Agreement for services for organizing enterprise management. Expenses for company management services. Trustee's remuneration

Currently, the current legislation of the Russian Federation allows for the possibility of concluding an agreement with an individual entrepreneur on the paid provision of services for managing the company. Meanwhile, regulatory authorities consider such agreements, as a rule, as an option for tax avoidance. In particular, claims are inevitable if an entrepreneur applies the simplified tax system and pays tax at rate 6 %. Can they be challenged?

Introductory part.

The question of the legality of transferring the powers of the head of a legal entity to an individual – a manager registered as an individual entrepreneur – currently has no clear solution.

On the one hand, part 3 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation provides for liability for evasion or improper execution of an employment contract or the conclusion of a civil law contract, whereas in fact there are labor relations. A fine for offenses of this kind may be imposed:

- for officials - in the amount of 10,000 to 20,000 rubles;

- on legal entities– from 50,000 to 100,000 rubles.

On the other hand, the current legislation does not directly prohibit the conclusion of an agreement with an entrepreneur on the provision of paid services for the management of the company.

Consequently, formally, the organization has the right to transfer the powers of the executive body to the manager - an individual who has the status of an entrepreneur. The implementation of this right depends on the will of the organization itself. Moreover, such a transfer for an organization in equally both attractive and dangerous from a tax point of view.

What is the tax benefit?

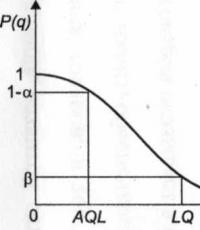

Comparative characteristics of civil law and labor relations in the analyzed situation, for convenience, we present it in a table. Let us assume that the contract establishes the manager’s remuneration in the amount of 50,000 rubles.

|

Indicators |

Labor relations with an individual |

Civil relations with individual entrepreneurs |

|---|---|---|

|

Subject of the agreement |

Execution by an individual labor function |

Performing individual entrepreneurs of a certain type of service |

|

Validity |

Indefinite or fixed-term (if the employment contract is concluded for a certain period) |

A civil contract is always concluded for a certain period |

|

Responsibilities of a tax agent |

The employer, as a tax agent, is obliged to calculate and withhold personal income tax when paying income to an employee and transfer it to the budget |

The customer does not have the responsibilities of a tax agent, since all taxes on income are paid by the individual entrepreneur himself |

|

Personal income tax – 6,500 rubles. (RUB 50,000 x 13%); insurance premiums(at basic tariffs) – Pension Fund of the Russian Federation (22 %), Social Insurance Fund (2.9 %), Compulsory Medical Insurance (5.1 %) – 15,000 rub. (RUB 50,000 x 30%); insurance premiums for “injury” (for example, for class V professional risk the tariff is 0.6%) – 300 rub. (RUB 50,000 x 0.6%) |

USNO – 3,000 rub. (RUB 50,000 x 6%); insurance premiums are paid by the entrepreneur |

|

|

RUB 21,800 (RUB 6,500 is withheld from the employee’s income) |

3 000 rub. (paid by the entrepreneur himself) |

As we can see, with the second version of the relationship, the organization can significantly save on the payment of fiscal payments. Another undoubted advantage of this option is urgent nature relationship between the parties (which guarantees the absence of problems associated with the reduction or dismissal of an employee).

Meanwhile, tax authorities often consider the transfer of powers to manage an organization to an entrepreneur using the simplified tax system as a tax evasion scheme, the purpose of which is to avoid the responsibilities of a tax agent for personal income tax. At the same time, arbitration practice in such disputes is ambiguous. And given that since 2017, relationships in the field of insurance premiums are regulated by the provisions of Chapter. 34 of the Tax Code of the Russian Federation, it can be assumed that disputes about the legality of transferring powers to manage a company to an entrepreneur using the simplified tax system (due to a reduction in the amount of insurance premiums) will flare up with renewed vigor.

Examples of court decisions.

A striking example of a positive decision for the organization is the Resolution of AS PO dated January 22, 2015 No. F 06-18785/2013 in case No. A 65-8559/2014. The essence controversial situation, which arose in 2011, is as follows.

Based on the results of the inspection of the company, inspectors considered that the transfer of powers of its director to an entrepreneur (one of the company’s participants) on the basis of an agreement paid provision services for managing the current financial and economic activities of the company were carried out for the purpose of evading personal income tax (claim amount – 669 thousand rubles).

However, the courts (all three instances) did not see in the company’s actions a scheme aimed at obtaining unjustified tax benefits. In doing so, they gave the following arguments.

Society in accordance with Art. 42 of Law No. 14-FZ has the right to transfer, under an agreement, the exercise of the powers of its executive body to the manager. Such transfer of powers to the manager is the prerogative of the company, since the resolution of this issue is within the competence of the general meeting of the company’s participants or its board of directors (supervisory board), if the latter is provided for by the charter (clause 2, clause 2.1, article 32, clause 4, clause 2, art. 33 of Law No. 14-FZ).

The coincidence of the powers of the general director with the powers of the manager is due to their performance of the same functions in managing the company, which directly follows from Art. 40 and 42 of Law No. 14-FZ. This circumstance cannot prove the imaginary nature of the agreement on the transfer of powers of the sole executive body to the manager.

The arbitrators of the AS PO also emphasized that the mere registration of an entrepreneur to enter into a disputed agreement does not indicate the illegality of the actions of the parties to the transaction. In turn, having the status of an entrepreneur entails not only the possibility of applying a 6% tax rate (of course, if the entrepreneur applies the simplified tax system with the object of taxation “income”), but also increased liability for obligations.

The interdependence of the company and the manager (the latter, we recall, was one of its participants), according to the judges of the AS PO, does not clearly indicate that the tax benefit received was unjustified. The latter can only be considered unfounded if interdependence influenced pricing.

Note:

The price of a contract for paid services includes compensation for the contractor’s costs and the remuneration due to him (Part.2 tbsp. 709 of the Civil Code of the Russian Federation). Income received from providing paid services, are included in the “simplified” tax base. According to the Ministry of Finance, compensation for the manager’s costs incurred in the exercise of the powers of the sole executive body should be included in the income taken into account when calculating the “simplified” tax (see Letter No. dated 04/28/2014 03‑11‑11/19830).

At the same time, other conclusions in a similar situation were made by the judges of the FAS UO in Resolution dated June 11, 2012 No. F 09-4929/12 in case No. A50-19343/2011. In this dispute, tax authorities were able to prove that the powers of the sole executive body of the company were transferred to an individual entrepreneur in order to obtain an unjustified tax benefit. The outcome of the dispute was influenced by the following circumstances of the case:

- the registration of the manager as an individual entrepreneur was carried out just a few days before the company made a decision to transfer the powers of the manager to him and was terminated immediately after the termination of the agreement on the provision of paid services for the management of the company;

- the entrepreneur did not show due business activity– all actions related to registration, making changes to the Unified State Register of Individual Entrepreneurs, submitting tax returns carried out by the company's lawyer in the absence of payment for services rendered by the entrepreneur;

- the amount of income paid to the manager is as close as possible to the income limit that allows the use of the simplified tax system;

- the entrepreneur had no other clients besides the company;

- the contract for the provision of management services with the individual entrepreneur contained signs of an employment relationship;

- The manager’s work schedule coincided with the work schedule of the company’s employees.

Taking into account these circumstances, the courts came to the conclusion that the agreement on the transfer of powers of the sole executive body to the manager, concluded between the company and the entrepreneur, is a labor agreement and was drawn up in order to obtain an unjustified tax benefit.

What's the end result?

So, the conclusion of an agreement on the transfer of powers of the sole executive body of the company to an entrepreneur from the point of view of current legislation is not illegal, and the exercise of the powers of the sole executive body is illegal business activity. This agreement by its nature is considered a mixed civil law agreement, since it contains certain elements of contracts of agency, trust management of property, and paid services.

Moreover, from paragraphs. 2 clause 2.1 art. 32 Law no. 14-FZ follows that not any citizen can be a manager, but only one who is an individual entrepreneur. After all, entrepreneurial activity without the formation of a legal entity, in contrast to work for hire, presupposes independently organized initiative activity of the subject at his own risk without subordination to the rules labor regulations adopted in a particular organization. In other words, the legislator in the analyzed situation initially intends to establish not labor, but civil law relations.

In this case, the entrepreneur (see Resolution of the Ninth Arbitration Court of Appeal dated 06/05/2017 No. 09AP-19171/2017 in case No. A 40-11416/2016):

- is in civil legal relations with the company on the basis of a paid service agreement;

- is referred to as a “manager” and is designated as a “manager” in contracts concluded on behalf of the company with counterparties, financial and official documentation, as well as in business correspondence;

- has the right to receive payment for services rendered by him as the manager of the company;

- acquires the rights and obligations to manage the current activities of the company on the basis of Law No. 14-FZ, other legal acts of the Russian Federation and agreements.

The relationship between the company and the manager, regulated by a contract for the provision of services, is not subject to the labor legislation of the Russian Federation. From Law no. 14‑FZ it follows that the action labor legislation applies only to relations between the company and the sole executive body of the company (director, general director) (but not the manager) and only to the extent that does not contradict the provisions of the said law.

Let us remind you that distinctive characteristics labor relations are (Articles 15, 16, 56 – 59 of the Labor Code of the Russian Federation):

- hiring an employee to a position provided for in the staffing table or assigning a specific job function to him;

- issuance of an order for his employment indicating the position, salary and other essential working conditions;

- remuneration of the employee at tariff rates or official salary (that is, the process of performing the labor function itself is paid, and not its final result);

- subordination of the employee to internal labor regulations.

In this regard, in the contract with the manager, in our opinion, it is inappropriate to include such elements of the employment contract as the systematic daily performance of a certain type of work by the contractor, fixed wages in the form hourly rates(otherwise, there is a high probability that tax authorities and courts will reclassify a civil contract into an employment contract). Moreover, by virtue of paragraph 5 of Art. 38 of the Tax Code of the Russian Federation, the results of services provided for company management do not have a unit of measurement, quantitative volume and price of a unit of measurement. The manager is given the entire volume (and not part) of the powers of the sole executive body, therefore he is also remunerated for managing all current activities without reference to any specific volume of powers performed.

In the above judicial acts, the claims of the controllers arose only in terms of personal income tax, since from 2010 to 2017, extra-budgetary funds were involved in the administration of insurance premiums. Currently, the corresponding powers have again been transferred to the tax authorities (Chapter 34 of the Tax Code of the Russian Federation). And this circumstance, in our opinion, will only aggravate the situation - now they have an additional incentive to prove that the transfer of powers of the sole executive body of the company to the entrepreneur had no effect business purpose and was pretending. Similar disputes have already arisen before (see, for example, the decisions of the Federal Antimonopoly Service dated February 14, 2013 in case No. A 65-15483/2012, FAS UO dated September 10, 2007 No. F 09-7158/07‑С2 in case no. A 71-226/07, which dealt not only with personal income tax, but also with unified social tax - the predecessor of current insurance premiums). You should also pay attention to the Decree of the AS FEB dated November 28, 2017 No. F 03-4497/2017 in case no. A73-3767/2017, in which the arbitrators agreed with the arguments of the auditors from the Pension Fund of the Russian Federation that the agreement concluded by the company with the entrepreneur using the simplified tax system for transferring to him the powers to manage the company was, in fact, an employment contract. Therefore, insurance premiums had to be calculated on the amount of payments. In support of their position, the judges pointed out that the contract did not define the terms for the provision of services characteristic of civil law relations (start date and end date), the possible number of stages, or the result achieved by the contractor upon completion of the provision of services. On the contrary, it spelled out the duties characteristic of the labor function that this entrepreneur performed as the head of this company, and not as a manager.

Simplified taxation system: accounting and taxation, No. 7, 2018

The founders of our organization entered into an agreement for the provision of organization management services with a manager who has the status of an individual entrepreneur. The tax authorities filed claims against us - in their opinion, the conclusion of this agreement is contrary to current legislation, and the head of the organization must work according to labor contract. Is such a formalization of the relationship between the organization and the manager legal?

IN Labor Code a manager is understood as an individual who, in accordance with the law or the constituent documents of an organization, manages this organization, including performing the functions of its single executive body (Article 273 of the Labor Code of the Russian Federation). In most cases, the head of an organization carries out his functions on the basis of an employment agreement (contract) concluded with him, taking into account the provisions of Chapter 43 of the Labor Code of the Russian Federation.

However, the provisions of Chapter 43 of the Labor Code of the Russian Federation do not apply to cases of management of an organization under an agreement with an individual entrepreneur (manager). Such relations will be regulated not by labor law, but by civil law. Let's consider options for their registration, as well as the tax consequences of such transactions for the enterprise.

Option 1

An agreement for the provision of paid services has been concluded with an individual entrepreneur performing management functions in an organization.

According to paragraph 1 of Article 69 of the Law of December 26, 1995 N 208-FZ “On joint stock companies"The powers of the sole executive body of a joint-stock company (director, general director) can be transferred by agreement to an entrepreneur (manager). Such a decision is made by the general meeting of shareholders on the proposal of the board of directors or the supervisory board of the company.

The transfer of powers of the sole executive body of the LLC to the manager is also allowed by Article 42 of the Law of February 8, 1998 N 14-FZ “On Limited Liability Companies” (if this is provided for by the charter of the LLC).

In this case, we can talk about the organization concluding a contract for the provision of paid services with a person who will perform management functions.

Taxation of income of a manager...

Under the generally accepted taxation system

The manager’s income received as remuneration for services performed will be subject to taxation general rules, defined in Chapters 23 and 24 of the Tax Code of the Russian Federation.

Example 1

Under the contract for the provision of paid services, the manager received remuneration for 2003 in the amount of 720,000 rubles. Expenses associated with the provision of services under the contract (car maintenance, provision of communication services, etc.) amounted to 100,000 rubles. An entrepreneur is exempt from paying VAT (Article 145 of the Tax Code of the Russian Federation).

Let us assume that the amount of costs associated with the provision of services under a management agreement is fully included in the expenses of the entrepreneur-manager.

In this case, the amount of personal income tax payable for the year will be 80,600 rubles. (RUB 720,000 - RUB 100,000) x 13%).

The amount of the unified social tax will be calculated based on the amount of remuneration of the entrepreneur-manager minus the amount of expenses incurred by him related to the provision of management services (RUB 620,000). Since the manager’s income exceeds 600,000 rubles, the amount of the Unified Tax will be (see clause 3 of Article 241 of the Tax Code of the Russian Federation): 38,950 rubles. + (620,000 rub. - 600,000 rub.) x 2% = 39,350 rub.

The amount of the fixed payment for insurance premiums for compulsory pension insurance for 2003 will be: 150 rubles. x 12 months = 1800 rub.

Note

According to paragraph 1 of Article 28 of the Law of December 15, 2001 N 167-FZ “On Compulsory Pension Insurance in the Russian Federation,” individual entrepreneurs pay such contributions in the form of a fixed payment. In 2003, the Government of the Russian Federation did not approve the value of the cost of the insurance year, and therefore the entrepreneur makes a fixed payment to minimum size- 150 rub. per month (for more details, see Article 28 of Law No. 167-FZ and the Rules approved by Decree of the Government of the Russian Federation of March 11, 2003 No. 148).

In the future, the amount of insurance contributions for compulsory pension insurance is counted towards the payment of the unified social tax in the part credited to the federal budget.

The manager’s income minus expenses incurred and taxes paid will be 500,050 rubles. (RUB 720,000 - RUB 100,000 - RUB 80,600 - RUB 39,350).

When using the simplified tax system

In this case, payment of a single tax by the manager entails exemption of income from entrepreneurial activity from personal income tax and unified social tax. At the same time, entrepreneurs using the simplified tax system remain payers of insurance premiums for compulsory pension insurance (clause 3 of article 346.11 of the Tax Code of the Russian Federation).

Example 2

The manager's remuneration for the year is 720,000 rubles, the amount of expenses is 100,000 rubles. The object of taxation under the simplified tax system is income (according to clause 1 of Article 346.20 of the Tax Code of the Russian Federation, the single tax rate will be 6%).

The amount of single tax under the simplified tax system payable for the year will be: 720,000 rubles. x 6% = 43,200 rub.

In this case, the entrepreneur will not be a payer of unified social tax and personal income tax.

The amount of insurance contributions for compulsory pension insurance will be determined based on the size of the annual amount of fixed payments (as in the previous example, it will be 1,800 rubles).

The manager’s income minus expenses and taxes and fees will be 575,000 rubles. (720,000 - 100,000 - 43,200 rubles - 1800).

The object of taxation under the simplified tax system is income reduced by the amount of expenses (according to clause 2 of Article 346.20 of the Tax Code of the Russian Federation, the single tax rate is 15%).

The amount of the single tax will be:

(720,000 rub. - 100,000 rub.) x 15% = 93,000 rub.

Personal income tax and unified social tax are not paid, and the amount of insurance contributions for compulsory pension insurance will also be 1,800 rubles.

As a result, the manager’s income minus expenses and tax payments will be 525,200 (720,000 - 100,000 - 93,000 - 1800).

Option 2

A property trust management agreement has been concluded with the individual entrepreneur who manages the organization.

In this case, according to clause 1 of Article 1012 of the Civil Code of the Russian Federation, one party (the founder of the management) transfers property to trust management for a certain period of time to the other party (the trustee), and the other party undertakes to manage this property in the interests of the founder of the management or the person specified by him ( actually we're talking about on the exercise of the powers of the property owner). At the same time, among the objects of trust management, clause 1 of Article 1013 of the Civil Code of the Russian Federation names enterprises and other property complexes. In the situation under consideration, on the basis of Article 1014 of the Civil Code of the Russian Federation, the founders of trust management will be the owners of the enterprise (shareholders, founders).

For your information

To carry out trust management, a citizen must register as an individual entrepreneur (Clause 1 of Article 1015 of the Civil Code of the Russian Federation).

To the number mandatory conditions The trust management agreements include the following (clause 1 of Article 1016 of the Civil Code of the Russian Federation):

Composition of the transferred property;

The name of the legal entity or the name of the citizen in whose interests the property is managed (the founder of the management or the beneficiary);

The amount and form of remuneration to the manager, if its payment is provided for in the contract;

The validity period of the agreement (in accordance with clause 2 of Article 1016 of the Civil Code of the Russian Federation cannot exceed 5 years).

The trustee is obliged to provide the management founder (beneficiary) with a report on the results of his activities within the time frame and in the manner established by the agreement (clause 4 of Article 1020 of the Civil Code of the Russian Federation).

According to Article 1023 of the Civil Code of the Russian Federation, the manager has the right to remuneration stipulated by the contract, as well as to reimbursement of necessary expenses incurred during the management of property from income from its use. At the same time, the manager cannot be a beneficiary under this agreement (clause 3 of Article 1015 of the Civil Code of the Russian Federation), that is, he can only receive remuneration for the implementation of trust management in the amount determined by the agreement.

The procedure for taxing the income of a trustee as a whole will not differ from that indicated above for cases of receiving remuneration under contracts for the provision of paid services and will completely depend on the taxation system used by the entrepreneur (generally accepted or simplified).

For comparison, we give an example of calculating the amount of tax payments if a similar remuneration is paid to the head of an organization who is in an employment relationship with it.

Example 3

The salary of the head of the organization for 2003 amounted to 620,000 rubles. (assume that the expenses indicated in the previous examples in the amount of 100,000 rubles were incurred by the organization).

The amount of unified social tax and insurance contributions for compulsory pension insurance will be 106,000 rubles. (RUB 105,600 + (RUB 620,000 - RUB 600,000) x 2%).

Personal income tax amount: 620,000 rubles. x 13% = 80,600 rub.

The manager’s income minus tax payments will be 539,400 rubles. (620,000 - 80,600).

In this case, the amount of the manager’s actual income will be comparable to that arising when applying the simplified tax system. At the same time, the organization will incur expenses in the amount of RUB 826,000. (taking into account possible expenses for the maintenance of transport, communications, etc. (100,000 rubles), as well as for the payment of unified social tax and insurance contributions for compulsory pension insurance). And in the situations discussed above (examples 1 and 2), the amount of expenses was 720,000 rubles.

In conclusion, we can say that the assignment management functions on managers who have the status of individual entrepreneurs, does not contradict current labor, civil and tax laws. In addition, the tax regime for the income of such entrepreneurs allows, in some cases, to reduce the tax burden on the enterprise. However, when making such decisions, organizations need to carefully analyze both the emerging legal consequences of involving entrepreneurs in management (for example, when concluding a trust management agreement), and the possible level of tax burden on the organization, which will depend on a number of factors (the amount of expenses for maintaining a manager, etc. .d.).

Accounting supplement to the newspaper "Economy and Life", issue 48, November 2003.

APPROVED

General meeting of shareholders _______________________________

(name of the authorized body of the Management

company and full name of the Management company with

indicating the organizational and legal form)

Protocol No. _____ dated “____”_________ 20__

Represented by ________________________________________, acting on the basis of ____________, hereinafter referred to as the “Company”, and ______________________, represented by ________________________________________, acting on the basis of ____________, hereinafter referred to as the “Management Company”, in accordance with Article 69 Federal Law RF "On Joint Stock Companies" have entered into this agreement on the following:

1. The Subject of the Agreement

1.1. The management company undertakes, on behalf of the Company, to provide services for managing the affairs and property of the Company, including fully assuming the powers of the permanent executive body (indicate the name of the individual or collegial body, for example: CEO or management, etc.), and the Company undertakes to pay for the services provided in the amount, in the manner and on the terms provided for in this agreement.

1.2. When managing the activities of the Company, the Management Company is obliged to comply with the Charter and all provisions of the internal documents of the managed company, as well as the norms of the legislation of the Russian Federation. The management company is obliged to carry out management functions as efficiently, wisely and conscientiously as possible in the interests of the Company, while for the period (specify the reporting period, for example 6 (six) months) achieve the following goals and financial and economic indicators: (indicate what goals and indicators the Company must achieve under the leadership of the Management Company, for example, achieve a certain level of profitability, sales volume, cost, maximize profit to a certain level and minimize costs, increase capitalization, etc.).

1.3. The rights and obligations of the Management Company to manage the current activities of the Company are determined by the terms of this agreement, the Charter of the Company, (indicate what other documents regulate relations related to the management of the Company, for example: Regulations on the Directorate of the Company, etc.), as well as the current legislation of the Russian Federation.

2. Powers, competence and responsibilities of the Management Company

2.1. For the period of validity of this agreement, the Company transfers to the Management Company all the powers of the permanent executive body of the Company (indicate the name of the body, for example: general director or directorate, etc.) provided for by the Charter of the Company, as well as any other powers vested in the executive bodies of joint stock companies in accordance with the current legislation of the Russian Federation.

2.2. In accordance with clause 2.1 of this agreement, the Management Company manages all current activities of the Company and resolves all issues within the competence of the permanent executive (specify individual and collegial) body of the joint-stock company, with the exception of issues falling within the exclusive competence of the General Meeting of Shareholders of the Company and the Board of Directors of the Company.

Including the Management Company represented by (indicate the name of the permanent executive body of the Management Company, for example: general director), acting on behalf of the Company on the basis of the Charter of the Company without a power of attorney:

- represents the interests of the Company in relations with other organizations, enterprises, institutions of any form of ownership, bodies government controlled, as well as individuals, including representing the interests of the Company in court with all procedural rights granted by law to the plaintiff, defendant, etc.;

- makes transactions on behalf and in the interests of the Company, enters into contracts, etc.;

- issues orders, gives instructions and instructions that are binding on all employees of the Company;

- ensures the implementation of decisions of the General Meeting of Shareholders and the Board of Directors of the Company;

- organizes promising and current planning production, financial, commercial activities of the Company, including based on observation data, research and analysis of the Company’s production and commercial processes, capabilities financial security programs, develops an effective development strategy and the main sections of the Company’s development plan, makes strategic decisions to improve the financial and economic activities of the Company and puts them into action through the implementation of specific development and restructuring programs of the Company, makes appropriate proposals and reports on the work done to manage the activities of the Company To the General Meeting of Shareholders and the Board of Directors of the Company;

- determines budgeting priorities and monitors expenses to ensure the financial stability of implemented programs, compiles calculations of the effectiveness of the implementation of development projects of the Company;

- presents to the General Meeting of Shareholders and the Board of Directors reasonable proposals for the development of new business areas and development of new markets;

- carries out the development of projects for technical and administrative modernization of the enterprise;

- disposes of the Company's property within the limits established by its Charter, this agreement and the current legislation of the Russian Federation;

- approves the rules, regulations and other internal documents of the Company, with the exception of documents approved by the General Meeting of Shareholders of the Company;

- defines organizational structure The Company, including considering the prospects for changing the status of individual structural divisions, creates new departments, structural divisions,

- distributes the scope of work and subordination within structural units, changes the order of relationships with other departments, expands or limits the scope of authority of the heads of the relevant units;

- approves the staffing table of the Company, its branches and representative offices, approves official salaries employees, determines the amount and procedure for bonuses and other incentive measures for employees, in accordance with established by law, imposes penalties on employees;

- asserts job descriptions for the Company's employees;

- concludes on behalf of the Company employment contracts with its employees, hires and dismisses employees of the Company, including appoints and dismisses the chief accountant, heads of departments, branches and representative offices;

- organizes the interaction of all structures and departments of the Company for the implementation of development projects of the Company;

- carries out coordination of work on the implementation of development projects of the Company at all stages, monitoring the compliance of decisions made and actions taken with the basic concept of development of the Company;

- analyzes economic and financial indicators at each stage of the implementation of the Company's development projects and submits relevant reports on the achieved results and performance indicators of the Company to the General Meeting of Shareholders or the Board of Directors of the Company;

- develops methods and takes measures to quickly respond to crisis and non-standard situations, which may lead to disruption of the Company’s development plan or other adverse consequences for the Company;

- ensures the creation of favorable and safe conditions labor for the Company's employees;

- opens settlement, currency and other accounts of the Company in banks;

- makes decisions on filing claims and claims on behalf of the Company against legal and individuals and on the satisfaction of claims against the Company;

- determines the production volumes of products and services, as well as the procedure and conditions of sales, approves contract prices for products and tariffs for services;

- ensures the fulfillment of the Company's obligations to the budget and counterparties under business contracts;

- makes decisions on obtaining and using loans and credits;

- organizes accounting and statistical accounting and reporting, including tax reporting;

- manages the development and presentation to the General Meeting of Shareholders (sole shareholder) of the draft annual report and annual balance sheet of the Company;

- ensures preparation, organization and holding of General Meetings of Shareholders of the Company;

- exercises control over the rational and economical use of material, labor and financial resources;

- within the limits of its competence, ensures compliance with the law in the activities of the Company;

- resolves other issues of the current activities of the Company.

2.3. Within _______ days from the date of entry into force of this agreement, the Management Company represented by (indicate the name of the permanent executive body) is obliged to contact the registration authority at the location of the Company with an application to make appropriate changes to the Unified State Register legal entities on the permanent executive body of the Company.

2.4. On behalf of and in the interests of the Company, without a power of attorney, only (indicate the position of the head of the permanent executive body of the Management Company) Management Company, and all other employees of the Management Company and the Company act on behalf of the Company only on the basis of a power of attorney issued by the head of the Management Company.

2.5. The management company is obliged to provide at least (specify frequency, for example: once a month, etc.) or at any time upon request of the General Meeting of Shareholders of the Company (or the Board of Directors of the Company) a report on the results of the financial and economic activities of the Company, including information on the costs of production and sales of products, a report on the actual flow of cash flows Money, with the attachment of relevant cash documents, the Company’s business plan, financial, statistical and tax reporting, administrative documents(orders, instructions), (list other documents and reports provided by the Management Company), as well as the Certificate of acceptance of services provided, which must contain details that meet the requirements of accounting legislation.

2.6. Every month, before the _______ day of the month following the month to be paid, the Management Company is obliged to provide the Company with a Report indicating the items of expenses and amounts paid by the Management Company in the process of carrying out activities to manage the Company. Copies of payment and other documents confirming the expenses of the Management Organization are attached to the report.

2.7. When performing executive and administrative functions in the process of managing the current activities of the Company, the Management Company and persons acting on its behalf must be guided by the Charter of the Company, internal documents of the Company and the norms of current legislation. If any provision of the Charter or internal document of the Company contradicts the law, the Management Company will be guided directly by the relevant provision of the law or other legal act.

2.8. The Management Company is obliged to provide free access to relevant documents to authorized representatives of the General Meeting of Shareholders, as well as to provide comprehensive information on all issues arising in the process of checking and monitoring the fulfillment of the Management Company's obligations and the exercise of powers granted by this agreement. In the event that the General Meeting of Shareholders of the Company appoints an independent auditor of the Company for the purpose of conducting an audit of the financial and economic activities of the Company, the Management Company is obliged to provide the auditor (audit organization) with all the necessary information and documents to carry out the audit.

2.9. The management company carries out major transactions and transactions in which there is an interest, in accordance with the procedure established by the Federal Law “On Joint-Stock Companies”.

2.10. In order to rationalize management and reduce the costs of maintaining the management staff, the Management Company has the right to dismiss the Company’s employees on the grounds provided for by law and take over all management and economic functions of the Company. In this case, financial documents and tax reporting The companies are signed by the head of the permanent executive body of the Management Company and the chief accountant (accountant) of the Management Company.

3. Rights and obligations of the Company

3.1. The Company is obliged to transfer to the Management Company all Required documents, including the Constituent documents of the Company, Licenses and permits for the right to carry out a certain type of activity, Certificates of state registration ownership rights to real estate, business contracts, accounting and statistical reporting, personnel records documents, etc., as well as the Company’s seal in accordance with the Certificate of acceptance and transfer of documents and the Company’s seal, which is an appendix and an integral part of this agreement.

3.2. The Company is obliged to provide the necessary assistance to the Management Company in fulfilling its obligations under this agreement. The Company's management bodies (General Meeting of Shareholders, Board of Directors) do not have the right to unreasonably avoid making decisions, approving transactions proposed by the Management Company, or refuse to make such decisions and approve transactions. In addition, the Company does not have the right to make decisions on amending the constituent documents, reducing the scope of powers of the Management Company compared to how they were determined at the time of concluding the contract.

3.3. The General Meeting of Shareholders of the Company has the right to receive information and exercise control over the implementation by the Management Company of its obligations under this agreement.

3.4. Audit committee The Company carries out inspections of financial and economic activities under the leadership of the Management Company in accordance with current legislation and the Charter of the Company.

3.5. To audit the financial and economic activities of the Company under the leadership of the Management Company, the General Meeting of Shareholders has the right to appoint an independent auditor.

4. Procedure for managing the Company

4.1. The Company is managed in accordance with current legislation Russian Federation, the norms of the Company's Charter and this agreement.

4.2. The highest governing body of the Company is the General Meeting of Shareholders. The competence of the General Meeting of Shareholders includes all issues listed in Art. 48 of the Federal Law "On Joint Stock Companies", as well as other issues listed in the Company's Charter. The Board of Directors (supervisory board) of the Company exercises general management of the Company's activities, with the exception of resolving issues referred to the competence of the General Meeting of Shareholders by the Federal Law "On Joint Stock Companies" and the Charter of the Company.

4.3. All decisions on issues related to the management of the current activities of the Company that are not within the exclusive competence of the General Meeting of Shareholders of the Company and the Board of Directors, i.e. the functions of the permanent executive body of the Company within the framework of this agreement are accepted on behalf of the Management Company by its permanent executive body . On all issues of the current management of the Company's activities, the Management Company is subordinate to the General Meeting and the Board of Directors of the Company. The main goal of the Management Company is to organize the implementation of decisions of the General Meeting of Shareholders and the Board of Directors of the Company.

4.4. The General Director of the Management Company, without a power of attorney, acts on behalf of the Company, issues orders and instructions on issues of the Company's activities, approves internal documents of the Company, enters into contracts and makes other transactions.

4.5. Transactions and other legally significant actions carried out by the General Director of the Management Company in the process of managing the Company directly give rise to legal consequences for the Company and do not require prior permission or subsequent approval from other management bodies of the Management Company or the Company, except in cases provided for by the Federal Law "On joint stock companies" or other legal acts.

4.6. The Management Company has the right to transfer all or part of the powers or duties granted to it by this agreement and the law to any of the employees of the Company or the Management Company or another person, distributing administrative, administrative and representative functions among them, and also has the right to form functional structures (departments, management) from its own personnel ) to carry out the management functions of the Company (for example, accounting and tax accounting, personnel services, etc.). In this case, these persons act on the basis of powers of attorney issued (name of the permanent executive body of the Management Company, for example: general director) Management company.

4.7. Activities to manage the Company are carried out with the involvement of full-time employees of the Management Company and the Company, as well as on the basis of civil contracts with consulting and other organizations and citizens.

4.8. Financial and payment documents of the Company are signed by (name of the permanent executive body of the Management Company, for example: general director) The Management Company or another person authorized by the Management Company, and Chief Accountant Society.

5. Settlements for transactions carried out by the Company

5.1. Settlements for the Company's transactions are carried out by the Management Company from its settlement, currency or other account or from the corresponding accounts of the Company.

5.2. Funds received from the Company's transactions are sent to the appropriate accounts of the Management Company or the Company. The decision on the settlement procedure is made by (name of the permanent executive body of the Management Company, for example: general director) Management company.

5.3. The management company is responsible for the Company's transactions within the limits of the Company's funds remaining on its accounts.

5.4. Tax and other obligatory payments are made from the Company’s accounts in the manner determined by legal acts. In cases provided for by law, payments for taxes and other obligatory payments may be made from the accounts of the Management Company.

6. Amount of remuneration and procedure for settlements under the agreement

6.1. The cost of the Management Company’s services consists of two components:

- compensation for implementation costs management activities;

- remuneration for the successful implementation of functions for managing the Company.

6.2. The Company fully pays the Management Company the amount of expenses for managing the Company, which includes: wages management company personnel, payroll taxes, running costs for office maintenance, transport, telephone conversations (list all types of expenses of the Management Company)

The management company provides the Company with an invoice for payment on a monthly basis, before the _______ day of the month following the month paid, as well as a detailed Report listing items of expenses and amounts payable. Copies of payment and other documents confirming the expenses of the Management Organization are attached to the report. The Company, within _______________ from the date of receipt of the listed documents, is obliged to pay the expenses of the Management Organization by transferring funds to the settlement account of the Management Company.

6.3. For performing functions for the implementation of current management and management of the Company, namely when the Company reaches financial indicators (indicate objective data characterizing the quality and/or volume of management services provided, for example, the average monthly turnover of the Company must be at least _______ rubles, sales volume must be at least _________ per month, etc., i.e. determine the amount of remuneration so that it is comparable to economic effect from implementation from management functions).

The management company is set a remuneration in the amount of ________ (________________) rubles per month.

6.4. Remuneration for performing functions related to the current management and management of the Company is paid to the Management Company (specify frequency, for example, monthly, etc.) within _______________ from the date of submission of the relevant report on the financial and economic activities of the Company, as well as the Certificate of acceptance of services provided, by transfer to the settlement account of the Management Company.

7. Responsibility of the parties

7.1. For failure to fulfill or improper fulfillment of obligations under this agreement, the parties are liable in accordance with the current legislation of the Russian Federation.

7.2. The management company is liable to the Company for losses caused to the Company by its guilty actions (inaction), unless other grounds and the amount of liability are established by the legislation of the Russian Federation. Among other things, the Management Company is obliged to compensate the Company for:

- the amount of penalties and other sanctions collected from the Company in established by law procedure for violation by the Company of legislation on taxes and fees;

- the amount of the penalty collected by counterparties for non-fulfillment or improper fulfillment by the Company of obligations under business contracts.

At the same time, the Management Company is not responsible for losses, the occurrence of which is due to circumstances that arose before the entry into force of this agreement, as well as if the Company is at fault for the occurrence of losses.

7.3. In case of late payment for the services of the Management Company, the Company is obliged to pay to the Management Company, at the choice of the final penalty, in the amount of _____ (_____)% of the amount payable for each day of delay, or a fine in the amount of _____ (_____) rubles, as well as compensate losses in part , not covered by a penalty.

7.4. For dishonest evasion of approval of actions and transactions proposed by the Management Company (for example, approval major deal, proposed by the management company for approval by the General Meeting of Shareholders, etc.) The Company is obliged to pay the Management Company a fine in the amount of ________ (________________) rubles. At the same time, the Management Company is not responsible for the occurrence of any adverse consequences for the Company.

8. Validity period, procedure for changing and terminating the contract

8.1. This agreement comes into force from the moment of its approval by the General Meeting of Shareholders of the Company and (indicate the name of the authorized body, for example, the General Meeting of Shareholders or the Board of Directors) Management company and is valid until “____”_________ 20__.

8.2. From the moment this agreement comes into force, the powers of the permanent executive body of the Company are suspended for the duration of this agreement.

8.3. This agreement may be terminated by agreement of the parties, approved by the authorized management bodies of the Company and the Management Company.

8.4. The contract is also considered terminated in the event of a unilateral refusal to perform it by any of the participants. The decision to unilaterally refuse to fulfill the agreement is made by the authorized bodies of the Company or the Management Company. The parties are obliged to notify each other of their unilateral refusal to fulfill the contract no later than (specify deadline).

8.5. The contract is considered terminated from the moment the authorized body of the Company makes a decision on unilateral refusal to perform it, if the reason for making such a decision was an immediate threat to the interests of the Company caused by dishonest actions of the Management Company.

8.6. The powers of the permanent executive body of the Company are restored from the moment of termination of this agreement.

9. Final provisions

9.1. All disputes and disagreements arising between the parties regarding the fulfillment of obligations under this agreement will be resolved through negotiations on the basis of current legislation and business customs.

9.2. If controversial issues are not resolved during negotiations, disputes are resolved in court in the manner prescribed by current legislation.

9.3. In case of change of name, location, bank details and other data, each party is obliged to inform the other party in writing within _______________ of the changes that have occurred.

9.4. In all other respects that are not provided for in this agreement, the parties are guided by current legislation.

9.5. This agreement is drawn up and signed in two copies of equal legal force, and is stored one at each side.

Is it possible to conclude an agreement with an individual entrepreneur for the provision of LLC management services for an indefinite period, or should such an agreement be concluded only for the term of office of the manager in accordance with the decision on the transfer of powers to manage the company?

Answer

The term of office of the individual entrepreneur must correspond to the decision on the transfer of powers to manage the company.

For more details on this, see the materials in the justification.

The rationale for this position is given below in the materials of the “Lawyer System” .

« How to formalize the transfer of authority management company

The concept of “management company” (“ management organization") the law does not disclose. In fact, the management company is commercial organization, which provides services in the field of enterprise management. To provide such services, a license is not required.

The functions of the management company can also be performed by individual entrepreneur- manager*.

The LLC instructs the management company to manage its affairs and property by exercising the powers of the sole executive body (director). The management company, in turn, is represented by its director or another person authorized by him.

Make a decision on transferring the powers of the director to the management company, approve such a company and the terms of the agreement with it, including the amount of remuneration, must general meeting members or board of directors. It depends on what is said in this regard in the charter (subparagraph 2, 3, paragraph 2.1, article 32, subparagraph 4, paragraph 2, article 33 of the Federal Law of February 8, 1998 No. 14-FZ “On companies with limited liability”, hereinafter referred to as the LLC Law). In this case, there is no need to make additional changes.