Who is considered an individual entrepreneur? Who is a sole proprietor? Two groups of commercial entities

The question of what an individual entrepreneur is is incorrect. IP is not what, but who. This is an individual entrepreneur - a person who, according to the law:

- At his own risk, he carries out his chosen economic activity in order to obtain benefits from it;

- Registered in this capacity with government agencies;

- Did not form a legal entity.

It’s hard to argue with point one, but there are nuances with point two and three.

So, you are tired of “working for your uncle” - a picky boss, strict discipline. You have decided to become your own boss. And they have already written a statement. Well, let's figure out what this means for you.

Is it necessary to register an individual entrepreneur?

It depends on who studied what. If you are a programmer, designer, artist, copywriter, journalist, accountant, repair apartments, cars, computer equipment, a taxi driver with your own car, you rent out your home, you don’t have to think about it too much. Your work does not involve the need to rent or purchase an office, workshop, other real estate and land, a place on the market or in a store and signing contracts with enterprises and organizations; you are unlikely to be identified by the police or tax office. There are now millions of “unregistered” entrepreneurs.

But remember, now you are your own serf. By leaving your official job and choosing the path of an entrepreneur without registration, you have lost:

- The right to rest - now you will work not from eight to five with two days off, but all the time you have free from sleep;

- Public health care and sick pay;

- Paid vacation - you can, of course, leave any day, but things won’t work;

- A labor pension in old age, if you have not yet earned it;

- Opportunity to contact law enforcement agencies and to court if clients deceive you;

- The right to travel abroad – many countries require proof of income to obtain a visa;

- Possibility of obtaining a loan from many banks for the same reason;

- If you are detained by the police for some reason, the first question will also be: what do you live on? And when it turns out that the income from unregistered business activities is used, the court has the right to seize this income from you (if it proves it), objects of activity, force you to pay tax and bring you to administrative and even criminal liability.

Many, going into illegal business, simultaneously register with the labor exchange. At the same time, in addition to earnings, they receive unemployment benefits for a year, and can be treated in a state hospital for free. Logical solution. But... it is precisely this that is described in the article of the Criminal Code “Fraud”.

Convinced, I’ll go register

Well, you managed to do this quite easily. Most likely in one day. Today it is generally possible via the Internet. Let's find out if your situation has changed much.

State registration as an individual entrepreneur has somewhat improved your position in points 2), 4) - if you pay in good faith insurance premiums, pension and sick leave you will earn. But, since no one knows how much an individual entrepreneur actually earns, your insurance premiums are calculated on the assumption that you receive the minimum statutory salary of this region salary. The size of pensions and sick leave will be appropriate.

And in paragraphs 6), 7), 8) there are very significant changes. The police now have no complaints against you, your documents are in order. Visas are given to entrepreneurs even better than to hired workers. Many banks provide loans. Now you can enter into contracts with organizations, rent real estate and equipment, open own store, workshop, studio or cafe, hire workers. You can freely dispose of your income, calculate the tax according to a simplified system - only 9% on dividends, and if you switched to UTII, you generally keep track of income only for yourself. Almost no bureaucracy.

But there is one thing. Do you know why in America private entrepreneurs (private entrepreneurs) are even billionaires, owners of newspapers, ships and factories, but in our country individual entrepreneurs are mostly small, even micro-businesses? And everything that is larger is . The fact is that individual entrepreneurs are liable for debts incurred in the course of doing business with all their personal property. And the legal participants persons in such a case lose only their right to it.

That is, if an individual entrepreneur goes bankrupt, his property will be described by bailiffs. Unfortunately, this is the fate of so many small businesses. However, there is a lifeline. Article 446 of the Code of Civil Procedure prohibits the confiscation of the only dwelling, if it is not purchased with a mortgage, a personal plot, a supply of provisions, ordinary household items and used for professional activity, some others. A car and a garage, a second apartment, luxury items, and money in bank accounts will inevitably be taken away. If they are registered to you, of course, they will be found.

An individual entrepreneur does not have the right to obtain licenses to trade in potent poisons, certain medications, and alcoholic beverages. Many companies that pay do not want the services of individual entrepreneurs due to conflicting taxation systems, leading to the fact that the “big” company actually pays this tax for the entrepreneur. An individual entrepreneur has the right to switch to , but then he will pay more to the treasury and will have to keep double records, which greatly complicates document flow. Without special education, you won’t be able to do this kind of accounting yourself; you’ll have to spend money on an accountant.

The IP cannot conduct business with anyone joint business. He must conduct all affairs personally; he has no right to hire a director even during his vacation. That is, he cannot rest or undergo treatment or leave without stopping the company. All documents will have to be brought to the clinic for his signature. An individual entrepreneur is required to make payments to social funds on a regular basis, even if there was no activity at all in the reporting year or the entrepreneur was seriously disabled and physically unable to do so. In 2011, the amount of such payment for an entrepreneur was 16,160 rubles. Not many, if any, where to get them. What if there is temporarily no place?

For individual entrepreneurs, issuing an invitation to enter the Russian Federation for their foreign partners is much longer and more difficult than it is for legal entities. faces. The procedure for obtaining entry into the border zone is much longer for individual entrepreneurs.

Or maybe it’s better to become a society?

Based on what has been said, it is clear: a person should register as an individual entrepreneur if he is only taking his first steps in entrepreneurship, does not understand anything about accounting, and has chosen a simple, completely non-risky type of business. And he has no plans to expand his business in the future. As soon as you gain a little experience, you need to close your individual entrepreneur activity in exchange for an LLC. Although it would have been better to do it right away.

In this society, no matter how strange it sounds, you may be the only participant. In the CIS countries, unlike most of the rest of the world, the law allows this. That is, the same entrepreneur, but with much greater opportunities and at the same time with sharply limited responsibility compared to an individual entrepreneur. You will be able to nominate yourself general director or, conversely, hire another person for this position and go on vacation to a resort. If necessary, invite participating partners to the society. You will transfer to yourself amounts of payments to insurance funds sufficient to accrue a maximum pension and substantial payments in the future. sick leave. It doesn’t hurt to lay down some straw.

If the company's property is sold, you will lose it, but nothing more. The property of a company can be completely legally withdrawn from its balance sheet in anticipation of collapse. In return or in parallel, open as many new companies as you like. True, you will have to write a little more paper, but not much at all. But this is a separate conversation.

In order to make a profit from their labor and at the same time remain clean before the state, an individual according to the law Russian Federation, registers with government agencies either by creating an enterprise or receiving the status of an individual entrepreneur. This procedure is established by the Civil Code of the Russian Federation and Federal law"ABOUT state registration legal entities and individual entrepreneurs." Making a profit without going through such procedures will lead to the imposition of fines and other sanctions.

What individual entrepreneurship is is discussed in detail in the legislative acts of the Russian Federation.

Individual entrepreneur is an individual who runs a business and has passed state registration in the manner prescribed by law without education legal entity.

From the moment of receipt of registration forms, the work carried out by an individual entrepreneur for the purpose of making a profit is regulated by the same parts of the Civil Code of the Russian Federation as for legal entities, however, the processes of work and interaction with counterparties and other market participants are simplified.

Aspects of entrepreneurship:

- allows you to work and receive financial gain legally;

- expands the range of possibilities;

- assigns a certain responsibility;

- from the moment of state registration, an individual officially begins to conduct business, which means that delays and excuses can no longer be allowed.

As with any business, running a business as an individual entrepreneur has its advantages and disadvantages.

Positive aspects of going through the procedure of state registration of individual entrepreneurs:

- Registration of an individual entrepreneur is simpler than the establishment of a legal entity (regardless of the legal form of the latter).

- The owner decides the tasks of an individual entrepreneur independently; the state does not regulate accounting for such persons in a special manner, accounting policies, etc.

- The entrepreneur himself manages the activities without resorting to hiring a director.

- Cash disciplines for individual entrepreneurs are simplified in comparison with enterprises. Expenses of funds from an individual entrepreneur are directed at the discretion of the person, with the exception of cases when taxable profit is reduced due to expenses.

- Reporting to the Federal Tax Service and other government agencies requires less labor input when filling out and submitting.

- Does not require strict document management.

- It is not necessary to draw up a business plan to receive borrowed funds.

- Fewer complaints from others government agencies on issues of work organization, lower penalties, fewer inspections than legal entities.

- The ability to use state support programs (different for individual regions, details should be clarified in the structures of the subject of registration).

- The right to conclude foreign economic contracts, like legal entities.

Despite the positive aspects, an entrepreneur is the same responsible status as that of a founder when creating a legal entity.

But it doesn’t end with only positive aspects; there are also disadvantages, which rarely anyone thinks about at the beginning of their activity.

- It will not be possible to work with all customers, since for counterparties cooperation with an individual entrepreneur carries great risks if the latter fails to comply with its obligations.

- In case of bankruptcy and a large volume of credit obligations, debt collection occurs from the property of such individual.

- There is a list of activities that an individual entrepreneur has no right to engage in.

- There is a restriction on hiring employees; their number is determined by the requirements for the selected tax regime.

- An individual entrepreneur is required to pay monthly insurance premiums for himself, regardless of whether he is already a pensioner or not.

- Obligations to submit reports to government authorities, including tax authorities, within the established time limits.

Despite all the nuances of operating as an individual entrepreneur, this is the only legal way to do business without organizing an enterprise.

When submitting and compiling tax reporting without violating deadlines, maintaining accounting and engaging in legal activities, there will be no problems with government agencies.

Everything that passes through public authorities is always backed up legislative acts, the concept and activities of individual entrepreneurs are no exception.

Basic laws and codes that guide a novice businessman in his activities:

- Federal Law “On State Registration of Legal Entities and Entrepreneurs”.

- Tax Code of the Russian Federation and laws of the region of Russia in which state registration was carried out.

- The Law “On Licensing of Certain Types of Activities” and industry regulations, for example, legislation on tourism, if necessary.

- Federal Law "On".

- Federal Law No. 209 of July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation.”

- Labor Code - when using labor hired workers.

- Federal Law No. 54 of May 22, 2003 “On the use of cash registers and cash payments, as well as using plastic cards.”

The activities of an individual entrepreneur, despite their simplicity in comparison with legal entities, still impose on the individual quite a lot of responsibilities in accordance with the specified regulations legislation of the Russian Federation.

Some activities are subject to additional regulations, information about what other laws the entrepreneur needs to study when choosing his OKVED code.

Each entrepreneur is an independent person, and he has the right to choose a taxation system based on his own convictions, and also, if necessary, voluntarily change it in the manner prescribed by law.

A change in the tax regime for individual entrepreneurs may occur automatically due to exceeding the norms allowed by the current regime.

In total, the Tax Code defines 5 modes under which an individual entrepreneur can operate:

- BASIC ( general system taxation) – implies maintaining a full-fledged accounting, payment of income tax, filling large quantity tax returns. At the same time, the entrepreneur gets the opportunity to conduct commercial activities without restrictions, recover VAT and engage in all types of activities, except those that are generally prohibited in the country or for individual entrepreneurs.

- STS (simplified taxation system). It also has a number of difficulties in terms of accounting, but it turns out to be simpler than OSNO. Within the framework of the simplified tax system, an entrepreneur can choose 2 options tax base: 6% of the total turnover or from 5 to 15% (the rate is determined by the laws of the constituent entity of the Russian Federation in which the activity is carried out) of income minus expenses. In this case, there are some restrictions.

- UTII (imputed tax). May be applicable by some individual entrepreneurs for state-defined types of activities. In this case, taxation is determined by the rate established by the state using coefficients. The mode has restrictions, so it is used by entrepreneurs less often than others.

- Patent system. Most often used by entrepreneurs involved in trade to the final consumer and the provision of services to the public. The tax in this case is fixed, accounting is limited to filling out a ledger of income and expenses. It has strict limits in terms of income, staff and OKVED.

- Unified Agricultural Sciences. Suitable for agricultural producers only.

Individual entrepreneurs have the right to apply several forms of taxation simultaneously, under individual species activities. This allows you not to exceed the limits established by law under the simplified tax system and patent, and to avoid restrictions on engaging in one or another type of business.

Due to the fact that individual entrepreneurship is a simplified form of state business registration, it has a number of limitations. May be applicable to all entrepreneurs or depending on the chosen taxation system.

Due to the fact that individual entrepreneurship is a simplified form of state business registration, it has a number of limitations. May be applicable to all entrepreneurs or depending on the chosen taxation system.

OKVED involves dividing all types of activities into 4 groups:

- permitted - all entrepreneurs and legal entities can engage in them without additional restrictions and approvals;

- licensed - you can work in the field of these codes only by obtaining a special license from the relevant government bodies;

- prohibited - types of activities that can be carried out by a limited number of enterprises (most often the public sector);

- unlicensed, but requiring additional permits - it is possible to conduct activities under these OKVED codes only by obtaining permits from regulatory authorities (for example, a sanitary station for public catering), and are available for individual entrepreneur registration.

Prohibited types of activities that, regardless of the form of taxation, individual entrepreneurs cannot engage in:

- production and wholesale distribution alcoholic products;

- production of narcotic drugs, psychotropic and pharmaceutical drugs;

- sale of electricity to civilians;

- space activities (flights);

- activities in the segment of non-state pension insurance and investment funds;

- employment of citizens of the Russian Federation abroad;

- establishment of security companies and provision of related services;

- air transportation;

- conducting examinations in the field of industrial safety;

- activities aimed at managing hydrometeorological or geophysical processes;

- production and distribution explosives and pyrotechnic products;

- storage, production, sale and development of ammunition, weapons and components, including chemical;

- development and production of aviation equipment and dual-use equipment, its repair and maintenance.

You will need to obtain a license before starting work for the following activities:

- Pharmaceuticals.

- Sales of tobacco products.

- Private detective activities.

- Transportation by ground or by sea transport etc., if provided by law.

Depending on the form of taxation, restrictions on work may also be imposed.

Table 1. Limitations on the activities of individual entrepreneurs based on the tax base chosen during registration

| Limitation | BASIC | simplified tax system | UTII* | Patent |

| State | No limits | Up to 100 people | No more than 100 | Up to 10 people |

| Annual turnover, rub. | Not installed | 150 million | No | 60 million |

| Everything is allowed, except those prohibited by the state for individual entrepreneurs | Companies cannot be established to provide legal services, pawnshops and gambling business. | Can only be used for the types of activities specified in clause 2 of Art. 346.26 ch. 26.3 Tax Code of the Russian Federation | All are prohibited, except those provided for in paragraph 2 of Art. 346 of Chapter 26.4 of the Tax Code of the Russian Federation as patent activities. |

*According to UTII in the Tax Code of the Russian Federation there are a number of additional restrictions, including sizes retail premises should not exceed 150 sq. m, the number of cars in the fleet for individual entrepreneurs providing transportation services cannot exceed 20 units.

It is preferable for an individual entrepreneur to decide on the types of activities and form of taxation before undergoing state registration. Restrictions on certain OKVED will not allow you to operate within the law and obtain the necessary certificates, and for violation of these parts of the law, criminal liability is provided.

If everything with the types of activities and the form of taxation has been decided, then the entrepreneur must go through the procedure of mandatory state registration; for this, the following is submitted to the registration authority:

- Statement of the established form.

- Passport of a citizen of the Russian Federation or a foreigner (with translation).

- Taxpayer identification number.

- And other forms established for certain categories of individuals.

Within 5 days after submitting the full package of papers, if there are no claims against the entrepreneur from government agencies, he receives a certificate of state registration, and information about him is entered into the register, where all data about the individual entrepreneur will be stored until the termination of activity.

Within 5 days after submitting the full package of papers, if there are no claims against the entrepreneur from government agencies, he receives a certificate of state registration, and information about him is entered into the register, where all data about the individual entrepreneur will be stored until the termination of activity.

An individual, regardless of citizenship, who has reached the age of majority and is recognized as legally capable, can become an individual entrepreneur. For foreigners, it is mandatory to have documents confirming legal grounds to stay on the territory of the Russian Federation (TRP or permanent residence permit).

In some cases, individual entrepreneur status can be obtained by persons under 18 years of age if they are recognized by authorized bodies as adults ahead of schedule, as a result of marriage, or with permission from parents or other legal representatives (guardians).

Individual entrepreneurs, as well as legal entities, have the right to use the labor of hired workers. In order to gain the legal opportunity to hire people to perform work, an individual entrepreneur (the requirements were in force until 2017) must go through the procedure of registering as an employer with the Pension Fund, FFOMS and Social Insurance Fund, having received the appropriate certificates.

Since 2017, an individual entrepreneur is obliged only when employing the first employee to submit information to the Social Insurance Fund that he has started labor Relations with an individual. This must be done in established by law terms – 30 calendar days. Otherwise, fines are provided for 90 days of delay - 5,000 rubles, over - 10,000 rubles.

The sequence of actions for registering an employee as an individual entrepreneur is not very different from the standard procedure at enterprises of other forms of ownership:

The sequence of actions for registering an employee as an individual entrepreneur is not very different from the standard procedure at enterprises of other forms of ownership:

Accept from the future employee a package of documents that includes:

- Passport of a citizen of the Russian Federation, or an alternative, for foreign citizens. Employment of foreigners involves the preparation of an expanded package, with the attachment of permit forms, as well as the completion of additional procedures, including at the Federal Migration Service;

- SNILS;

- employment history;

- education diploma and certificates (if required to perform work).

If an individual has not previously been employed, registration of SNILS and a work book is the obligation of the individual entrepreneur as the first employer for such an employee:

- Accept the application for registration with the state.

- Draw up an employment or civil law contract (used only for one-time work, in this case a work book is not required).

- Issue an order for recruitment and commencement of work duties.

- Create a personal employee card.

- No later than a week from the date of signing the employment contract, make an entry in work book.

If the employee did not work for 5 days and quit, an entry in the employment record may not be made.

Termination of IP

In cases where an individual entrepreneur decides to stop conducting business activities, he must close the individual entrepreneur in accordance with the procedure established by law. The procedure for terminating a business, as well as registration, is regulated by the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs.” The procedure is determined by Art. 22.3 of the said act. In cases of forced termination of activity or death of an individual entrepreneur, registration authorities are guided by the data received from government agencies, courts or notary.

As for the voluntary procedure, the individual entrepreneur must submit the following documents to the structures:

- An application completed in the prescribed manner.

- Payment confirming payment of the state duty.

- Evidence that he submitted Required documents to the Pension Fund.

Until the official termination of business activities, an individual remains obligated to pay taxes and fees provided for by law, regardless of whether business is being conducted or not, so it is worth considering that such termination of work is unacceptable for the individual entrepreneur himself.

Conducting activities and receiving financial benefits from them in Russia without going through state registration procedures is an illegal form of income. At the same time, the formation of an enterprise is a complex and lengthy process. If the view economic activity allows, then most individuals choose to register as an individual entrepreneur. The opportunities obtained in this case are slightly less than those of legal entities, and there are no complaints from authorities and order.

I am writing an article for those who want to open their own business, but do not know how or do not have enough time to do it...

Let's first look at what an IP is!

The abbreviation IP is very often found everywhere today, after the crisis and at the time of the crisis, many “resigned due to at will", because employers did not pay wages or did not want to do this. Not the point... The main thing at this moment, many people, out of hopelessness of the situation, began to “think about” where to get money?, what to live on? what to eat? etc. .d. And many tried to make money on what they knew, and in order not to break the law and not be afraid of persecution by supervisory authorities, they formalized their actions in a legal way by registering an individual entrepreneur.

Why individual entrepreneur and not LLC?

What is an IP? An individual entrepreneur (individual entrepreneur) is an individual endowed with the rights of a legal entity but without forming a legal entity, who has the right to engage in entrepreneurial activities (buy, sell, provide services and even engage in production, construction, etc.), hire employees and etc.

Here is how this concept is interpreted on Wikipedia: Individual entrepreneurs- individuals registered in accordance with the procedure established by law and carrying out entrepreneurial activities without forming a legal entity.

Individuals carrying out entrepreneurial activities without forming a legal entity, but who have not registered as individual entrepreneurs in violation of the requirements of the civil legislation of the Russian Federation, when performing the duties assigned to them by the Tax Code, do not have the right to refer to the fact that they are not individual entrepreneurs

It is more or less clear what an individual entrepreneur is.....

Let's return to the question then: “Why individual entrepreneur and not LLC?”

To answer this question, I will give the table below:

Individual entrepreneur or LLC? differences and differences

|

1. State fee for individual entrepreneur registration - 800 rubles 2. Easy to register as an individual entrepreneur and the opening period is 6-8 working days. 3. Registered at the place of registration. 4. Not responsible for his obligations with all his property. 5. Does not keep accounting records; does not keep a book of income and expenses. 6. Lack of cash discipline, the ability to freely dispose of the proceeds received. 7. Opening a current account for an individual entrepreneur is not a mandatory procedure, even if business is ongoing. 8. In the general taxation regime, individuals pay income tax on profits received. persons 13%. 9. Individual entrepreneur pays a fixed payment in Pension Fund. In 2011 - 16,000 rubles. 10. Money from the current account can be used as desired. 11. Cannot carry out certain types of activities. 12. Since 2012, implement international shipping will be impossible. 13. Licenses have ceased to be issued for many types of activities. 14. It’s easy to close an individual entrepreneur. |

1. The state fee for registering an LLC is 4,000 rubles. 2. When registering an LLC, an authorized capital of at least 10,000 rubles is required. (there is an option not to deposit money to the account or to the organization’s cash desk) 3. The legal address of the LLC is registered at the location of the company. The address of the location of the LLC. (registration of one of the founders or general director may be the address of the LLC) 4. Non-responsibility for their obligations by contributions of participants to the authorized capital, i.e. authorized capital. 5. Mandatory accounting. 6. Mandatory cash discipline under any taxation regime. 7. As such, there is no obligation to open a current account, but without opening it it is impossible to pay taxes and make payments over 100,000 rubles. one deal at a time. (if the activity is 0, then you don’t have to have an account, because you don’t need to pay any taxes). 8. Under the general taxation regime, a profit tax of 20% is paid on profits received. 9. Can engage in any type of activity. 10. There are no licensing restrictions. 11. Liquidating (closing) an LLC is more difficult. 12. LLC is more solid. 13. In an LLC you can change the name, OKVED, taxation system, legal address(LLC location address), composition of founders, general. directors, LLC can be bought or sold. |

Based on the data in the table, opening a sole proprietorship is beneficial when you are engaged in a small (simple) business.

By the way, if you are engaged in any business and have not registered an individual entrepreneur, LLC, etc., you can get into big trouble!

For conducting business activities without registration as an individual entrepreneur, administrative, tax and criminal liability is provided. Each type of liability presupposes its own rules for recording violations, drawing up documents and actually holding them accountable.

According to the Civil Code of the Russian Federation, entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, the sale of goods, and the provision of services.

To confirm the conduct of activities, it is necessary to prove two circumstances: systematicity and profit. Systematic activity It is considered if it is carried out two or more times a year. When a citizen has once sold any property or provided a service to someone, he will not be considered to be engaged in entrepreneurial activity. Likewise, if a person sells goods, including systematically (that is, more than twice), but for the same money for which he bought them, or cheaper, the transactions will not be considered entrepreneurial activity. Because there is no profit.

Let's start with administrative responsibility. It is provided for in Part 1 of Art. 14.1 of the Code of the Russian Federation on Administrative Offences. The possible fine ranges from 500 to 2000 rubles.

The decision to prosecute is made by the magistrate (Article 23.1 of the Code of Administrative Offenses of the Russian Federation). The case can be considered either at the place where the offense was committed, or at the place of residence of the individual (if he files a petition to consider the case at his place of residence). A protocol on violation, that is, carrying out activities without registration, can be drawn up by: the police, the tax inspectorate, territorial bodies of the Ministry of Antimonopoly Policy, state inspection on trade, quality of goods and protection of consumer rights (Article 28.3 of the Code of Administrative Offenses of the Russian Federation). In addition, a prosecutor can initiate a case of an administrative offense (Article 28.4 of the Code of Administrative Offenses of the Russian Federation). Usually, employees of one of the listed departments come to an individual with an inspection, conduct an inspection of the premises or a test purchase, discover that the individual is conducting his activities illegally, that is, without registering as an individual entrepreneur, after which a protocol is drawn up.

Operating without registration as an individual entrepreneur is a continuing offense. A citizen can be brought to justice only within two months from the date of drawing up the protocol.

Note. For carrying out business activities without registration as an individual entrepreneur, administrative, tax and criminal liability is provided.

When the protocol is drawn up incorrectly or contains contradictions, the judge must return the document to the department that compiled it for revision. Two months is enough short term, and while the protocol is being finalized, the deadline often expires. If the case is not considered by the judge within two months from the date of drawing up the protocol, the judge will issue a decision to terminate the administrative proceedings.

Criminal Code of the Russian Federation

Criminal liability for illegal business is provided for in Art. 171 of the Criminal Code. It occurs if, as a result of an inspection carried out by the police or the prosecutor’s office, it is proven that either the infliction of major damage to citizens, organizations or the state, or the receipt of income on a large scale, that is, in the amount of at least 250 thousand rubles. (note to Article 169 of the Criminal Code of the Russian Federation).

Given that test purchases are usually carried out for small amounts, the detection of such an offense falling under criminal liability is unlikely within the framework of a test purchase. Cases of illegal business are usually discovered during the investigation of cases of legalization of proceeds from crime. Other unregistered entrepreneurs do not need to worry about criminal liability, because they must prove receipt of income in the amount of more than 250 thousand rubles. difficult, so the police usually open cases under Art. 171 of the Criminal Code, if there is no evidence of receiving income on a large scale.

Liability for illegal business causing damage from 250 thousand rubles. up to 1 million rubles (that is, on a large scale) is as follows: a fine of up to 300 thousand rubles. or in the amount of salary (other income) of the convicted person for a period of up to two years, or compulsory work for a period of 180 to 240 hours, or arrest for a period of four to six months.

For illegal business that causes damage or generates income on an especially large scale, a fine of 100 to 500 thousand rubles is provided. or in the amount of the salary (other income) of the convicted person for a period of one to three years, or imprisonment for a term of up to five years with a fine of up to 80 thousand rubles. or in the amount of the salary (other income) of the convicted person for a period of up to six months. Damage or income exceeding 1 million rubles is considered especially large.

If a citizen is brought to criminal responsibility for the first time, and is also positively characterized by his neighbors at his place of work, he is not a persistent offender public order, then, most likely, he will only be awarded a fine.

Owners of residential premises who rent them out must keep in mind that for renting out residential premises they will be subject to criminal liability under Art. 171 of the Criminal Code is impossible, regardless of the amount of rent that the investigator can prove. This was reported by the Supreme Court of the Russian Federation in Resolution of the Plenum of the Supreme Court of the Russian Federation dated November 18, 2004 No. 23.

tax code

The Tax Code provides for liability for activities without registration in two articles at once: 116 and 117. Evasion of registration with the inspectorate is subject to a fine of 10 percent of income received, but not less than 20 thousand rubles. In cases where the activity was carried out for more than 90 calendar days, the fine will be 20 percent of the amount of income, but not less than 40 thousand rubles. (Article 117 of the Tax Code of the Russian Federation). For violation of the deadline for registration with the inspectorate, the fine will be 5 thousand rubles. or 10 thousand rubles if the delay is more than 90 calendar days (Article 116 of the Tax Code of the Russian Federation). They can only be punished under one of the articles. Let's figure out when each of them is used.

A citizen must register with the inspectorate before he begins to receive income from activities. Therefore, the period of delay for the application of the above articles should be counted from the moment of the first proven case of receipt of proceeds. According to Art. 116 will be fined if the application for state registration is submitted before the act is drawn up tax audit, but later than the day of receipt of the first revenue. If on the date of drawing up the tax audit report the application has not yet been submitted, liability arises under Art. 117 Tax Code.

In addition to the fine for lack of state registration, inspectors have the right to assess additional taxes by calculation. The failed merchant will be assessed additional personal income tax and contributions to extra-budgetary funds. And if in the region where the individual entrepreneur operates, the activity has been transferred to UTII, and the entrepreneur’s activities fall under this regime, then instead of income tax, controllers will calculate UTII. Penalties for late payment will be added to the amount of taxes calculated by the inspectors. In addition, a fine is established for non-payment of taxes - 20 percent of the amount of additional taxes and penalties (Article 122 of the Tax Code of the Russian Federation).

Note. In addition to the fine for lack of state registration, inspectors have the right to assess additional taxes by calculation, as well as impose penalties and fines for late payment.

Taxes and fines from individuals are collected in court according to the rules provided for by the Civil Procedure Code in a court of general jurisdiction. So the decision of the controllers or the protocol alone is not enough; the culprit will pay the fine only on the basis of a court decision.

We pointed out possible sanctions that threaten individuals operating without registration. The final verdict depends on the situation, the available facts and the court's decision. The most effective method of protecting yourself from inspectors is to not allow them onto your territory, especially if the activity is carried out by a citizen at home. Inspectors have the right to enter residential premises only by court decision. But inspectors can obtain information about illegal activities not only during an inspection. Of course, there is a chance of a random visit, but it is small. Basically, controllers come after receiving messages from a businessman’s competitors or complaints from offended customers. Tax inspectorates collect information about unregistered entrepreneurs. Having accumulated information, they can schedule an on-site inspection and inspect the premises and territories used to generate income. Other departments (police, prosecutor's office, Rospotrebnadzor) will come to check the unregistered entrepreneur, most likely in connection with complaints received from defrauded customers.

And receive profit from its activities or engage in individual activities without forming a legal entity.

In accordance with Article 23 of the Civil Code of the Russian Federation, a citizen has the right to engage in entrepreneurial activity without forming a legal entity from the moment of state registration as an individual entrepreneur. Any citizen has the right to conduct business, but not every citizen is able to exercise this right.

To acquire the status of an individual entrepreneur, a citizen must have the following general characteristics of a subject of civil law:- Legal capacity(the ability to have civil rights and bear responsibilities)

- Legal capacity(the ability to acquire and exercise civil rights through one’s actions)

- Have a place of residence(the place where the citizen resides permanently or primarily).

Only capable citizens can carry out entrepreneurial activities, that is, those who are able to independently perform legal actions, conclude and execute them, acquire property and own, use and dispose of it. By general rule civil capacity arises in full upon reaching the age of majority (on reaching 18 years of age).

The status of an individual entrepreneur is acquired as a result of state registration citizen as an individual entrepreneur.

An unjustified refusal of state registration may be appealed by a citizen in an arbitration court. Refusal of state registration of an entrepreneur is allowed only in cases of discrepancy between the composition of the submitted documents and the composition of the information contained in them with the requirements of the Regulations on the procedure for state registration of business entities (No. 1482).

Property disputes between citizens registered as individual entrepreneurs, as well as between these citizens and legal entities are permitted arbitration courts, with the exception of disputes not related to the implementation of entrepreneurial activities by citizens.

An entrepreneur bears increased responsibility, unlike other citizens, since in accordance with the current legislation (Article 401 of the Civil Code of the Russian Federation), a person who fails to fulfill or improperly fulfills an obligation when carrying out business activities bears responsibility regardless of the presence of guilt. Creditors can also make claims against an individual entrepreneur for obligations not related to business activities (causing harm to the life, health or property of citizens or legal entities, collecting alimony, etc.).

An entrepreneur (individual) can work in any position on a paid basis in any private, public or public organizations, unless this work or position is prohibited by law from being combined with entrepreneurship. Unlike legal entities, the property of individual entrepreneurs, constituting objects commercial activities, can be passed on by inheritance and by will. But the right to engage in entrepreneurial activity does not pass by inheritance.

Individuals carrying out business activities without registration bear liability, including criminal liability, in accordance with the legislation of the Russian Federation. All income received from such activities is subject to collection to the state.

Commercial activity without forming a legal entity

Two groups of commercial entities

In accordance with Russian legislation, two groups of entities can engage in commercial activities:- citizens or individuals;

- legal entities.

The law establishes equal treatment of citizens and legal entities in determining their rights and obligations, in determining any conditions for doing business (commerce, entrepreneurship) that do not contradict the law.

The concept of an individual entrepreneur

Individual entrepreneur- a citizen engaged in entrepreneurial (commercial) activities without forming a legal entity.

A citizen can act in the market as an individual entrepreneur only from the moment of his state registration.

An independent type of individual entrepreneur is the head farm carrying out activities without forming a legal entity, who is also recognized as an individual entrepreneur from the moment of state registration of his farm.

Basic rights and obligations of an individual entrepreneur

Citizens registered as individual entrepreneurs have rights and obligations, including:- the right to create legal entities independently or jointly with other persons;

- are obliged to answer for their obligations with all their property;

- may be declared bankrupt by a court decision.

If carried out without forming a legal entity, the rules governing the activities of legal entities apply.

Associations of individual entrepreneurs

Engaging in entrepreneurial activity without forming a legal entity is possible not only by individual entrepreneurs, but also by their associations. Such an association is possible only on the basis of a simple partnership agreement. Under a simple partnership agreement, two or more persons pool their contributions and act together without forming a legal entity to make a profit or achieve another goal.

For the validity of this agreement, the simultaneous presence of three mandatory elements is necessary:- common goal;

- connection of deposits of individual entrepreneurs;

- joint activities to achieve the set goal.

When conducting common affairs, each partner has the right to act on behalf of all partners, unless the terms of the agreement provide for other conditions. Moreover, in relations with third parties, the authority of a partner to make transactions on behalf of all partners is certified by a power of attorney issued to him by the other partners.

Partners bear joint liability for all common obligations, regardless of the grounds for their occurrence. Moreover, even if a person ceased his participation in the agreement, but the agreement between the remaining partners was not terminated, he is liable to third parties for general obligations that arose during the period of his participation in the agreement.

Types of individual entrepreneurs.

Types of individual entrepreneurs are presented in Fig. 1.Bankruptcy (insolvency) of an individual entrepreneur.

An individual entrepreneur may be declared bankrupt if he is unable to satisfy the demands of creditors for monetary obligations or fulfill obligations for mandatory payments within three months from the date of their execution and if the amount of his obligations exceeds the value of his property.

Insolvency (Bankruptcy) of an individual entrepreneur

An individual entrepreneur may be declared bankrupt by decision of the arbitration court in the event that he is unable to satisfy the claims of creditors related to his business activities. Also, an individual entrepreneur can voluntarily officially declare bankruptcy.

The grounds and procedure for recognizing an individual entrepreneur are established by Federal Law No. 127 “On Insolvency (Bankruptcy).

The basis declaring an individual entrepreneur bankrupt is his inability to satisfy the demands of creditors for monetary obligations or to fulfill the obligation to make mandatory payments.

Statement declaring an individual entrepreneur bankrupt can be filed by the debtor, creditor, tax and other authorized authorities for requirements for mandatory payments.

The entrepreneur is considered bankrupt and his registration as an individual entrepreneur loses force from the moment the arbitration court makes a decision to declare the individual entrepreneur insolvent and to open bankruptcy proceedings. The entrepreneur's licenses issued to him are revoked.

Out of court an entrepreneur is considered bankrupt after he officially declares his bankruptcy in the “Bulletin of the Arbitration Court of the Russian Federation” and the official publication government agency in bankruptcy cases.

The debtor's declaration of bankruptcy and its liquidation shall indicate the period for filing claims of creditors and objections of creditors against the liquidation of the debtor, which cannot be less than two months from the date of publication of the said announcement.

An individual entrepreneur declared bankrupt cannot be registered as an individual entrepreneur within one year from the moment he was declared bankrupt.

The arbitration court sends a copy of the decision to declare the individual entrepreneur bankrupt and to open bankruptcy proceedings to the body that registered the citizen as an individual entrepreneur, and also forwards the decision to all known creditors.

Creditors' requirements IPs are satisfied in accordance with established by law priority at the expense of the property belonging to him, with the exception of property that cannot be foreclosed on in accordance with Federal Law No. 229 “On Enforcement Proceedings”.

The claims of creditors of each subsequent priority are satisfied after the last satisfaction of the claims of the creditors of the previous priority. If the amount is insufficient to fully satisfy all the claims of creditors of one priority, these claims are satisfied in proportion to the amount of recognized claims of each creditor of this priority.

After completing settlements with creditors, an individual entrepreneur declared bankrupt is considered free from fulfillment of remaining obligations related to his business activities, even if they were not declared in arbitration court. Also considered repaid, regardless of whether they were actually satisfied, are claims for other obligations not related to business activities that were presented and taken into account by the court when declaring an individual entrepreneur bankrupt.

Exception made only for requirements on compensation for harm caused to life and health, and others personal requirements, which remain in force regardless of whether they were presented during the bankruptcy procedure, in the event that they remained unsatisfied.

Upon completion of the bankruptcy procedure, the bankrupt loses the validity of his registration as an individual entrepreneur and all subsequent disputes from that moment are resolved in the courts of general jurisdiction.

Individual entrepreneur (IP)(obsolete private entrepreneur (PE), PBOYUL until 2005) is an individual registered as an entrepreneur without forming a legal entity, but in fact possessing many of the rights of legal entities. The rules of the civil code regulating the activities of legal entities apply to individual entrepreneurs, except in cases where separate articles of laws or legal acts are prescribed for entrepreneurs.()

Due to some legal restrictions (it is impossible to appoint full-fledged directors to branches in the first place), an individual entrepreneur is almost always a micro-business or small business.

according to the Code of Administrative Offenses

Fine from 500 to 2000 rubles

In case of gross violations or when working without a license - up to 8,000 rubles. And, it is possible to suspend activities for up to 90 days.

From RUB 0.9 million for three years, and the amount of arrears exceeds 10 percent of the tax payable;

From 2.7 million rubles.

Fine from 100 thousand to 300 thousand rubles. or in the amount of the culprit’s salary for 1-2 years;

Forced labor for up to 2 years);

Arrest for up to 6 months;

Imprisonment for up to 1 year

If the individual entrepreneur fully pays the amounts of arrears (taxes) and penalties, as well as the amount of the fine, then he is exempt from criminal prosecution (but only if this is his first such charge) (Article 198, paragraph 3 of the Criminal Code)

Evasion of taxes (fees) on an especially large scale (Article 198, paragraph 2. (b) of the Criminal Code)

From 4.5 million rubles. for three years, and the amount of arrears exceeds 20 percent of the tax payable;

From 30.5 million rubles.

Fine from 200 thousand to 500 thousand rubles. or in the amount of the culprit’s salary for 1.5-3 years;

Forced labor for up to 3 years;

Imprisonment for up to 3 years

Fine

If the amounts for criminal prosecution are not reached, then there will only be a fine.

Non-payment or incomplete payment of taxes (fees)

1. Non-payment or incomplete payment of tax (fee) amounts as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other unlawful actions (inaction) entails a fine in the amount of 20 percent of the unpaid amount of tax (fee).

3. The acts provided for in paragraph 1 of this article, committed intentionally, entail a fine in the amount of 40 percent of the unpaid amount of tax (fee). (Article 122 of the Tax Code)

Penalty

If you were just late in payment (but did not provide false information), then there will be penalties.

The penalties for everyone are the same (1/300 multiplied by the key rate of the Central Bank per day of the amount of non-payment) and now amount to about 10% per annum (which is not very much in my opinion, taking into account the fact that banks give loans for at least 17-20 %). You can count them.

Licenses

Some types of activities an individual entrepreneur can only engage in after receiving a license, or permissions. Licensed activities of individual entrepreneurs include: pharmaceutical, private investigation, transportation of goods and passengers by rail, sea, air, as well as others.

An individual entrepreneur cannot engage in closed types of activities. These types of activities include the development and/or sale of military products, trafficking in narcotic drugs, poisons, etc. Since 2006, the production and sale of alcoholic beverages has also been prohibited. An individual entrepreneur cannot engage in: alcohol production, wholesale and retail trade alcohol (except for beer and beer-containing products); insurance (i.e. be an insurer); activities of banks, investment funds, non-state pension funds and pawnshops; tour operator activities (travel agency is possible); production and repair of aviation and military equipment, ammunition, pyrotechnics; production of medicines (sales possible) and some others.

Differences from legal entities

- The state fee for registering individual entrepreneurs is 5 times less. In general, the registration procedure is much simpler and fewer documents are required.

- An individual entrepreneur does not need a charter and authorized capital, but he is liable for his obligations with all his property.

- An entrepreneur is not an organization. It is impossible for an individual entrepreneur to appoint a full and responsible director.

- Individual entrepreneurs do not have cash discipline and can manage the funds in the account as they please. Also, the entrepreneur makes business decisions without recording them. This does not apply to working with cash registers and BSO.

- An individual entrepreneur registers a business only in his name, in contrast to legal entities, where registration of two or more founders is possible. Individual entrepreneurship cannot be sold or re-registered.

- A hired employee of an individual entrepreneur has fewer rights than a hired employee of an organization. And although the Labor Code equates organizations and entrepreneurs in almost all respects, there are still exceptions. For example, when an organization is liquidated, the mercenary is required to pay compensation. When closing an individual entrepreneur, such an obligation exists only if it is specified in the employment contract.

Appointment of director

It is legally impossible to appoint a director in an individual entrepreneur. The individual entrepreneur will always be the main manager. However, you can issue a power of attorney to conclude transactions (clause 1 of Article 182 of the Civil Code of the Russian Federation). Since July 1, 2014, it has been legislatively established for individual entrepreneurs to transfer the right to sign an invoice to third parties. Declarations could always be submitted through representatives.

All this, however, does not make the people to whom certain powers are delegated directors. For directors of organizations, a large the legislative framework about rights and responsibilities. In the case of an individual entrepreneur, one way or another, he himself is responsible under the contract, and with all his property he himself is responsible for any other actions of third parties by proxy. Therefore, issuing such powers of attorney is risky.

Registration

State registration of an individual entrepreneur carried out by the Federal Tax Service of the Russian Federation. The entrepreneur is registered with the district tax office at the place of registration, in Moscow - MI Federal Tax Service of the Russian Federation No. 46 for Moscow.

Individual entrepreneurs can be

- adult, capable citizens of the Russian Federation

- minor citizens of the Russian Federation (from 16 years of age, with the consent of parents, guardians; married; a court or guardianship authority has made a decision on legal capacity)

- foreign citizens living in the Russian Federation

OKVED codes for individual entrepreneurs are the same as for legal entities

Necessary documents for registration of an individual entrepreneur:

- Application for state registration of an individual entrepreneur (1 copy). Sheet B of form P21001 must be filled out by the tax office and given to you.

- A copy of the Taxpayer Identification Number.

- A copy of your passport with registration on one page.

- Receipt for payment of the state fee for registration of an individual entrepreneur (800 rubles).

- Application for switching to the simplified tax system (If you need to switch).

An application for registration of individual entrepreneurs and other documents can be prepared online in a free service.

Within 5 days you will be registered as an individual entrepreneur or you will receive a refusal.

You must be given the following documents:

1) Certificate of state registration of an individual as an individual entrepreneur (OGRN IP)

2) Extract from a single state register individual entrepreneurs (USRIP)

After registration

After registering an individual entrepreneur It is necessary to register with the pension fund and the Compulsory Medical Insurance Fund and obtain statistics codes.

Also necessary, but optional for an entrepreneur, is opening a current account, making a seal, registering a cash register, and registering with Rospotrebnadzor.

Taxes

Individual entrepreneur pays a fixed payment to the pension fund for the year, 2020 - 40,874 rubles + 1% of income over 300,000 rubles, 2019 - 36,238 rubles + 1% of income over 300,000 rubles. The fixed contribution is paid regardless of income, even if the income is zero. To calculate the amount, use the IP fixed payment calculator. There are also KBK and calculation details.

An individual entrepreneur can apply tax schemes: simplified tax system (simplified), UTII (imputed tax) or PSN (patent). The first three are called special modes and are used in 90% of cases, because they are preferential and simpler. The transition to any regime occurs voluntarily, upon application; if you do not write applications, then OSNO (general taxation system) will remain by default.

Taxation of an individual entrepreneur almost the same as for legal entities, but instead of income tax, personal income tax is paid (under OSNO). Another difference is that only entrepreneurs can use PSN. Also, individual entrepreneurs do not pay 13% on personal profits in the form of dividends.

An entrepreneur has never been obliged to keep accounting records (chart of accounts, etc.) and submit financial statements (this includes only a balance sheet and financial statements). financial results). This does not exclude the obligation to keep tax records: declarations of the simplified tax system, 3-NDFL, UTII, KUDIR, etc.

An application for the simplified tax system and other documents can be prepared online in a free service.

Inexpensive programs for individual entrepreneurs include those with the ability to submit reports via the Internet. 500 rubles/month. Its main advantage is ease of use and automation of all processes.

Help

Credit

It is more difficult for an individual entrepreneur to get a loan from a bank than for a legal entity. Many banks also give mortgages with difficulty or require guarantors.

- An individual entrepreneur does not keep accounting records and it is more difficult for him to prove his financial solvency. Yes, there is tax accounting, but profit is not allocated there. Patent and UTII are especially opaque in this matter; these systems do not even record income. The simplified tax system “Income” is also unclear, because it is not clear how many expenses there are. The simplified tax system "Income-Expenditures", Unified Agricultural Tax and OSNO most clearly reflect the real state of the individual entrepreneur's business (there is an accounting of income and expenses), but unfortunately these systems are used less frequently.

- The individual entrepreneur himself (as opposed to the organization) cannot act as collateral in the bank. After all, he is an individual. The property of an individual can be collateral, but this is legally more complicated than collateral from an organization.

- An entrepreneur is one person - a person. When issuing a loan, the bank must take into account that this person can get sick, leave, die, get tired and decide to live in the country, giving up everything, etc. And if in an organization you can change the director and founders with the click of a finger, then in this case an individual entrepreneur can just close it and terminate the loan agreement or go to court. IP cannot be re-registered.

If a business loan is denied, then you can try to take out a consumer loan as an individual, without even disclosing your plans to spend money. Personal loans usually have high rates, but not always. Especially if the client can provide collateral or has a salary card with this bank.

Subsidy and support

In our country, hundreds of foundations (state and not only) provide consultations, subsidies, and preferential loans for individual entrepreneurs. Different regions have different programs and help centers (you need to search). .

Some commercial organizations They also offer their own discounts and promotions. Online accounting Elba for newly created individual entrepreneurs is now free for the first year.

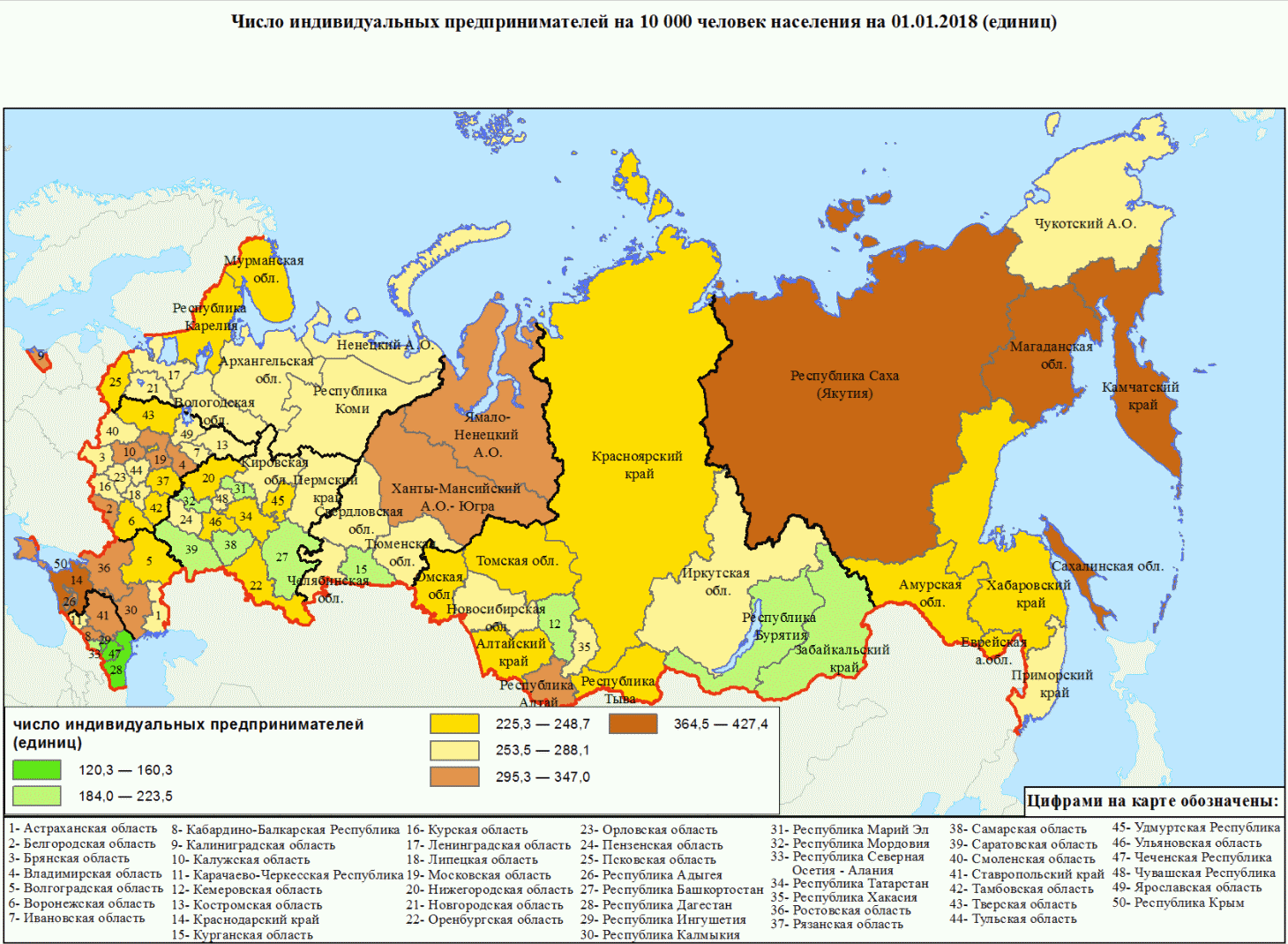

Rice. Number of individual entrepreneurs per 10,000 population

Experience

Pension experience

If the entrepreneur pays everything regularly to the Pension Fund, then the pension period runs from the moment of state registration until the closure of the individual entrepreneur, regardless of income.

Pension

By current legislation An individual entrepreneur will receive a minimum pension, regardless of how many contributions to the Pension Fund he pays.

The country is undergoing almost continuous pension reform and therefore it is not possible to accurately determine the size of the pension.

Since 2016, if a pensioner has the status of an individual entrepreneur, then his pension will not be indexed.

Insurance experience

The insurance period for the Social Insurance Fund only applies if the entrepreneur voluntarily pays contributions to the social insurance (FSS).

Difference from employees

The Labor Code does not apply to the individual entrepreneur himself. It is accepted only for hired workers. An individual entrepreneur, unlike a director, is not a mercenary.

Theoretically, an individual entrepreneur can hire himself, set a salary and make an entry in the work book. In this case, he will have all the rights of an employee. But it is not recommended to do this, because... then you will have to pay all salary taxes.

Only a female entrepreneur can receive maternity leave and only under the condition of voluntary social insurance. .

Any businessman, regardless of gender, can receive an allowance of up to one and a half. Either in RUSZN or in the FSS.

Individual entrepreneurs are not entitled to leave. Because he has no concept of working time or rest time and production calendar does not apply to him either.

Sick leave is granted only to those who voluntarily insure themselves with the Social Insurance Fund. Calculated based on the minimum wage, the amount is insignificant, so in social insurance it makes sense only for mothers on maternity leave.

Closing

Liquidation of an individual entrepreneur is an incorrect term. An entrepreneur cannot be liquidated without violating the Criminal Code.

Closing an individual entrepreneur occurs in the following cases:

- in connection with the adoption of a decision by an individual entrepreneur to terminate activities;

- in connection with the death of a person registered as an individual entrepreneur;

- by court decision: forcibly

- in connection with the entry into force of a court verdict of deprivation of the right to engage in entrepreneurial activity;

- in connection with the cancellation of a document (overdue) confirming the right of this person to reside in Russia;

- in connection with a court decision to declare an individual entrepreneur insolvent (bankrupt).

Databases on all individual entrepreneurs

Website Contour.Focus

Partially free Contour.Focus The most convenient search. Just enter any number, last name, title. Only here you can find out OKPO and even accounting information. Some information is hidden.

Extract from the Unified State Register of Individual Entrepreneurs on the Federal Tax Service website

For free Federal Tax Service database Unified State Register of Individual Entrepreneurs (OGRNIP, OKVED, Pension Fund number, etc.). Search by: OGRNIP/TIN or full name and region of residence (patronymic name does not have to be entered).

Bailiffs Service

For free FSSP Find out about enforcement proceedings for debt collection, etc.

With help, you can keep tax records on the simplified tax system and UTII, generate payment slips, 4-FSS, Unified Settlement, SZV-M, submit any reports via the Internet, etc. (from 325 rubles/month). 30 days free. Upon first payment. For newly created individual entrepreneurs now (free).

Question answer

Is it possible to register using temporary registration?

Registration is carried out at the address permanent residence. To what is indicated in the passport. But you can send documents by mail. According to the law, it is possible to register an individual entrepreneur at the address of temporary registration at the place of stay, ONLY if there is no permanent registration in the passport (provided that it is more than six months old). You can conduct business in any city in the Russian Federation, regardless of the place of registration.

Can an individual entrepreneur register himself for work and make an entry in his employment record?

An entrepreneur is not considered an employee and does not make an entry in his employment record. Theoretically, he can apply for a job himself, but this is his personal decision. Then he must conclude with himself employment contract, make an entry in the work book and pay deductions as for an employee. This is unprofitable and makes no sense.

Can an individual entrepreneur have a name?

An entrepreneur can choose any name for free that does not directly conflict with the registered one - for example, Adidas, Sberbank, etc. The documents and the sign on the door should still have the full name of the individual entrepreneur. He can also register the name (register trademark): it costs more than 30 thousand rubles.

Is it possible to work?

Can. Moreover, you don’t have to tell them at work that you have your own business. This does not affect taxes and fees in any way. Taxes and fees to the Pension Fund must be paid - both as an individual entrepreneur and as a mercenary, in full.

Is it possible to register two individual entrepreneurs?

An individual entrepreneur is just the status of an individual. It is impossible to simultaneously become an individual entrepreneur twice (to obtain this status if you already have it). There is always one TIN.

What are the benefits?

There are no benefits in entrepreneurship for people with disabilities and other benefit categories.