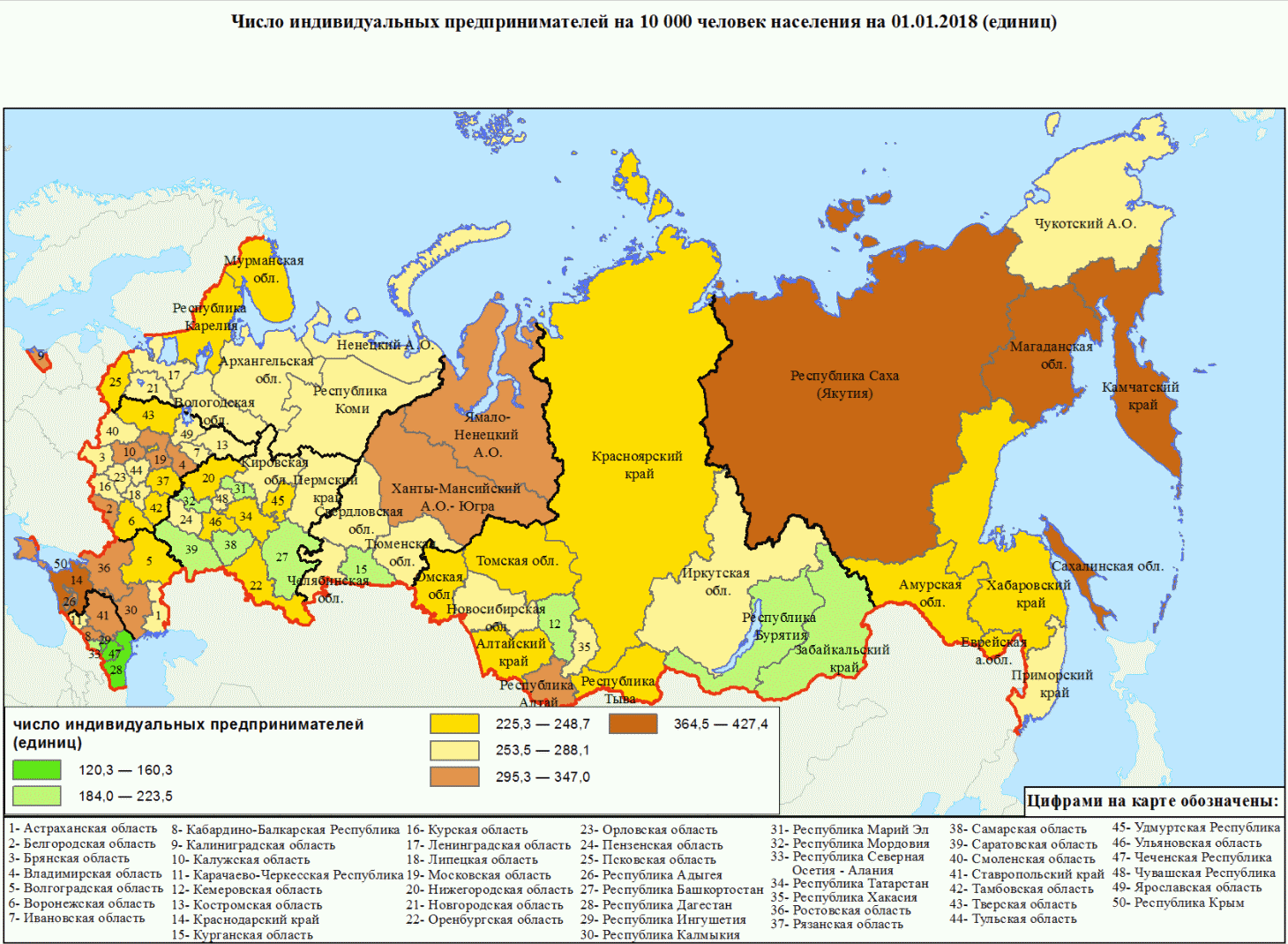

Rice. Number of individual entrepreneurs per 10,000 population

Experience

Pension experience

If the entrepreneur pays everything regularly to the Pension Fund, then the pension period runs from the moment of state registration until the closure of the individual entrepreneur, regardless of income.

Pension

According to current legislation, an individual entrepreneur will receive a minimum pension, regardless of how many contributions to the Pension Fund he pays.

The country is undergoing almost continuous pension reform and therefore it is not possible to accurately determine the size of the pension.

Since 2016, if a pensioner has the status of an individual entrepreneur, then his pension will not be indexed.

Insurance experience

The insurance period for the Social Insurance Fund only applies if the entrepreneur voluntarily pays contributions to the social insurance (FSS).

Difference from employees

The Labor Code does not apply to the individual entrepreneur himself. It is accepted only for hired workers. An individual entrepreneur, unlike a director, is not a mercenary.

Theoretically, an individual entrepreneur can hire himself, set a salary and make an entry in the work book. In this case, he will have all the rights of an employee. But it is not recommended to do this, because... then you will have to pay all salary taxes.

Only a female entrepreneur can receive maternity leave and only under the condition of voluntary social insurance. .

Any businessman, regardless of gender, can receive an allowance of up to one and a half. Either in RUSZN or in the FSS.

Individual entrepreneurs are not entitled to leave. Because he has no concept of working time or rest time and production calendar does not apply to him either.

Sick leave is granted only to those who voluntarily insure themselves with the Social Insurance Fund. Calculated based on the minimum wage, the amount is insignificant, so in social insurance it makes sense only for mothers on maternity leave.

Closing

Liquidation of an individual entrepreneur is an incorrect term. An entrepreneur cannot be liquidated without violating the Criminal Code.

Closing an individual entrepreneur occurs in the following cases:

- in connection with the adoption of a decision by an individual entrepreneur to terminate activities;

- in connection with the death of a person registered as an individual entrepreneur;

- by court decision: forcibly

- in connection with the entry into force of a court verdict of deprivation of the right to engage in entrepreneurial activity;

- in connection with the cancellation of a document (overdue) confirming the right of this person to reside in Russia;

- in connection with a court decision to declare an individual entrepreneur insolvent (bankrupt).

Databases on all individual entrepreneurs

Website Contour.Focus

Partially free Contour.Focus The most convenient search. Just enter any number, last name, title. Only here you can find out OKPO and even accounting information. Some information is hidden.

Extract from the Unified State Register of Individual Entrepreneurs on the Federal Tax Service website

For free Federal Tax Service database Unified State Register of Individual Entrepreneurs (OGRNIP, OKVED, Pension Fund number, etc.). Search by: OGRNIP/TIN or full name and region of residence (patronymic name does not have to be entered).

Bailiffs Service

For free FSSP Find out about enforcement proceedings for debt collection, etc.

With help, you can keep tax records on the simplified tax system and UTII, generate payment slips, 4-FSS, Unified Settlement, SZV-M, submit any reports via the Internet, etc. (from 325 rubles/month). 30 days free. Upon first payment. For newly created individual entrepreneurs now (free).

Question answer

Is it possible to register using temporary registration?

Registration is carried out at the address permanent residence. To what is indicated in the passport. But you can send documents by mail. According to the law, it is possible to register an individual entrepreneur at the address of temporary registration at the place of stay, ONLY if there is no permanent registration in the passport (provided that it is more than six months old). You can conduct business in any city in the Russian Federation, regardless of the place of registration.

Can an individual entrepreneur register himself for work and make an entry in his employment record?

An entrepreneur is not considered an employee and does not make an entry in his employment record. Theoretically, he can apply for a job himself, but this is his personal decision. Then he must conclude with himself employment contract, make an entry in work book and pay contributions as for an employee. This is unprofitable and makes no sense.

Can an individual entrepreneur have a name?

An entrepreneur can choose any name for free that does not directly conflict with the registered one - for example, Adidas, Sberbank, etc. The documents and the sign on the door should still have the full name of the individual entrepreneur. He can also register the name (register trademark): it costs more than 30 thousand rubles.

Is it possible to work?

Can. Moreover, you don’t have to tell them at work that you have your own business. This does not affect taxes and fees in any way. Taxes and fees to the Pension Fund must be paid - both as an individual entrepreneur and as a mercenary, in full.

Is it possible to register two individual entrepreneurs?

An individual entrepreneur is just the status of an individual. It is impossible to simultaneously become an individual entrepreneur twice (to obtain this status if you already have it). There is always one TIN.

What are the benefits?

There are no benefits in entrepreneurship for people with disabilities and other benefit categories.

Some commercial organizations They also offer their own discounts and promotions. Online accounting Elba for newly created individual entrepreneurs is now free for the first year.

Single State Register individual entrepreneurs (USRIP) contains complete open information about individual entrepreneurs legally carrying out entrepreneurial activity on the territory of the Russian Federation. Registration of individual entrepreneurs is carried out by the Federal Tax Service of Russia. Registers are also maintained by the Federal Tax Service of the Russian Federation. Register data is used to check the counterparty, exercise Due Diligence, obtain an extract from the Unified State Register of Individual Entrepreneurs for an individual entrepreneur, and for other purposes for which it is necessary to provide official registration data to the Federal Tax Service of Russia.

On the CHESTNYBUSINESS portal, you can obtain free information about the state registration of individual entrepreneurs, peasant (farm) farms, and complete open data from the Unified State Register of Individual Entrepreneurs.

The data on the portal is updated daily and synchronized with the nalog.ru service of the Federal Tax Service of Russia*.

To obtain data from the Unified State Register of Individual Entrepreneurs, use the search bar:

To do this, enter the TIN or OGRNIP or full name of an individual entrepreneur in the search bar.

Using the Unified State Register of Individual Entrepreneurs you can get the following for free up-to-date information about the Counterparty - individual entrepreneur (head of peasant (farm) enterprises, individual):

- . Individual entrepreneur status (current, activity terminated);

- . Registration date, tax authority that carried out the registration;

- . Kinds economic activity;

- . Registration in extra-budgetary funds;

- . Other official public information.

Please note: the legal address of an individual entrepreneur is the address of his registration as an individual, therefore it does not apply to open data and is not published. Changes to the registers, changes to any data, are carried out only by the Federal Tax Service after an official request from the Manager and submission of the appropriate form for changes.

We wish you a fruitful comfortable work with the registers of the Unified State Register of Individual Entrepreneurs of the Federal Tax Service of Russia on the portal!

Your HONEST BUSINESS.RF.

* Unified State Register of Individual Entrepreneurs data is open and provided on the basis of clause 1 of article 6 Federal Law dated 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs”: Information and documents contained in state registers are open and publicly available, with the exception of information to which access is limited, namely information about identity documents of an individual .

Taxpayer Identification Number (TIN, read as "ienen") is a special digital code that is issued to individuals and legal entities in order to streamline and control the payment of taxes.TIN plays one of the main roles in the individualization of legal entities and individuals with the status of an individual entrepreneur (IP) as taxpayers.

Check the TIN and get information about the counterparty

TIN of legal entity and individual entrepreneur

Entity receives a tax identification number from the tax authority at the place of registration of the person simultaneously with other registration documents.Individuals with individual entrepreneur status can obtain a TIN in two ways:

1) simultaneously with the assignment of individual entrepreneur status and the issuance of a certificate of registration as an individual entrepreneur;2) at any time before registration as an individual entrepreneur (in this case, upon registration There is no need to get a TIN again).

Without a TIN, an individual will not be able to obtain individual entrepreneur status.

Legal entities and individuals with the status of individual entrepreneurs, when concluding any agreements, are obliged indicate your TIN in the details.

The TIN must be located on stamps (for individual entrepreneurs - if there is a stamp).

TIN of an individual without individual entrepreneur status

Individual can obtain a TIN from the tax authority at the place of residence.Currently obtaining TIN by individuals is voluntary. Exception: TIN is required for an individual when appointing him to the position of a civil servant.

In practice, when applying for employment in other positions, they are often asked to present the TIN along with other documents. Such a requirement cannot be mandatory, since it is not reflected in Labor Code RF.

TIN verification

Anyone can visit our website for free check the correctness of the TIN counterparty - a legal entity or an individual with the status of an individual entrepreneur, as well as the fact of making an entry on the registration of a legal entity in the Unified State Register of Legal Entities.Knowing the TIN and the name of the organization, you can obtain an extract from the Unified State Register of Legal Entities for verification:

- reliability of documents received from the counterparty (since legal entities and individual entrepreneurs are required to indicate the TIN on any documents issued by them local acts and documents);

- the fact of the existence of a legal entity (situations are possible when an unscrupulous counterparty, for selfish purposes, acts in a transaction on behalf of a non-existent legal entity);

- reliability legal address counterparty;

- last name, first name and patronymic of the director of the legal entity and other information about the legal entity.

An individual can, via the Internet, and knowing the TIN - the amount of debt for taxes and fees. TIN verification individuals is carried out free of charge online.

Verification of the counterparty: procedure in questions and answers

Verifying a counterparty by TIN is a mandatory procedure that all business representatives face sooner or later, regardless of their line of business. Is it worth cooperating with a counterparty, is it possible to trust him and make an advance payment? This is only a short list of questions that can be answered by carrying out a procedure such as checking the counterparty by TIN.

If we consider individual situations, the need to check the counterparty can be useful to an accountant who wants to make sure of the transparency of the activities of a potential partner of his company before concluding an agreement. By using the TIN number on our website you can obtain an extract about the legal entity from the Unified State Register of Legal Entities, as well as expanded financial data on the legal entity.

It will be rational to present basic information about conducting a verification of a counterparty by TIN in the form of questions and answers in order to achieve a high degree of understanding of the need for this procedure and the features of its implementation.

What is verification of a counterparty by TIN?

Checking a counterparty by identification number includes a search for information about him and its further analysis aimed at determining the integrity/bad faith of a potential partner.

Who is responsible for checking counterparties?

In most cases, checking the counterparty by TIN is the responsibility of employees of the legal service and economic department. If such structural divisions the enterprise does not, responsibility for checking the counterparty will be borne by the person authorized to conclude the contract.

Why do you need to check your counterparty?

The verification of the counterparty is carried out to minimize financial risks from cooperation with him. Analysis of data obtained using the Taxpayer Identification Number (TIN) will help avoid delays in deliveries, problems with the quality of goods or services, and will make it possible to stop fraudulent schemes of the counterparty.

Besides, this check necessary to avoid sanctions from tax authorities: if violations are found, then responsibility for choosing a counterparty will fall entirely on your organization. The consequences may be different (exclusion of a transaction of a dubious nature from expenses, refusal to accept VAT for deduction), so it is imperative to check the counterparty.

What exactly is studied when checking a counterparty?

The specifics of checking a counterparty - the procedure, responsibilities of the parties, the criteria by which research is carried out - are not established at the legislative level. The concept of “verification of a counterparty” is currently not included in normative legal acts, is absent from the Tax Code.

Along with this, in 2006, a Resolution of the Plenum of the Supreme Arbitration Court RF, which somewhat clarifies who should check the counterparty. It is devoted to the issue of assessing the validity of a person receiving a tax benefit. It may be found unfounded in court if it turns out that the taxpayer acted imprudently. In practice, this means that responsibility for checking the counterparty rests with business representatives. In fact, in most cases the audit is carried out by accountants.

What documents are most often requested when checking a counterparty?

The absence of a written counterparty verification scheme somewhat complicates the process. At the same time, a standard practice has already developed, which involves collecting and studying such documents of the counterparty as the charter, an extract from the Unified State Register of Legal Entities, certificates of state registration and tax registration, a letter from statistics indicating activity codes, documents identifying the counterparty and confirming his authority .