Part-time work in 1s zup. Part-time work: setting up a schedule and calculating wages. Calculating the salary of a part-time employee

- Olga says:

Good afternoon The lesson is very clear. I just have a question: is this how the coolant and clock should be set on the report card for this employee? Or should it be Me and the clock?

- admin says:

Personnel officers say that ideally it should be I/OJ

- Anton says:

There is one problem. For example, an employee works 20 hours a week, and the norm is considered to be 40 hour weeks. Her salary is 8,000 rubles. If she works a full month in January, she will receive: 8000*(60/120) = 8000*0.5 = 4000. We count February, which she also worked in full: 8000*(75/151) = 8000 * (0, 496689) = 3973.51. This is exactly what the ZUP will think. If the number of hours in the schedule according to which the norm is calculated ends in an odd number (this happens when there is a shortened working day), then the salary is not calculated correctly.

- admin says:

Why isn't it true? I already talked about the pre-holiday day and the incomplete schedule

- Anton says:

I take my words back, it turns out that 1C calculates everything correctly. Now all that remains is to prove it to the accountant

- Olga says:

Please tell me how to make sure that I/OJ is included in the report card? I only get coolant

- Alexander says:

Everything is clear, but then what about the document “Changing the terms of payment for parental leave”?

Isn't this document intended to start paying an employee?

- admin says:

Alexander, the problem is that the “Change of conditions...” document cannot change the employee’s schedule. And working part-time means a change in schedule. So we have to make personnel moves.

- Alexander says:

Now everything is clear

- Sergey says:

Thank you very much everything worked out at its best!

- Svetlana says:

Thank you very much for the lesson!

Please tell me what to do if the start date of the ESD coincides with the date of transfer to the part-time work schedule (daddy draws up the ESD and is transferred to part-time work time one date)? Thank you very much.

- Elena says:

Good explanations from a good specialist, it helped a lot in understanding!

- Tatyana says:

Good afternoon The report shows coolant. Everything in the personnel documents is correct. The salary calculation does not include hourly wages.

- Irina says:

Tell me what to do in such a situation. Before the maternity leave, the employee had a salary accrual by the day, now she is leaving maternity leave ahead of schedule while maintaining her benefits. I need to transfer her to an hourly salary, but the program does not allow me to do this, because... in the registry information Status of employee organizations there is a line that on the date of the end of the maternity leave Salary by day - Start. How to convert it to Salary by the hour?

- Natalia says:

The salary calculation does not include hourly wages. How to fix?

- Konstantin says:

The situation is like that of Irina and Natalya... Tell me how to fix it?

- Konstantin says:

I found how to fix it.

Early return to work from parental leave on a part-time basis while maintaining benefits in the 1C: ZUP program should be reflected as follows.

In the personnel accounting subsystem, exit from vacation must be reflected in the information register “Status of employees of organizations”; let’s do this with the document “Return to work of the organization.”

Then, in the document “Personnel Transfer of Organizations”:

On the “Employees” tab, set a part-time working schedule;

On the “Accruals” tab, we will stop “Parental leave without pay” and begin “Salary by the hour” or another accrual for the time worked, due to the employee in accordance with the remuneration system.

- Alexey says:

What needs to be done to get the employee back on vacation? Those. the employee went on vacation, then accordingly expressed a desire to work, and during this period he managed to go on vacation, sick leave, and the sick leave was interrupted by a document returning to work. And then the employee again deigned to go on vacation. How to properly arrange his care?

- Irina says:

Good afternoon. They still haven’t answered what to do with the report card? In large organizations, I can’t wean them from entering timesheets, and on principle. When reflecting the entire sequence, the program sees only half a day of coolant in the timesheet, and the remaining half of the day remains behind the timesheet. Moreover, if you do not run the timesheet, the program calculates well and correctly. How to get out of this situation?

- Anna says:

Thank you, very useful lesson.

- Julia says:

Everything is fine, but in the personnel transfer you need to change the bet size - it will no longer be 1, but in our example it will be 0.9 bets

- Illona says:

Thank you very much for this training, it helped me a lot.

- Sergey says:

If you pre-generate a timesheet and post it, the salary will not be filled out in the NZRO. And if you create a report card later, it will be filled out as “I” without “OJ”.

- Julia says:

We still only accrue benefits, although the register now includes an hourly salary and a regional salary. Tell me, what could be the reason? Release 90.3

thank you in advance

- Julia says:

everything figured out...Salary by the hour The benefit is in displacing

- Ekaterina says:

Good afternoon

Please tell me how to apply for maternity leave again after the employee worked part-time while receiving a care allowance? Create another personnel transfer document with a note in Accruals - stop salary, and start maternity leave?! But in this case, the employee’s status does not change back to “on parental leave.” Please explain the situation. Thank you in advance!

- Anya says:

Good afternoon

Ekaterina, have you sorted out this problem: Please tell me how to apply for maternity leave again after the employee worked part-time while receiving a care allowance? Create another personnel transfer document with a note in Accruals - stop salary, and start maternity leave?! But in this case, the employee’s status does not change back to “on parental leave.” Please explain the situation. Thank you in advance!?

Part-time work is established by agreement between the employee and the employer, as well as in cases provided for by the Labor Code of the Russian Federation. We'll tell you how to correctly process and calculate the salary of an employee working part-time in the 1C: Salaries and Personnel program government agency 8".

Part-time working conditions

Shortened working hours are provided for certain categories of employees.

According to Art. 92 of the Labor Code of the Russian Federation, minor workers, disabled people of groups I or II and workers whose working conditions are classified as harmful or hazardous conditions labor.

Shortened duration working week established for women working in the Far North and equivalent areas (Article 320 of the Labor Code of the Russian Federation), as well as for pedagogical and medical workers(Articles 333 and 350 of the Labor Code of the Russian Federation).

An employee can be assigned both a part-time working day and a part-time working week (for example, 4 working days of 7 working hours).

The establishment of reduced working hours in the manner determined by law does not entail a reduction in the amount of work for the employee. wages.

Part-time working hours can be established both upon hiring and subsequently when certain circumstances arise.

Part-time work is a reduction in hours of work for each working day (for example, 6 hours of work instead of 8).A part-time work week is a reduction in the number of working days in each work week (for example, with a five-day work week, an employee is given an additional day off or days off).

Hiring an employee for part-time work.In order to indicate the number of bets in personnel documents and set up part-time work schedules, you must first select the checkbox in the personnel records settings “Part-time work is used” ( chapter “Settings” – “Personnel records”).

In the document "Recruitment" We can set different rates for employees. For example, 1 (bet), 1\8 (eighth of the bet), 1\4 (quarter of the bet), 1\3 (third of the bet), 1\2 (half the bet), 2\3 of the bet (two thirds of the bet), arbitrary the number of bets, and we can also indicate the bet as a decimal fraction.

The ability to change an employee’s rate during work is available in the document "Personnel transfer" ( chapter “Personnel” – “Receptions, transfers, dismissals” or “All personnel documents”).

Please note that on the tab "Salary" documents "Recruitment" or "Personnel transfer" The employee's accruals are indicated in full in accordance with the staffing table. If the rate changes, the planned wage fund will be calculated automatically.

Read also Which organizations are subject to mandatory audit

Setting up a part-time schedule

When hiring or transferring an employee to a part-time position, it is necessary to create an appropriate part-time work schedule.

Let's look at setting up a part-time work schedule using the example of a 20-hour workweek schedule of 4 hours of work per day. To do this, open the section "Settings" and in the document log "Employee work schedules" create a work schedule with a name . By button "Change chart properties" in the window that opens “Setting up a work schedule” check the box "Part-time work", type of part-time work "Part-time". Also check the box – "Five days (schedule normal duration working hours)".

Please note by checking the box “Calculate the norm using a different schedule”, it is necessary to determine how further accruals will be calculated:

- indicate a full-time work schedule. The share of part-time work when calculating wages is determined as the ratio of the lengths of the working week of the part-time and full-time work schedules. In this case, remuneration will be calculated according to the formula:

Result = Tariff rate monthly (salary by day) * Share of part-time work / Standard time according to full-time work schedule (by day) * Time worked (by day)

- establish and indicate a full-time work schedule. Salary calculation (by the hour) is made taking into account the number of hours according to schedules in a particular month. In this case, wages (hourly) will be calculated using the formula:

Result = Monthly tariff rate (salary by hour) / Standard time according to full-time work schedule (by hour) * Time worked (by hour)

- do not install. The share of part-time work when calculating salary is determined according to the employee’s rate. The time standard for calculation is determined based on the number of working days and hours according to the part-time work schedule. In this case, wages (by day) will be calculated using the formula:

Read also The Ministry of Finance may increase VAT, personal income tax and income tax in 2018

Result = Monthly tariff rate (salary by day) * Proportion of part-time work / Standard time according to the part-time work schedule (by day) * Time worked (by day).

Next, fill out the work schedule, set the duration of the working day from Monday to Friday - 4 hours, the duration of the working week will be calculated automatically - 20 hours. In chapter "Types of Time" checkbox "Turnout" is set by default, that is, the schedule provides for work during the daytime.

Checkboxes "Night Hours", “Evening hours”, “Baby feeding breaks” are established if the schedule provides for work according to these types of time.

The checkboxes will be available if similar checkboxes are selected in setting up payroll parameters in the section “Settings” – “Payroll calculation”- link “Setting up the composition of charges and deductions”– bookmark "Hourly payment".

We have set all the parameters, then press the button "OK", and schedule "Part-time (20 hours)" will be filled in accordance with the configured settings. Now in the document "Recruitment" or "Personnel transfer" we can indicate this schedule.

Setting up a part-time work schedule is similar to the above settings, with the exception of the details "Type of part-time work" – "Part-time work week." The work schedule in this case is filled out individually, depending on the number of working days per week.

Please note that the indicators "Normal days" And "Normal Hours", used in the formulas of most accruals are recorded in the employee’s work schedule, and, if the checkbox is checked “Calculate the norm using a different schedule”, then the employee’s working time norm corresponds to the “other schedule” norm.

Calculating the salary of a part-time employee

Let's consider two options for paying a part-time employee on the chart "Part-time", but with different planned accruals.

In the document "Recruitment" on the tab "Salary" assign the employee a planned accrual “Payment by salary (hourly)”. The settings for this type of accrual indicate that the result is calculated using the formula:

Salary * TimeInHours / StandardHours.

The salary of this employee will be calculated based on the following indicators:

- Salary– set based on full-time work;

- TimeInHours– this is the time worked according to the part-time work schedule;

- NormHours– these are hours according to a full-time work schedule.

Due to difficult economic conditions, many enterprises are forced to take measures, in particular, to introduce a part-time or part-time working week. A.V. talks about how to reflect such changes in the 1C: Salary and Personnel Management 8 program in this article. Yarvelyan, Sea Data CJSC.

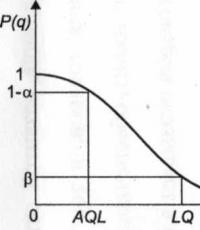

Let's now see how the changes made to the program affected the calculation of workers' monthly earnings (using the example of wage calculation for January 2009 shown in Fig. 3).

Rice. 3

If Ms. Petrova had worked in January as before (5 days a week for 8 hours), she would have worked 128 hours (16 days for 8 hours - a reduced working day in the previous holidays V in this example is not taken into account). That is, the standard time, which, as indicated in the schedule, is calculated according to the main work schedule (the usual five-day week), is 128 hours.

Let us remind you that Ms. Petrova’s earnings are calculated based on hours worked. In fact, according to the new work schedule, 96 hours were worked in January (16 days, 6 hours each). Thus, Ms. Petrova for January 2009 should be accrued earnings in the amount of:

20,000 rub. x 96 hours / 128 hours = 15,000 rub.

Note that if Ms. Petrova had been assigned a calculation type Salary by day, then the amount of her earnings for January 2009 would not have differed from previous months, and would have been, as before, 20,000 rubles. This would happen because the number of working days in a month according to the new work schedule is exactly the same as in a regular five-day week (16 days). This means that earnings would be calculated using the formula:

20,000 rub. x 16 days / 16 days = 20,000 rub.

For Mr. Sergeev, the standard time in January 2009 is the same as for his colleague, but in his case, not hours, but days are taken for calculation, because his earnings are calculated by day. Thus, according to the norm, he had to work 16 days, but in fact he went to work 9 times, therefore, the amount of his earnings for January 2009 is:

20,000 rub. x 9 days / 16 days = 11,250 rub.

Please note that in this case, the type of salary does not have any significance for the calculation, because on the days on which the employee went to work, he worked exactly as much as he should have worked according to his old schedule - the usual five-day week.

In the event that the month is not fully worked, the earnings of any of the workers considered in the example will be reduced in proportion to the time worked. However, other things being equal, Mr. Sergeev will have some advantage: he can be sick for 4 whole days (from Thursday to Sunday), and the illness will not in any way affect his main income in the organization, because he was sick on his days off.

Thus, using an example, we examined the mechanisms by which the “1C: Salary and Personnel Management 8” program can reflect the transfer of employees to reduced working hours.

From the editor: We draw the attention of our readers that this article is about reduced working hours if standard work schedules are used in the 1C: Salary and Personnel Management 8 program. Article about timesheets and individual schedules will be published in the next issue of the journal. In it, the author will specifically address the issues of recording data on work during reduced working hours.

Legal justification for transferring employees to part-time work

In accordance with Article 74 Labor Code Russian Federation(hereinafter referred to as the Labor Code of the Russian Federation), in cases where reasons associated with changes in organizational or technological working conditions may lead to mass dismissal of workers, the employer, in order to preserve jobs, has the right to introduce a part-time (shift) and/or part-time schedule. working week for up to six months.

A part-time regime can only be introduced taking into account the opinion of trade union organization. Changes to terms and conditions employment contract, introduced in accordance with Article 74 of the Labor Code of the Russian Federation, should not worsen the employee’s position in comparison with those established by the collective agreement and agreements.

In letter dated 06/08/2007 No. 1619-6, Rostrud explains:

“When working on a part-time basis, the employee’s payment is made in proportion to the time he worked or depending on the amount of work he performed.

Thus, when a part-time working regime is established, the amount of wages decreases regardless of the wage system ( official salary, tariff rate)."

Registration of transfer of employees to part-time work in the program

In order to formalize the transfer of employees to part-time work in the 1C: Salary and Personnel Management 8 program, it is necessary to create new work schedules that meet the requirements of the new work mode, and then register the corresponding personnel movement.

Let's look at an example.

Example

ZAO Stankoimport employs Ms. V.A. Petrova, consultant, and Mr. S.A. Sergeev, advisor. The working hours for both are five days, the salary is also the same - 20,000 rubles, the only difference is that for Ms. Petrova the amount of earnings is calculated based on hours worked, and for Mr. Sergeev - based on days worked.

Thus, provided that the time worked is fully worked, the amount of accruals for the month for both employees is equal to 20,000 rubles.

Due to changes in working conditions, the employer is introducing a part-time working regime at the enterprise from 01/01/2009. In this case, consultant Petrov is transferred to part-time work (that is, a five-day work week with a working day of 6 hours), and advisor Sergeev is transferred to a part-time work week (that is, a three-day work week with a working day of 8 hours).

As a result of the change in working hours, the monthly earnings of these employees will be reduced, despite the fact that the salary amount in the employment contract remains the same.

Let us now reflect these changes in the program "1C: Salary and Personnel Management 8".

Introduction of work schedules

Information about work schedules at the enterprise is contained in the directory Opening hours. Let's introduce two new graphs - Five days for 6 hours And Three day work week(see Fig. 1).

Rice. 1

In both cases:

- the schedule type remains Five Days;

- in the Part-time working time attribute, a flag is set and the corresponding type of shortened working time is indicated (the field is simply informational; it may be left blank).

The method of accounting for standard working hours is calculated According to the specified schedule, in this case, the main work schedule must be selected as the schedule before the order to change working conditions comes into effect - a five-day week of 8 hours.

For graph Five days for 6 hours table Work schedule is filled in in accordance with the new schedule, for example: Monday from 9 to 13, Monday from 14 to 16, etc. In this case, data must be filled in for all working days from Monday to Friday, and the total number of working hours per day must be equal to 6.

In graphics Three day work week table Work schedule filled in as follows:

- for days on which the employee will go to work (for example, Monday, Tuesday, Wednesday), the schedule completely coincides with the main five-day schedule;

- There should be no non-working days in the table; if the day of the week is not specified in the table, it is considered a weekend by default; however, for clarity, you can create additional lines for non-working days with empty values for the start and end times of work; in this case, when checking the schedule, the program will report empty fields, but such filling in the schedule will not affect the correctness of the work.

It should be noted that the total number of days in the work schedule for both schedules must match the specified type of schedule (for a five-day week, 5 days must be specified), and the total number of hours in the table must match the value of the attribute Hours per week. So, in our example, the total number of hours for the chart Five days for 6 hours equals 30, for graph Three-day work week - 24.

After saving both schedules, you need to fill out a calendar for each of them. Since in our case the order to change the regime comes into force on January 1, 2009, we fill out the calendars for 2009. At the time of filling out the schedules in the program must be completed Regulated production calendar for the corresponding year.

So, the graphs have been created. The next step will be to create a personnel transfer that will change the working hours of Ms. Petrova and Mr. Sergeev.

Creating a personnel move

new document Personnel transfer of organizations can be created:

- separately for each employee whose working conditions change;

- one for all employees whose working conditions change.

After filling out the list of employees in the tab table Workers the date of entry into force of the order to move (column C) is filled in, only column is changed Schedule- it indicates new part-time work schedules (see Fig. 2).

Rice. 2

On the bookmark Accruals all data remains the same.

Question on 1C Salary and Personnel Management 8:

By order of the enterprise, we reduce working hours to a four-day working week (up to 6 hours a day, up to 24 hours a week, up to 3 days a week). How to reflect it in the program?

In accordance with Article 74 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), in cases where reasons related to changes in organizational or technological working conditions may lead to mass dismissal of workers, the employer, in order to preserve jobs, has the right to introduce a part-time regime. working day (shift) and/or part-time work week for up to six months.

A part-time working regime can only be introduced taking into account the opinion of the trade union organization. Changes to the terms of the employment contract, introduced in accordance with Article 74 of the Labor Code of the Russian Federation, should not worsen the employee’s position in comparison with those established by the collective agreement and agreements.

In letter dated 06/08/2007 No. 1619-6, Rostrud explains: “When working part-time, the employee’s payment is made in proportion to the time he worked or depending on the amount of work he performed.

Thus, when a part-time working regime is established, the amount of wages is reduced regardless of the remuneration system (official salary, tariff rate).”

Answer 1c:

In order to formalize the transfer of employees to part-time work in the 1C: Salary and Personnel Management 8 program, it is necessary to create new work schedules that meet the requirements of the new work mode, and then register the corresponding personnel movement.

We create new work schedules - a flag is set in the Part-time working time attribute and the corresponding type of shortened working time is indicated (the field is simply informational, it may remain blank). Method of accounting for standard working hours - calculated according to the specified schedule, while the main work schedule must be selected as the schedule before the order on changes in working conditions comes into effect - a five-day week of 8 hours.

The work schedule table is filled in in accordance with the new schedule

It should be noted that the total number of days in the work schedule for schedules must match the specified type of schedule (for a five-day week, 5 days must be specified), and the total number of hours in the table must match the value of the Hours per week attribute.

After saving both schedules, you need to fill out a calendar for each of them. At the time of filling out the schedules in the program, the Regulated Production Calendar for the corresponding year must be completed.

Then we make a personnel transfer document in which we change only the work schedules of employees.

After these operations, as usual, we do Payroll documents for employees.

More questions and answers on 1C Salary and Personnel Management 8:

Adding a comment:

How to transfer an employee to part-time work in 1C ZUP 3?

To transfer an employee to part-time work in the 1C: Salary and Personnel Management 3.0 program, you must:

- Create and configure a work schedule.

- Complete the “Personnel Transfer” document.

Setting up a work schedule.

The work schedule is entered in the “Work Schedule” directory. This reference book can be opened on the tab “Settings” - “Enterprise” - “Employee work schedules”.

We create new schedule work by clicking on the “Create” button

In the “Name” field, enter the name of the schedule, for example, “Five days 20 hours”. Select the year for which the chart will be filled out. After that, click on the “Change chart filling parameters” hyperlink.

We make the following work schedule settings:

- We select the method of filling out the schedule by day of the week, i.e. This is a five-day period.

- Set the flag “Take into account holidays”, i.e. Holidays will be considered non-working days for the created schedule.

- We set the sign “Part-time working time” - “Part-time working day”, i.e. the employee will work five days a week, but not eight hours a week, but less.

- Set the checkbox “Calculate the norm according to a different schedule” and select the full-time work schedule according to production calendar. Those. if we create a “Five-day 20 hours” schedule, then the norm for this schedule will be the “Five-day 40 hours” schedule. With this setup, the employee will receive the full salary (for example, 10,000 rubles) only if he works for a month according to the “Five-day 40 hours” schedule and there are no deviations. But if an employee works according to the “Five-day 20 hours” schedule, then he will receive a salary in proportion to the time worked (for our example, no more than 5,000 rubles).

- We set the work schedule and the length of the working week.

- To fill out the schedule for the selected year, click on the “Finish” button.

- The chart will be filled according to the specified settings. To save the schedule, click “Save” or “Save and close”.

Personnel transfer to a part-time work schedule.

To register a transfer to a part-time work schedule, you must complete the “Personnel Transfer” document. This document opens on the “Personnel” tab - “Receptions, transfers, dismissals.”

To create a document, click on the “Create” - “Personnel transfer” button.

In the “Personnel Transfer” document, set the transfer date. On the “Main” tab, check the box “Transfer to another schedule” and select a part-time work schedule (for our example, this is the “Five-day 20 hours” schedule).

On the “Payment” tab, cancel the action of the “Payment by salary” calculation type and add the new kind calculation “Payment by salary (hourly)” and enter the salary amount, as when working on a full-time work schedule according to the production calendar. If you leave the “Payment by salary” calculation type in effect, the employee will be accrued the full amount of salary for the days worked, even if he worked not 8 hours, but 4 hours. When assigning the calculation type “Payment by salary (by the hour)” to an employee, the salary amount will be calculated based on the hours worked, and not the days according to the employee’s schedule. Post the document.

The salary calculation for June for such an employee is as follows.