Basic principles of budgeting. Fundamentals of Budgeting. Towards effective budgeting

The budgeting system is an organizational and economic complex represented by a number of special attributes introduced into the enterprise management system. The most important of them are:

– the use of special media for management information – budgets;

– assignment structural divisions status of business units (financial responsibility centers - FRC);

– high level of decentralization of enterprise management.

Traditionally, a budget was understood as a financial plan in the form of a balance sheet in which costs are reconciled with income. However, in the enterprise budgeting system, this category has acquired a broader semantic content. Often, a budget is understood as any document that reflects any aspect of activity in the process of fulfilling the mission of an enterprise. The budget sets the direction of activity. It also reflects the actual results of these activities. The main idea implemented by the budgeting system is the combination of centralized strategic management at the enterprise level and decentralization operational management at the level of its divisions.

Decentralization of enterprise management when using a budgeting system means:

– delegation of managerial powers (and therefore responsibility) to lower-level units;

– increasing the economic independence of these units;

– providing units with certain property necessary to solve the tasks they face;

– assigning to units the costs associated with their activities; “fixing” means providing the ability to control these costs within a wide range;

– assigning part of the income they receive to departments;

– alienation of part of the income received by each division to finance the activities of divisions that do not have the opportunity to receive such income from the outside;

– the primacy of the enterprise’s mission over the goals of individual divisions. The degree of possibility of interference of higher levels in the activities of lower ones determines the level of centralization of management.

Basic elements of the budgeting system

The main elements of the budgeting system are income, costs, financial result (deficit or surplus), principles of construction budget system.

Budget revenues are funds received free of charge and irrevocably at the disposal of the corresponding Central Federal District - the center of profit or income. Secured income is income that goes entirely to the corresponding budget. Regulatory revenues are funds transferred from one budget to another:

– subsidy – funds transferred on a gratuitous and irrevocable basis to compensate for the deficit;

– subvention – funds transferred on a gratuitous and irrevocable basis for the implementation of certain targeted expenses;

– subsidy – funds transferred on the basis of shared financing of targeted expenses.

Budget expenditures are funds allocated for financial support tasks and functions of the subject of management.

Budget deficit is the excess of budget expenditures over its revenues.

Expenditure sequestration is a regular reduction of all expenditure items (except protected ones) when there is a threat of a budget deficit.

Budget surplus is the excess of budget revenues over its expenses.

Budget classification is a systematic economic grouping of budget income and expenses according to homogeneous characteristics. The enterprise budget system is based on the following principles:

– unity of the budget system;

– differentiation of income and expenses between levels of the budget system;

– independence of budgets;

– completeness of reflection of budget incomes and expenses;

– budget balance;

– no budget deficit;

– efficiency and economy of using budget funds;

– general (total) coverage of budget expenses;

– reliability of the budget.

When building a budgeting system, it should be remembered that financial planning is closely connected and based on the marketing, production and other plans of the enterprise, subordinate to the mission and overall strategy of the enterprise: no financial forecasts will gain practical value until production and marketing decisions have been worked out.

Principles of building a budget system

The principle of unity of the budget system means the unity of the following elements: regulatory regulatory framework; budget documentation forms; sanctions and incentives; methodology for the formation and use of budget funds.

The principle of separating income and expenses between separate budgets means assigning the corresponding types of income (in whole or in part) and the authority to make expenses to the relevant management entities.

The principle of budget independence means:

– the right of individual management entities to independently carry out the budget process;

– the presence of own sources of income for the budgets of each management entity, determined in accordance with the methodology for forming the enterprise’s budget;

– the right of management entities to independently, in accordance with the current methodology, determine the directions for spending funds from the relevant budgets;

– inadmissibility of the withdrawal of income additionally received during the execution of the budget, amounts in excess of income over

budget moves and savings on budget expenditures.

The principle of completeness of reflection of income and expenses of budgets means that all income and expenses of the subject of management are subject to reflection in its budget.

The principle of budget balance means that the volume of budgeted expenditures must correspond to the total volume of budget revenues and receipts from sources of financing its deficit.

The principle of efficiency and economy in the use of budget funds means that when drawing up and executing budgets, the relevant management subjects must proceed from the need to achieve specified results using the least amount of funds or achieve best result using a budgeted amount of funds.

The principle of total cost coverage means that the budgetary costs of all financial responsibility centers must be covered total amount enterprise income.

The principle of budget reliability means the reliability of forecast indicators for the socio-economic development of an enterprise, the realistic calculation of budget revenues and expenses.

Factors for increasing production efficiency when implementing a budgeting system

The purpose of implementing a budgeting system is to increase the efficiency of the enterprise. The criterion for efficiency is the excess of an enterprise's income over its costs when performing the functions assigned to the enterprise (its mission).

The efficiency of an enterprise during the transition to a budgeting system increases due to the following factors:

1. The entire set of financial flows associated with the formation of income and costs is brought into a single balance sheet. The problem of their coordination at the level of both the enterprise and its individual divisions is being solved. Complete clarity is created about how every ruble of the budget appears in the enterprise, how it moves and is used.

2. Assigning budgets to departments transfers a significant part of the responsibility for the level wages workers from the director of the enterprise to the heads of these departments.

3. The principle of material interest of all personnel in the results of the work of their department and the enterprise as a whole is implemented. The actual payroll of the department is calculated at the end of the budget period on a residual basis as the unused part of the cost limit established for it. The limit increases with income. It becomes profitable to increase income and reduce costs, since at the same time wages will increase.

4. The budget process implements all financial management functions at the enterprise, namely planning, organization, motivation, accounting, analysis and regulation. Moreover, financial management is carried out in real time.

5. It becomes possible to focus financial policy on solving specific problems. For example, an enterprise located in a difficult financial situation, can form the basis of the budget necessary funds and a repayment schedule for its overdue accounts payable.

6. Financial planning is based on a plan for production, material, technical and staffing. The budgeting system becomes the basis for integrated management of all areas of the enterprise's activities.

Enterprise budget system

The budget structure of an enterprise represents the organizational principles of constructing a budget system, its structure, and the relationship of the budgets combined in it.

The budget system of an enterprise is a set of budgets based on production, economic relations and the structural structure of the enterprise, regulated by its internal regulatory documents. Consolidated budget is a collection of all budgets used in the enterprise’s budget system. The consolidated budget includes the budget of the enterprise as a whole and the budgets of individual management entities within it.

The enterprise budget system can be supplemented by the following aspects of the classification of budget documents:

– by functional purpose: property budget, income and cost budget, traffic budget Money, operating budget;

– in relation to the level of integration of management information: budget of the primary accounting center, consolidated budget;

– depending on the time interval: strategic budget, operational budget;

– depending on the stage of the budget process: planned budget, actual (executed) budget.

Typically, at the enterprise level, the main budget documents are considered:

1. Balance sheet (property budget) – form 1 financial statements enterprises.

2. Profit and loss statement (budget of income and expenses) – Form 2 of the enterprise’s financial statements.

3. Cash flow statement (cash flow budget) – Form 4 of the enterprise’s financial statements.

The budget for the production and economic (operational) activities of an enterprise is a document reflecting the production and sales of products, and other production results (it is not included in the official reporting and is developed in any form). The budget for the production and economic activities of the enterprise is transformed into a system of budgets for the operating activities of financial responsibility centers.

Implementation of a budgeting system

The system that implements enterprise budget management includes the following parts: economic, organizational, information, computer.

The economic part of the supporting system is represented by a certain economic mechanism operating within the enterprise. This mechanism assumes:

– assigning certain property to divisions of the enterprise, vesting rights to manage this property, income and costs;

– application of special methods for distributing income received and generating costs;

– use of economic incentive methods.

Developing a budget requires a significant amount of effort regulatory information– consumption rates, prices, tariffs, etc. To obtain it, significant preparatory work is carried out analytical work, during which a thorough inventory of the enterprise’s income and expenses is carried out, reserves and losses are identified.

Organizational support includes modification of the organizational structure of enterprise management and changes in its document flow. Moreover, the implementation of the system usually does not require a radical restructuring of the organizational structure. In this area, the minimum requirements are as follows:

– each division is assigned the status: “income center”, “profit center”, “cost center”, etc.;

– a division is created that operates the budget management system (settlement and financial center, treasury, etc.);

– the head of this division is vested with the powers of deputy director of the enterprise.

The document flow diagram of the enterprise changes as follows:

– new documents are being introduced – mandatory income and cost plans;

– all types of actual expenses of the enterprise are checked against the budget before their execution.

The computer part of the software includes:

- personal computers;

– universal software environment;

– a specialized software package that implements the development and execution of budget documents.

Budgeting system options

In relation to the system accounting enterprises, autonomous and adapted versions of the budgeting system are possible.

The adapted version is based on the use of accounting information. The autonomous option involves creating your own accounting system, independent of accounting.

Each of these options has certain advantages and disadvantages.

The adapted version relies on well-established accounting information flows. It is free from duplication of accounting information and in this regard is more economical compared to stand-alone. It is especially attractive to use the adapted version with well-developed analytical accounting, when property, income and costs are taken into account by divisions of the enterprise. It should be noted that such accounting is sometimes identified with budgeting.

However, a significant problem here is budget planning. An important principle of the budget management system is the comparability of planning and accounting information. Therefore, in the adapted version, planning should be done in an “accounting” style. That is, if accounting is carried out in the context of accounting accounts, planning should also be carried out accordingly. In this case, a number of complex methodological problems arise, which to date have not had a satisfactory solution. And the stronger the analytical accounting, the more complex the planning.

The standalone option uses its own accounting system. This causes duplication of accounting information, resulting in increased management costs. However, the budgeting system is cheaper to develop and easier to operate.

The main functional blocks of the system are:

– planning block;

– accounting unit;

– analysis block;

- normative base.

When developing budgets, full compliance with plans for production activities, income and costs, cash flow and property of the enterprise must be ensured. The plans of the enterprise as a whole must correlate with the system of corresponding plans of individual divisions.

Consolidation of budgets

If the company is a holding consisting of several separate enterprises (business units, branches, individual legal entities), then the question arises about the formation of consolidated budgets and reports for the entire company.

Consolidation of budgets can be carried out in two ways:

– joint planning and accounting of the activities of all enterprises in one system, which allows you to immediately generate consolidated budgets and company reports;

– maintaining separate accounting and generating own planning and reporting documents for each of the company’s enterprises and their subsequent integration into consolidated budgets and reports of the company.

Various areas of activity of the company's enterprises, an increase in the number of heterogeneous business transactions contribute to the maintenance of separate specialized accounting for each enterprise. This leads to the need to consolidate individual budgets and reports of the company's enterprises, which, in turn, requires the development of a methodology for this procedure.

If there are business transactions between different enterprises of the company, the consolidation procedure becomes more complicated, and it becomes necessary to exclude internal turnover when creating consolidated budgets and reports. One of the common types of internal turnover is intra-group sales. Profit from internal turnover may be included in balance sheet balances, for example, in products that trading house purchased from company enterprises. Complex cases arise if internal turnover profits are part of the materials that are then used to produce the product.

In order to correctly exclude all the influence of internal turnover when consolidating budgets and reports, it is necessary to study the features of the company’s business organization and develop a consolidation methodology. The creation of such a tool will make it possible to quickly and efficiently prepare consolidated budgets and reports for provision to interested users and for making management decisions.

Budgeting is one of the control panels of managers. But why? After all, these “remote controls” in the hands of managers are already quite enough, why was another method of managing the finances of an enterprise invented for business efficiency? Let's look at some theory.

Let's start with the global system, namely with the question, what is “ financial management».

The term “management” itself means management. However, the word "management" in financial sector is not used, since the mighty Russian language represents the term “control” as a physical effect, for example, controlling a machine.

You will probably think that what difference does it make whether you manage a car or finances? Here we need to look deeper.

Financial management is not just the management of financial resources and financial activities of an enterprise. It is the brain of the organization that collects information about financial resources and financial activities enterprises; this is the brain that makes calculations of the received data on the financial resources and financial activities of the enterprise; this is the brain that analyzes every detail of education, movement financial resources, and also analyzes the implemented management decisions in the financial policy of the enterprise.

Until certain times, financial management was implemented in the area of already made decisions. But in our time, it has become vital to carry out short- and long-term planning of financial activities, looking into the future of the life of the enterprise in numbers.

This is where the budgeting system arose. Thus, budgeting is a constant procedure for drawing up, maintaining and executing budgets (financial plans).

Financial planning is the process of developing a system of financial plans (budgets), indicators to ensure the development of an enterprise with the necessary financial resources and increase the efficiency of its activities in the coming period.

The need to draw up budgets is due to many reasons. Here are examples of some of them:

Uncertainty of the future;

Uncertainty about the future;

Coordination of various enterprise structures in their use of financial and material resources, limited resources, etc.

The main goal of budgeting is to increase the efficiency of the enterprise, its financial stability and development.

This is achieved by solving the following tasks:

· determination of the volume of possible cash flows (from all sources of cash flows);

· determination of opportunities for the sale of goods, works, services (their quantity and cost) based on the results of concluded contracts and competition;

· justification of all possible expenses for the period of drawing up budgets;

· establishing optimal proportions in the distribution of financial resources;

· analysis of the efficiency of the enterprise based on the results of prepared budgets, analysis of the financial indicators of the enterprise;

· identifying risks, analyzing the need for their use, and reducing them.

Principles of the budgeting system

Like any system, the enterprise budgeting system has a number of principles that emerged as a result of studying this topic:

1. The principle of unity.

This principle means that budgeting should be carried out uniformly throughout the enterprise. In other words, all divisions of the organization are united, interconnected, and have the same economic goals; Communication between departments is carried out by coordinating the budgets of all departments.

2. The principle of participation.

This principle means that each structure of the enterprise participates in financial planning: it provides data on financial indicators of his unit, makes adjustments; heads of all departments participate in the adoption management decisions when analyzing the results of budget execution.

3. The principle of continuity.

In order to ensure effective budgeting, planned activities at the enterprise must be carried out regularly and continuously.

With the constant preparation and adjustment of budgets, their effectiveness is at high level. Also, for the continuous preparation of current budgets, it is necessary to carry out the plan-fact-analysis procedure, since on its basis values for future budgets are compiled.

4. The principle of flexibility.

This principle is characteristic feature budgeting. It lies in the fact that the financial manager has the right to adjust the budget, and when drawing up, pledge a little more or less funds, thereby creating a reserve for security, for example, excess “credit potential”, which can be borrowed if there is a need for funds.

5. The principle of efficiency.

According to this principle, the costs of budgeting should not be higher than the costs of its application. That is, financial planning should increase the efficiency of the enterprise, and not vice versa.

The budgeting system in our country began to develop later than abroad. As a rule, this system is inherent in large corporations and enterprises; limited liability companies live a modest life, but, despite the small turnover of funds, budgeting could contribute to their development.

Based on experience foreign countries, you can identify a considerable number of advantages when using budgeting in an enterprise.

These include:

Budgeting helps you control production activities, manipulating her is justified. Without a production budget, the head of the enterprise sees only the end result, be it positive or negative, and it is difficult to assess the reasons for the result obtained;

Budgeting significantly increases the efficiency of distribution and use of company resources, and also allows you to identify weaknesses.

If the enterprise does not have a budgeting system, then, basically, in order to analyze the activity of the enterprise, the indicators of the current period are compared with the previous one. But this can either lead to incorrect conclusions, or the situation may not fully manifest itself.

If the results of the work have changed in better side, this is good, but it does not take into account the new opportunities that were not there before, which may not be used for new and better results.

Financial Responsibility Centers

As we said earlier, budgeting is not just the process of drawing up budgets. This is a long cycle: planning - drafting - execution - analysis. This is a colossal work that must be performed not by one person, but by a department. Financial responsibility centers help financial managers with this.

The Financial Responsibility Center (FRC) is that part of the company’s financial structure that carries out business operations in accordance with its budget and has all the necessary resources and powers for this. Financial responsibility centers are divided according to responsibility for achieving goals for specific budgets.

The following central financial districts can be distinguished:

· cost center - a structural unit (or group of units), the head of which is responsible for maintaining a certain amount of costs (for example, a production workshop, purchasing department). For the cost center to operate effectively, a cost budget is drawn up and must be adhered to; a target setting for minimizing costs is given, but at the same time they need to take into account that when costs are reduced, the quality of products may decrease due to the purchase of lower-quality raw materials, or the hiring of unqualified employees;

· income center - a structural unit (or group of units), the head of which is responsible for maintaining a certain amount of income; this division is related to the main activity and can affect the income of this activity (for example, the sales department);

· profit center - a structural unit (or group of units), the head of which is responsible for maintaining a certain amount of profit (revenue - direct costs - indirect costs);

· investment center is a structural unit (or group of units) of an enterprise, the management of which is responsible not only for revenue and costs, but also for investments and the efficiency of their use (for example, a department additional education, which develops new educational programs).

Based on this, we will compile Table 1.1, which reflects the results of the introduction of Financial Responsibility Centers: positive features and difficulties that may be encountered.

Table 1.1 Result of the introduction of Financial Responsibility Centers

|

Positive features |

|

|

Achieving transparent operation of the enterprise |

The need to disclose confidential information to a large number of employees (the heads of the Central Federal District are privy to the intricacies management accounting, which is not always good) |

|

Empowering managers of financial responsibility centers with authority and responsibility contributes to staff development and increases their motivation |

Conflicts related to the distribution of indirect costs between the central financial department and pricing |

|

Expanding the rights and competencies of employees (in particular, financial ones) |

Making wrong decisions due to insufficient competence of the second level of management |

|

Increasing the speed of making correct decisions at low |

Lack of uniform standards in the activities of different Central Federal Districts |

|

levels, due to the fact that the CFD manager is “narrow” a specialist, but at the same time very good |

Inaction, indifference, resistance from employees who may not be interested in achieving transparency and efficiency |

|

Possibility of motivating employees for the financial results of their activities |

Resistance from employees who do not want to make independent decisions and take responsibility, as well as do accounting work |

|

More accurate calculations due to the use of several indirect cost distribution bases (if there are several cost centers) |

Increased time and other costs resources for management accounting |

|

Positive features |

Negative traits, difficulties |

|

Stimulating cost reduction (working within approved budgets and individual plan-fact analysis for each financial responsibility center) |

The emergence of unhealthy competition between individual central federal districts |

When assessing plan execution by financial responsibility centers, budgeting is the basis, and the work of managers of the Central Federal District is assessed based on reports on budget execution, which motivates managers to take responsibility. If plans are not fulfilled, attention should be paid to the Central Federal District responsible for these plans.

Functions of the budgeting system

The budgeting system allows you to make decisions in terms of analyzing the optimality of production, planning production and sales of products, and making investments.

When setting up budgeting in an organization, the following issues need to be considered:

1) which department or employee (depending on the size of the enterprise) will be involved in budgeting;

2) choosing a method for future budgeting;

3) how control over budget execution will be carried out;

4) selection of methods and methods for analyzing deviations from the planned value.

Based on the experience of small enterprises, we can conclude that budgeting is carried out by the economic department, which includes financial managers, economists and a manager.

Economists, in cooperation with accounting departments, present actual and standard budget costs and results, and financial managers develop recommendations for optimizing their results.

Economists calculate the expected result of activity in various areas and assess how realistic it is to achieve it. They are also required to foresee the economic situation of the organization after a certain period of time when analyzing the execution of various budgets.

To consider the following questions, we will analyze the functions of the budgeting system.

Budgeting is designed to perform three main functions:

Planning;

Control.

1. Planning.

This function is the most important, since budgeting is its basis, the beginning of the cycle of the budgeting process. Budgets are drawn up on the basis of the organization’s strategic plans, which ensures the rational distribution of the enterprise’s financial resources.

When creating budgets, there is quantitative certainty about the prospects for the company's activities; all results, future efficiency and costs acquire monetary expression.

In addition, the budgeting system contributes to a clear and correct choice of goals, development of a business strategy, and proper performance of the strategic management function.

Among other things, budgeting is the basis of management accounting. The entire accounting system must present accurate facts by type of product, structural division, area of trade, or all of these indicators at the same time.

The budgeting system in an organization allows you to have accurate information and compare the intended goals with the results of its activities (plan-fact-analysis).

3. Control.

Of course, this function is also very important, since no matter how good the plan is, it will remain useless if there is no clear control over its implementation.

Also, to exercise control in the field of budgeting, it is necessary to regularly review budgets and, if necessary, make adjustments.

Methods for developing budgets

Even at the stage of drawing up the regulatory framework that will regulate the budget process, it is necessary to decide on the method of developing budgets.

It is believed that there are three main methods for drawing up budgets that can be used at all stages of the budget cycle, that is, during planning, coordination, and approval. These are the following methods:

- "down up";

- "top down";

Iterative.

When using the “bottom-up” method, budgets are drawn up from lower structures to higher ones, that is, based on the plans for the activities of departments and projects, which are then transferred higher to determine the final results and indicators for the entire company.

With the next method - “top-down” - everything happens the other way around: the figures of the leading divisions are descended to lower divisions, that is, budgets are drawn up on the basis of the desired (target) indicators, which are compiled by the company’s management.

For this method, the final indicators are determined based on economic forecasts, as well as the strategy of the enterprise.

With the iterative method, the budgeting process includes several stages.

First, information about the desired results of the enterprise comes from top management to lower divisions; Next, information about capabilities is collected, then generalized from below and fed back up the hierarchical management structure, and such a scheme can be carried out several times depending on the situation.

During the planning procedure, in order to make correct and rational decisions, enterprise management must have generalized and filtered information from all departments, which is available to lower-level managers.

They, in turn, are provided with this information by the budget process at the analysis stage, built on the bottom-up principle.

At the same time, very often lower-level managers themselves can plan their activities more rationally if they have complete information received from management, who, as a rule, are much better aware of the overall picture within the company and know the long-term goals of the company. Top-down budgeting is very useful in this regard.

Judging by practice, we can see that iterative budgeting methods are more often used, which contain features of both one and the other option - the question is which approach prevails.

Budgets drawn up “from the bottom up” contain the collection and filtering of the necessary information from lower-level managers to the management of the enterprise.

Managers who are responsible for execution budget indicators, prepare budgets for those areas of activity within which they are responsible.

This approach is very smart, because In the process of drawing up budgets, managers apply their accumulated experience, knowledge of the importance and problems of a particular area.

This increases the likelihood that the right goals will be set and the right budgets will be adopted, for the execution of which the department will strive to achieve the planned goals.

But such a difficult process also has its downside: a large amount of effort and time will be spent on coordinating the budgets of various structural units.

In addition, quite often the indicators transmitted “from below” can be greatly changed by managers during the procedure for approving budgets, which, in the event of an unreasonable decision to change or with weak argumentation, a negative reaction from subordinates may occur. And the more often such a situation occurs, the greater the likelihood of a decrease in trust in management, as well as attention to the budget process on the part of lower-level managers.

In the future, this may affect the accuracy and care of data preparation, or even indicate deliberately false figures in the initial versions of budgets.

The bottom-up budgeting method is quite widespread in Russia, both because of the unclear market situation and because of the reluctance of management to engage in planning.

Budgets drawn up on a top-down basis require the management of an enterprise to have a clear understanding of the basic intricacies of the organization and the ability to form a transparent and realistic forecast for at least a short period.

This method ensures consistency of budgets between different departments, and also allows you to set targets for sales, expenses, etc. to evaluate the performance of financial responsibility centers.

The most rational method is an iterative budgeting system, in which control financial figures are first given from top to bottom, and after forming in the opposite direction, from bottom to top throughout the entire system of enterprise budgets, up to the main financial budgets - the budget of income and expenses (BDR), cash flow budget (CFB) and Consolidated Balance Sheet.

If the set goals are achieved, budgets are presented to management for approval, after which they become directives from the project and are sent to all managers of the company for implementation and monitoring of their implementation.

If, based on the results of the analysis, a discrepancy between the obtained final indicators and the desired ones is discovered, then the company management receives an assignment to prepare a different version of the budgets. Such manipulations are repeated until a suitable version is reached, which will be accepted as approved.

Financial Director

No. 5, 2002

Budgeting is one of the main tools for company management. The most "advanced" Russian enterprises already successfully use the budgeting procedure to plan their activities. But, as can be seen from the results of the round table held by our magazine, practitioners with budgeting experience have questions that require clarification. What can we say about those domestic companies that are just now starting to implement budget processes. That is why our magazine is starting to publish a series of articles devoted to this topic. In them, relying on personal experience, the authors will talk about their vision of the budgeting problem. At the same time, the editors will try to give an opportunity to speak out to those who have an opinion different from the author’s. We open the series of articles with material about general principles budgeting.

A company that wants to succeed in the competition must have a strategic development plan. Successful companies they create such a plan not on the basis of statistical data and their projection for the future, but based on a vision of what the company should become after a certain time. And only after that they decide what should be done today in order to be at the intended point tomorrow.

In the process of achieving set goals, deviations from the given route are possible, so at each “turn” the enterprise has to calculate various options for its further actions. The tool for such calculations is budgeting.

In numerous textbooks devoted to this topic, one can find various definitions of the concepts “budget” and “budgeting.” Within the framework of this article, the author proposes to use the following terminology.

Budget is a plan for a certain period in quantitative (usually monetary) terms, drawn up with the aim of effectively achieving strategic goals.

Budgeting- This is a continuous procedure for drawing up and executing budgets.

Let's look at the basic principles that you need to pay attention to

a company counting on the successful implementation of budgeting.

Three components of success

Like any procedure, budgeting must be carried out according to pre-approved rules. Therefore, first of all, it is necessary to develop and approve uniform rules on the basis of which the budgeting system will be built: methodology, design of tabular forms, financial structure etc. It is necessary to ensure that these rules work. And here the “human factor” plays an important role.

Managers often greet budgeting with hostility. Some perceive this simply as additional work that they are trying to impose on them, others fear that budgeting will reveal shortcomings in the work of their departments, and still others may not even understand what is required of them. To force managers to carry out budget procedures, you need to use the notorious “administrative resource”.

Budgeting regulations, the budget itself, the motivation system - all this must be approved by internal company orders, for failure to comply with which employees should be punished. Thus, the second component of budgeting is organizational procedures. The third key to success is automating the entire budgeting process. In large enterprises, the volume of information is enormous, but no matter how significant it is, it must be processed in a timely manner. IN modern business Nobody needs yesterday's data. It is necessary to analyze today's indicators and forecast for tomorrow, the day after tomorrow, a month in advance, etc. Automation of budgeting is, first of all, automation of planning. In essence, this is the automation of those procedures that are described in the budgeting regulations.

Final budget forms

The entire budgeting procedure should be organized in such a way that at the last stage management receives three main budget forms:

- budget of income and expenses;

- cash flow budget;

- forecast balance.

Some businesses consider it sufficient to draw up only one budget: income and expenses or cash flow. However, for effective planning of the company’s activities, it is advisable to receive all three budget forms at the output. The budget of income and expenses is determined economic efficiency enterprises, in the cash flow budget directly plan financial flows, and the forecast balance reflects the economic potential and financial condition enterprises. It is unlikely that financial directors need to explain that without at least one of the three budgets, the planning picture will be incomplete.

Personal experience

Igor Govyadkin, Director for Economics and Finance of the Main Information Computing Center of Moscow

We draw up a budget of income and expenses and a cash flow budget. But we are not interested in the forecast balance, since we have no problems with financial stability or independence.

All final forms are filled out based on operating budgets (sales budget, production budget, etc.). General scheme the formation of final budgets based on operating ones can be found in any textbook on budgeting or management accounting, so we will not present it within the framework of this article. However, in one of the following articles we will analyze in detail the process of forming all budgets using the example of a Russian holding company.

It should be noted that after drawing up a budget of income and expenses, a cash flow budget and a forecast balance, the planning work does not end. Firstly, the data obtained are the initial data for management analysis, for example to calculate coefficients. And secondly, the stage of correction, approval, and resolution of problematic issues begins. The entire budgeting process enters the second round, and as a result, one part of the quantitative information moves into the “mandatory” category, and the other into the category of immediate updated plans.

Efficiency is in following the principles

The principles of effective budgeting are common sense and quite simple. To compare and analyze data from different periods, the budgeting process must be constant and continuous. The periods themselves must be the same and approved in advance: week, decade, month, quarter, year. Let's look at the basic rules that any budgeting company must follow.

The principle of "sliding"

Continuity of budgeting is expressed in the so-called “sliding”. There is a strategic planning period, such as five years. For this period, a so-called development budget is drawn up, which should not be confused with a business plan. The business plan should contain not only quantitative information, but also the idea of the business, marketing research, production organization plan, etc. In principle, the financial part of the business plan represents the development budget.

The five-year strategic planning period includes another period of four quarters. Moreover, such a planning period is always maintained: after the first quarter, another one is added to the fourth and a budget for four quarters is drawn up again. This is the principle of "sliding". What is it for?

Firstly, using a “rolling” budget, an enterprise can regularly take into account external changes (for example, inflation, demand for products, market conditions), changes in its goals, and also adjust plans depending on the results already achieved. As a result, forecasts of income and expenses become more accurate than with static budgeting. With regular planning, local employees become accustomed to the requirements and align their day-to-day activities with the company's strategic goals.

Secondly, with static budgeting, the planning horizon is significantly reduced by the end of the year, which does not happen with a “rolling” budget. For example, a company that approves a budget for the year in advance once a year in November, in October has plans only for the next two months. And when the budget for January appears, it may turn out that it is already too late to order some resources, the application for which should have been placed three months before delivery, that is, in October.

Personal experience

Igor Govyadkin

We use a static budget, since our main customer - the Moscow Government - works within the framework of annual budgets. But we draw up the preliminary budget for next year in September.

Approved - execute!

Approved budgets must be executed - this is one of the basic rules. Otherwise, the whole idea of planning and achieving your goals is null and void. For non-compliance it is necessary to punish, for execution - to motivate (the issue of motivation within the framework of the budgeting process will be discussed in detail in one of the following articles of this series).

Personal experience

Alexander Lopatin, deputy general director Svyazinvest company

When a step to the left or a step to the right of the budget is considered a crime - this is extreme. There is no need to be afraid to revise the budget - this is a normal process. You just need to clearly define the reasons for the change, the procedure for making changes, etc. If everything is clear to everyone, there are regulations, then problems and questions should not arise.

Teijo Pankko, Chief Financial Officer of Alfa-Bank

The budget is practically a law. Since we approved it, it means that this is how we want to work. And the end result must be achieved. If something unplanned happens, we must understand why it happened, why the set goals were not achieved, and make appropriate operational decisions.

At the same time, as mentioned above, budgeting is primarily based on common sense. Any company may encounter force majeure circumstances, so the regulations must provide for a procedure for both planned and emergency budget adjustments. Ideally, the budget should include the probability of any event occurring. For this you can use, for example, a flexible budget.

A flexible budget is prepared on an “if-then” basis. That is, a flexible budget is a series of “hard” budgets based on various forecasts. In the future, no matter what events occur (military conflicts, global economic crisis, new OPEC decisions), the budget will not have to be reviewed or adjusted. It will be necessary to strictly implement the budget, which is based on the fulfilled forecast.

The Royal Dutch/Shell Group successfully used flexible budgeting in the 1980s. At that time, many oil companies believed that by 1990 oil prices would rise to $60-80 per barrel, and based on this they planned their development strategy. Royal Dutch/Shell Group has developed three possible scenarios, one of them taking into account low prices for oil. The real price in 1990 was $25 per barrel. The use of "flexible" planning allowed the Royal Dutch/Shell Group to develop better than other companies in the current conditions. It is advisable to draw up a flexible budget in the case when there are parameters that do not depend on the enterprise, but have a significant impact on the results of its activities. Such parameters can be sales price, volume of demand, price of resources (for example, when the main resource is oil) and others external factors affecting the work of the company.

From indicative planning to directive planning

How often should you review your budget? The answer to this question should be contained in the regulations. Budget revision is the same regulated procedure as the preparation or execution of a budget. To do this, all plans must be divided into two categories: preliminary (indicative) and mandatory (directive).

The process of moving a plan from the “preliminary” category to the “mandatory” category must include certain stages: adjustment, coordination and approval. The duration of all stages is specified in the budgeting regulations. All this is necessary to ensure that the budget is not just a plan, but a plan that can be implemented. You can only get managers to fulfill an unrealistic budget once, but if you demand this constantly, the manager will simply leave the company.

Personal experience

Igor Govyadkin

We have adopted a year and a quarter as an indicative planning period, but the monthly budget falls into the category of directive plans.

Elena Korneeva, financial director of the company "I.S.P.A.-Engineering"

We do not draw up directive plans, only indicative ones. Even within the weekly budget. The situation is changing very quickly, and therefore we try to quickly respond to all changes. The budget cannot be monumental, it must reflect real life enterprises.

Toward common standards

All budget forms (tables) must be the same for all accounting centers. This is especially true for holdings that include various enterprises. If each plant uses its own forms, then the financial service management company the bulk of the time will be spent on data consolidation, rather than on planning and analyzing results.

The procedure for filling out budgets at different enterprises of the holding, as well as at the levels of financial responsibility centers within enterprises, should be the same standard and based on a unified methodology. Accordingly, the deadlines for submitting budgets by divisions of the holding to the management company should be uniform.

The principle of detailing expenses

In order to save resources and control the use of funds, all significant expenses should be detailed. The author recommends detailing all expenses that account for more than 1% of total expenses, although company size should also be taken into account. The point of detailing is to prevent managers of costly departments from profiting at the expense of the company.

The directive part of the budget should be much more detailed than the indicative part and have the highest possible level of detail.

Detailing may be subject to accounting period. For example, the income and expense budget can be detailed by month, and the cash flow budget by week or even banking day, since control over financial flows requires greater care and efficiency.

The principle of "financial structure"

Before implementing budgeting, an enterprise needs to create a financial structure that can be built on principles other than organizational structure. Some divisions can be combined into a single financial accounting center. Conversely, within one division, different accounting centers can be distinguished (for example, by type of product or area of activity).

Depending on the category of the accounting center (whether it is a profit center or a cost source), various systems criteria for assessing the effectiveness of these units.

Having developed a financial structure, the enterprise will identify the number of levels of collection of budget information and, depending on this, will be able to create a schedule for drawing up budgets for each accounting center.

"Transparency" of information

To eliminate the possibility of distortion of information and strengthen control over budget execution, a specialist analyzing data from final budget forms needs access to the budgets of each accounting center, as well as to the operating budgets within the accounting centers themselves, down to the lowest level. In addition, he must have information about the stage of budget formation at all lower levels. And if some department submitted a budget later than necessary, then the financier responsible for budgeting must promptly receive information about the reasons why this happened. Therefore, constant monitoring of the budgeting process at all levels is necessary. In automated budgeting programs, such monitoring is easy to carry out; it is much more difficult to do this if budgets are formed in ordinary spreadsheets.

Towards effective budgeting

All procedures and principles described above must be reflected in the “Budgeting Regulations” that are uniform for the entire company. This document should define the procedure for approving budgets and their consolidation, forms of documents, workflow schemes, as well as the timing of consideration and decision-making at all levels of collecting budget information.

It must be remembered that budgeting is a large systemic task. But, despite the difficulties that arise in the course of solving it, we must try to adhere to the principles described above.

The main thing is to understand why budgeting is needed.

Interview with the financial director of the Econika corporation Vladimir Borukaev

How long has your company been using budgeting?

When we started doing business, we, like many other companies, didn’t even think about introducing budgeting. Then, in 1993-1994, we began to carry out planning in the classical form in which it is meant. Budgeting was introduced in stages. Some areas were implemented intensively, others gradually.

What should financial directors who are planning to introduce budgeting in their enterprises first pay attention to, where to start?

In my opinion, when implementing budgeting, the main thing is to understand the essence of the process. If a person does not understand the process, it will just be numbers. Management must monitor performance for each budget item. If they have changed, you need to understand why this happened.

Does your enterprise have a system of motivation and managerial responsibility for budget execution? What kind of fines, bonuses?

And fines and bonuses, of course, exist. But there is no direct, clearly defined dependence on budget execution. With us, each manager is responsible for his department and the final result he receives. You cannot reward or punish for the fulfillment or non-fulfillment of one budget item, especially in the short term, without understanding the process as a whole. It is necessary to understand the reasons, which do not always depend on the person responsible for the budget item.

The sales budget is often called one of the most difficult budgets to both plan and execute. How is it compiled in your company?

The sales budget is formed based on the goals set for each department. For each source of income, a marketing plan, on the basis of which sales volume is predicted.

On what basis are these plans formed? Are they brought down from the top by management or initiated by the units themselves?

The management company determines the strategic goals and directions of development of the holding as a whole, and the subsidiaries, in accordance with them, independently form their own product and marketing strategies and plans, which are then approved by the Board of Directors.

During the round table on budgeting, which was held by our magazine, among others, questions were raised: how should a financier control technical services, how to check the reality of the numbers in their budget requests? What do you think about it?

When approving write-off standards, we first look at the existing statistics of the costs that we want to standardize. Moreover, several people usually participate in the development of standards, for example, heads of the transport service and logistics department. In addition, an auditor or an independent consultant is also involved in this process and provides an opinion. The standard is approved by a special commission.

At what point does an enterprise need to introduce budgeting? It’s no secret that many companies still manage without it?

If this is not a one-time transaction, then planning is already required, at least for large indicators. If the business has a long history, then everything needs to be calculated more accurately and seriously. Although some heads of organizations believe that “the money goes and goes, why do we need planning and budgeting.” Typically, this approach ends up having a negative impact on the business.

If you are interested in automation of budgeting, implementation of treasury or accounting according to IFRS, check out ours.

The main principles of building an effective budgeting system for a company:

- The Company's budgeting system is built in accordance with the Order on approval of the organizational structure, the Order on approval of the financial structure and standards for constructing budgeting systems.

- Objects of the Company's budgeting system are Financial Responsibility Centers (FRC). Each Central Federal District has a manager who is responsible for the economic results of the Central Federal District. The structure of the Central Federal District does not necessarily coincide with the administrative or organizational and legal structure of the Company.

- Setting goals within the framework of the Company's budgeting system can be carried out top-down (from the Board of Directors on the basis of the Budget assignment to the heads of the Central Federal District), and bottom-up (from the heads of the Central Federal District to the Board of Directors), consolidation and protection of budgets from the heads of the Central Federal District to the Board of Directors.

- Participation in the budgeting process is the direct responsibility of the managers of the Central Federal District, which includes planning the activities of the unit, determining the resources necessary to implement plans, forming and protecting budgets, monitoring the execution of budgets and saving them (searching for internal reserves).

- Budgets within the system are built on the principle of nesting. The principle of nesting the budget structure is to build upper-level budgets by consolidating items from lower-level budgets. Level 2 budgets are consolidated into level 1 budgets, which, in turn, are consolidated into consolidated budgets, and so on.

- Within the framework of the system, separate budgeting of income, expenses, cash flow, investments, assets, liabilities, and capital of the Company is accepted, i.e. accounting of income and expenses is carried out in such a way as to ensure monthly receipt of complete information in the volume and context of internal reporting indicators.

- The purposes of the budgeting system differ:

- receipts/payments of funds;

- income/expenses recognized on an accrual basis.

- Within the framework of the budgeting system, the following methods are used: “cash” and “accrual”. The cash method is applied to payments and is used to compile, while the accrual method is used to compile the Budget of Income and Expenses.

- Under the accrual method, results of business transactions are recognized in the period in which they affect the Company's results of operations (rather than when cash or cash equivalents are received or paid).

- As part of the Company's budgeting system, budget classifiers are organized in which the financial results of the Company's assets, liabilities, capital, income, expenses, and cash flow are consolidated item by item.

- Each head of the Central Federal District is responsible for a specific item in the budget classifiers. If financial results several central financial districts are formed under the article, each head of the central federal district is responsible for the financial result of the article in the part in which it influences.

- The Company's budgeting system establishes control over the targeted use of funds, control of costs by classifier items, both before and after their occurrence.

- Planned parameters for the activities of departments and the Company as a whole are set by the budgeting system. The source of information on the actual execution of budgets is the management accounting system.

- The budgeting procedures and established target standards (limits, indicators) remain unchanged throughout the entire established budget period.

- The budgeting process in the Company is carried out for the year, broken down by month.

- The principle of the functionality of the budget structure is to implement the possibility of forming budgets for various functions of the Company by consolidating items covering a given function from various operating budgets.

- The principle of distribution of the budget structure is to distribute responsibility for each article of the classifiers between the Central Federal District through budget formats. Thus, responsibility for each indicator that makes up the financial result of the Company is personalized.

What are budgeting systems, why OLAP is so good for them, why big business spends tens and even hundreds of millions of rubles on their maintenance?

For some reason, there is no article in RuNet on the topic of designing budgeting systems, written in popular language. This material is an attempt to fill this gap and in simple words talk about the functional and technical side of such systems. In order to keep the volume of material within reasonable limits and not rewrite textbooks, it was necessary to omit or simplify some details.

If any statements seem controversial or insufficient to you, I will be glad to criticize and communicate in the comments.

What is budgeting

Conceptually, budgeting is the process of planning operations with assets of various types. In its simplest form, this means planning cash receipts and payments.

Typically, budgeting arises in an enterprise at the moment when several employees appear who have the right to enter into contracts and make financial decisions at their own discretion. This delegation allows you to close many more deals at the same time and takes the brakes off your revenue, but comes at the cost of losing intuitive control over efficiency and profitability. As a result, three new problems arise:

Firstly, several people, independently earning and spending money from a common pot, need a tool for coordinating actions: one earns money, another pays wages, a third buys materials, and a fourth attracts loans - coordination is needed.

Secondly, the balance of the current account can no longer serve as a tool for monitoring affairs - when large quantities unrelated, parallel transactions, it is uninformative.

For example, the amount in the current account will grow, even if the company is operating at a loss, as long as the growth in sales volume covers current expenses.

Conversely, an untimely large purchase can destroy a highly profitable business if it causes the company to be unable to meet other obligations and to file for bankruptcy.

Thirdly, the opportunity to pay with company money and accept obligations for it is an irresistible temptation for employees. In the absence of control, abuse is inevitable.

Thus, the main task of the budgeting process is to solve these three problems.

The solution method is as follows:

The first step is to build a mathematical model that will calculate, balance and coordinate future income and expenses, providing each of the delegates with guidance on how much, on what and when he can spend, and how much he must earn to meet these expenses.

The second step is to build a process for agreeing contracts and approving invoices to comply with established rules.

The third step is to take into account actual financial transactions and adjust plans and limits so that income and expenses continue to match each other.

Why use OLAP for budgeting

Budgeting and BI systems are usually built using OLAP - On-Line Analytical Processing technology. In fact, OLAP is a close relative of spreadsheet processors: Google.Sheets and MS Excel. In OLAP cubes, you can also enter data and formulas into cells, establish connections between them, quickly calculate amounts (aggregates), write scripts that will manipulate many cells and ranges, etc. The main difference is that a table processor cell has three coordinates - sheet, row and column, while an OLAP cube cell can have several dozen coordinates.For example: Oracle Hyperion has six required dimensions, two multi-currency and twelve user-defined. Most budget models include from 9 to 14 dimensions, but in some cases there may be 20. This number of dimensions is necessary to always store interrelated numbers in adjacent cells, regardless of the complexity of their structure, thereby reducing most operations with them to arithmetic, and reduce the speed of reporting generation to seconds.

BI systems also provide many important services: the ability to write SQL-like queries, create and fill out beautiful reports with the mouse, centrally store all data, manage viewing and editing rights, program integration with other databases, etc.

The benefits of OLAP are even more clearly demonstrated by solving a typical corporate governance problem:

Problem: At the end of the next quarter, reports showed that costs were growing faster than revenues. Task: Identify specific operations that most influenced the problem, the managers responsible for this, and jointly plan measures to normalize the situation.

Solution: Open from the OLAP cube to the cost and income report. Next, one by one, open the sections with the mouse: by product, by time period, sales channel, region, division, customer category, type of cost, etc. to the level of specific accounting entries. Localize exact deviations in the costs and volumes of operations, organize them by volume. Obtain specific facts and measurable indicators for further work with responsible managers, in order of their contribution to the total deviation.

Now imagine how many spreadsheets you need to create and view to do the same in a company with a couple of dozen divisions or more?

General principles for constructing budgeting systems

For any system, it is true that the absence of clearly formulated goals leads to the creation of a multifunctional, but completely useless product. Goals are the criterion for prioritizing requirements. Lack of priorities will lead to the team spending most of its resources on implementing unimportant and conflicting functions.In case of budgeting ultimate goals This:

- Ensure the expediency and coordination of the company’s income, expenses, receipts and payments in conditions where financial transactions are carried out simultaneously by many employees.

- Organize control over payments and cash receipts so that at any time you know the limits on types of costs that the company can afford, taking into account actual income and expenses that occurred in the past, as well as taking into account the need to maintain a sufficient reserve of cash to cover future costs and risks.

You should pay attention to the word “Feasibility”. This phrase may be unclear to some readers, others will think that we're talking about that all income and expenses should be subordinated to the goal of making a profit, and they will also be wrong.

Profit is a popular goal for managers, but it is not the most reasonable, so most professional managers They want not just profit, but an increase in the Company’s financial flow. Financial flow consists of the growth rate of turnover (income), profit margin and asset value. It is necessary to design the system so that it allows you to find the right balance between the size of profit, the rate of growth of business turnover and the size of assets in such a way as to obtain maximum benefit both today and in the future.

Technically, the budgeting system is simple - it is an array of amounts of financial transactions, broken down by several analytics, one of which is always the calendar period. On the other hand, it is quite complex - it consists of a couple of dozen hierarchical directories, hundreds or thousands of forms and reports, and dozens of scripts.

If you are an experienced financial manager and know exactly what you want, then you can easily build one for yourself. However, if this is your first implementation, then there is a high probability of difficulties, especially if you are a financier and understand in management accounting methodology.

A complete, methodologically correct budget model that takes into account the structure of a business is objectively complex. But few people can clearly formulate so many tasks and requirements and set priorities on the first try. As a result, you will most likely end up with a system that implements all the requirements of the methodology, but is of little use for solving basic problems.

To avoid this, it is necessary to complicate the system gradually, implementing functions in the order of cause-and-effect relationships between the problems they solve.

In my opinion, the priorities between functions should be as follows:

- Ensure basic coordination - draw up a plan for the types of receipts and payments, by period.

- Establish personal responsibility and limits - delegate planning to departments, maintain a master plan and organize the approval of contracts and accounts.

- Introduce factual accounting and basic performance assessment procedures.

- Ensure the possibility of objective control - move from planning amounts to price and physical indicators.

- Implement costing and pricing calculations - one by one, introduce procedures and reports in accordance with the management accounting methods you require.

- Introduce planning in the context of legal entities and implement master budgets, starting with BDDS and BDR.

- Complicate: Introduce additional sections and advanced accounting and business analytics methods.

Building budget planning functions

The first task that a company solves when planning a budget is the coordination and coordination of financial transactions between all authorized employees. In order to do this, at a minimum, you need to have a table with the amounts of cash receipts and expenses broken down by types (elements) and calendar periods.

Thus, we receive the first and most important reference books: “Types of income and expenses” and “Periods”. Different organizations have different volumes of activity, financial habits, and terminology, so “Receipts and Costs” are often replaced by “Accounts” or “Items.”

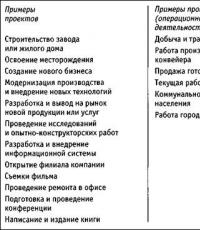

Picture 1 - Examples of simple budgets

The next step is to set personal limits, which is why the third most important reference book is the “Financial Responsibility Centers” (FRC).

Having three dimensions with reference books “Articles”, “Periods”, “CFD”, you can already delegate the rights to carry out financial transactions to employees and coordinate their actions. But at the same time, you can control the validity of the entered amounts only informally, by communicating with everyone, and this is a very labor-intensive and time-consuming procedure that must be repeated regularly. The second unpleasant consequence is that you cannot quickly make financially sound decisions, for example: at what price to purchase materials, whether to pay a new employee the desired salary, etc.

To change this, you need to budget not amounts, but indicators: the amount of materials purchased, average purchase prices, employee hourly rates, labor costs, natural production and sales volumes, etc. In this case, you can double-check the data using objective sources without communicating with employees. In addition, you can conveniently delegate this task to assistants. Planning prices and natural volumes also allows you to quickly determine the impact of deviations of one indicator on another and on the amount, and this will significantly strengthen your arguments in negotiations with partners.

Thus, we come to four directories: “Articles”, “Period”, “CFD” and “Indicators”, while the number of elements in the “Indicators” directory depends on the number of units of measurement, coefficients and formulas used. In the simplest case: “Price”, “Quantity” and “Amount”.

Picture 2 - Budgeting from natural indicators in the context of the Central Federal District

The control efficiency has now become much better, but you still cannot calculate the cost of production and determine the minimum and optimal prices. The easiest way to determine your cost is to simply divide all your expenses by the number of products produced. However, this will only work if you produce one product, otherwise questions immediately arise about the fairness of distribution. Therefore, financiers use more complex approaches, such as Marginal Costing, Absorption Costing, Activity Based Costing, etc.

The simplest of them is Marginal Costing. With this approach, all types of costs are divided into two groups: direct and indirect. Next, for each product, standards are calculated by type of cost, and the calculations are programmed so that when you enter the production volume, the volume of direct costs is automatically calculated. Obviously, in this case, the minimum possible selling price of the product will be its marginal cost.

Using the Marginal Costing method, we come to five directories: “Articles”, “Period”, “CFD” and “Indicators”, “Products”, and in the directory “Indicators” we also add “cost standards”.

Picture 3 - Budget after implementing Marginal Costing

Then the following problem arises: in most organizations it turns out that there will be more indirect costs than direct ones. If you produce more than one type of product and are not ready to intuitively divide indirect costs, you will need to apply Absorption Costing and understand the fair cost of production, taking into account all costs. With this approach, it is necessary to divide all costs into two categories: those related to the production of a specific type of product and those necessary for the operation of the Central Federal District as a whole.

The first category of costs is allocated to specific products and divided by production volume to obtain unit costs, but such simple costs are rare. The second category is more difficult to distribute: not every central federal district produces products; in addition, they constantly provide services to each other, so their expenses are mixed.

To solve this problem, you will need to first distribute all costs to specific central financial districts, and then divide all central financial districts into Product and Service, based on whether they directly produce products. The costs of all Service CFDs must be distributed to Product CFDs, in one or more iterations. The total costs of Product CFDs are distributed among the types of products they produce.

At the same time, indicators like “Distribution Bases” appear in the system, allowing you to fairly allocate costs from Service CFDs to Product CFDs and further by type of product.

Examples of such databases: “Number of hours for equipment repairs”, “Area of cleaned workshops”, “Labor hours for production of a type of product”, etc.

As a result, we can divide the allocated costs by the production volume and get the cost, and we can also study the mathematical dependence of the cost on the production volume.

Thus, in our model, the “Indicators” reference book becomes even more complicated and the first serious calculation scripts appear.

Picture 4 - Budget after implementing Absorption Costing

Now we can determine prices, discounts and other parameters important for doing business. We can continue to complicate the model by introducing additional management accounting methods if the situation requires it.

This way we will get closer to professional financial models, which will allow you to control not only costs and revenues, but income and expenses, current and non-current assets, capital and debts and many more important figures.

The complexity of the model and the number of directories increase even more if the company uses several legal entities, operates in several regions, uses several sales channels, factories, types of workflow, etc.

Picture 5 - Professional budgeting model

However, all this will be absolutely useless if we do not compare our plan with the actual results of the work, so we must move on to the next section.

Construction of performance evaluation functions

Efficiency is a relative indicator that is obtained by comparing two other indicators.The very first method that is usually implemented is the Plan-Act comparison. To do this, a reference book “Scenarios” is introduced into the budget model, with the elements “Plan” and “Fact”. Now we can enter actual data into the system and calculate the amount of deviations, and then redo the rest of the plan. However, if we change the numbers on the “Plan” element, we will erase what was originally entered and lose valuable information. In order to avoid this, another element “Fact-Forecast” is introduced in the “Scenarios” directory, into which the data of the “Fact” element from the past and the data of the “Plan” element for the remainder of the period are uploaded.

After this, we can adjust the numbers on the “Fact-Forecast” element and use them as new plan, while maintaining the ability to compare with the original figures and evaluate the accuracy of planning. Typically, companies review plans once a quarter or once a month; for this purpose, they create three or eleven elements of the “fact-forecast” type in the “Scenarios” directory.

The next task that is usually implemented is to compare operating results with the same period last year. This allows us to understand how much better or worse we have become. On the one hand, we can add “Period” to the dimension each time New Year with quarters, months, days and weeks, however, it is much more convenient to build tables using reference books located in different dimensions of the OLAP cube. So the best solution will create a separate dimension in the OLAP cube and place the “Fiscal Year” reference book there. This way, we can easily make a report that will contain periods in columns and financial years in rows, and the difference in the results of similar periods will be very clear.

Additionally, we can introduce the “Version” dimension in order to store different variants budget: working, agreed and approved versions, etc.

Picture 6 - A complete budgeting system

By making these changes, we can implement more advanced functions and approaches, improving our management and depth of understanding of the situation in the company through the use wide range methods developed by accountants over 400 years of development of their science.

Conclusion