Economic efficiency of an organization: concept and assessment. Indicators of efficiency of use of fixed assets How the efficiency of an enterprise is calculated

To produce any type of product, including construction, the presence and interaction of three elements is necessary: means of labor (fixed assets), objects of labor ( working capital) and living labor (organization employees).

Basic production assets either directly participate in the process of creating construction products, or create the necessary conditions for its implementation. In the process of production use, fixed assets wear out and lose their original consumer value. One of the sources of funds for compensation of retired fixed assets is their depreciation.

Depreciation of fixed assets- this is a gradual transfer of the cost of means of labor as they become physically and morally worn out to the cost of manufactured products for the purpose of accumulation Money for subsequent reimbursement of worn-out fixed assets. The amount of depreciation charges is determined according to the established norms of depreciation charges as a percentage of the depreciable cost of fixed assets. The calculation of depreciation charges depends on the method of calculating depreciation established by the organization. In the test, students calculate depreciation charges using the linear method.

Residual value expresses the cost of fixed assets that has not yet been transferred to the cost of manufactured products and shows what part of fixed assets is not taken into account in the cost of work. Residual value is determined as the difference between the original cost of fixed assets and the amount of depreciation. Physical wear and tear in value terms equal to the accumulated amount of depreciation charges.

That is, in every billing period in the control work, the residual value is defined as the original cost of fixed assets minus the amount of depreciation calculated for the year.

Average annual cost fixed assets is determined for each organization based on the dynamics of movement of fixed assets. During the year, some funds leave, others enter. For the purpose of more correctly determining the indicators of capital equipment, their planning and accounting, the average annual cost of fixed assets is calculated.

Where  – average annual cost of fixed assets, rub.;

– average annual cost of fixed assets, rub.;

F fast – the cost of fixed assets received (accepted on the balance sheet) during the year, rub.;

F select – cost of fixed assets retired (removed from the balance sheet) during the year, rub.;

T fast. – the number of months of operation of received fixed assets (from the month following receipt to the end of the year);

T select – the number of months in which the retired fixed assets did not work (from the month following the month of write-off until the end of the year).

By doing test work To calculate indicators of the efficiency of use of fixed assets, it is recommended to use the residual value of fixed assets instead of the average annual cost.

The efficiency of using fixed assets is assessed by a system of technical and economic indicators. The level of efficiency in the use of fixed assets in the production of construction products is determined using the indicator capital productivity, which is calculated by the ratio of the annual volume of construction and installation work to the average annual cost of fixed assets. The economic meaning of the capital productivity indicator is as follows. that it reflects the actual volume of construction and installation work performed per one ruble of the average annual cost of fixed assets. The higher the capital productivity, the better the use of fixed assets.

In addition to capital productivity, to study the equipment of construction production with fixed assets, the inverse value is used - capital intensity, which characterizes the cost of basic production assets, per unit cost of construction and installation work. The decrease in capital intensity reflects the savings in labor embodied in fixed assets that participated in the creation construction products.

Capital-labor ratio– indicator of labor equipment with production fixed assets. It is determined by the ratio of the cost of fixed production assets per employee. The capital-labor ratio for the reporting period is compared with the indicators for the previous period and the change in its level is determined. At the same time, labor productivity must grow at a higher rate than its capital-labor ratio, since only in this case will capital productivity increase.

Table 2.1 Indicators of efficiency of use of fixed assets

|

Indicator name |

Magnitude indicator |

Growth rate, % |

|||||

|

2nd year to 1st year |

3rd year to 2nd year |

||||||

|

Depreciation (wear and tear) of fixed assets | |||||||

|

Residual value of fixed assets | |||||||

|

Capital productivity | |||||||

|

Capital intensity | |||||||

|

Capital-labor ratio | |||||||

To evaluate the financial and economic activities of an organization, reporting forms such as Balance Sheet, Profit and Loss Statement, and Cash Flow Statement are generated. These forms are compiled in absolute values. For rate economic efficiency economic indicators are used. Let's calculate basic financial ratios using Excel.

Cost-benefit analysis

To calculate enterprise economic efficiency ratios in Excel, we use conditional data characterizing economic activity.

We have a balance:

Profit and loss report with indicators for 2 years:

Let's calculate the efficiency ratios of the enterprise.

Gross profit margin is a profitability indicator that reflects the percentage of profit in sales volume. Calculated as the quotient of gross profit and revenue. It also shows whether the company has the opportunity to reduce its price in response to the changed situation in the competitor market. IN financial analysis used only in combination with an indicator such as operating profit margin before tax liabilities.

For clarity, let us transfer to the table “Analysis of profitability indicators” the data necessary for calculating the gross profit margin:

Formula for calculating gross profit margin:

* Result cells are set to percentage format.

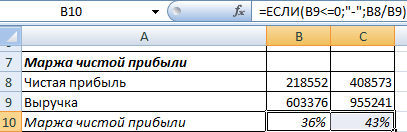

The net profit margin - a comparison of net profit with revenue - characterizes the degree of efficiency of the enterprise.

Let’s transfer the data necessary for the calculation from the Report and find the net profit margin indicator:

Operating profit margin before taxes (EBIT margin)—the ratio of operating profit to revenue—shows how much a firm's profitability depends on sales volume.

Calculation in Excel:

Asset efficiency - the ratio of net profit to the value of all assets - characterizes how competently the enterprise's property is used.

Let's calculate in Excel:

To calculate average assets, data is taken from the balance sheet (line “Total Assets”). It is necessary to find the average value of the data at the beginning of the period and at the end of the period ((ng indicator + kg indicator) /2).

Return on equity—a comparison of net income to average equity—illustrates the efficiency with which capital is used.

Calculation data and formula:

These are the main coefficients of economic efficiency of an enterprise.

Liquidity and financial stability analysis

In a market economy, the main role is given to the financial resources of the enterprise. To assess the effectiveness of their use, various methods are used (calculation of profitability indicators, analysis of financial ratios, assessment of cost, structure and capital flow). Let's use the method of analyzing financial ratios.

The efficiency of using an enterprise's resources is characterized by coefficients for assessing financial stability, solvency, asset and capital turnover.

Financial stability assessment coefficients:

Analysis of efficiency ratios financial resources is carried out dynamically. The indicators are compared with the recommended ones and with data from other organizations working in related fields.

An indicator such as liquidity characterizes the ability of an enterprise to make necessary expenses. The calculation of ratios involves comparing the elements of current assets with short-term liabilities.

This is one of the most stringent assessments of an organization's liquidity.

An investment project is a multi-page document containing descriptive and calculation parts.

The descriptive part presents general description project, characteristics of the invested object, description of the project idea and the method of implementing this idea, description of the environment with characteristics of the market for competitive products, advantages of own products, marketing plan conquering a market segment and much more.

The calculation part contains technical calculations for the implementation of the project, the construction calculation part of the project with construction estimates and the economic part with calculations of the economic efficiency of the proposed solution. We are considering the calculation investment project from an economic point of view, the main thing in which is the calculation of performance indicators of the investment project.

All investment efficiency indicators can be divided into absolute indicators, measured in monetary units and time periods, and relative indicators, measured in percentages or ratios.

The first group of indicators includes:

- net present value of the investment project NPV (Net present value);

- payback period of investments PP (Pay-Back Period);

- discounted payback period DPP (Discounted payback period).

The second group consists of the following indicators:

- PI (Profitability Index);

- internal rate of return IRR (internal rate of return);

- modified internal rate of return MIRR (Modified Internal Rate of Return);

- investment efficiency ratio ARR (Accounting Rate of Return).

Calculation of the net present value of an investment project

This indicator is calculated using the formula:

- NPV - net present value of investment;

- ICo - initial invested capital (Invested Capital);

- CFt - cash flow (Cash Flow) from investments in the t-th year;

- r - discount rate;

- n is the duration of the project life cycle.

Calculation example: The company plans to replace outdated equipment in the auxiliary equipment production workshop. This will require 85 million rubles for the purchase, delivery and installation of new equipment. The dismantling of old equipment is fully covered by its sale on the market. The lifespan of investments in new equipment is the obsolescence time of 6 years. We accept the discount rate corresponding to the enterprise's rate of return of 14%. Calculation of income from the operation of new equipment by year is as follows:

Discount rate r in in this example unchangeable. But this is unlikely, since it is influenced by many factors, such as inflation, changes in the refinancing rate, price fluctuations in the market for manufactured products, etc. In the above calculation formula, in this case, the discount rate can be replaced by the predicted rate for each year. And when calculating the actual NPV for analyzing the effectiveness of investments, this is done without fail.

Calculation of the payback period of investments

The payback period of an investment is an indicator of the return on investment to an investor measured in time periods - months or years. General form The formula for determining it looks like this:

PP=N, if ![]()

- CFt—receipt of income from the project in the t-th year;

- N - payback period, years.

For the above example, PP = 3 years, since more precisely - 2 years and 8 months.

If cash flows are discounted at an accepted rate, then the discounted payback period of investments can be calculated using the formula:

DPP=N, if

More precisely, DPP = 3 years 6 months.

Calculation of relative performance indicators

Calculation of the profitability index

The investment return index shows the profitability of each invested unit of investment at the current time, that is:

For our example, PI = (10.526 + 27.7 + 32.39 + 27.54 +25.26 + 17.51) / 85 = 140.926/85 = 1.66. This can be interpreted as follows: every ruble of investment brings 0.66 rubles of income.

Calculation of internal rate of return

The internal rate of return on investments is determined when the discounted cash inflows from the investments that caused them are equal to the investments. That is:

IRR is the internal rate of return on investments.

Based on this formula, it becomes clear that IRR, on the one hand, is the average rate of return of the project for its entire life cycle, on the other hand, the marginal rate of return of the project, below which one cannot fall.

Therefore, it is compared with barrier rates for a given investment object to make a decision on the feasibility of investment design. If it is equal to or less than the cash flow discount rate determined on the basis of the cost of the weighted average capital of the invested object, then any investor will abandon such a project without hesitation.

Therefore, it is compared with barrier rates for a given investment object to make a decision on the feasibility of investment design. If it is equal to or less than the cash flow discount rate determined on the basis of the cost of the weighted average capital of the invested object, then any investor will abandon such a project without hesitation.

In our example, the discount rate is 14%. Let's see what the internal rate of return on investment is in our example.

Let us determine the value of the internal rate of return using the method of successive approximation:

Thus, the IRR is equal to 32%, which significantly exceeds the discount rate and the weighted average return of the invested object. It is advisable to implement the project.

Quite often, in the process of investing in large projects, problems of investment shortage arise; in this case, a decision is made to reinvest the profits received during the implementation of the project. In this case, the modified internal rate of return on investments MIRR is calculated, which is calculated using the formula:

- d - weighted average cost of capital;

- r - discount rate;

- CFt - cash inflows in the t-th year of the project life;

- ICt - investment cash flows in the t-th year of the project’s life;

- n is the life cycle of the project.

Here it is necessary to pay attention to the fact that all investments and reinvestments are reduced to the beginning of the project at the same discount rate, and all income is reduced to the end date of the project according to the discount rate of the corresponding weighted average cost of capital of the invested object.

From the above equation, the modified internal rate of return in our example is determined:

As we can see, MIRR< IRR. The advantage of this indicator is that in the case of alternating inflows, it gives an objective assessment of the investment project, which the IRR indicator cannot provide.

The calculation of the efficiency of an investment project, an example of which we have examined, should be supplemented by the calculation of another indicator - the efficiency coefficient of the investment project ARR. This indicator is reciprocal payback period PP, that is, ARR = 1/PP, if we define the latter as the ratio of the average annual return on investment to the initial investment.

The calculation of the efficiency of an investment project, an example of which we have examined, should be supplemented by the calculation of another indicator - the efficiency coefficient of the investment project ARR. This indicator is reciprocal payback period PP, that is, ARR = 1/PP, if we define the latter as the ratio of the average annual return on investment to the initial investment.

The formula for calculating the investment efficiency ratio looks like this in this case:

CFcr - average annual return on investment.

If the coefficient is calculated for the entire life cycle, then the formula takes the form:

If is the liquidation value of the investment project.

For our example, the calculation looks like this:

ARR = 228/ 6/ 85 = 0.447 or in percentage terms 44.7%.

Possible deviations from the calculation of this indicator for the payback period are associated with the methodology for determining the average annual income from investments.

In conclusion, it should be noted that the calculation of all the above indicators is easy to carry out on a computer using standard Excel programs.

Overall Equipment Effectiveness (OEE) is an excellent way to calculate the efficiency of a manufacturing process and equipment usage. But how to make the calculation correctly? And is there an ideal OEE?

Overall Equipment Effectiveness (OEE) calculations help you see how efficiently you are using your equipment and identify the six most significant and common sources of efficiency loss that lean manufacturing aims to eliminate.

The six most significant causes of loss of efficiency are:

1. Shutdowns - unscheduled equipment changes and unscheduled maintenance, general shutdowns, failure of auxiliary equipment, etc.

2. Setup or adjustment - readjustment, planned change of equipment, downtime due to lack of materials or operators, time to start up equipment, etc.

3. Minor stops/downtime – usually these are stops of up to 5 minutes that do not require the intervention of support personnel. They can occur due to minor problems, interruptions in the delivery of materials, cleaning/inspection.

4. Reduced productivity is any problem that reduces the operating speed of the equipment compared to the rated speed (equipment wear, decreased power, increased loading time)

5. Defects during startup – defects produced during startup, warm-up or other initial stages of equipment operation.

6. Manufacturing defect - defect obtained during the production process.

All these 6 reasons influence the value of the indicators used to calculate OEE.

Standard OEE formula = %A x %T x %Q, Where

- %A (Availability)Availability is the ratio of the available working time of the equipment to the total working time. The value of this indicator is influenced by stopping and setting/adjusting equipment, i.e. 1 and 2 reasons for loss of efficiency.

- %T (Throughput) Productivity is the ratio of actual operating time to net operating time. Reasons 3 and 4 play a significant role here: minor downtime and decreased productivity.

- %Q (Quality) Quality is the ratio of quality products to the total quantity of products. This indicator depends on the last two reasons: decrease in efficiency: defects at startup and manufacturing defects.

When using this method, in addition to the OEE value itself, you can also get information about in which direction you should improve the operation of the equipment. For example, if you received the values A = 64%, T = 95%, Q = 90%, then in addition to the OEE value of 55%, you can also conclude that the main efforts should be focused on improving the equipment availability indicator. In this case, it is worth carefully working on unscheduled stops and stops associated with setting up and adjusting equipment.

Second method for calculating OEE, also known as the throughput factor method, is very useful for evaluating an overall process or line.

OEE = (AT)/(TPR x SOT), where

- AT (Actual Throughput)Actual throughput is the quantity of quality output

- TPR (Theoretical Processing Rate) The theoretical processing rate is the processing speed at the bottleneck of the system under ideal conditions

- SOT (Scheduled Operating Time) scheduled operating time is the amount of operating time scheduled by the system (including production and maintenance)

But in order to use OEE as the main indicator production activities to make the most of it, make sure you don't make the following mistakes:

- Not using ideal equipment speed or processing time. You should not lower the bar by using the average speed of the equipment. You run the risk of not seeing the impact of the six leading causes of inefficiency in your operation.

- Don't take into account changeover time. Changeover is not production, but production increases throughput, which, in fact, is our main goal. This means that every minute spent on changeover is a minute stolen from throughput.

- You do not identify the bottleneck of the line. The second formula for calculating OEE only works if you know the location of the bottleneck on the production line, i.e. section (operation, step) with a minimum throughput. It is this place that sets the pace for the entire line, so its importance should not be underestimated.

- Focus on the OEE number, not on the main problems. Very often, while calculating performance indicators, we forget that the goal is not the calculation of numbers itself, but the implementation of corrective measures.

Speaking of the meaning of OEE. There is no ideal OEE to achieve. Much more important is to accept necessary measures to improve performance and see how the result of the formula OEE = %A x %T x %Q changes for the better.

The efficiency of using fixed assets is characterized by the capital productivity indicator, calculated as the ratio of the volume of production for the year (at the enterprise level) to the average annual total cost. At the industry level, output or gross value added is used as an indicator of production, and at the level of the economy as a whole, value is used.

Capital productivity This is the volume of output divided by the average amount of industrial production fixed assets at original cost.

Rational use of fixed production assets is necessary to increase the production of social product and.

Increasing the level of use of fixed assets makes it possible to increase the size of production output without additional capital investments and to a greater extent. short time. Accelerates, reduces the cost of reproduction of new funds and reduces.

Economic effect An increase in the level of use of fixed assets is an increase in social productivity.

Capital productivity shows how much output (or profit) an organization receives from each ruble of its fixed assets.

Let us determine by the method of absolute differences the influence on the volume of production of two factors associated with fixed assets:

- quantitative (extensive) factor - the amount of fixed assets;

- qualitative (intensive) factor - capital productivity.

Table No. 1.

The increase in production output compared to the previous year was influenced by the following factors:

- an increase in the amount of fixed assets could increase production output by +6174 x 1.01 = +6235.7 thousand rubles.

- a decrease in capital productivity reduced output by the amount of (-0.18) x 27985 = - 5037.3 thousand rubles. The total influence of two factors (balance of factors) is: +6235.7 - 5037.3 = +1198 thousand rubles.

Capital intensity

Capital intensity is the reciprocal of capital productivity. It characterizes how many fixed production assets account for 1 ruble of manufactured products.

Capital intensity is the average amount of industrial production fixed assets at original cost divided by the volume of output.

Reducing capital intensity means saving labor.

The value of capital productivity shows how much production is obtained from each ruble invested in fixed assets, and serves to determine the economic efficiency of using existing fixed assets.

Capital intensity value shows how much money needs to be spent on fixed assets to obtain the required volume of output.

Thus - capital intensity shows, how many fixed assets account for each ruble of output. If the use of fixed assets improves, then capital productivity should increase and capital intensity should decrease.

When calculating capital productivity, working machines and equipment (the active part of fixed assets) are separated from fixed assets. A comparison of growth rates and percentages of implementation of the capital productivity plan per 1 ruble of the cost of fixed industrial production assets and per 1 ruble of the cost of working machinery and equipment shows the impact of changes in the structure of fixed assets on the efficiency of their use. The second indicator in these conditions should be ahead of the first (if the share of the active part of fixed assets increases).

Capital-labor ratio

The capital-labor ratio has a huge impact on the values of capital productivity and capital intensity.

The capital-labor ratio is used to characterize the degree to which workers are equipped with labor.

Capital-to-capital ratio and capital productivity are interconnected through the indicator labor productivity(Labor productivity = Product output / ).

Thus, capital productivity = labor productivity / capital-labor ratio.

To improve production efficiency, it is important to ensure faster growth in production compared to the growth of fixed production assets.

Using the problem, we will consider the method of calculating capital intensity, capital-labor ratio and capital productivity.

Task

| Base period | Reporting period | |||

| Company | Volume of production | Average cost of PF | Volume of production | Average cost of PF |

| 1 | 18 | 15 | 36 | 24 |

| 2 | 140 | 35 | 158,4 | 36 |

Find

- Dynamic coefficient of the concern's average capital productivity;

- The absolute impact on the change in average capital productivity of changes in capital productivity at each enterprise and changes in the capital structure.

Solution

Impact of changes in capital productivity of changes in fixed assets

Analysis of the condition and use of fixed assets

The volume of production depends on many factors, which can be grouped into three main groups:

- factors related to the availability, use, i.e. main industrial and production funds (funds);

- factors related to security () and their use;

- factors related to availability, movement and use.

The analysis should examine and measure the influence of these factors on . At the same time, the influence of each group of factors (resources) is determined ceteris paribus, i.e., it is assumed that factors belonging to other groups acted as intended.

Let's consider the first group of factors (resources) influencing the volume of output. All other things being equal, the greater the amount of fixed assets and the better their use, the greater the volume of production.

Main sources of information for analysis of fixed assets are: f. No. 5 of the annual report “Appendix to the Balance Sheet”, inventory cards for accounting of fixed assets, acts of acceptance and transfer of fixed assets, invoices for the internal movement of fixed assets, acts of acceptance and transfer of repaired, reconstructed, modernized fixed assets,

Fixed assets (assets) are means of labor used to manufacture products or to service the production process.

The analysis should begin by studying structure of fixed assets, i.e. ratios of different groups of fixed assets in total amount their cost.

Necessary so that in the structure of fixed assets the specific gravity of their active part increased, i.e. working machines and equipment that directly affect objects of labor, i.e. for materials. At the same time, the return on the use of fixed assets increases.

Then you should check how fixed assets are updated and calculate the following indicators:

- fixed assets

- fixed assets

These coefficients should be calculated over several periods and the dynamics of renewal, disposal and growth of fixed assets should be monitored.

Then you need to study age composition of equipment, which is very important for characterizing the technical condition of fixed assets. For this purpose, equipment is grouped by service life.

This grouping shows the share of new equipment, the return on use of which is the highest, the share of equipment with average service life, as well as the percentage of obsolete labor tools.

Comparison of these indicators over several years shows trends in their changes (it should be borne in mind that renewal and disposal rates are calculated for a given period, and wear and tear rates are calculated at the beginning and end of the period).

Technological level of equipment

It is necessary to study the technological level of the equipment.

For this purpose, equipment is divided into the following groups:

- manually operated equipment;

- partially mechanized simple equipment;

- fully mechanized simple equipment;

- partially automated equipment;

- fully automated equipment;

- automated and programmable equipment;

- flexible, automated and programmable equipment.

In the process of analysis, the technological level of equipment is expressed by the following indicators:

Level of mechanization machinery and equipment is the total cost of equipment of types 2 - 7 divided by the total cost of equipment of types 1 - 7.

Automation level machinery and equipment is the total cost of equipment of types 4 - 7 divided by the total cost of equipment of types 1 - 7.

Level of complex automation machinery and equipment is the total cost of equipment of types 5 - 7 divided by the total cost of equipment of types 1 - 7.

Indicators of maintenance of machines and equipment

Level of labor mechanization is the number of workers servicing mechanized equipment divided by the total number of production workers.

Labor automation level This is the number of workers servicing automated equipment divided by the total number of production workers.

Analysis of the use of fixed assets

Having analyzed the state of fixed assets, we move on to analyzing their use. The most common indicators of the use of fixed assets are: capital productivity, capital intensity and capital-labor ratio (see the beginning of the article).

Equipment usage indicators

After studying the general indicators of the use of fixed assets, it is necessary to consider the use of equipment as the most active part of fixed assets, on which production output mainly depends.

Extensive use equipment can also be characterized by the coefficient of extensive equipment use.

Extensive equipment utilization rate— this is the actual number of machine-hours worked by the equipment divided by the basic (planned) number of machine-hours worked by the equipment.

K ex= Actual operating time of the equipment, hour / Standard operating time of the equipment, hour

Having considered the extensive use of equipment, let’s move on to studying its intensive use, i.e. usage but performance. It is analyzed by comparing actual indicators of product removal per machine-hour (machine-hour) with planned indicators, with indicators of previous periods, as well as with indicators of other related enterprises for groups of similar equipment

Equipment use performance can be characterized by the coefficient of intensive use of equipment.

Equipment intensive utilization rate- this is the actual average output per one worked machine-hour divided by the basic (planned) average output per one worked machine-hour.

Integral use of equipment, i.e. simultaneously in time and productivity, expressed coefficient of integral equipment utilization, which is defined as the product of the coefficients of extensive and intensive use of equipment.

At the conclusion of the analysis, it is necessary to summarize the reserves for increasing production output associated with fixed assets.

Such reserves can be:- commissioning of uninstalled equipment;

- increasing equipment shifts;

- eliminating the causes of above-planned whole-shift and intra-shift equipment downtime;

- reduction of planned losses of equipment operating time;

- implementation of organizational and technical measures aimed at reducing the operating time of equipment to produce a unit of product.