The regulating function of wages means that. The role of wages in a market economy. The essence and functions of wages

Wages serve several functions.

Reproductive function consists in ensuring the possibility of reproduction of the labor force at a socially normal level of consumption, that is, in determining such an absolute amount of wages that allows for the implementation of the conditions for normal reproduction of the labor force, in other words, maintaining or even improving the living conditions of the worker, who should be able to live normally (pay for rent, food, clothing, i.e., basic necessities), who should have a real opportunity to take a break from work in order to restore the strength necessary for work.

Also, the employee must have the opportunity to raise and educate children, the future labor force. Hence the initial meaning of this function, its determining role in relation to others. In the case when the salary at the main place of work does not provide the employee and his family members with normal reproduction, the problem of additional earnings arises. Working on two or three fronts is fraught with depletion of labor potential, a decrease in professionalism, deterioration of labor and production discipline, etc.

Stimulating function is important from the position of the management of the enterprise: it is necessary to encourage the employee to be active at work, to achieve maximum output, and increase labor efficiency. This goal is served by establishing the amount of earnings depending on the results of labor achieved by each. The separation of payment from the personal labor efforts of workers undermines the labor basis of wages, leads to a weakening of the stimulating function of wages, to its transformation into a consumer function and extinguishes the initiative and labor efforts of a person.

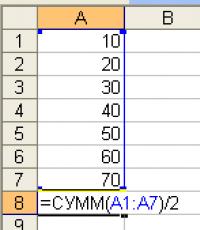

An employee should be interested in improving his qualifications in order to earn more money, because... higher qualifications are paid higher. Enterprises are interested in more highly qualified personnel to increase labor productivity and improve product quality. The implementation of the stimulating function is carried out by the management of the enterprise through specific remuneration systems based on the assessment of labor results and the connection between the size of the wage fund (WF) and the efficiency of the enterprise.

The main direction for improving the entire wage organization system is to ensure a direct and strict dependence of wages on the final results of the economic activities of work collectives. In solving this problem, the correct choice and rational application of wage forms and systems, which will be discussed below, play an important role.

Status function salary presupposes the correspondence of the status, determined by the size of the salary, with the labor status of the employee. Status refers to a person’s position in a particular system of social relations and connections. Labor status is the place of a given employee in relation to other employees, both vertically and horizontally. Hence, the amount of remuneration for labor is one of the main indicators of this status, and its comparison with one’s own labor efforts allows one to judge the fairness of remuneration.

This requires the transparent development of a system of criteria for remuneration of individual groups, categories of personnel, taking into account the specifics of the enterprise, which should be reflected in the collective agreement (contracts). The status function is important primarily for the workers themselves, at the level of their claims to the salary that workers of the corresponding professions have in other enterprises, and the orientation of the staff to a higher level of material well-being. To implement this function, a material basis is also needed, which is embodied in the corresponding efficiency of labor and the activities of the company as a whole.

Regulatory function- is the regulation of the labor market and the profitability of the company. Naturally, all other things being equal, the employee will be hired by the enterprise that pays more. But another thing is also true - it is not profitable for a company to pay too much, otherwise its profitability decreases. Enterprises hire workers, and workers offer their labor on the labor market. Like any market, the labor market has laws for the formation of labor prices.

Production-share the wage function determines the extent of participation of living labor (through wages) in the formation of the price of a product (product, service), its share in total production costs and in labor costs. This share makes it possible to establish the degree of cheapness (high cost) of labor, its competitiveness in the labor market, because only living labor sets materialized labor in motion, and therefore presupposes mandatory adherence to the lowest limits of the cost of labor and certain limits for wage increases. This function embodies the implementation of previous functions through a system of tariff rates (salaries) and grids, additional payments and allowances, bonuses, the procedure for their calculation and dependence on the payroll.

The production-share function is important not only for employers, but also for employees. Some non-tariff payment systems and other systems assume a close dependence of individual wages on the wage fund and the personal contribution of the employee. Within an enterprise, the wage fund of individual divisions can be based on a similar dependence (through the labor contribution coefficient (LCC) or in another way).

The organization of wages at an enterprise involves solving a twofold problem:

Guarantee payment to each employee in accordance with the results of his work and the cost of labor in the labor market;

Ensure that the employer achieves a result in the production process that would allow him (after selling the products on the goods market) to recover costs and make a profit.

Thus, through the organization of wages, the necessary compromise is achieved between the interests of the employer and the employee, promoting the development of social partnership relations between the two driving forces of the market economy.

The economic purpose of wages is to provide conditions for human life. For this reason, a person rents out his services. It is not surprising that workers strive to achieve high wages in order to better satisfy their needs. Moreover, a high level of wages can have a beneficial effect on the country’s economy as a whole, ensuring high demand for goods and services.

With a generally high level of wages and a tendency towards their increase, the demand for most goods and services is growing. It is generally accepted that this phenomenon leads to the creation of new and development of existing enterprises and contributes to the achievement of full employment. Proponents of the high-wage economy add that in developed industrial countries, wages are both the main source of income and the main source of livelihood for the bulk of the population.

The stimulating effect it provides is not only greater than other incomes can provide, but also affects the entire country and the economy as a whole. This is a healthy impact, stimulating the production of basic consumer goods rather than expensive items for the elite. And, finally, high wages stimulate the efforts of enterprise managers to use labor wisely and modernize production.

Obviously, there is a certain limit that cannot be exceeded when setting wages. Wages should be high enough to stimulate demand, but if they rise too much, there is a danger that demand will exceed supply, and this will lead to rising prices and trigger inflationary processes. In addition, it will cause a sharp reduction in employment in society and an increase in unemployment.

It is important that wages, while contributing to the rationalization of production, do not simultaneously generate mass unemployment. It is clear that wage issues occupy an important place in the daily concerns of workers, employers and government authorities, as well as their relationships with each other.

While all three parties are interested in increasing the overall volume of production of goods and provision of services, and, consequently, wages, profits and income, their distribution, on the contrary, leads to a clash of interests. The most interested party here is employers, their goals are multifaceted - to reduce production costs, while satisfying government requirements for wages, as well as maintaining a measure of social justice and preventing conflicts between the administration and the workforce.

For the employer, the amount of wages that he pays to employees, along with other costs associated with hiring personnel (social benefits, training, etc.) form the cost of labor - one of the elements of production costs.

While employees are primarily interested in the amount of money they receive and what they can buy with it, the employer views wages from a different angle. To the cost of labor, he adds the cost of raw materials, fuel, and other production costs in order to determine the cost of production and then its selling price. Ultimately, the amount of wages affects the amount of profit that the employer receives.

Thus, the main requirements for organizing wages at an enterprise, meeting both the interests of the employee and the interests of the employer, are:

1) ensuring the necessary wage growth;

2) with a decrease in its costs per unit of production;

3) a guarantee of increasing wages for each employee as the efficiency of the enterprise as a whole increases.

Wages fulfills her own unique complex functions.

The main function is reproductive wage function . It ensures the possibility of reproduction of the labor force.

One of the most important - stimulating (motivational) wage function aimed at increasing interest in the development of production. With the help of wages, social problems are solved and the principle of social justice is realized.

Finally, accounting and production wage function . It characterizes the extent of participation of living labor in the process of formation of the price of a product, its share in total production costs.

So, salary is multifunctional. All its inherent functions represent an inextricable unity and only together allow us to correctly understand its essence and content, contradictions and problems that arise in the process of improving the organization of remuneration.

This is important to emphasize because often the opposition of these functions, the overestimation of some and the underestimation of others lead to a violation of their unity and, as a consequence, to one-sided and sometimes incorrect theoretical and practical conclusions regarding the organization of wages.

From the above it follows that each of the functions interacts with the others. For example, such wage functions , How accounting and production, reproductive, stimulating, at the same time play a social role. In turn, in reproductive function are being implemented stimulating and accounting and production functions of wages.

At the same time, with general unity, each or several functions are to a certain extent opposite to the others, or even exclude any of them, or reduce the result of its action.

The most significant contradiction of functions is that some of them lead to wage differentiation, others, on the contrary, to their leveling. The stronger the equalization, the weaker the differentiation, the weaker the stimulating effect of wages. This is a completely normal phenomenon, reflecting internal unity and the struggle of opposites. It does not indicate the inaccuracy of the selected functions.

At wage regulation it is necessary to skillfully use the objective unity and opposition of its functions, to strengthen some or weaken others in a timely manner. This will make it possible to organize wages not only in accordance with its objective content, but also taking into account the peculiarities of the development of society.

At the present stage of development of Russian society the highest priority payroll functions, which should first of all be strengthened and activated, are reproductive and stimulating.

Reproductive wage function lies in the ability of wages to compensate for labor costs that took place in the process of human production activity. If the level of wages is insufficient even for the simple reproduction of the labor force, then it does not fulfill its purpose. reproductive function.

Degree of implementation reproductive function can be assessed in relation to the salary received by the employee or the minimum wage (minimum wage) to the level of the subsistence level (physiological, etc.).

Has a different nature and different content stimulating wage function . Thus, for the implementation of the reproductive function of wages, the main (and almost the only) condition is its size. The stimulating function is determined by completely different mechanisms and dependencies. Statements like: “Pay more - there will be more motivation for the employee” are not entirely accurate and justified. The reason for the weak incentive function of wages is different.

It is necessary to strictly distinguish between the concepts “ stimulating (motivational) function» « stimulating role» wages. They are very close, but they cannot be identified.

Stimulating wage function — its ability to direct the interests of workers to achieve the required results of labor (more quantity, higher quality, etc.) by ensuring the relationship between the size of remuneration and labor contribution. The stimulating role of wages manifests itself in ensuring the relationship between wage levels and specific results of workers’ work activities.

Thus, stimulating role can be thought of as a kind of “engine” stimulating function. The “engine” is running, which means that the stimulating function is being implemented, but it is “slipping” - there is no close connection between the amount of remuneration and its results, and accordingly, wages do not ensure the proper interest of workers in achieving high final results.

It can be said that degree of implementation of the stimulating function proportional the level of the stimulating role of wages. This is precisely the fundamental difference and organic relationship between these concepts.

This approach to determining the content " stimulating (motivational) function" And " stimulating role» wages can be extended to other types of employee income.

Let us recall, however, that reproductive wage function cannot be quantitatively measured, it can only exist or be absent, but the stimulating role of wages is measurable. Level of stimulating role may increase or decrease depending, first of all, on ensuring the connection between wages and the labor contribution of employees and their results.

Therefore, it can be assessed, analyzed and compared through effectiveness. By increasing the efficiency of wages, one can judge the increase in its stimulating role.

Currently, primarily due to low usage stimulating wage functions in its considered understanding, more than 50% of workers in the real sector of the economy, social sphere and public service do not fully realize their physical and intellectual potential in the process of work. This is one of the significant reserves for economic growth and improving the standard of living of the Russian population.

Salary functions

Reproductive

ensuring full recovery of the employee’s expenses and creating conditions for his normal life activities

Stimulating

wages are a means of motivation through the establishment of a quantitative relationship between the amount of payment and the quantity, quality and results of workers’ work

Social

wages should reflect the social status of the employee and solve the problem of social justice

Formation of effective demand

the influence of wages through the effective demand of the population on the volume and structure of goods and services produced and, to a large extent, on investment policy

Regulating (resource-allocation)

optimization of the deployment of labor resources by region, economic sector, enterprise through influence on the demand and supply of labor

Accounting and production

reflects the extent of participation of living labor in the process of formation of the price of a product, its share in total production costs.

Motivational

the development of creativity in work and moral and prestigious attitudes shapes the moral qualities of workers, their work morale.

41. Wage regulation system and its elements.

From the requirements of economic laws, a system of principles for regulating wages can be formulated, including:

The principle of payment based on costs and results. For a long period of time, the entire system of organizing wages in the state was aimed at distribution according to labor costs, which does not meet the requirements of the modern level of economic development. Currently, the principle of payment based on costs and labor results, and not just costs, is more strict.

The principle of increasing the level of wages based on an increase in production efficiency, which is determined, first of all, by the action of such economic laws as the law of increasing labor productivity, the law of increasing needs. It follows from these laws that an increase in employee wages should be carried out only on the basis of increasing production efficiency.

The principle of faster growth of social labor productivity compared to wage growth, which follows from the law of increasing labor productivity. It is designed to ensure the necessary savings and further expansion of production.

The principle of material interest in increasing labor efficiency follows from the law of increasing labor productivity and the law of value. It is necessary not only to ensure a material interest in certain results of labor, but also to interest the employee in increasing labor efficiency. The implementation of this principle in the organization of remuneration will contribute to the achievement of certain qualitative changes in the operation of the entire economic mechanism.

Typically, wages are regulated and controlled by competent government agencies.

42. State regulation of wages, its main directions.

State regulation of wages - implementation of measures aimed at implementing the principle of correspondence between the measure of labor and the measure of its payment, ensuring equal pay for equal work.

Directions of state regulation of wages:

Legislative regulation of the conditions and procedure for remuneration, enshrined in the Labor Code of the Russian Federation and other regulations

Regulation of wages of employees in the public sector of the economy based on the tariff system

Establishment of the minimum wage (minimum wage)

Interdistrict regulation using regional coefficients and wage premiums

Tax regulation using direct (income tax) and indirect (VAT, sales tax, excise tax) taxes

Wage indexation

Establishment of regional coefficients and percentages of premiums

Establishment of state guarantees for wages.

There are three types of income and wage policies:

Controlling inflation through taxes and fiscal measures;

Revenue regulation based on government rules and regulations;

Tripartite cooperation policy.

Thus, the state implements measures to regulate wages at two levels:

Determines the state guarantees ensuring the interaction of all employers and employees in order to develop and agree on terms of remuneration;

Directly implemented by the state. guarantees established for employees of state organizations. sectors of the economy that are financed from budgets of different levels.

The short form has become widespread in everyday life description salary as the price of labor power, coming from political economy.

Wages according to Marx

The term salary used to indicate the price of a specific product - labor. In the process of functioning, labor creates value and added value, which is appropriated by the capitalist. The worker who sells his labor power must receive from the capitalist labor price equivalent, equal to or at least approaching the cost of labor. Otherwise, he will not be able to function as a full-fledged worker, since there will be no reproduction of the labor force.

The cost of labor power is determined by the labor socially necessary for its reproduction, that is, the cost of a certain amount of means of subsistence necessary for the reproduction of labor power, namely food, clothing, housing, costs of training and acquiring qualifications, as well as maintaining the worker’s family. Economic essence of wages was first discovered by Karl Marx. He created an entire economic science - political economy, which reveals the mechanism for obtaining surplus value. The capitalist, using economic coercion, forces the labor power he has purchased to function longer than the time necessary to reproduce its value, that is, he forces the worker to create surplus value. If the price of labor is low, no fair wages, then the difference between the proper cost of labor power and this reduced wage forms an additional source of capitalist profit. Salary amount depends on the size of surplus value, on the level of development of the productive forces in a particular country, and on the organization of the working class, the strength of its resistance to the bourgeoisie. How are wages determined in Russia?In the USSR, different constructions were used to determine wages, since it was believed that there was no exploitation of the worker. Besides the meaning it gave labor code wages Several more definitions have been used:

Salaries in modern conditions interpreted more from a legal perspective. |

Wages as an economic category

I think modern is more important for us meaning of wages. How labor price wages defined in political economy, but today a stable word form salary Wikipedia defines in other words:

Wages (employee remuneration) - remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, as well as compensation payments and incentive payments. (Article 129 of the Labor Code of the Russian Federation) Salary (colloquial salary) is monetary compensation (other types of compensation are practically unknown) that an employee receives in exchange for his work.

Salary value in this definition coincides with the concept wages and colloquial form - salary(derived from salary word). Signs of wages listed in the definition on the Wikipedia website coincide with the concept of wages, which gives federal wage law.

The essence of wages is manifested in its main functions (Fig. 1.4), which it performs in the phases of general reproduction: production, distribution, exchange and consumption.

1. Reproductive function is to ensure the reproduction of labor at a certain level of consumption, i.e. the amount of wages should make it possible to maintain and improve the living conditions of workers and members of their families. Expenses for the reproduction of labor depend on natural, climatic, socio-economic, cultural and other conditions. These expenses include costs for food, clothing, housing, recreation, medical care, education, meeting social and spiritual needs, etc. In addition, the employee must have the opportunity to raise and educate children, the future labor force. Socio-economic development and scientific and technological progress lead to a sharp increase in costs for the reproduction of labor (Fig. 1.5). The reproduction function of wages acts as a determinant in relation to other functions.

Rice. 1.4.

Some researchers separately highlight social function wages, which in essence is a continuation and addition of reproduction. Wages should not only ensure the reproduction of the labor force, but also allow satisfying the entire range of secondary needs (social, cognitive, aesthetic, spiritual), enable a person to take advantage of a set of social benefits (high-quality medical and educational services, education for children), and also provide a decent standard of living of an employee who continues to work at retirement age.

Rice. 1.5.

- 2. Distribution (production-share) function involves establishing the employee’s share in the created product. Wages are directly related to the degree of participation of the performer in the production process and reflect the employee’s contribution to the activities of the enterprise. In other words, the distribution function reflects the share of living labor in the distribution of income between the owners of the means of production and hired workers. This share makes it possible to establish the degree of high cost or cheapness of labor depending on the level of qualifications, education, professional experience of the employee, and his competitiveness in the labor market. The distribution function is implemented through various systems and forms of remuneration, additional payments and allowances, bonuses and the procedure for their calculation, the dependence of wages on the wage fund. The use of non-tariff wage systems implies a close dependence of individual wages on the personal contribution of the performer and his achievement of organizational goals.

- 3. Resource-allocation (regulating) function ensures efficient and optimal placement and use of labor resources both at the level of economic sectors and regions of the country, and within enterprises and organizations. Differences in wage levels lead to labor mobility and movement of labor resources to the most efficient sectors and areas of the economy, to specific jobs, motivate workers to look for work in certain regions of the country, industries, and contribute to meeting the enterprise's needs for personnel of a certain professional and qualification composition .

In a market economy, state regulation in the field of placement of labor resources is reduced to a minimum, and the formation and functioning of the labor market presupposes the freedom of the employee to choose the sphere of application of labor. All other things being equal, a person will go to work where they pay more and there are opportunities for career growth. In turn, it is not profitable for the employer to pay too high wages, since in this case the profitability of the enterprise decreases. Thus, workers offer their labor in the labor market, and employers hire workers, making certain demands on them. The labor market, like any market, has its own laws for the formation of labor prices.

- 4. Stimulating function comes down to encouraging the employee to be effective at work, maximize output, and improve the qualitative and quantitative indicators of work activity. This goal is achieved by establishing the amount of wages depending on the performance of the performer’s work. The action of the stimulating function depends on the distribution and reproduction functions and is aimed at increasing production and increasing the efficiency of use of all types of resources available in the enterprise. In order to receive a higher salary, an employee strives to improve his qualifications, acquire the necessary professional competencies, intensify his work activity, and achieve higher quality labor indicators. In turn, the employer is interested in attracting more competent, highly qualified and motivated workers who have the physical and intellectual labor potential necessary to perform the job. The implementation of the incentive function is carried out by management through the use of specific systems and forms of remuneration, the development of bonus systems for employees, and the connection between the size of the wage fund and the efficiency of the enterprise (organization).

- 5. Status function is that the level of wages determines the social status of a person, the prestige of the profession and specialty in the labor market, as well as the status of the company. Social status is understood as the position of an individual in a social group, society as a whole, the system of interpersonal relationships, recognition and respect for him by other people. Labor status is the place of an employee in an organization in relation to other employees, both vertically and horizontally. The amount of remuneration for work is one of the main indicators of social status, and by comparing one’s remuneration with the efforts expended and comparing them with the efforts and remuneration of other workers, a person makes a conclusion about the fairness of remuneration.

- 6. Function of forming effective demand of employees consists in determining their purchasing power, which affects aggregate demand, the structure and dynamics of national production. The effect of this function is manifested in the fact that regulation of wages makes it possible to establish rational proportions between commodity demand and supply.

- 7. Function of ensuring social savings (source of social risk insurance) assumes that the amount of wages determines the amount of contributions to pension insurance and the financing of both the insurance and funded parts of the pension. The level of wages also determines the amount of insurance payments for such social risks as loss of work (unemployment benefits), temporary loss of ability to work (paid sick leave), and paid leave (for maternity and childcare).

Thus, wages perform various functions, the analysis of which allows us to understand its economic and socio-psychological essence, its inherent contradictions that arise in the process of improving the organization of wages.