Thesis on the topic “Formation and management of bank debt capital using the example of CJSC Bank “Sovetsky”” on the subject of finance and credit. International student scientific bulletin Collection imprint

Keywords

EQUITY/ BORROWED CAPITAL / PROBLEMS OF OPERATION AND USE OF VARIOUS SOURCES OF ENTERPRISE CAPITAL/ OWN CAPITAL / LOAN CAPITAL / PROBLEMS OF FUNCTIONING AND USE OF VARIOUS SOURCES OF THE CAPITAL OF THE ENTERPRISEannotation scientific article on economics and business, author of the scientific work - Elena Yuryevna Merkulova, Natalia Sergeevna Morozova

The main sources of formation of the enterprise's property are own and borrowed capital, the amount of which is in the liability side of the balance sheet. Using only equity, the enterprise has the highest financial stability, but limits the pace of its development. Borrowed capital ensures the growth of the financial potential of an enterprise if it is necessary to significantly expand its assets and increase the growth rate of its volume economic activity. It is capable of generating an increase in financial profitability due to the effect of financial leverage. At the same time use debt capital generates the risk of reduced financial stability and the risk of loss of solvency. The level of these risks increases in proportion to the increase in the share of use debt capital. Assets generated through debt capital, generate a lower rate of return, which is reduced by the amount of loan interest paid. There is also a high cost dependence debt capital from fluctuations in financial market conditions. Thus, an enterprise using borrowed capital has a higher financial potential for its development and the possibility of increasing financial profitability, but to a greater extent generates financial risk and the threat of bankruptcy. Analysis of the effectiveness of using your own and debt capital organizations is a way of accumulating, transforming and using accounting and reporting information, with the purpose of: assessing the current and future financial condition of the organization, i.e. the use of its own and debt capital; justify the possible and acceptable pace of development of the organization from the standpoint of providing them with sources of financing; identify available sources of funds, evaluate rational ways to mobilize them; predict the position of the enterprise in the capital market.

Related topics scientific works on economics and business, the author of the scientific work is Elena Yuryevna Merkulova, Natalia Sergeevna Morozova

-

Basic methods for optimizing the capital structure of an enterprise

2016 / Merkulova Elena Yurievna, Morozova Natalia Sergeevna -

Methodological approaches to building the optimal capital structure of shipping companies

2016 / Khrapova E.V., Kychanov B.I. -

Improving the management of the capital structure of a manufacturing enterprise

2016 / Zakirova Olga Vladimirovna, Kudryavtseva Olga Pavlovna -

Composition and capital structure of the organization

2018 / Agafonova Anastasia Sergeevna -

Borrowed capital: role and significance in modern conditions, indicators and methods for assessing the condition, security and efficiency of use

2014 / Abdukarimov Ismat Tukhtaevich, Abdukarimov Lyudmila Georgievna -

Key aspects of analyzing the financial stability of an organization

2016 / Berdnikova Leila Farkhadovna, Portnova Ekaterina Sergeevna -

Practical aspects of capital analysis using the example of JSC Vladkhleb

2017 / Bubnovskaya Tatyana Viktorovna, Isakova Elizaveta Alekseevna -

Assessing the efficiency of using an enterprise's own and borrowed capital

2016 / Karaeva F.E. -

Analysis of theories of capital structure and their applicability in a market economy

2018 / Abdyldaeva Umut Maratovna

The main sources of formation of property of the enterprise are own and loan capital which size is in a balance passive. Using only own capital, the enterprise has the highest financial stability, but limits rates of the development. The loan capital provides growth of financial capacity of the enterprise in need of essential expansion of its assets and increase of growth rates of volume of its economic activity. It is capable of generating a gain of financial profitability due to effect of financial leverage. At the same time use of the loan capital generates risk of decrease in financial stability and risk of loss of solvency. The level of these risks increases in proportion to growth of specific weight of use of the loan capital. The assets created by the loan capital generate smaller rate of return which decreases for the amount of the paid loan percent. Also there is a high dependence of the cost of the loan capital on fluctuations of an environment of the financial market. Thus, the enterprise using the loan capital has higher financial potential of the development and a possibility of a gain of financial profitability, however to a large extent generates financial risk and threat of bankruptcy. The analysis of efficiency of use of own and loan capital of the organizations represents the way of accumulation, transformation and use of information of accounting and the reporting aiming: to estimate the current and perspective financial state of the organization, i.e. use of own and loan capital; to prove the possible and acceptable rates of development of the organization from a position of providing them by financing sources; to reveal available sources of means, to estimate rational ways of their mobilization; to predict the position of the enterprise at the market of the capitals.

Text of scientific work on the topic “Characteristics and analysis of the use of equity and borrowed capital of an enterprise”

UDC 336.64 doi: 10.20310/1819-8813-2016-11-10-35-40

CHARACTERISTICS AND ANALYSIS OF THE USE OF OWN AND BORROWED CAPITAL OF THE ENTERPRISE

MERKULOVA ELENA YURIEVNA Federal State Budgetary Educational Institution of Higher Education "Tambov" State University named after G.R. Derzhavin", Tambov, Russian Federation, e-mail: [email protected]

MOROZOVA NATALIA SERGEEVNA Lipetsk branch of the Federal State Budgetary Educational Institution of Higher Professional Education " Financial University

under the Government of the Russian Federation", Lipetsk, Russian Federation, e-mail: [email protected]

The main sources of formation of the enterprise's property are its own and borrowed capital, the amount of which is in the liability side of the balance sheet. Using only its own capital, the enterprise has the highest financial stability, but limits the pace of its development. Borrowed capital ensures the growth of the financial potential of an enterprise if it is necessary to significantly expand its assets and increase the growth rate of the volume of its economic activity. It is capable of generating an increase in financial profitability due to the effect of financial leverage. At the same time, the use of borrowed capital generates the risk of reduced financial stability and the risk of loss of solvency. The level of these risks increases in proportion to the increase in the proportion of use of borrowed capital. Assets formed through borrowed capital generate a lower rate of return, which is reduced by the amount of loan interest paid. There is also a high dependence of the cost of borrowed capital on fluctuations in financial market conditions. Thus, an enterprise using borrowed capital has a higher financial potential for its development and the possibility of increasing financial profitability, but to a greater extent generates financial risk and the threat of bankruptcy. Analysis of the effectiveness of the use of equity and borrowed capital of organizations is a method of accumulation, transformation and use of accounting and reporting information, with the purpose of: assessing the current and future financial condition of the organization, i.e., the use of equity and borrowed capital; justify the possible and acceptable pace of development of the organization from the standpoint of providing them with sources of financing; identify available sources of funds, evaluate rational ways to mobilize them; predict the position of the enterprise in the capital market.

Key words: equity capital, borrowed capital, problems of functioning and use of various sources of capital of an enterprise

The study of capital structure has always been the focus of attention of economists of different schools and areas of economic teaching. Research of enterprise capital as economic category, starting from the second half of the 19th century. and up to the present day, was carried out by such scientists as: D. Clark, J. Keynes, K. Marx, D. Mil, V. Pa-reto, W. Petty, D. Ricardo, A. Smith, I. Schumpeter. They made a huge contribution to the development of the topic of capital, and also highlighted problems that are directly related to the analysis of equity capital and the effectiveness of the use of data obtained from analytical procedures. Thus, Professor L. T. Gitlyarovskaya notes that capital analysis is a complex and continuous process of collecting, classifying and applying the obtained data.

nal accounting and financial statements, to determine the financial position of the company, diagnosing the pace of expansion of financial and economic activities, identifying available sources of capital formation and their rational use, including forecasting the company’s future development in the capital market.

The sources of capital formation for an enterprise are its own and borrowed funds (Table 1). Review of current Russian regulatory documents on accounting leads us to the fact that the concept of “equity capital” is contained only in the Concept of accounting in the market economy of Russia. In other regulatory documents is being considered

capital structure and methodological aspects of accounting of its constituent elements.

The equity capital of an enterprise is understood as the value of assets that belong to the owner of the enterprise on the basis of property rights, used to generate income.

Equity capital usually includes invested capital, that is, capital reinvested by the owners of the enterprise and accumulated capital, which is created in excess of what was originally invested by the founders. Invested capital consists of such equity items as authorized capital, additional capital (in terms of the share premium received). The first component of invested capital is proposed in the balance sheet Russian enterprises authorized capital, the second component is additional capital (in terms of the share premium received), and the third component of the invested capital is reflected in additional capital or fund social sphere. The accumulated capital of the enterprise is executed in the form that is formed due to net profit (reserve capital, retained earnings, accumulation fund and other items). It has also been established that the greater the share of accumulated capital, the higher the quality of equity capital. Sources with the help of which it is formed

Yes. That is, equity is understood as the difference between the assets of an enterprise and its liabilities. It has a rather complex structure, and its composition is directly determined by the organizational and legal form of the enterprise.

equity capital can be divided into two groups: internal and external. Internal sources include: net profit, depreciation charges, property revaluation fund and other income. External sources include: issue of shares, gratuitous financial assistance, and other sources.

All information about equity capital, which is generated by the accounting and analytical system, is used not only by internal, but also by external users (Fig. 1).

As a result, the maximization of equity capital occurs at the expense of any of its sources of formation, which has a positive effect on the activities of the enterprise as a whole, increases its financial independence from external sources of financing and increases production volumes.

Based on the above, we can conclude that competent management own capital and the sources of its formation will allow us to analyze the emergence, co-

Sources of enterprise capital formation and their characteristics

No. Sources of capital formation Characteristics of attracted capital

Internal External Long-term Short-term Own Borrowed

1. Contributions of founders (including additional capital from share premium) + + +

2. Retained earnings (including reserve capital and funds from profits) + + +

3. Long-term loans and credits (including issued bonds) + + +

4. Short-term loans and credits + + +

5. Accounts payable (commodity loans) + + +

standing and application, as well as provide significant proposals for adoption management decisions.

Borrowed (attracted) funds represent part of financial resources enterprises invested in enterprise assets.

They represent economic and legal obligations to third parties. In accounting, raised funds are defined as liabilities, i.e. these funds must be returned to creditors within the terms established by the contract.

Users

Domestic

Financial managers

Owners

Information about financial results

Data on the effectiveness of deposits, amounts, dividends, cost of capital

< л Налоговые органы

Suppliers, customers, organizations

Enterprise management Management information Investors Expediency of investments

Data required for audit

Information about tax payments

Information

about solvency

and liquidity

Creditors

Information about solvency

Rice. 1. Users of property information]

The Financial Accounting Standards Board of the American Institute of Certified Public Accountants (FASB) defines a liability as a probable future outflow of economic benefits arising from an entity's existing obligations to delegate assets or provide services to other entities through its transactions. or events arising in

E. t MERKULOVA, N. 8. MOROZOVA

capital formed in the accounting and analytical system

past periods. In addition, liabilities should include debt incurred in the course of business activities (accounts payable).

Borrowed capital for commercial structures plays a very important role as an additional means of financing business activities. However, after a certain period of time, each entrepreneur is obliged to return these funds to creditors not only in full, but

and as established by the contract, with interest.

When deciding on the rationality of attracting borrowed funds, it is important for entrepreneurs to assess the current situation with the financial condition of the enterprise, the structure of financial resources, which are reflected in the liability side of the balance sheet. But a high share and high interest rate for using a loan can make it unwise to attract new borrowed funds.

Despite the fact that by attracting borrowed funds, an enterprise receives a number of privileges, however, under some circumstances (low level of profitability), they can also turn out to be their downside, a lack of income received, which worsens financial position and can lead to bankruptcy. In addition, an enterprise that has a sufficient portion of borrowed funds in total amount economic assets, has a lesser degree of opportunity for capital maneuverability. In the event of unpredictable circumstances, such as: a decrease in demand for goods, an increase in costs for raw materials and supplies, a drop in product prices, seasonal fluctuations in demand, etc., all this can provoke a loss of solvency of the enterprise, a decrease in income and a decrease in profitability, i.e. e. deterioration financial condition enterprises.

The attracted sources of funds in accounting (financial) accounting include long-term and short-term liabilities. Attracting borrowed funds into the turnover of an enterprise is considered a normal phenomenon, which contributes to a short-term improvement in the financial condition of the enterprise, if the funds received are not frozen, but are used in the turnover of the organization.

According to the purpose of raising, borrowed capital is divided into funds necessary for:

Reproduction of fixed assets and intangible assets;

Replenishment of current assets;

Satisfying social needs.

According to the form of attraction, borrowed funds are divided into funds in cash, commodity form, in the form of equipment, etc.

Based on sources of attraction, borrowed funds are divided into external and internal.

According to the form of security, all borrowed funds are divided into: secured by a pledge or pledge, secured by a surety or guarantee, and unsecured.

For the further development and functioning of the company’s activities, it is often enough before

It involves choosing one of several options for the source of capital: equity or borrowed capital. Before an organization decides to raise borrowed funds, it is important to evaluate the structure of liabilities in the financial statements; if the share of debt is high enough, then raising new borrowed funds will be unwise and even dangerous. If an enterprise decides to use raised capital, then the financial manager needs to analyze and study in detail the terms and to what extent borrowed funds are provided. Undoubtedly, the company will have a number of advantages by attracting borrowed funds, but certain circumstances can complicate the financial situation and lead the company to bankruptcy.

With the help of borrowed funds, the company's assets can be financed and replenished, and this offer is quite attractive since the lender does not make claims on the company's future income. But at the same time, regardless of the results of the organization’s activities, he has every right to claim a pre-agreed amount from the contract and interest on it.

As you know, the amount of obligations and the timing of their repayment are known in advance, which undoubtedly simplifies financial planning of cash flows. But the amount of expenses that is associated with interest on the use of borrowed funds encourages the organization to increase income through the rational use of borrowed funds.

If the share of borrowed funds significantly exceeds the share of its own, then the enterprise has scanty opportunity to maneuver capital. Also, unforeseen circumstances, such as: increased costs for raw materials, decreased demand for products, falling prices for goods, seasonal changes in demand, etc., in conditions of unstable financial condition, can serve as one of the main reasons for the loss of solvency of the company.

From the point of view of financial stability, the most rational option for an enterprise is to use its own capital, since there is no threat of bankruptcy, and investors will not demand the return of their funds at any time. But the difficulty is that own funds are quite limited due to their organizational and legal difficulties. Then, in the current situation, the company has the right to use the attracted capital under certain conditions. Sometimes borrowed funds can be very profitable economically.

sky point of view. For example, the cost of attracted capital, in some cases, costs the company much less than the cost of its own. This fact is explained by the fact that the risk own sources significantly dominates the creditor risk, since the amount of the incentive is fixed in the loan agreement, and the loan is guaranteed by sureties and collateral.

If the funds raised exceed the permissible amount, the financial stability of the enterprise is reduced, the risk of creditors increases and the cost of borrowed capital increases. Attracting additional own sources is a rather lengthy and slow procedure; attracting borrowed capital is much simpler. For example, a company with a perfect level of profitability uses borrowed capital much more often than its own. It is also important to note that the weighted average cost of capital (WACC) is the main economic criterion for the optimal capital structure. Preference should be given to a source of capital formation that helps minimize the weighted average cost of capital (ACC).

There are several factors that are not always amenable to economic research: the risk associated with the source of capital formation, all kinds of legal changes, time spent and funds for borrowed capital.

The ratio between own and borrowed sources of funds is greatly influenced by such factors as the external and internal operating conditions of the business entity and the financial strategy chosen by it:

The difference between dividend rates and interest rates for loans. If dividend rates are less than interest rates, then deleveraging should be done, and vice versa;

Reduction or expansion of activities of business entities. As a result, there is either an increase or decrease in the need to attract borrowed funds;

Accumulation of excess or unused stocks, materials and obsolete equipment;

Diversion of funds into the formation of doubtful accounts receivable, which attracts additional borrowed funds.

The ratio between an enterprise’s own and borrowed funds is one of the main analytical factors that reflect the degree of risk of investing financial assets.

resources, i.e. the greater the share of borrowed capital, the greater the degree of risk, and vice versa.

Therefore, an enterprise that takes advantage borrowed capital, will have sufficient financial opportunities for its further development (formation of an additional volume of assets) and the possibility of increasing the profitability of the business entity, but financial risk and the threat of bankruptcy that arise in the event of an increase in the share of borrowed funds in the total capital should not be excluded.

Literature

1. Savitskaya G.V. Analysis of economic activity of enterprises. M.: INFRA, 2015. P. 401.

2. The concept of accounting in the market economy of Russia" (approved by the Methodological Council on Accounting under the Ministry of Finance of the Russian Federation, the Presidential Council of the IPB RF on December 29, 1997). // Reference and legal system “ConsultantPlus”.

3. Afanasov A. A. Capital structure management industrial enterprise // Modern tendencies in economics and management: a new look. 2010. No. 5-2. pp. 33-37.

4. Analysis of economic activity in industry / ed. V. I. Strazheva. M.: graduate School, 2015. pp. 21-24.

5. Dontsova L. V. Analysis of financial statements: textbook / L. V. Dontsova, N. A. Nikiforova. 4th ed., revised. and additional M.: Publishing house "Delo and Service", 2016. pp. 204-206.

6. Zhunusov K. S. Problems of debt capital management and ways to overcome them // Current aspects modern science. 2014. No. 6. P. 165-170.

7. Kanke A. A., Koshevaya I. P. Analysis of the financial and economic activities of the enterprise. 2nd ed., rev. and additional M.: Publishing house "FORUM"; INFRA-M, 2015. pp. 223-224.

8. Efimova O. V. The financial analysis modern tools for making economic decisions. 3rd ed., rev. and additional M.: Publishing house "Omega-L", 2013. P. 134.

9. Cheglakova S. G. Accounting and analysis. M.: Delo i Servis, 2015. P. 400.

10. Balabanov I. T. Fundamentals of financial management. How to manage capital? M.; Finance and Statistics, 2014. P. 113.

11. Prokhomenko I. S. Financial management. M.: UNITY-DANA, 2012. P. 387.

1. Savitskaya G. V. Apya^ khozyajstvennoj deya-tel "nosti predpriyatij. M.: IOTRA 2015. S. 401.

2. Kontseptsiya bukhgalterskogo ucheta v rynochnoj ekonomike Rossii (odobrena Metodologicheskim sovetom po bukhgalterskomu uchetu pri Minfine RF, Prezidentskim sovetom IPB RF ot 12/29/1997) // Sprav.-pravovaya sistema “Konsul”tantPlyus”.

3. Afanasov A. A. Upravleniye strukturoj kapitala promyshlennogo predpriyatiya // Sovremennye tendentsii v ekonomike i upravlenii: novyj vzglyad. 2010. No. 5-2. S. 33-37.

4. Analiz khozyajstvennoj deyatel "nosti v promysh-lennosti / pod red. V. I. Strazheva. M.: Vysshaya shkola, 2015. S. 21-24.

5. Dontsova L. V. Analiz finansovoj otchetnosti: uchebnik / L. V. Dontsova, N. A. Nikiforova. 4-ye izd., pererab. i dop. M.: Izdatel "stvo "Delo i Servis", 2016. S. 204-206.

6. Zhunusov K. S. Problemy upravleniya zaemnym kapitalom i puti ikh preodoleniya //

Aktual"nye aspekty sovremennoj nauki. 2014. No. 6. S. 165-170.

7. Kanke A. A., Koshevaya I. P. Analiz finansovo-khozyajstvennoj deyatel "nosti predpriyatiya. 2-ye izd., ispr. i dop. M.: ID "FORUM"; INFRA-M, 2015. S. 223-224.

8. Efimova O. V. Finansovyj analiz sovremennoj instrumentan) dlya prinyatiya economic reshenij. 3rd edition, ispr. i dop. M.: Izdatel"stvo "Omega-L", 2013. S. 134.

9. Cheglakova S. G. Bukhgalterskij uchet i analiz. M.: Delo i Servis, 2015. S. 400.

10. Balabanov I. T. Osnovy finansovogo me-nedzhmenta. How upravlyat" kapitalom? M.; Finansy i statistika, 2014. S. 113.

11. Prokhomenko I. S. Finansovyj menedzhment. M.: YuNITI-DANA, 2012. S. 387.

CHARACTERISTIC AND ANALYSIS OF USE OF OWN AND LOAN CAPITAL OF THE ENTERPRISE

MERKULOVA ELENA YURYEVNA Tambov State University named after G. R. Derzhavin, Tambov, the Russian Federation, e-mail: [email protected]

MOROZOVA NATALIYA SERGEEVNA Lipetsk Branch of Financial University under the Government of the Russian Federation, Lipetsk, the Russian Federation, e-mail: [email protected]

The main sources of formation of property of the enterprise are own and loan capital which size is in a balance passive. Using only own capital, the enterprise has the highest financial stability, but limits rates of the development. The loan capital provides growth of financial capacity of the enterprise in need of essential expansion of its assets and increase of growth rates of volume of its economic activity. It is capable of generating a gain of financial profitability due to effect of financial leverage. At the same time use of the loan capital generates risk of decrease in financial stability and risk of loss of solvency. Level of these risks increases in proportion to growth of specific weight of use of the loan capital. The assets created by the loan capital generate smaller rate of return which decreases for the amount of the paid loan percent. Also there is a high dependence of the cost of the loan capital on fluctuations of an environment of the financial market. Thus, the enterprise using the loan capital has higher financial potential of the development and a possibility of a gain of financial profitability, however to a large extent generates financial risk and threat of bankruptcy. The analysis of efficiency of use of own and loan capital of the organizations represents the way of accumulation, transformation and use of information of accounting and the reporting aiming: to estimate the current and perspective financial state of the organization, i.e. use of own and loan capital; to prove the possible and acceptable rates of development of the organization from a position of providing them by financing sources; to reveal available sources of means, to estimate rational ways of their mobilization; to predict the position of the enterprise at the market of the capitals.

Key words: own capital, loan capital, problems of functioning and use of various sources of the capital of the enterprise

Collection output:

INFLUENCE OF BORROWED CAPITAL ON THE FINANCIAL CONDITION OF THE ENTERPRISE

Pachkova Olga Vladimirovna

Ph.D. econ. Sciences, Associate ProfessorFederal State Autonomous Educational Institution of Higher Professional Education "Kazan (Volga Region) Federal University", Russian Federation, Republic of Tatarstan, Kazan

Gaptelkhakov Marat Rafkatovich

4th year student of the Federal State Autonomous Educational Institution of Higher Professional Education "Kazan (Volga Region) Federal University", Russian Federation, Republic of Tatarstan, Kazan

INFLUENCE OF BORROWED CAPITAL ON FINANCIAL CONDITION OF THE ENTERPRISE

Olga Pachkova

candidate of Economic Sciences, Associate professor of FSAEI HVE “Kazan Federal University”, Republic of Tatarstan, Kazan

Marat Gaptelhakov

4-year student, FSAEI HVE “Kazan Federal University”, Republic of Tatarstan, Kazan

ANNOTATION

The article discusses borrowed sources of financing for an enterprise. Since in its activities the company is faced with the need to attract additional funds. The types of borrowed capital are considered, the effect of financial leverage is shown in detail, since effectively attracted borrowed capital must satisfy the conditions of reducing costs and increasing profits from the use of capital.

ABSTRACT

The article deals with borrowed sources of financing. Since the company faces the need to raise additional funds in its activity. The types of debt capital are considered; the effect of financial leverage is shown in detail, as effectively involved borrowed capital must satisfy the conditions to reduce costs and increase profits from the capital use.

Keywords: borrowed capital; Bank loan; bond loan; leasing; financial leverage effect.

Keywords: borrowed capital; bank credit; funded loan; leasing; effect of financial leverage.

As a business operates, the need for cash increases, requiring adequate capital gains financing. At the same time, if an enterprise lacks its own funds, it can attract funds from other organizations, which are referred to as borrowed capital. Borrowed capital refers to funds that are lent to an enterprise third parties to achieve the goals of its activities, as well as to make a profit.

The organization of debt capital has a significant impact on the efficiency of companies and is key if they are to make long-term and costly investments.

Among the advantages of using borrowed capital are the following: greater opportunities for attracting, especially with a high borrower rating; increase in return on equity; the possibility of using tax shields that reduce the cost of capital, since interest paid is included in the cost of production; accelerated development of the enterprise and others.

In addition, the use of borrowed capital also has disadvantages: attracting borrowed funds creates financial risks (interest rate, risk of loss of liquidity), the targeted nature of the use of borrowed funds, and the complexity of the procedure for raising borrowed funds.

Borrowed capital as a long-term source of financing is divided into such sources of financing as bank loans, bond loans and leasing. In a general sense, a loan is the provision of funds or other things by one party (the lender) to another party (the borrower).

The bond loan plays a significant role in terms of financing the company's activities. It is carried out through the issue and sale of bonds. The issue of bonds is designed to attract investment from a wide range of people, in contrast to a bank loan. With a bank loan, the lender is a bank or other lending organization.

According to Art. 665 of the Civil Code of the Russian Federation, leasing is the operation of acquiring ownership by the lessor (lessor) of the property specified by the lessee (lessee) from a seller specified by the lessee with the subsequent provision of it for a fee for temporary possession and use for business purposes.

Thus, leasing is a type entrepreneurial activity, which provides for the investment of financial resources by the lessor in the acquisition of property with its subsequent provision to the lessee on lease terms.

The leasing car market is developing rapidly in Russia. This is primarily due to the fact that the cost of expensive property can be completely written off in an extremely short period of time, while its consumer qualities do not actually change. But the market leader in terms of leasing at the end of 2014 is railway equipment, which occupies 42.2%. By comparison, leasing cars account for 21.7% of the market.

When choosing a method for raising borrowed capital, an enterprise should pay attention to the following key parameters:

1. volume of financial resources;

2. deadline for their provision;

3. level of interest payments for the resources provided;

4. type of rate for attracting resources (floating or fixed);

5. the need for collateral and its conditions;

6. terms of repayment.

The indicator of financial leverage helps answer the question of how much borrowed funds are per ruble of own rubles. This is the ratio of debt to equity. The effect of financial leverage reflects the change in the return on equity obtained through the use of borrowed funds. It is calculated using formula 1:

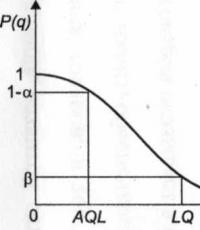

The figure below shows the components of the financial leverage effect (Fig. 1).

Figure 1. Financial leverage effect

The tax coefficient (1-t) shows to what extent the effect of financial leverage is manifested in connection with different levels of income tax.

One of the multipliers is the so-called financial leverage differential (Dif) or the difference between the company's return on assets (economic profitability), calculated by EBIT, and the interest rate on borrowed capital. The financial leverage differential is the main condition that forms the growth of return on equity. To do this, it is necessary that economic profitability exceeds the interest rate of payments for the use of borrowed sources of financing, i.e., the financial leverage differential must be positive. If the differential becomes less than zero, then the effect of financial leverage will only act to the detriment of the organization.

The final component is the financial leverage ratio (or financial leverage - FLS). This ratio characterizes the strength of the impact of financial leverage and is defined as the ratio of debt capital (D) to equity capital (E).

The differential and the lever arm are closely interconnected. As long as the return on investment in assets exceeds the price of borrowed funds, i.e. the differential is positive, return on equity will grow the faster the higher the debt-to-equity ratio. However, as the share of borrowed funds increases, their price increases, profits begin to decline, as a result, the return on assets also falls and, consequently, there is a threat of a negative differential.

According to economists, based on a study of empirical material from successful foreign companies, the optimal effect of financial leverage is within 30-50% of the level economic profitability assets (ROA) with financial leverage of 0.67-0.54. In this case, an increase in return on equity is ensured that is not lower than the increase in return on investment in assets.

The effect of financial leverage contributes to the formation of a rational structure of the enterprise's sources of funds in order to finance the necessary investments and obtain the desired level of return on equity, at which the financial stability of the enterprise is not compromised.

For almost any company, borrowed sources of financing mean the possibility of more intensive development, largely due to the formation of an additional amount of assets. However, companies using borrowed capital are more exposed to financial risk and the threat of bankruptcy. Therefore, it is necessary to approach the issue of choosing sources of debt financing more carefully, taking into account all possible risks.

Bibliography:

1.Civil Code of the Russian Federation. Part 2 of January 26, 1996 No. 14-FZ // Collection of legislation of the Russian Federation. - 1996. - No. 5. - Art. 665.

2. Kovalev V.V. Financial management course: textbook. allowance. M.: TK Velby, Prospekt Publishing House, 2008. - 448 p.

3. Kovalev V.V. Financial management: theory and practice: textbook. allowance. M.: TK Welby, Prospekt Publishing House, 2007. - 1024 p.

4.Koltsova I. Five indicators for an objective assessment of your company’s debt burden // Financial Director. - 2006. - No. 6. - P. 16-21.

5. Market structure by leased items // Rating agency"Expert RA" [ Electronic resource]. - Access mode. - URL: http://www.raexpert.ru/rankingtable/leasing/leasing_2014/tab03/ (access date: 03/28/2015).

6. Effect of financial leverage (DFL) // Website analysis of the financial condition of the enterprise [Electronic resource]. - Access mode. - URL: http://afdanalyse.ru/publ/finansovyj_analiz/1/ehffekt_finansovogo_rychaga/7-1-0-222 (access date: 03/27/2015).

| Whether or not this publication is taken into account in the RSCI. Some categories of publications (for example, articles in abstract, popular science, information journals) can be posted on the website platform, but are not taken into account in the RSCI. Also, articles in journals and collections excluded from the RSCI for violation of scientific and publishing ethics are not taken into account."> Included in the RSCI ®: no | The number of citations of this publication from publications included in the RSCI. The publication itself may not be included in the RSCI. For collections of articles and books indexed in the RSCI at the level of individual chapters, the total number of citations of all articles (chapters) and the collection (book) as a whole is indicated."> Citations in the RSCI ®: 0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Whether or not this publication is included in the core of the RSCI. The RSCI core includes all articles published in journals indexed in the Web of Science Core Collection, Scopus or Russian Science Citation Index (RSCI) databases."> Included in the RSCI core: No | The number of citations of this publication from publications included in the RSCI core. The publication itself may not be included in the core of the RSCI. For collections of articles and books indexed in the RSCI at the level of individual chapters, the total number of citations of all articles (chapters) and the collection (book) as a whole is indicated."> Citations from the RSCI ® core: 0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Journal-normalized citation rate is calculated by dividing the number of citations received by a given article by the average number of citations received by articles of the same type in the same journal published in the same year. Shows how much the level of this article is above or below the average level of articles in the journal in which it was published. Calculated if the RSCI for a journal has a full set of issues for given year. For articles of the current year, the indicator is not calculated."> Normal citation rate for the journal: | Five-year impact factor of the journal in which the article was published, for 2018."> Impact factor of the journal in the RSCI: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Citation normalized by subject area is calculated by dividing the number of citations received by a given publication by the average number of citations received by publications of the same type in the same subject area published in the same year. Shows how much the level of a given publication is higher or lower than the average level of other publications in the same field of science. For publications of the current year, the indicator is not calculated."> Normal citations by area: | 1

|

Indicator name |

||||||

|

Authorized capital |

||||||

|

Extra capital |

||||||

|

Retained earnings from previous years (uncovered losses from previous years) |

||||||

|

Unused profit (loss) for the reporting period |

||||||

|

Reserve Fund |

||||||

|

Sources of own funds |

table 2

Structure of liabilities of PJSC ROSBANK, thousand rubles.

|

Indicator name |

||||||

|

Deposits of individuals with a term of over a year |

||||||

|

Other deposits of individuals (including individual entrepreneurs) (for a period of up to 1 year) |

||||||

|

Deposits and other funds of legal entities (for a period of up to 1 year) |

||||||

|

incl. current funds legal entities (without individual entrepreneur) |

||||||

|

Correspondent accounts of LORO banks |

||||||

|

Interbank loans received for a period of up to 30 days |

||||||

|

Own securities |

||||||

|

Obligations to pay interest, arrears, accounts payable and other debts |

||||||

|

Expected cash outflow |

||||||

|

Current responsibility |

Table 3

Capital adequacy standards of PJSC ROSBANK

Table 4

Types of sources for replenishing the bank's equity capital

|

Types of sources of equity capital |

Description of sources |

|

Accumulation |

The easiest and least expensive method of replenishing capital, especially for banks whose activities are characterized by a high rate of profit. Thus, small banks that are unable to attract investors due to the lack of an appropriate reputation rely on this method |

|

Reinvestment |

|

|

Placement of shares on the Russian stock market |

Plays an important role in the formation of bank capital. The stock price largely depends on the level of dividends paid, i.e. An increase in dividends leads to an increase in stock prices. Therefore, high stock returns contribute to increasing capital through sales additional shares |

|

Dividend policy |

Has a significant impact on the ability to expand the capital base through internal sources. A high share of profits allocated to capital gains leads to lower dividends paid. Accordingly, high dividends lead to an increase in the market value of the bank’s shares, which makes it easier to increase capital through external sources |

One of the important indicators of a bank’s reliability is the bank’s own funds (capital) adequacy standards.

From January 1, 2014, Russian banks must calculate three capital adequacy standards instead of one, as was the case before, which is associated with the implementation of Basel III. In addition to the total capital adequacy standard (10%), the adequacy of basic capital (5%) and fixed capital (5.5%, and from 2015 - 6%) appears. According to the Basel Committee, more stringent approaches to calculating capital and liquidity ratios should reduce the risks of a systemic banking crisis and improve the sector's ability to cope with the consequences of global financial collapses.

Based on the data presented in table. 3, we can conclude that for the period under review, the capital adequacy indicators of PJSC ROSBANK corresponded to standard values.

For the normal functioning of the bank, much attention is paid to the amount of own and attracted capital, risks and its assets.

The equity capital of a commercial bank forms the basis of its activities and is an important source of financial resources. It is designed to maintain customer confidence in the bank and convince creditors of its financial stability. Capital must be large enough to provide borrowers with confidence that the bank is able to meet their loan needs even in unfavorable economic development conditions National economy. This led to increased attention from state and international authorities to the size and structure of the bank’s equity capital, and the bank’s capital adequacy indicator was considered one of the most important in assessing the bank’s reliability. At the same time, equity capital is of paramount importance to ensure the stability of the bank and the efficiency of its operation. A limiting factor to its growth remains the need to create reserves for active operations.

Level required capital should be determined depending on the expected financial losses, the determination of which is difficult due to the lack of statistics. Thus, equity capital is really very important, so let’s look at the sources of its replenishment. Types of sources of replenishment of the bank's equity capital are presented in table. 4.

As indicated in table. 4 sources of capital growth for a bank can be internal (profit) and external (shareholder funds). But it is worth noting that the method of increasing capital at the expense of shareholders is not publicly available, due to the fact that small banks do not have sufficient reputation to attract them. It follows that the sources of capital growth for the main group of Russian banks should be sought within the business, and not outside.

In 2006, there were 1,729 IPOs worldwide, valued at US$247 billion. IPO or initial public offering is the first public sale of shares of a joint stock company, including in the form of the sale of depositary receipts for shares, to an unlimited number of persons. Carrying out an IPO allows the bank to gain access to the capital of a much larger circle of investors, but in turn requires costs for placement and payment of dividends.

They did not refuse to hold an IPO at PJSC ROSBANK until the last moment. But ultimately, the Board of Directors of the Bank decided to increase its authorized capital by placing an additional issue of shares by private subscription. The fact is that if PJSC ROSBANK carried out an IPO, then the share of the strategic investor Societe Generale (SG) in the bank’s capital would be diluted. Currently, SG owns 99.4% of the shares of PJSC ROSBANK. Cooperation with such a shareholder allowed the Bank to quickly improve its rating and improve access to the international debt capital market.

PJSC ROSBANK manages its capital to ensure the continuation of the activities of all SG Group companies in the foreseeable future and at the same time maximizing profits for shareholders by optimizing the ratio of debt and equity.

The capital structure is reviewed by the Group's Management Board once every six months. As part of this assessment, the Board, in particular, analyzes the cost of capital and the risks associated with each class of capital. Based on the recommendations of the Management Board, the Group adjusts the capital structure by paying dividends, issuing additional shares, raising additional subordinated borrowings or paying off existing loans.

At the moment, PJSC ROSBANK is one of the Russian banks with high capitalization and a sufficient level of liquidity, its indicators comply with all mandatory standards.

Bibliographic link

Ivanova I.V. OWN CAPITAL OF THE BANK AND METHODS OF ITS FORMATION // International Journal of Applied and Fundamental Research. – 2015. – No. 8-3. – P. 537-540;URL: https://applied-research.ru/ru/article/view?id=7146 (access date: 03/20/2020). We bring to your attention magazines published by the publishing house "Academy of Natural Sciences" 1

Increasing business efficiency is impossible only within the enterprise's own resources. To expand their financial capabilities, enterprises resort to attracting additional borrowed funds in order to increase investments in own business, getting more profit. The issue of the formation, functioning and reproduction of capital by small businesses, which are not always easy to attract borrowed capital, is a pressing issue. An indicator of a company's market stability is its ability to develop successfully in conditions of transformation of the external and internal environment. In most cases, small businesses use a bank loan as a source of borrowing, which is explained by the relatively large financial resources of Russian banks, as well as the fact that when receiving a bank loan there is no need to publicly disclose information about the enterprise. To do this, it is necessary to have a flexible structure of financial resources and, when the need arises, to be able to attract borrowed funds, i.e., to be creditworthy.

small business

capital Management

lending

Borrowed capital

1. Guseva E. G. Production management at a small enterprise. Educational and practical manual. –M.: MGUESI, 2008. –114 p.

2. Kovalev V.V. Financial analysis: capital management, investment selection, reporting analysis. - M.: Finance and Statistics, 2007. –512s.

3. Sheremet A.D., Sayfulin R.S. Enterprise finance. Tutorial. –M.: Infra-M, 2007. –343 p.

4. Financial analysis of the company's activities. – M.: East service, 2009.

5. Holt Robert N. Fundamentals of financial management. - Per. from English - M.: Delo, 2010.

Currently, in the context of the existence of various forms of ownership in Russia, the study of issues of the formation, functioning and reproduction of capital in small businesses is becoming especially relevant. The possibilities for the establishment of entrepreneurial activity and its further development can only be realized if the owner wisely manages the capital invested in the enterprise.

Increasing business efficiency is impossible only within the enterprise's own resources. To expand their financial capabilities, it is necessary to attract additional borrowed funds in order to increase investments in their own business and obtain greater profits. In this regard, attraction management and effective use borrowing is one of the most important functions of financial management, aimed at ensuring the achievement of high final results of the economic activity of the enterprise. This topic is especially acute for newly organized small businesses, which do not always have the opportunity to finance themselves.

The borrowed capital used by such enterprises characterizes the total volume of their financial liabilities. Sources of borrowed capital can be funds raised on the securities market and credit resources. The choice of source of debt financing and the strategy for attracting it determine basic principles and mechanisms for organizing the financial flows of the enterprise. Efficiency and flexibility in managing the formation of debt capital contribute to the creation of optimal financial structure enterprise capital.

Currently, the main ways to attract borrowed capital are bank loans, equity financing, and leasing. In most cases, small businesses use a bank loan as a source of borrowing, which is explained by the relatively large financial resources of Russian banks, as well as the fact that when receiving a bank loan there is no need to publicly disclose information about the enterprise. This eliminates some of the problems caused by the specifics of bank lending, which is associated with simplified requirements for application documents, with relatively short terms consideration of loan applications, with flexibility of borrowing conditions and forms of loan security, simplification of the availability of funds, etc.

Majority Leaders Russian companies do not want to disclose financial information about their enterprises, as well as make changes in financial policies. As a consequence, there is the fact that only 3% of Russian companies use equity financing.

According to a number of modern scientists, the concepts of “capital” and “financial resources” require differentiation from the point of view of financial management of enterprises. Capital (equity funds, net assets) is the property of an organization that is free from obligations, that strategic reserve that creates conditions for its development,, if necessary, absorbs losses and is one of the most important pricing factors when we're talking about about the price of the organization itself. Capital is the highest form of mobilization of financial resources.

The following set of different functions of capital is distinguished:

production resource (production factor).

Object of ownership and disposal.

Part of financial resources.

Source of income.

Object of time preference.

Object of purchase and sale (object of market circulation).

Liquidity factor carrier.

The use of borrowed capital to finance the activities of an enterprise, according to many economists, is economically beneficial, since the payment for this source is on average lower than for equity capital. This means that interest on loans and borrowings is less than return on equity capital, which essentially characterizes the level of cost of equity capital. In other words, under normal conditions, debt capital is a cheaper source compared to equity capital.

In addition, attracting this source allows owners and top managers to significantly increase the volume of controlled financial resources, i.e. expand the investment opportunities of the enterprise.

Highlight various shapes attracting borrowed funds. Thus, borrowed capital is raised to service the economic activities of the enterprise in the following main forms (Fig. 1.1):

Fig. 1.1 Forms of raising borrowed funds.

According to the degree of security for borrowed funds raised in cash, which serves as a guarantee of their full and timely repayment, the following types are distinguished (Fig. 1.2.):

Fig.1.2. Types of borrowed funds in cash.

A blank or unsecured loan is a type of loan that is issued, as a rule, to an enterprise that has a good track record of timely repayment and compliance with all terms of the loan agreement. IN financial practice This category of enterprises is characterized by a special term - “first-class borrower”;

Thus, based on the composition of borrowed funds, in financial practice the main creditors of an enterprise may be:

- commercial banks and other institutions providing loans in cash (mortgage banks, trust companies, etc.);

- suppliers and buyers of products (commercial credit from suppliers and advance payments from buyers);

- stock market (issue of bonds and other securities other than shares) and other sources.

Another way to attract borrowed funds is to expand the practice of financial leasing. Every year, an increasing share of Russian enterprises use leasing. The attractiveness of financial leasing as a form of lending for commercial banks is associated with a lower degree of risk of investing funds in investments due to the fact that:

- credit resources are used to purchase the active part of fixed assets - equipment, the actual need for which is confirmed and its use by the lessee organization is guaranteed;

- The lessee organization decides to enter into an agreement only if all the necessary conditions are available for organizing production, including production space, labor, raw materials and supplies, except equipment.

Thus, capital management is a system of principles and methods for developing and implementing management decisions related to its optimal formation from various sources, as well as ensuring its effective use in various types economic activity of the enterprise.

We can also summarize the focus of attracting capital, namely solving the following problems:

- Formation of a sufficient amount of capital to ensure the necessary pace of economic development of the enterprise.

- Optimization of the distribution of generated capital by type of activity and areas of use.

- Providing conditions for achieving maximum return on capital at the envisaged level of financial risk.

- Ensuring the constant financial balance of the enterprise in the process of its development.

- Ensuring a sufficient level financial control over the enterprise on the part of its founders.

- Ensuring timely reinvestment of capital.

The formation of borrowed capital of an enterprise should be based on the principles and methods of developing and executing decisions that regulate the process of raising borrowed funds, as well as determining the most rational source of financing of borrowed capital in accordance with the needs and development opportunities of the enterprise. The main objects of management in the formation of borrowed capital are its price and structure, which are determined in accordance with external conditions.

The structure of borrowed capital contains sources that require their own coverage to attract them. The quality of the coating is determined by its market value, the degree of liquidity or the possibility of compensation for raised funds.

Analyzing bank lending, we found that one of the main problems is the reluctance of banks to issue money to finance new enterprises that do not have a credit history. But it is precisely during this period that borrowed capital is especially important for such enterprises. In addition, the problem of high rates for new businesses is also difficult to resolve.

In other cases, attracting a bank loan is one of the most popular ways of financing an enterprise. The main feature of bank lending is a simplified procedure (with the exception of cases of syndicated bank loans and lending in relatively large volumes).

Correct application of the above recommendations allows enterprises to increase profitability by increasing production volumes and sales of products. The need to attract external sources of financing is not always associated with the insufficiency of internal sources of financing. These sources, as is known, are retained earnings and depreciation charges. The considered sources of self-financing are not stable, they are limited by the speed of cash turnover, the rate of product sales, the size current expenses. Therefore, free money is often (if not always) not enough, and an additional injection of it aimed at increasing asset turnover will be extremely useful for most enterprises.

Bibliographic link

Kravtsova V.A. POLICY FOR ATTRACTING BORROWED CAPITAL BY SMALL BUSINESS ENTERPRISES. // International student scientific bulletin. – 2015. – № 1.;URL: http://eduherald.ru/ru/article/view?id=11974 (access date: 03/20/2020). We bring to your attention magazines published by the publishing house "Academy of Natural Sciences"