Liquidity of current assets. The risk of liquidity shortages and ways to manage them. Liquidity ratios: balance sheet formula

The article presents the main approaches to assessment financial condition enterprises using indicators for assessing liquidity, solvency, financial stability and profitability of the enterprise. A calculation of economic profitability according to DuPont was made, which served as the basis for determining the actual and forecast effect of financial leverage. Particular attention is paid to modeling the growth of enterprise liquidity.

IN modern conditions Most enterprises are characterized by a “reactive” form of activity management, which is a reaction to the current problems of the organization. In this regard, assessment of the existing financial condition and timely response to external conditions are possible only by improving the tools for managing financial and economic activities.

In the current and future time periods, a set of internal, stable characteristics is characterized by substantive complexity and inconsistency, which determines the need to use various assessment methods and further develop a mechanism for managing the financial condition of the enterprise.

The assessment methods and mechanism for managing the financial condition of an enterprise are based on financial analysis, the methodology of which consists of three large interconnected blocks:

analysis financial situation and business activity;

analysis financial results;

· assessment of possible prospects for the development of the organization.

Among the main approaches to financial condition management, the most important is the approach based on time duration. A special feature of this classification is the identification of current and future assessments of financial condition.

The current assessment includes the existing financial balance, when the state of finances does not interfere with the functioning of the enterprise. This is possible subject to the following basic conditions:

the required level of efficiency is met if the organization, using the provided capital, covers the costs associated with its receipt;

the liquidity condition is met. In other words, the organization (enterprise) must always be in a state of solvency;

the financial condition of the organization is assessed as stable.

The simultaneous fulfillment of these conditions causes significant difficulties, since, for example, the tasks of achieving the required profitability and liquidity are undoubtedly contradictory. Possible option We will study the compatibility of various goals when modeling financial development using the example of Irena LLC.

The holding company “Irena LLC” was founded in 2005. The main tasks are assistance in the clearance of cargo and other warehouses in a number of regions, carried out on the basis of a license to operate as a customs broker. The company has a transport and logistics department, which allows it to provide services for the delivery, placement and consolidation of cargo in European warehouses.

One of the most important components of the analysis of financial condition is the assessment of the financial stability of the organization. When performing analysis financial stability We chose to assess the ability of Irena LLC to pay its obligations and maintain ownership rights in the long term.

When studying the structure of inventories, the main attention was paid to studying trends in changes in such elements as raw materials, work in progress, finished goods and goods for resale, and shipped goods. The presence in the balance sheet of the item “Accounts receivable, payments for which are expected more than 12 months after the reporting date” indicates negative aspects of the organization’s work.

To calculate the final values characterizing financial stability, we will evaluate the initial data that had a significant impact on the final indicators (Table 1). According to the grouping data, it can be observed that in the company the amounts that determine the amount of operating capital (CF) and the total amount of the main sources of inventory and costs (VI) coincide. At the same time, the total amount of inventories and costs decreased by 323 thousand rubles. in absolute terms.

Table 1. Grouping of financial statements itemsbased on

financial stability of Irena LLC for 2007–2009. at the beginning of the period

|

Indicator |

Calculation method, p. |

Amount, thousand rubles |

Deviations, thousand rubles |

||

|

2007 |

2008 |

2009 |

|||

|

Total inventory and costs (ZZ) | |||||

|

Functioning capital (CF) |

490 + 590 – 190 | ||||

|

The total value of the main sources of formation of reserves and costs (VI) |

490 + 590 + 610 – 190 | ||||

For a more detailed analysis of financial stability, we will calculate the coefficients characterizing financial stability (Table 2).

Table 2. Financial stability coefficients of Irena LLC

|

Indicator |

Calculation method, p. |

Years |

Optimal value |

||

|

2007 |

2008 |

2009 |

|||

|

Capitalization rate (U1) |

(590 + 690) / (490 – 475 – 465 – 244) |

< 1,5 |

|||

|

Provision ratio of own sources of financing (U2) |

((490 – 475 – 465 – 244) – 190) / 290 |

> 0,6–0,8 |

|||

|

Financial independence coefficient (U3) |

(490 – 475 – 465 – 244) / 300 |

> 0,4 |

|||

|

Funding ratio (U4) |

(490 – 465 – 475 – 244) / (590 + 690) | ||||

|

Financial stability coefficient (U5) |

(490 – 465 – 475 – 244 + 590) / 300 |

> 0,7 |

|||

|

Security ratio inventories own funds (U6) |

((490 – 465 – 475 – 244) – 190) / 210 |

> 0,6 |

|||

|

Permanent asset index |

190 / (490 – 475 – 465 – 244) | ||||

The capitalization ratio (U1) indicates the organization’s high dependence on external capital. The deviation from the standard value varies from year to year, but exceeds the optimal standard value. Thus, in 2009, the minimum value for the entire study period was 2.88, which is 1.3 higher than the norm (see Table 2).

Thus, we can conclude that Irena LLC is worth 1 ruble own funds, invested in assets, attracted 2 rubles. 88 kop. A decrease in the indicator in dynamics is favorable, since the lower the value of this coefficient, the less the organization depends on attracted capital.

The ratio of availability of own sources of financing (U2) shows that 25% of current assets are financed by own sources. The level of provision of Irena LLC with its own working capital was below the norm in 2009 by 0.35 points. It should be noted that the minimum value for this coefficient must be greater than or equal to 0.1. In the period under study, this value was exceeded in 2007 by 0.14 points, in 2008 - by 0.18 points. A favorable trend is the growth of indicators in dynamics, since a high value of the indicator allows us to conclude that the organization does not depend on borrowed sources of financing when forming its working capital.

The financial independence ratio (U3) is also below normal. However, the growth of this indicator is a positive trend and indicates that, from a long-term perspective, the organization will depend less and less on external sources of financing.

The financing ratio (U4) indicates that the share of own funds in total amount sources of financing in 2009 amounted to 35%. A fairly low value characterizes the enterprise's policy as highly dependent on external sources.

The financial stability coefficient (U5) does not exceed the standard value over the years. This trend is quite unfavorable, since it is the most important ratio, and it shows that in 2009 only 26% of balance sheet assets were generated from sustainable sources. The value of the coefficient does not coincide with the value of the financial independence coefficient, which allows us to conclude that Irena LLC does not use long-term loans and borrowings.

The coefficient of provision of material inventories with own funds (U6) shows that in 2009, inventories and costs are formed entirely from own funds. This indicator indicates an insignificant share of reserves in the structure of assets.

The permanent asset index has been declining over the years, and in 2009 compared to 2007 the reduction was 9 points. This coefficient shows that the share of immobilized (dead) funds in own sources is decreasing.

Analyzing the business activity of the enterprise (Table 3), it should be noted that all indicators over time demonstrate a favorable growth trend.

Table 3. Indicators business activity(turnover) LLC "Irena"

|

Indicator |

2007 |

2008 |

2009 |

|

Permanent asset turnover | |||

|

Turnover of current (current) assets | |||

|

Turnover of all assets |

The economic content of the analysis of liquidity, solvency and profitability of an enterprise is closely interdependent with the concept of “business activity”.

For a detailed analysis of the solvency of the enterprise, we will analyze the dynamics of absolute and relative structural changes in the current assets of the enterprise.

As noted above, the analysis of balance sheet liquidity consists of comparing assets for assets, grouped by the degree of decreasing liquidity, with sources of formation of assets for liabilities, which are grouped by degree of maturity.

Using balance sheet liquidity analysis, we will assess changes in the financial situation in the organization from the point of view of liquidity.

Relative liquidity indicators are comparable in dynamics for 2007–2009. The analysis of balance sheet liquidity is carried out according to the data in table. 4. The balance sheet of the organization Irena LLC is not absolutely liquid (Tables 4–6).

Table 4. Analysis of the liquidity of the balance sheet of Irena LLC at the end of the year for 2007–2009.

|

Assets |

2007 |

2008 |

2009 |

Passive |

2007 |

2008 |

2009 | |

|

Most liquid assets (A1) |

Most urgent obligations (P1) | |||||||

|

realizable assets (A2) |

Short term liabilities (P2) | |||||||

|

Slowly realizable assets (A3) |

Long-term liabilities (P3) | |||||||

|

realizable assets (A4) |

Constant liabilities (P4) | |||||||

The first condition (A1 is greater than or equal to P1) for the period under study is met due to the absence of the most urgent obligations in the organization. The second (A2 is greater than or equal to P2) is not fulfilled due to the lack of quickly realizable assets at the enterprise (A2).

The third condition for balance sheet liquidity (A3 is greater than or equal to P3) is satisfied over time due to the absence of long-term liabilities.

The fourth condition (A4 is less than or equal to P4), characterizing minimum financial stability, is not met for the entire study period.

To determine the current situation and future trends in balance sheet liquidity, we will calculate the amount of surplus and deficiency for each of the analyzed groups (Table 5).

Table 5. Payment surplus (+) or deficiency (–)

liquidity balance of Irena LLC at the end of the year for 2007–2009.

|

Calculation method |

Amount of payment surplus (+) or deficiency (–) |

||

|

2007 |

2008 |

2009 |

|

A comparison of the liquidity result for the first two groups characterizes current liquidity. During the period, the payment surplus for the first group decreased, which significantly reduces the liquidity of the balance sheet in the event of short-term liabilities (Table 5).

For the second group, the dynamics of the payment gap decreased by 12,230 thousand rubles, which, of course, given the overall negative picture, is a positive trend.

Prospective liquidity is characterized by a payment surplus or deficiency in the third group. During the study period, at LLC Irena, the payment surplus in the third group increased by 724 thousand rubles.

Since, as noted above, balance sheet liquidity and enterprise liquidity are significantly different concepts, it is necessary to analyze the enterprise’s liquidity using the coefficient method (Table 6).

As can be seen from the data in table. 6, in Irena LLC, the values of the current and quick liquidity ratios are significantly lower than the recommended ones, and the absolute liquidity ratio at the end of the study period decreased by 0.04 points. The decline in performance indicators can be assessed negatively.

The signal indicator of the financial condition of the organization is the coefficient of maneuverability of equity capital (AC).

Table 6. Liquidity ratios

and solvency of Irena LLC for 2007–2009.

It shows what part of the operating capital is immobilized in inventories and long-term receivables. A decrease in the indicator in dynamics is a positive fact. Increasing cash flow is a positive thing. The presence and increase in short-term financial investments should also be assessed positively, since the structure of current assets becomes more liquid.

Profitability assessment, in turn, shows high level unprofitability in 2007 and growth in profitability over 2008–2009. (Table 7).

The profitability (loss) ratio of assets in 2007 reflects the amount of loss in the amount of 37.7 rubles per ruble of the organization’s assets. There is a positive trend in dynamics. So, in 2009 the company received 2 rubles. 13 kopecks profit per ruble of assets.

The return on equity ratio in 2009 shows that the company received 8 rubles. 29 kopecks profit for each ruble of the organization's equity capital.

Table 7. Profitability (loss) ratios of Irena LLC

In 2007, the company received a loss equal to 312 rubles. 72 kopecks per 1 ruble of equity capital.

There is also a positive trend in the return on sales ratio, which in 2009 was 5.28%. For comparison: the coefficient in 2007 is negative and shows a loss of 26 rubles. 84 kopecks for every ruble of sales.

The analysis showed the presence of significant issues that are relevant for the enterprise at the moment, which are reflected in the operating and financial activities. To solve existing problems, it is advisable to improve the financial mechanism.

The analysis of the financial condition revealed existing trends in the financial stability management mechanism. The negative point is the low financial stability of the enterprise and the imperfection of the financial mechanism of its management.

The consequences of financial instability for Irena LLC in the future can be very significant. A situation becomes real in which the enterprise will be dependent on creditors and is in danger of losing its independence.

The reasons for the current situation are as follows:

1) consistently low volumes of profit received;

2) management problems associated with irrational management of the financial mechanism at the enterprise.

In this regard, it is advisable to focus on various aspects of the financial and operational activities of Irena LLC.

The advisability of raising borrowed funds when forming a financial strategy is a controversial issue. In this case, we offer the company the following forecast options.

Let's consider the effect of increasing financial stability through the use of the financial leverage effect, which shows by what percentage the return on equity will change due to the use of borrowed funds. This indicator determines the limit of economic feasibility of borrowing funds.

In turn, we will calculate return on assets using the Dupont formula.

Let's transform the formula for economic profitability (ER) by multiplying it by Turnover / Turnover 1 = 1. Such an operation will not change the amount of profitability, but two important elements of profitability will appear: commercial margin (CM) and transformation coefficient (CT).

where EBIT is operating profit - an analytical indicator equal to the volume of profit before interest on borrowed funds and paying taxes;

Turnover - the sum expression of revenue from sales and non-operating expenses, thousand rubles;

KM - margin coefficient;

CT - transformation ratio.

In our case, the economic profitability is 1.9% (ER = 442 / (25,585 + 20,369) / 2 × 76,596 / 76,596 = 442 / 76,596 × 100 × 76,596 / 22,977.5).

A margin ratio of 0.57% shows that every 100 rubles. turnover give 0.57% of the result.

The transformation coefficient shows that every ruble of an asset is transformed into 3 rubles. 30 kopecks

Thus, the actual profitability is at a very low level, which, even without preliminary calculations, indicates the inappropriateness of borrowing funds.

Let's test our hypothesis by calculating financial leverage.

The tax corrector equal to 0.8 (we find the TC by substituting the EFR (1 – 0.2) into the first part of the formula) shows that the effect of financial leverage in our case does not significantly depend on the level of profit taxation.

In addition, the identification of three components of the effect of financial leverage makes it possible to purposefully manage it in the process of the organization’s financial activities.

The financial leverage ratio (LC/SC) enhances the positive or negative effect obtained through the differential.

EGF = (1 – 0.2) × (1.9% – 0%) × 0 / 5196 = 0.

The calculation showed that there is no effect of financial leverage, since there is no use of a paid loan. An indicator value of 0 indicates that any increase in the financial leverage ratio will cause a zero increase in return on equity.

The average interest rate for a loan is 15% per annum. In this case, for the positive effect of financial leverage, the company needs to increase its return on assets to 16%, that is, 16 times. Then the level of profit obtained from the use of assets (economic profitability) will be greater than the costs of attracting and servicing borrowed funds.

Thus, in order for an enterprise to increase its solvency and increase the net profit remaining at the disposal of the enterprise, it is advisable to pay special attention to increasing profitability from operating activities.

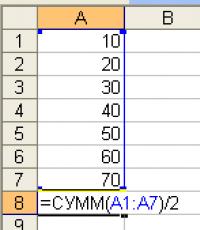

Management of enterprise liquidity and profitability is the most important aspect of the financial strategic development of the enterprise under study. In this regard, the mechanism for managing operational activities and modeling the liquidity of Irena LLC acquire the greatest importance. Let's predict changes in revenue using the extrapolation smoothing method (Table 8).

A graphical representation of the predicted value is shown in the figure.

Table 8. Forecast of changes in revenue using the extrapolation smoothing method

|

Years |

Revenue, thousand rubles |

|

Forecast (optimistic option) |

Revenue forecast using the least squares method (linear extrapolation smoothing)

The trend equation constructed using the least squares method has the following form:

y = 4585x + 66,239.

The calculated equation indicates positive revenue growth under the given conditions. The revenue forecast was made in order to identify the development prospects of the enterprise under favorable trends.

In relation to improving the financial management mechanism, as well as to correct the current situation and achieve forecast values, the management of the enterprise should take measures to increase its own capital, which is possible through liquidity modeling. The basis of the model is the assumption that the main element of equity capital is profit growth, since profit creates the basis for self-financing and will be a source of repayment of the enterprise’s obligations to the bank and other creditors, which will reduce short-term liabilities and increase liquidity.

To achieve this goal, it is necessary to increase the turnover of the enterprise's assets already in 2010, for which purpose increase the sales volume and provide discounts for quick payment. The calculation of the discount amount is presented in table. 9.

Table 9. Modeling the size of the discount for fast payment for goods of Irena LLC

|

Indicator |

Discount for prepayment, % |

No discount, deferment 10 days |

||

|

Inflation (4% per month) | ||||

|

Coefficient of decline in purchasing power of money |

1 / 1,026 = 0,975 |

|||

|

Losses from inflation for every 1 thousand rubles. implementation |

1000 – 975 = 25 |

|||

|

Losses from providing a discount for every 1 thousand rubles. |

1000 × 0.1 = 100 |

1000 × 0.05 = 50 |

1000 × 0.02 = 20 | |

|

Income from alternative investments - 2% per month |

900 × 0.02 × 0.975 = 17.55 |

950 × 0.02 × 0.975 = 17.55 |

980 × 0.02 × 0.975 = 17.55 | |

|

Payment of a bank loan - 18% per annum (thousand rubles) |

1000 × 0.18 / 12 = 15 |

|||

|

100 – 17,55 = 82,45 |

50 – 18,525 = 31,475 |

20 – 19,11 = 0,89 | ||

The proposed option for improving the financial mechanism is a necessary condition not only for the analyzed enterprise, but also for an enterprise of any organizational and legal form, since it represents a central part of the economic mechanism, which is explained by the leading role of finance in the sphere of material production.

L. S. Sokolova,

Ph.D. econ. sciences

Liquidity is one of the key concepts in economics. In general, it is needed so that investors and lenders can understand how profitable an investment in a particular asset is.

For reference: assets are the funds of a business entity from which it is planned to receive benefits.

What is liquidity in simple words

Liquidity is the ability of assets to be converted into cash without any loss. The faster an asset is converted into money, the more liquid it is.

The essence of this term can be most easily understood by simple example. Let's say you have several assets: real estate, a deposit in a bank on demand and securities. Which one will be more liquid? To answer this question, you need to understand which of the following can be realized faster or converted into cash without loss? It is currently quite difficult to sell real estate; in addition, this will require costs for paperwork, etc., not to mention significant time costs.

As for the possibility of selling securities, this is influenced by many factors: their type, maturity date, market situation, exchange rates, quotes, etc. In any case, it is obvious that their implementation will require significant moral and financial costs.

A demand deposit involves investing funds in a bank with the possibility of withdrawing them at any time. Accordingly, this asset is the most liquid, since you can convert a cash investment into as soon as possible without incurring any costs. And if you may need money in the near future, then he is the best option from those proposed.

Let's look at our example. A demand deposit, as we found out, is the most liquid asset. At the same time, it is also the least profitable. As a rule, the interest rate in banks is minimal. Accordingly, this asset is also the least risky. Those. the risks of losing money in this case are reduced to almost zero.

Investments in real estate are more profitable, but also riskier. There is always the possibility of a home's value falling in value. Finally, investing in securities is the riskiest type of investment. After all, it is extremely difficult to determine how, for example, stock quotes on the stock exchange will change. Accordingly, the highest risks are observed here. Risk, therefore, acts as a price for high income.

Knowing the basics of liquidity is important not only for individual investing, but also for the functioning of banks and companies.

Liquidity of the enterprise

Classification of species

The above example will help you understand the types of liquidity of an enterprise. According to the degree of ability to convert assets into cash, they are divided into several types:

- highly liquid (A1);

- quick liquid (A2);

- slow liquid (A3);

- difficult to liquidate (A4).

The most liquid asset is money, since it does not require any manipulation to convert it into cash. Quickly liquid assets usually include accounts receivable that do not exceed one year. Slowly liquid assets include: accounts receivable over a year, work in progress, inventories, VAT. Hard-to-liquid assets are non-current assets (buildings, structures) that have a long sales period.

Knowledge about the types of liquidity is necessary in order to correctly assess how creditworthy and solvent an enterprise is. These two, at first glance, similar concepts differ in the following way. Creditworthiness shows the ability of an enterprise to repay obligations with the help of highly liquid and quickly liquid assets. And solvency - with the help of assets of all types. Accordingly, the calculation of solvency indicators is important for assessing the financial condition of a company upon its liquidation or sale. Creditworthiness is needed primarily by lenders to assess the value of borrowed capital.

Video about the liquidity indicators of the enterprise:

Liquidity of an enterprise is the company's ability to pay off obligations as quickly as possible. It demonstrates her financial stability. The liquidity of an enterprise means that it has current assets in an amount that is sufficient to fulfill short-term obligations. In general, an enterprise can be considered liquid if the amount of current assets exceeds the amount of short-term debts.

Liquidity ratios: balance sheet formula

Indicators and ratios are used to assess the level of liquidity. They can be either absolute or relative. Absolute indicators include:

- current liquidity;

- prospective liquidity.

Relative indicators are presented by the following liquidity ratios:

- current;

- fast;

- absolute.

The level of liquidity is calculated by comparing assets by degree of liquidity (in the numerator) and liabilities (liabilities) in the denominator. Therefore, to calculate liquidity indicators, you should refer to the balance sheet of the enterprise. The division of assets by liquidity level was presented above. Therefore, let’s now look at the obligations (liabilities on the balance sheet). They are divided according to the level of increasing deadlines:

- most urgent obligations (P1): raised funds;

- medium-term liabilities (P2): short-term debts;

- long-term liabilities (P3);

- permanent liabilities (P4) (equity).

A1 exceeds P1;

A2 is higher than P2;

A3 is greater than P3;

A4 exceeds P4.

First, let's look at the calculation methods absolute indicators liquidity.

Current liquidity needed to reflect the absolute amount of coverage of short-term liabilities with the help of the most liquid assets (A1 and A2). Respectively, formula for calculating current liquidity presented as:

Current liquidity= (A1 + A2) – (P1 + P2)

Prospective liquidity is needed to calculate the absolute value of the excess of A3 (slowly realizable assets) over long-term liabilities (P3). The formula looks like this:

Prospective liquidity= A3 – P3

It is needed in order to calculate the company’s ability to fulfill its obligations with the help of working capital (which includes all assets except A4).

Current ratio = (A1 + A2 + A3) / (P1 + P2).

Formula (balance lines): (1200 – 1230 – 1220) / (1500 – 1550 – 1530).

Quick ratio is needed in order to calculate the possibility of fulfilling short-term obligations using the first two groups of assets (A1 and A2).

Quick or urgent liquidity ratio = (A1 + A2) / (P1 + P2).

Balance formula (lines): (1230 + 1240 + 1250) / (1500 – 1550 – 1530).

Helps to calculate the ability to fulfill short-term obligations using A1, i.e. highly liquid assets.

Absolute liquidity ratio = A1/ (P1 + P2).

This indicator is needed to calculate the financial reliability of the enterprise.

Formula for balance line numbers: (1240 + 1250) / (1500 – 1550 – 1530)

As you can see, the calculation formulas differ from each other only in the numerators. The denominator remains unchanged.

For the bank

The concept of liquidity is also necessary for successful banking. At the same time, it is important for the bank not only to correctly assess the liquidity of the borrowing company in order to justify issuing a loan. It is also necessary to take into account your own liquidity in order to meet the indicators banking established by the Central Bank, and stay “afloat” in the banking business.

To analyze banking activities, indicators similar to the analysis of enterprise liquidity are used. For this purpose, the following banking standards established by the Instruction of the Central Bank of the Russian Federation No. 139-I are used:

- H1 is a whole group of indicators, which includes:

N1.0 – reflects the adequacy of the bank’s own funds and is the main indicator of banking activity. It is for failure to meet this indicator that the large number banking licenses. The minimum value currently set by the Central Bank of the Russian Federation is 8%.

H1.1 – shows the adequacy of the basic capital. The minimum value is 4.5%.

N1.2 – shows the adequacy of fixed capital and is set at 6%.

- N2 – instant liquidity standard. Shows the bank's ability to repay its obligations within one business day. The minimum acceptable value is 15%.

- N3 – current liquidity ratio. Reflects the ability of a credit institution to fulfill its obligations within the next 30 days. The minimum standard level is 50%.

- N4 – long-term liquidity ratio. Demonstrates the ability of a credit institution to withstand the risk of non-fulfillment of its obligations due to the placement of funds in long-term assets. The maximum value of the indicator is set at 120%.

These are the main liquidity standards, although the Instructions also highlight others.

For securities

The concept of liquidity is widely used in the securities market when investing. Thus, securities are distinguished by their level of liquidity.

One of the most liquid securities is a bond, especially a government bond. Since its issuer (i.e., the one who issued it) is the state, the level of trust in which is traditionally higher than in private companies, the risk of non-fulfillment of obligations under it is minimal. However, according to the golden rule of investment presented above, the profitability of such a security will be minimal. A corporate bond will be considered a more liquid security. Its issuer is a private company. Moreover, the closer the bond's maturity date, the more liquid it is.

Stocks are less liquid than bonds. Among them, the most liquid are the shares of the largest reliable companies and banks, the so-called “blue chips”. These include, for example: Gazprom, VTB, Sberbank, etc. Since these companies are practically not in danger of bankruptcy, the risk of investing in them is minimized. However, their profitability is minimal. Among shares, the least liquid are shares of new companies that have not yet had time to widely establish themselves in the market. Thus, one of the riskiest investments is investing in shares of venture capital firms. However, the profitability from them will be significantly higher than from investing in blue chips.

This applies to classic securities. However, there are derivative financial instruments that are even less known in Russia: futures, forwards, options, etc. These securities are less liquid because the risk of investing in them is the most significant.

Thus, the calculation of liquidity indicators is important not only at the enterprise. Neither a bank, nor private investors, nor even an ordinary household can do without this.

Bank liquidity- the ability of assets to be easily converted into money. An asset that can be quickly sold at a market price is considered liquid. Liquidity financial organization represents the ratio of available assets to monetary obligations to be fulfilled. A bank’s liquidity reflects its ability to fulfill its obligations in a timely manner and in full.

A shortage of liquidity in a bank can lead to its insolvency, and excess liquidity has a negative impact on profitability (“extra” money is difficult to force to bring the bank income - it is not in demand by clients, so banks try to get rid of it, including through the interbank loan market). Thus, bank liquidity and solvency are closely related.

The main sources of bank liquidity are cash on hand and in accounts, and assets that can be converted into money (for example, securities). The interbank market also plays an important role, where banks can trade liquidity among themselves or buy it from the National Bank.

Bank liquidity indicators in Belarus, which are used when making decisions on the parameters of the National Bank's operations, are the current liquidity and position of the banking system. The calculation of bank liquidity (meaning the current liquidity of commercial banks) is carried out by summing up Belarusian rubles in correspondent accounts of banks with the National Bank minus the required volume until the end of the period of fulfillment of reserve requirements. If the value is negative (current liquidity deficit), it reflects the volume of borrowing by banks from the required reserve fund (ORF), and if positive (current liquidity surplus or surplus), it reflects the amount of funds in the REF in excess of the required amount.

The position of the banking system, which is also one of the indicators of liquidity, represents the net claims of banks to the National Bank for instruments for regulating current liquidity and reserve requirements at the end of the day.

In order to improve the requirements for the safe and sustainable functioning of the banking system of Belarus, the Board of the National Bank adopted Resolution No. 180 dated May 18, 2017 “On approval of the Instructions on the procedure for identifying systemically important banks, non-banking financial institutions and introducing amendments and additions to some regulatory legal acts National Bank of the Republic of Belarus." The document came into force on January 1, 2018.

According to the document, Basel III liquidity indicators (liquidity coverage and net stable funding indicators) are established as mandatory standards for the safe functioning of banks of the Republic of Belarus, as well as requirements for reporting on their implementation and analytical information on liquidity risk monitoring tools.

To control the liquidity status of a bank and non-bank financial institution (NPO), the following liquidity standards are established:

- liquidity coverage ratio;

- net stable funding standard.

To supervise the liquidity state of Development Bank OJSC, a net stable funding standard is established for it. The liquidity coverage ratio is intended to assess the ability of a bank or non-profit organization to provide a reserve of highly liquid unencumbered assets at a level sufficient for the timely and full fulfillment of the obligations of the bank or non-profit organization in stressful conditions, accompanied by a significant lack of liquidity, in the next 30 days. The amount of liquidity coverage is calculated as the ratio of the amount of highly liquid assets and the net expected cash outflow over the next 30 days.

The minimum acceptable value of the liquidity coverage ratio is set at 100%.

These additions and changes to the current requirements of the National Bank in the field of banking supervision will help strengthen control over the risks of the banking system, as well as improve the capital, liquidity and liquidity risk management system in banks.

If you notice an error in the text, please highlight it and press Ctrl+Enter

Let's try to understand how the liquidity analysis of an enterprise's balance sheet is carried out, and what are the main types of liquidity ratios for assessment.

Liquidity of the enterprise's balance sheet

Liquidity of the enterprise's balance sheet– the company’s ability to cover its obligations to creditors using its assets. Balance sheet liquidity is one of the most important financial indicators of an enterprise and directly determines the degree of solvency and the level of financial stability. The higher the liquidity of the balance sheet, the greater the speed of repayment of the company's debts. Low balance sheet liquidity is the first sign of bankruptcy risk.

Balance sheet liquidity analysis is a grouping of all assets and liabilities of an enterprise. So assets are ranked according to the degree of their realizability, i.e. The greater the liquidity of an asset, the higher the rate of its transformation into cash. The funds themselves have the maximum degree of liquidity. The company's liabilities are ranked according to the degree of maturity. The table below shows the grouping of the company's assets and liabilities.

| Types of enterprise assets | Types of enterprise liabilities | ||||

| A1 | Possess maximum speed implementation | Cash and short term. Finnish investments | P1 | High maturity | Accounts payable |

| A2 | Possess high speed implementation | Accounts receivable<12 мес. | P2 | Moderate maturity | Short-term liabilities and loans |

| A3 | Have a slow implementation speed | Accounts receivable >12 months, inventories, VAT, work in progress | P3 | Low maturity | Long-term liabilities |

| A4 | Hard to sell assets | Non-current assets | P4 | Permanent liabilities | Company's equity |

Analysis of liquidity of the enterprise balance sheet. Solvency assessment

To assess the liquidity of the enterprise's balance sheet, it is necessary to conduct a comparative analysis between the size of assets and liabilities of the corresponding groups. The table below presents an analysis of the company's liquidity.

| Liquidity analysis | Solvency assessment |

| A1 > P1 | An enterprise can pay off its most urgent obligations using absolutely liquid assets |

| A2 > P2 | An enterprise can pay off short-term obligations to creditors with quickly realizable assets |

| A3 > P3 | An enterprise can repay long-term loans using slow-selling assets |

| A4 ≤ P4 | This inequality is satisfied automatically if all three inequalities are met. The enterprise has a high degree of solvency and can pay off various types of obligations with the corresponding assets. |

Analysis and execution of inequalities for various types assets and liabilities of the enterprise allows us to judge the degree of liquidity of the balance sheet. If all conditions are met, the balance is considered absolutely liquid. When analyzing the balance sheet, it should be taken into account that more liquid assets may cover less urgent liabilities.

Master class: “An example of analysis and assessment of balance sheet liquidity”

Balance sheet liquidity ratios. Absolute and relative

At the next stage of liquidity analysis, the solvency indicators of the enterprise are assessed, and the following two absolute coefficients are calculated:

Current liquidity– an indicator reflecting the ability of an enterprise to repay its obligations in the short term.

Prospective liquidity– an indicator reflecting the company’s ability to repay debt in the future.

Analysis of balance sheet liquidity allows you to determine the availability of resources to repay obligations to creditors, but it is general and does not allow you to accurately determine the solvency of the enterprise. For this purpose, in practice, relative liquidity indicators are used. Let's look at them in more detail.

Current ratio (Current ratio) – an indicator reflecting the degree to which assets cover the most urgent and medium-term obligations of the enterprise. The formula for calculating the coefficient is as follows:

Quick ratio(Quick ratio) – an indicator reflecting the degree to which highly liquid and quickly realizable assets cover the current liabilities of the enterprise. The formula for calculating the absolute liquidity ratio is as follows:

Quick ratio > 0,7.

Absolute liquidity ratio (Cash ratio) – shows the degree to which the most liquid assets cover the current liabilities of the enterprise. The formula for calculating quick liquidity is as follows:

In practice, the optimal value of this indicator is considered Cash ratio > 0,2.

Total balance sheet liquidity(Total liquidity) – an indicator reflecting the degree to which the assets of the enterprise repay all its liabilities. It is calculated as the ratio of the weighted sum of assets and liabilities according to the formula:

In practice, the optimal value of this indicator is considered Total liquidity > 1.

Provision ratio of own working capital– reflects the degree to which the enterprise uses its own working capital. The formula is presented below:

The normative value of the indicator is K sos > 0.1.

Capital agility ratio– reflects the amount of capital in reserves. The calculation formula is as follows:

This indicator is analyzed over time and its tendency to decrease is considered optimal. In addition to the presented indicators, to analyze the liquidity of the balance sheet, enterprises use indicators including the company’s operating activities, size cash flow, indicators of capital maneuverability, etc.

Master class: “An example of assessing liquidity ratios for OJSC Gazprom.” Example with conclusions

Resume

Analysis of balance sheet liquidity is an important task of the enterprise in terms of the state of assets and liabilities, as well as the ability to timely and fully pay off its obligations to borrowers. The higher the liquidity of the balance sheet, the higher the solvency of the company and the lower the risk of bankruptcy. When assessing the solvency of an enterprise, it is necessary to analyze the coefficients over time and in comparison with industry averages. This will identify possible threats to the risk of bankruptcy.

Bank liquidity– the ability of a credit institution to fulfill its financial obligations in full and on time.

The term “organizational liquidity” should be distinguished from another financial term – “liquidity”, which means the ability to quickly and with minimal losses convert an asset into cash.

The liquidity of a financial organization is determined by the ratio of available assets to monetary obligations to be fulfilled. In this case, two points must be taken into account.

Firstly, assets can be not only cash, but also other valuables that, from a financial point of view, have the property of liquidity.

Secondly, the liquidity of an organization is a concept that is closely related to time. There is a bank's current liquidity - the ratio of assets and upcoming payments immediately. It can be calculated for any other period. For example, monthly liquidity is the ratio of receipts to payments during the month, etc.

The concept of bank liquidity is opposed to the concept of profitability. Excessively high liquidity reduces the profitability of operations. If reserves are high, then less cash is used for investments. An extreme case: at the time of creation of a credit organization, all its funds are in a correspondent account with the Central Bank. Liquidity reaches 100%, and profitability is zero, since investments have not yet been made.

As the bank develops its activities, it attracts money from depositors and issues loans. At the same time, profitability increases and liquidity decreases.

At the same time, current investors may demand the return of their funds at any time. Thus, excessively low liquidity is associated with the risk of failure of the financial institution. To prevent this from happening, regulators introduce liquidity standards.

There are several sources of bank liquidity. Internal funds include own funds - in cash and on correspondent accounts, other assets that can be converted into money over a certain period: loan portfolio, if assigned, securities, etc.

In addition, it is customary to highlight external sources liquidity: funds that can be quickly raised if needed. These are interbank loans, as well as loans from central banks.

In his activities credit organizations use different methods of liquidity management. In particular, they draw up so-called payment calendars, reflecting upcoming receipts and debits of funds, and calculate payment positions. Situations where cash is temporarily insufficient to meet current financial obligations, while the total value of assets exceeds total debt, are called cash gaps.