Where is Alexey Khotin now? The former main owner of Yugra Bank, Alexey Khotin, was detained. What is known about the shareholders of Ugra

Business, 26 Sep 2017, 19:55

Khotyna AlexeiBusiness, 26 Sep 2017, 19:55

Rosgeology filed a lawsuit against the developer of the Dulisminskoye field ... in the Moscow branch of Ugra Bank. Representative of the largest co-owner of Ugra Alexey Khotyna reported that the businessman owns only the oil assets of Exillon Energy... has not yet responded to RBC's request. Former president of Ugra Bank Alexei Nefedov told RBC that all bank loans were issued in strict... Khotyna Khotyna Khotin The owner of Ugra announced the Saudi prince’s plan to enter the bank’s capital ... News" with reference to the press service of the largest co-owner of "Ugra" Alexey Khotyna. Forbes assesses the fortune of the prince, who is investing in assets for... the case of restoration of work financial institution", says the press service. Khotyna. Prince Al-Waleed began investing in the banking sector in 1980...starting payments to Ugra depositors. On July 28, the Central Bank declared the proposed Khotin rescue plan for Ugra and revoked its license to operate... ... » Alexei Khotyn Khotyna ... The Central Bank revoked the license of Bank Ugra ... » Alexei Khotyn proposed a bank rehabilitation plan, within the framework of which Ugra’s obligations to the DIA should be secured by collateral of the loan portfolio and a personal guarantee Khotyna ... Khotyna Khotyna Alexey Khotin proposed his plan to save Ugra ... to the law. According to the press service of the main owner of Yugra Bank, Alexey Khotyna, which describes the reorganization mechanism proposed by the businessman to the Central Bank, the obligations of “Yugra... DIA and state funds require a change in the controlling shareholder, that is, the status Khotyna as a sanatorium is impossible, experts point out. “Either the order must be declared invalid...Khotina released a statement: “Currently Alexei Khotyn is located in Moscow, since the successful resolution of the current situation with Ugra Bank requires his direct participation. Alexei Khotyn together with...

Battle for Yugra: The Prosecutor General’s Office intervened for the first time in the banking supervision of the Central Bank The Russian Prosecutor General's Office admitted that there were no grounds for introducing a temporary administration into Yugra Bank. With its decision, the supervisory authority created a precedent in the Russian banking sector. On Wednesday evening, July 19, the Prosecutor General's Office published a message on its official website that it “protested two orders of the Bank of Russia relating to the activities... The collapse of Ugra: what led to the largest insurance event among banks Alexei Khotyn Khotyna Alexei The collapse of Ugra: what led to the largest insurance event among banks ..., a temporary administration was introduced. To the management and owners of the bank, including a billionaire Alexei Khotyn, faces criminal prosecution. Bank Ugra, which ranks 33rd in..., according to media reports, consists of non-banking assets of the main owner of the bank, Alexey Khotyna(see help). “Almost all borrowers had huge volumes of transactions... time,” the president of Ugra Bank said in response to a request from RBC. Alexei Nefedov. - I also want to refute that the bank illegally withdrew assets... Alexey Khotin Khotyna Khotyn Alexei Khotyn Khotyna estimated at $950 million... Bank Ugra found 20 billion rubles. after the Central Bank's demands for additional capitalization ... Financial is owned by a businessman Alexey Khotin, owning 52.5% of the shares of Ugra Bank. Bank financing by company Khotyna is carried out free of charge. Khotyn announced the termination of obligations... may actually stop the work of the bank. Alexei Khotyn - Russian entrepreneur, is included in the Forbes ranking of the 200 richest businessmen in Russia. State Khotyna estimated at $950 million... The media learned that the Khotin family had no unpledged assets ... Khotinykh sources named Rosselkhozbank, headed by the son of the ex-head of the FSB. Owners hotel complex"Moscow" and TC "Gorbushkin Dvor", Belarusian businessmen Alexei and Yuri Khotiny pledged all their assets for bank loans, Vedomosti wrote on Monday, citing sources. Alexei Khotyn, managing... the former head of the Ministry of Internal Affairs of Russia Boris Gryzlov, “who also began to help Khotin». Alexei Khotyn in 2016 for the first time entered the list of the richest businessmen in Russia...Yesterday, an administration in the person of the Deposit Insurance Agency (DIA) was introduced into Ugra Bank. A moratorium on settlements with creditors was also introduced, and the powers of the management and main owner Alexei Khotin were terminated. The Bank of Russia announced that it will conduct a survey financial condition jar. The regulator had questions from Ugra's clients in the oil industry and a legal entity involved in real estate. Assets in these industries formed the basis of the non-banking business of the main owner of the bank, Alexey Khotin.

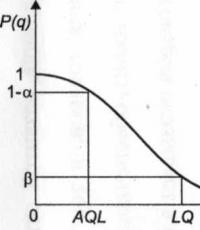

The bank had a high concentration of loans to owners, says Deputy Chairman of the Central Bank Vasily Pozdyshev. “Most of the loan portfolio was used to finance the business owners. In our opinion, the bank circumvented the limitation of risk on owners with the help of schemes (regulated by the Central Bank standard - no more than 25% of capital; at Ugra, as of June 1, according to official reports, own funds was 50 billion rubles, according to RBC). But it is necessary not only to assume, but also to prove,” he added. According to Stanislav Volkov, director of bank ratings at RAEX (Yugra refused to participate in this agency’s rating), loans to related parties accounted for about a third of the bank’s portfolio in mid-2015. “These are mainly real estate rental companies and the oil sector,” says Volkov. “The bank itself does not admit this.”

The composition of a small part of the loan portfolio can be judged from the data of the Kontur-Focus system. According to them, many of the pledges in Ugra Bank are indeed connected with Khotin, his managers and acquaintances. An example is the company “Surguttrans” of Anastasia Makarova (She is also involved in managing the assets of Alexey Khotin) - the company laid an oil pipeline from the Travyanoye to the Multanovskoye field with a length of 148 km in the Khanty-Mansiysk-Yugra Okrug and forest areas of 101.3 hectares and 540 hectares in that same area. The loan amount is unknown.

Makarova was the founder and director of a number of companies that are associated with Khotin - Kub CJSC and Second Real Estate Agency LLC. The tax authorities tried to interrogate her in the case of tax violations, but she did not appear when summoned and did not provide documents to the Federal Tax Service. It got to the point that representatives of the Federal Tax Service in 2015 tried to find her through investigators from the Russian Ministry of Internal Affairs in the Krasnogorsk region. The tax authorities considered the activities of her company extremely suspicious - the company did not have significant property or transport, the company's staff consisted of one person.

Other bank loans could also be issued through an acquaintance or to maintain a relationship. Manager Khotin, former manager companies "Negusneft" and Sky Property (manages real estate assets of Alexey Khotin) Mark Lapunov took out a loan for a blue BMW X6M, and the company "Equipsport" of the daughter of the head of the FSB support service Mikhail Shekin Anastasia Zadorina received funds secured by a dozen sewing machines, ironing tables and heat presses. The companies of Khotin and his partners were previously supported.

Loans related to oil and construction business, were taken little-known and small companies- they were taken by the companies “Yuzhno-Vladigorskoe”, “Burneft” (laid the drilling rigs), “Promdelo” and others. The bank “Yugra” mortgaged not the best business centers of the Khotin empire - East Gate Business Center (53,000 sq. m. ), Technopark-Sintez (12,000 sq. m.), Au-room (20,000 sq. m.). The highest quality Khotin properties were pledged to Alfa Bank, VTB, Sberbank and Rosselkhozbank. There is no information about serious loans from Ugra issued to large and understandable borrowers in the Contour Focus database.

Last year, partners of the owner of the Complex Investments holding, Alexei Khotin, argued that he is not the owner of oil assets. According to the representative of the Rus-Oil company, Eduard Sapunkov, Khotin has no relation to his company, and its owner is Sergei Podlesetsky (previously worked with Khotin). He assures that the attempt to connect the Rus-Oil company with Khotin carries a “negative connotation.” Sapunkov explained that the oil companies Dulisma, Matyushkina Vertical (ex-assets of the Hungarian MOL), Polar Lights, Gustorechenskoye, Negusneft, Irelyakhneft and Development of St. Petersburg (their total reserves are more than 100,000 tons of oil) Khotin also does not belong.

The owners of the assets that the media previously attributed to Khotin, according to Sapunkov, are also Sergei Koshelenko. Previously, Koshelenko claimed that he used his personal savings and loan money to buy Northern Lights from Rosneft and the American ConocoPhillips. According to Forbes, the purchase price was about $150-200 million.

Perhaps the managers who worked with Khotin became very wealthy. In 2014, Koshelenko managed to buy out an additional issue of Otkritie Bank in the amount of 10 billion rubles. In general, only for the above oil assets, according to Forbes estimates.

From the statements of the regulator’s representatives it followed that the bank’s actions were enough for the Central Bank to appeal to law enforcement agencies. “We sent appeals to law enforcement agencies regarding the work of the bank,” said Vasily Pozdyshev.

Alexey Khotin in the Basmanny Court

On Friday, April 19, the Basmanny District Court placed the former owner of Yugra Bank, Alexei Khotin, under house arrest in the Onegin residential complex.

The Investigative Committee, together with the ex-chairman of the board of Yugra, Dmitry Shilyaev, who was also placed under house arrest, is suspected of embezzling at least 7.5 billion. We are talking about the people with whom Khotin has been associated recently.

Since 2017, the Central Bank of the Russian Federation has unsuccessfully tried to initiate a case against Alexey Khotin.

“The negative difference between the assets and liabilities of Bank Yugra (“hole” in capital) grew to 164 billion rubles.

This data follows from the report of the provisional administration.

The assets of Bank Ugra on the date of its declaration as bankrupt - September 25, 2018 - amounted to 34.007 billion rubles, and liabilities reach almost 198.2 billion.

According to materials available to Rucriminal.info, it was established that the money was withdrawn by issuing loans in foreign currency to companies associated with the ex-owner of Ugra Alexei Khotin.

However, for two years now the Central Bank of the Russian Federation has not been able to initiate a case against this businessman.

We have restored the chronology of the Bank of Russia’s unsuccessful struggle to “land” Khotin.

And it was unsuccessful because Khotin hid all his assets in Rosselkhozbank, which is controlled by his friend Dmitry Patrushev.

On November 11, 2017, the Bank of Russia sent an application to the Ministry of Internal Affairs of Russia and the Investigative Committee to initiate a criminal case against the owners and top managers of Ugra under articles of the Criminal Code of the Russian Federation 159 (theft by fraud), 160 (embezzlement), 201 (abuse of authority) and 196 (deliberate bankruptcy).

The statement was about the theft of funds by providing credit funds to a legal entity associated with Khotin.

The application was “dropped” to the UEBiPK Main Directorate of the Ministry of Internal Affairs of Russia for Moscow, which repeatedly (December 11, 2017, March 13, April 17, May 10, 2018) issued decisions refusing to initiate a criminal case.

Subsequently, these decisions were canceled.

On June 6, 2018, the Internal Affairs Directorate for the Central Administrative District of the Main Directorate of the Ministry of Internal Affairs of Russia for Moscow also issued a decision to refuse to initiate a criminal case.

An investigation into the facts of theft revealed by the Central Bank of the Russian Federation has not been started.

According to Rucriminal.info, on March 16, 2018, the Bank of Russia sent a new application to the Ministry of Internal Affairs of Russia and the Investigative Committee to initiate a case regarding the theft of Ugra property under the guise of issuing loans to legal entities (all associated with Khotin), concluding agreements on transferring loan debt to insolvent legal entities, concluding forward contracts for the purchase and sale of foreign currency for rubles, as well as possible deliberate bankruptcy of the bank.

The case has still not been opened, and a year has already passed.

On July 18, 2018, the Bank of Russia sent a new statement to the Russian Ministry of Internal Affairs regarding the theft of bank property under the guise of issuing loans to legal entities.

The investigation has not yet begun.

In addition, on September 11 and October 24, 2017, February 22 and May 22, 2018, the temporary administration sent statements to the SD of the Ministry of Internal Affairs of Russia regarding the theft of the Bank’s property.

The result is the same as in all previous cases.

Rucriminal.info sources believe that this reluctance of the security forces to begin an investigation against Alexei Khotin is due to his friendship with Dmitry Patrushev.

The latter is now a minister Agriculture, and previously headed Rosselkhozbank.

Moreover, in his new post he retained influence on Rosselkhozbank.

And Rosselkhozbank is the main custodian of Khotin’s assets.

When it became clear that the businessman’s affairs were very bad and his assets would soon be “hunted” by the Central Bank of the Russian Federation, as well as unfriendly creditors, Khotin registered his most liquid assets (primarily real estate) as additional collateral for loans received from Rosselkhozbank ... " .

According to Rucriminal.info sources, now the value of Khotin’s assets pledged to Rosselkhozbank is at least five times higher than the amount of loans received from this bank.

Thus, Khotin’s most “tasty” assets are not available to other creditors, and the businessman regularly pays interest on loans to Rosselkhozbank.

The case moved forward when the lawyers of Alfa Bank Mikhail Fridman decided that Khotin was violating the settlement agreement signed with him in 2017.

“This is due to Khotin’s significant violations of the terms of the settlement agreement. We are talking about real estate objects included in the settlement agreement,”- Rucriminal.info sources expressed their opinion.

Considering that Khotin was sent under house arrest, the whole fight for him is still ahead.

Let us remember, for now, some people who were always with Khotin.

A source from Rucriminal.info said that when Khotin raider seized his first facility in the capital - the Moscow Soap Factory - then the then head of the Moscow City Internal Affairs Directorate, Vladimir Pronin, personally came to collect statements against Khotin and a number of materials incriminating Alexey from investigators.

At that time he was a major patron of Khotin.

This kind of collaboration certainly paid off.

Now Pronin owns almost half of his native Kursk region, including the Deirra stud farm.

And in Moscow he has a huge construction business.

This is how the former chief metropolitan policeman succeeded.

Since those distant times, the level of connections of Khotin himself has increased significantly.

He especially loved to brag about how he had everything under control at the Central Bank of the Russian Federation.

The patron of Alexey and his Yugra bank was the deputy chairman of the Bank of Russia, Alexey Simanovsky, so Khotin could siphon billions from his native credit institution as much as he wanted with impunity.

And what was there to fear if “Ugra” was registered not in Khotin’s name, but in the name of frontmen? individuals.

Then Simanovsky “flew” from his post, and Dmitry Tulin became deputy chairman of the Central Bank of the Russian Federation.

Khotin began to boast that he had everything “under control” with Tulin.

And then, as sources told Rucriminal.info, Tulin, out of friendship, strongly recommended that Khotin take over the controlling stake in Ugra.

They say that everyone will leave the bank behind, and large state support is guaranteed (it will be possible to pump in not only depositors’ money, but also money allocated from the budget).

In short, he promised the most promising prospects.

And Khotin fell for it.

Almost as soon as Khotin recognized ownership of Ugra, Tulin forgot about his former friendship.

The bank was bombarded with inspections that revealed gigantic “holes.”

Everything ended naturally - the bank’s license was revoked.

Only now it will not be fictitious individuals who will be financially responsible for the “hole” of tens of billions of rubles, but Khotin himself.

According to Rucriminal.info sources, in private conversations Khotin directly lamented the fact that he had succumbed to Tulin’s persuasion and “signed up” Ugra to himself.

I considered this my main mistake.

As a result, Khotin did not spare tens of millions of rubles for the information “war” with the Central Bank of the Russian Federation.

And, of course, he was worried about subsidiary liability.

This is when the state can recover from Khotin tens of billions withdrawn from Ugra.

And he has something to take away.

Khotin managed to seize a number of oil producing enterprises, including NK Dulisma, which became part of the Rus-Oil company controlled by him.

Khotin also acquired a stake in the oil company Exillon Energy.

The main shareholders of Exillon are the Khotin offshore Senegal International Agency ltd (29.99%) and another offshore Sinclare Holings Limited (26.69%).

In total, they own 56.68%. Sinclare Holings Limited at the time of purchase of Exillon shares belonged to a businessman and sponsor of the Bolshoi Theater.

Khotin and Klyachin are close friends; they have many joint affairs and affairs.

Therefore, no one doubted that Klyachin bought the shares in order to immediately transfer them under the control of Khotin, who became the main owner of Exillon.

He attracted the vice-president of Transneft, Mikhail Margelov, as a partner in his oil projects, and his own son, Dmitry Mikhailovich Margelov, was previously an adviser to the chairman of the board of directors of Rus-Oil JSC, and in 2016 he took the chair general director Exillon Energy.

Khotin, of course, hid his oil assets very ineptly.

He transferred some to offshore companies, some to his assistant Sergei Podlisetsky.

“- the Khotins’ problems arose after there was a change in the leadership of the Service economic security FSB. The businessmen, according to journalists, had established contacts with the head of the “K” department, Viktor Voronin, and the head of the SEB, Yuri Yakovlev. And the new leadership of the SEB had many questions for the Khotins.

- the largest creditor of Ugra until today was Rosselkhozbank, which is headed by Dmitry Patrushev. The bank sabotaged the Central Bank's requests until the last minute and saved Khotin.

— Deputy Head of the Central Bank Vasily Pozdyshev and Director of the Banking Supervision Department Anna Orlenko have a personal dislike for Khotin and Nefedov. Nefedov was also detained in connection with the case.

— Khotin personally gave guarantees of immunity to all top managers of the bank, who are now in continuous movement between private “dealers”, security forces and offices of the Old Square.

— Khotin’s intermediary was the deceased.

-Khotiny were going to buy Khudainatov’s holding.

— In 2017, the Central Bank informed the Prosecutor General’s Office six times about the withdrawal of assets from Ugra. In addition, the regulator knocked on the door of Rosfinmonitoring twice because of the bank’s dubious transactions. But Patrushev saved.

-Khotin left the country several times, but returned in the hope of restoring his status. He did not believe in the arrest. When he was arrested, he considered it a joke and allegedly offered the security forces a billion rubles to let him go.

“The resolution of the issue with the detention of Alexei Khotin, as they say, was sanctioned by the President.”.

Such strict deadlines are not new, says the president of the Club of Bank Accountants, Kirill Parfenov: “One bank received an order on December 31 to accrue additional reserves by the end of the month.” According to him, it is also practiced to provide reports “urgently upon completion”: “Perhaps this is due to the fact that if you accrue quickly and do not allow anything else to be done, then there will be complete confidence that the bank will not fail. It is likely that the decision has already been made and it just needs to be supported by reporting.”

This is approximately what happened: on July 7, a meeting of the Central Bank Banking Supervision Committee (CBN) was held, the result of which was an order to introduce a temporary administration in the person of the DIA from July 10 into Ugra.

The bank, according to Shilyaev, did everything on time - at 15.05 a report on reserves was sent to the Central Bank and by courier with a paper version, in which Ugra reported that the reporting forms would be submitted before 17.00 on July 7: “Before sending the report, we They showed it to a working group of Central Bank employees inspecting the bank. In the letter, we explained that the required forms are compiled based on data for the entire bank (with branches in different time zones) on the second business day after the reporting date. Therefore, at 15.00 there cannot be reports for July 7, but we undertake to provide them before 17.00, which was done at approximately 16.45, we have a note from the bank’s curator on the paper version.” In that day electronic reporting was sent to the Central Bank, he added.

Elvira Nabiullina Chairman of the Bank of Russia

We are already seeing such aggressive attraction of deposits from the population to finance projects of owners who, most likely, will not service loans now<...>There is no cure for this business model.

But on Fridays the regulator has a short day - just before 16.45 - and Ugra did not have time to fulfill the order, representatives of the Central Bank insisted in court. But in this short day the Central Bank managed a lot, it was told in court: to discuss at the CBN financial position“Ugra”, based on the results of the order, send a request to the DIA to prepare a plan to prevent the bank’s bankruptcy, obtain the agency’s written consent and approve its plan at another meeting of the CBN.

“The Central Bank actually looked at the bank’s reporting back then and saw that it complied with the reserve requirements and did not violate the standards?!” – Ugra’s lawyer asked several times at the court hearing. The representative of the Central Bank did not answer - he only insisted that this did not matter for the introduction of a provisional administration ( Arbitration court Moscow supported this position).

No unnecessary disputes

The Central Bank explained the introduction of a temporary administration in Ugra by the detected signs of withdrawal of assets and unreliable reporting, as well as the “technical” execution of its instructions: the bank formed reserves for some loans, and then disbanded them for others. Transactions with derivative instruments, which were very profitable for Ugra, also raised suspicions.

Peter Aven member of the board of directors and co-owner of Alfa Bank

Otkritie and B&N Bank were completely market banks working with big amount borrowers had large interbank relationships, while Ugra mainly lent to the main shareholder.

According to Shilyaev, Central Bank employees came for an inspection in May and did not leave until the very end. This was confirmed in court by a representative of the Central Bank. “A landing party of about 30 people was constantly in the bank” and could watch online how “Yugra” complied with the order, Shilyaev notes.

“The Central Bank and I never argued, we followed all the instructions and recommendations, we strictly followed everything regulatory documents regulator and legislation,” he assures. This kind of humility is not typical. When receiving serious, multi-billion dollar orders between the regulator and the bank, “there is always first correspondence and discussion about the amount of reserves that need to be accrued,” says Oleg Vyugin, chairman of the board of directors of Safmar Financial Investments, former first deputy chairman of the Central Bank and chairman of the board of directors of MDM Bank. : “The assessment [of collateral by an independent appraiser] is also used,” financial indicators[borrower's] business or something additionally offered [as security for the loan]. This is a completely acceptable practice on the part of the Central Bank - discussing the figures they have developed. I don’t know how it is now, but once upon a time the Central Bank listened and sometimes even agreed on other figures, less cruel.”

There were no other plans

After a comprehensive inspection of the Central Bank in July 2016, the bank received a statement of unformed reserves for 76 billion rubles. The main complaints are an incorrect assessment of credit risks and the cost of collateral, says Shilyaev: “Yugra Methodology”<...>was actually approved by the Central Bank, because [before] it did not raise any complaints. And the bank took into account the mortgaged property based on the reports of independent appraisers from the top 20.”

Recognition of collateral and assessment of reserves for corporate borrowers is the most difficult topic when checking banks; there is no standard practice and there is always a subjective point of view; no methodology will cover all situations, says Pavel Alekseev, head of the strategy, planning and controlling directorate of OTP Bank: “The professional judgment of a bank and Central Bank specialist plays a big role. The Central Bank employs adequate people, but with a specific focus - to increase reserves. However, not very bloodthirsty."

After that inspection, the Central Bank, according to Shilyaev, did not issue an order, Ugra sent objections to the act, in response, the bank was “orally recommended to prepare a plan to improve financial stability” - to eliminate the regulator’s comments. In August, a plan was drawn up with a schedule for additional accrual of reserves for the entire 76 billion rubles. in the first six months, registration of additional collateral and additional capitalization of the bank, and in the next six months - registration of real estate being built by borrowers as collateral, he says: “The plan was adjusted after the regulator’s comments about some minor inconsistencies. There were no other plans."

Dmitry Shilyaev former chairman of the board of bank "Ugra"

It felt like fulfilling yet another order unnerved the regulator, who expected us to lie down and give up.

10 borrowers suspected by the Central Bank of inaccurate reporting received confirmation from auditors that the transactions were reflected correctly, new assessments of collateral were ordered with a confirmatory examination by the SRO, Shilyaev lists: “For six months, we created reserves in the amount of more than 76 billion rubles. and [then] reduced due to pledges. In total, security was issued for 150 billion rubles. But we did not adjust all the reserves, but approximately 60 billion – that is, the net additional creation of reserves was up to 20 billion.”

Here's how it was: every month the bank formed reserves for part of the portfolio, and the next month it reduced them by issuing new pledges and eliminating criticism of borrowers (based on signs of unrealistic activity). This is called improving the quality of the loan portfolio, says Shilyaev. The Central Bank took it differently.

By March 1, “Yugra” fulfilled the plan and reported to the Central Bank, but it began to send new instructions - including based on the July 2016 inspection report, Shilyaev claims: “On May 19 at 7 pm they were invited to come to a meeting in Balchug, where “closer to 11 o’clock, they were given an order to increase reserves by at least 46 billion rubles, and were given three weeks to complete.”

All or nothing

There were a lot of inconsistencies in the order, Shilyaev claims: for example, to create reserves for borrowers who have already repaid the debt. In reality, 57.7 billion rubles had to be added, he says: “We were shocked, because the bank had already digested these reserves and no comments were made.” But the bank complied with this instruction, and the capital dropped to 33 billion rubles.

It could have been worse: in June, by compensation, the bank received ownership of shares in nine companies (everywhere less than 20%) with licenses for 28 oil fields: Erbogachenskoye, Nizhnekirenskoye, Moktakonskoye, etc. As a result of tripartite transactions between Ugra, its borrowers and owners assets, loans worth more than 8 billion rubles were repaid. - through the transfer to the bank of pledged shares valued at 19.3 billion (Vedomosti has copies of the reports).

On June 13, Ugra reported on the fulfillment of the May order. And on the evening of June 21, a new one arrived - it had to be completed no later than the next day and reported before June 26 inclusive. “It was again based on the July 2016 act,” says Shilyaev. “And we concluded that the Central Bank is taking all possible actions to ensure that we violate either the requirements of the order or the standards.” “Even if the borrower no longer exists, the bank is obliged to create the reserve specified in the order and wait until the Central Bank figures it out and admits the mistake—those are the rules,” he complains.

The new order required additional reserves to be formed by adjusting the value of collateral for loans from 34 borrowers in accordance with the fair value established by the Central Bank (RUB 35.4 billion versus 97 billion in the bank’s calculations), and for three borrowers – not to take into account the pledged property at all. These are Irelyakhneft, Meridian LLC and Multanovskoye, which laid oil wells, gas lift lines and plumes from wells. The document does not contain data on Meridian, but there is information on Irelyakhneft and Multanovsky: the debt to the bank is 17.4 billion rubles, the cost of collateral is 12.6 billion according to Yugra and 8.3 billion according to the Central Bank. .

170 billion rubles.

That’s how much deposits in Ugra were insured; in total, the population kept 184.7 billion rubles in the bank. (data from the Central Bank). With “the most optimistic approach to assessing the imbalance of Ugra, the necessary financing for rehabilitation would exceed the amount of insurance liability of the DIA,” the regulator noted. The Central Bank explained the collapse of Ugra by its business model: projects related to beneficiaries were financed from the funds of individuals, and the scale of the borrowers’ activities did not correspond to the size of the loans

The regulator did not allow the value of collateral to be taken into account to reduce reserves - it is applicable only when selling a business as a whole, because “objects<...>are not able to generate income in isolation from the entire property complex of the field,” the Central Bank indicated. “The value of the collateral was ordered to be reset to zero, although we explained to the Central Bank that the property complex was divided between several collateral agreements for one borrower. Previously, the regulator took this calmly,” says Shilyaev.

If the property complex is divided according to loan agreements, but is held by the bank as collateral for one borrower, this is a strong position, says former top manager banks from the top 20: “The Central Bank allows in this case to reduce reserves at the expense of collateral.” But here reputation is of enormous importance, he notes: “If a bank has cheated the regulator more than once, then there is no trust in it. And even when the entire property complex is pledged under one agreement, the Central Bank begins to doubt the bank’s assessments. If the bank has a good reputation, then 20 collateral agreements are not a problem.”

Vyugin draws attention to the fact that the Central Bank did not respond to Ugra’s objections to the inspection report: “Some strange practice, perhaps this means that trust has been completely destroyed. In principle, the Central Bank reacts to letters, at least they should respond: “Our position has remained unchanged, your arguments do not pass for such and such a reason.”

Time loss

"Ugra" again found a way out. This time, the shareholder forgave her a debt of $85 million on subordinated deposits. Since 2015, Khotin has thus helped the bank for $780 million - as the Central Bank suspects, through a loan scheme. “Yugra” reported again - the order was fulfilled, everything is in order, says Shilyaev.

The new order - because of which Shilyaev waited in vain for guests from Balchug - arrived on July 6. This time, real estate came to the rescue: the bank received 115,450 sq. m. from 10 borrowers. m of space in Moscow business centers with a market value of 16.9 billion rubles, while loans of approximately 3 billion were stopped, says Shilyaev: “This difference made it possible to fulfill the order.” But the Central Bank calculated that the fair value of these assets was 6.4 billion rubles, and after a couple of weeks - already 5.2 billion, he continues.

Shilyaev talks about two orders from the temporary administration: July 12 - to reflect the received real estate in the balance sheet dated July 10 based on the Central Bank’s assessment (minus 10.5 billion rubles from capital), July 27 - to also adjust its value based on new assessment Central Bank dated July 26, and reflect the postings on July 21. In total, Ugra, which reported daily to the Central Bank, had at least three orders from the temporary administration dated July 27 (Vedomosti has copies) that adjusted the balance on the operational day of June 21 - i.e. retroactively.

“In this case, the Central Bank writes: “Incorrect accounting, unreliable reporting.” It’s safe to say that for a bank that submits reports every day, sanctions would follow for this,” says Parfenov. – But this is a monument, who will plant it! This is bad, but they have created a system in which they themselves have a certain judgment and force others to carry it out. But they treat themselves very leniently.”

By order of July 10, the securities of subsoil users received under compensation were transferred to those valued at cost, their positive revaluation was canceled and reserves were formed for possible losses for them in the amount of 50–100%. Result: on the balance sheet of Ugra, net investments in these shares turned out to be 6 times cheaper than they were - 3.2 billion rubles.

Discrepancies in the valuation of fields can be much greater, says GL Asset Management portfolio manager Sergei Vakhrameev: “Each has a different geology, it can cost $1/barrel in terms of reserves, or it can cost nothing at all. To assess the value of an asset, you need inside information: how the field will be developed, when it will reach peak production, what kind of oil there will be. But the most important parameter is the proof of reserves.” All the deposits are small, with unconfirmed reserves, far from communications, production at most is planned only from 2018. It is still impossible to objectively assess their investment value, says Vakhrameev, or it will turn out to be a very large fork.

Ugra's relationship with the regulator worsened in the spring of 2015 - after it was included in the list of banks published by the DIA for additional capitalization through OFZ, Shilyaev believes. But at a meeting at the Central Bank, it was verbally proposed to refuse, claims Shilyaev, after which pressure began: new checks with instructions, a requirement to disclose beneficiaries (so among them, Alexey Khotin appeared with a share of 52%, whom the market considered the owner of Ugra, but the bank is categorically denied), in 2016 - restrictions on the size of deposits and rates on them, the bank was transferred under supervision to Moscow and to a daily reporting form, he lists. “The bank met all the criteria [for additional capitalization]. We asked the Central Bank to explain which clause of the law we do not comply with, but we did not receive an answer,” complains Shilyaev. In the spring of 2016, Ugra withdrew its application for additional capitalization by 9.9 billion rubles, but “the Central Bank got a taste for it,” he says.

Another order of the DIA on July 10 was to create 100% reserves under forward contracts with Extract-Fili CJSC and Vostok-Burenie LLC for 13.1 billion rubles, concluded in 2015–2016. with calculations in 2018. “This is nonsense, the reserve is formed only for assets that carry the risk of non-return,” says Shilyaev. “And under these contracts the counterparty must transfer rubles and only then the bank must supply the currency.”

Typically, forwards are valued at fair value (based on expected profit), which depends on the volatility of the underlying asset, says Fitch senior analyst Alexander Danilov: “I don’t even remember that banks created reserves for them, especially for the entire amount of the contract - most likely just a mistake." The DIA corrected it with an order dated July 27: to restore (i.e. cancel) all these reserves - by 13.1 billion rubles, and on the operational day of July 21.

The next day, July 28, the Central Bank revoked Ugra’s license, justifying this by the fact that on July 22, after the additional creation of reserves, the negative capital exceeded 7 billion rubles.

Shilyaev believes that regulators tweaked the figures and plans to challenge their actions in court.

The main thing is not the form, but the content, notes Danilov: “Perhaps, from a formal point of view, it matters what date this or that decision of the Central Bank/provisional administration was issued, but much more important (for example, for creditors) is the question of what the bank’s “In fact, there are assets and what their real value is.”

Come on, rate it

All reports on the assessment of oil assets that ended up in Ugra were prepared in five days by one expert from the Business Valuation Bureau. He evaluated these companies when their shares were pledged to Ugra, so it was logical for him to re-evaluate, including due to the timing, explains Shilyaev. The Business Assessment Bureau did not respond to a request for comment.

The real estate received as compensation was valued by five companies. The “Esarji-assessment” accredited by the DIA differed from the Central Bank by 3.4 times, and from the City Cadastre Bureau by 5 times. “We don’t look at the Central Bank and other comrades,” said the bureau’s general director, Roman Beloborodov. – We have a license, we are checked, we are not some kind of fake one-day operation. We are independent experts, we analyzed the market, and we calculated that the numbers were as follows.” Other appraisers declined to comment.

S.A. Ricci, at the request of Vedomosti, appreciated market value all 29 real estate objects of Ugra: 17–21 billion rubles. “The assets are quite decent, they are capable of generating rental flow,” says the CEO of S.A. Ricci Alexander Morozov.

Illustration copyright Svetlana Kholyavchuk/Tass Image caption The controlling shareholder of Ugra Bank is a mysterious native of Belarus, Alexey Khotin

The Central Bank introduced a temporary administration at Bank Yugra, which is one of the twenty largest Russian banks in terms of the size of attracted deposits from the population. The regulator estimated the amount of deposits at 180 billion rubles. This is the largest insurance event in the history of Russian banks.

Russia's Central Bank said on Monday that it had discovered signs of asset withdrawal, deposit fraud and unreliable reporting at Yugra Bank, which is controlled by publicity-shy businessman Alexei Khotin.

The introduction of a temporary administration for six months means that the powers of the bank's shareholders and management are suspended.

Typically, the tasks of the provisional administration include assessing the “hole” in the bank’s capital, that is, the difference between the bank’s assets and its liabilities. Practice shows that if the size of this “hole” turns out to be relatively small, the bank will be sanitized. Otherwise, Ugra may lose its license.

In addition to introducing temporary administration, a moratorium on settlements with creditors was introduced at the bank.

According to the law, the moratorium is an insured event, that is, depositors will be able to apply to the Deposit Insurance Agency (DIA) to receive payments as early as July. The maximum amount of insurance compensation is 1.4 million rubles.

“The volume of deposits is more than 180 billion rubles, most of these deposits are insured - as of June 1, almost 170 billion rubles of deposits were insured, that is, they fall under the deposit insurance system,” Deputy Chairman of the Central Bank Vasily Pozdyshev told reporters.

There have never been such payments in the history of the DIA. The BBC Russian service tells what Kholina Bank is famous for and how it came to the brink of collapse.

What is known about "Yugr"e"

- one of the largest Russian banks

According to banki.ru data, Ugra ranks 30th in Russia in terms of assets. The bank ranked 16th in terms of loan size: Ugra’s loan portfolio amounted to 262 billion rubles as of May 2017.

- one of the most active players in the deposit market

The bank held almost 182 billion rubles of deposits from individuals - this is the 15th place in Russia in terms of the volume of household deposits.

IN last years The bank actively attracted deposits. For example, in 2015, household deposits in Ugra increased by 137%. For comparison, over the same period, Sberbank's deposits of individuals increased by only 29%, and VTB - by 36%.

The active activity of Ugra in the household deposit market attracted the attention of the Central Bank, because the bank accepted deposits at rates above market rates. In March, the bank limited the attraction of household deposits; this was a restrictive measure on the part of the Central Bank, Vedomosti wrote.

- one of the leaders in business growth

From 2012 to 2017 authorized capital the bank grew from 170 million rubles to almost 13 billion rubles, said Yugra President Alexey Nefedov at a forum in St. Petersburg.

"Behind a short time The bank made a dramatic breakthrough. From a small financial institution in Tyumen Megion, a city of only 40 thousand people, Ugra has become one of the top 30 largest Russian banks. This is the merit of the entire team, primarily the shareholders,” said Nefedov.

- the bank provided loans to business owners

More than half of Ugra’s loan portfolio accounts for loans to the bank’s shareholders, said Pozdyshev, deputy chairman of the Central Bank, after the introduction of the temporary administration.

“We sent appeals to law enforcement agencies,” he said.

The bank invested all raised funds in Russian companies in different sectors of the economy, said Ugra President Nefedov.

What is known about the shareholders of Ugra

- controllingthbank shareholder- Belarus-born businessman Alexey Khotin

Alexey Khotin appeared on the list of Yugra shareholders in January 2016. At that time, as indicated in the bank's documents, he owned 0.48% of the bank's shares. Another 52.4% of the shares belonged to the Swiss company Radamant Financial AG, of which Khotin is the beneficiary.

According to Forbes magazine, the structures of Alexey Khotin and his father Yuri Khotin bought the financial organization in 2012. The magazine estimates Alexey Khotin's fortune at $950 million. In the ranking of the richest businessmen in 2017, he ranks 110th.

“The owner of Yugra Bank, Alexey Khotin, plans to support the bank until complete financial recovery - the main thing is that we are given such an opportunity,” said bank president Nefedov, whose words were relayed to journalists by the Ugra press service.

- kings of Russian real estate

Alexey and Yuri Khotin are regularly included in the Russian Forbes ranking of rentiers. In 2017, father and son took eighth place on the list. According to the magazine, they rent out almost 1.3 million square meters. m of retail and office real estate.

Rental income in 2016 was $295 million, according to Forbes. The magazine wrote that the Khotins own shopping complex"Gorbushkin Dvor", the Four Seasons Hotel near Red Square and other real estate in Moscow.

But in April 2017, businessman Sergei Podlisetsky told Lenta.ru that he was the owner of Gorbushkiny Dvor, and Alexey Khotin only lent him part of the funds for the purchase. In June of this year, the Kommersant newspaper wrote that Podlisetsky, a friend of the Khotin family, sold shopping mall to the main owner of Pharmstandard, Viktor Kharitonin.

In addition, it is believed that the Khotin family has an oil business. The total oil reserves in the fields developed by the Khotin structures are estimated at 215 million tons (for comparison, Rosneft produced 203 million tons of oil in 2015).

- connections with Belarus

Forbes wrote that the business of the Khotin family acquired a “different scale” after the disgraced former head of the Ministry of Internal Affairs of Belarus, Vladimir Naumov, moved to Moscow.

According to the publication's sources, in Russia the former minister began helping his fellow countrymen, allegedly using his connections. In particular, the magazine wrote, Khotin is well acquainted with the former head of the Russian Ministry of Internal Affairs and ex-speaker of the State Duma Boris Gryzlov.

The media also reported that Viktor Lagvinets, an associate of the former manager of the President of Belarus Ivan Titenkov, works in the structures of the Khotin family. In the late 90s, Lagvinets was detained on charges of abuse of official position, and then released.

- sponsor of the Putin Night Hockey League

Since 2013, Ugra Bank has been a sponsor of the Night Hockey League (NHL), an amateur sports organization, created in 2011 on the initiative of Vladimir Putin (then he served as prime minister).

Putin regularly participates in NHL matches and scores several goals in each game.

It is not yet known who will be the league's partner instead of Ugra. “The situation is still unclear, it has not been discussed. But life does not end there, there will be another partner,” NHL board member Sergei Babinov told Interfax.

The league's general director, Igor Bakhmutov, told TASS that the bank's problems will not affect its financial position.

- avoid publicity

Journalists have repeatedly tried to find out what Alexey and Yuri Khotin look like, but they are unable to photograph them. Businessmen do not appear in public.