Specify the factor that influences pricing. The influence of supply and demand on pricing. The influence of the state on pricing processes. Marketing pricing solutions

Before all commercial and many non-profit organizations One of the main problems is determining the price of your goods and services. In market conditions, pricing is a very multifaceted process influenced by many factors.

The main of these factors are the following:

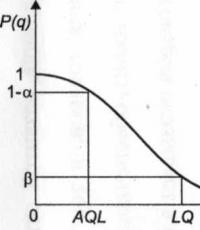

1. Demand for products. Demand has a significant impact on price. The higher the price of a product, the fewer products offered at that price can be purchased by buyers. The relationship between price and demand for it is described by a demand curve, which shows the inverse relationship between the price of a product and the demand for it. If, as prices rise, the demand curve falls, the supply curve, on the contrary, increases. This is explained by the fact that increasing prices motivates manufacturers to increase sales volumes. The price at which supply and demand are equal is called the equilibrium price. This is the price at which the product will be sold. In reality, the relationship between supply and demand is constantly changing as a result of the influence of various factors.

To quantify fluctuations in supply and demand under the influence of various factors, the concept of elasticity is used. Elasticity gives an idea of the extent to which a change in price affects the level of demand.

Demand for various goods can be either elastic or inelastic. Goods of inelastic demand include, for example, everyday goods and relatively inexpensive goods. In addition to elastic and inelastic demand, there is a special case when a percentage fluctuation in price leads to exactly the same change in sales and total revenues remains unchanged.

- 2. State regulation of prices. In an imperfect market, the emerging equilibrium price does not contribute to the optimal state and stability in society. Therefore, the state, by establishing regulated prices, purposefully creates new equilibrium conditions. But the following must be taken into account:

- · the price set by the state cannot change quickly enough under the influence of changes in supply and demand, so there may be a shortage or overstocking of products;

- · complete refusal to interfere in the pricing process deprives society of the opportunity to influence the price level of industries and enterprises.

State regulation of prices is carried out in several main areas. Attempts to collude on prices and establish fixed prices by product manufacturers and representatives of wholesale and retail trade are legally limited.

No matter how "justified" these fixed prices are, they are considered illegal. Entrepreneurs who install them are severely punished, and huge fines are imposed on companies. Such violations are called “horizontal price fixing.”

To avoid suspicion of such violations of the law, entrepreneurs should not: consult or exchange information with competitors about prices, discounts, terms of sale and credit; discuss prices, markups and costs of any firms at professional industry meetings; negotiate with competitors to temporarily reduce production in order to maintain high prices.

“Vertical price fixing” is also a punishable offense. It manifests itself in the fact that manufacturers or wholesale require the sale of their goods at specific prices, thus controlling retail prices. The state also prohibits price discrimination if it harms competition. Thus, manufacturers and wholesalers are obliged to offer their goods to different buyers - participants in distribution channels on the same terms.

- 3. Costs of production and sales of products. The price of a product is based on the costs associated with its production and sale, so their size largely determines the price level. Costs include costs that depend on (the level of use of raw materials and materials, the degree of loading production capacity, labor productivity) and independent (transport tariffs, cost of raw materials, materials, raw materials) from the activities of the enterprise.

- 4. Price competition. Competition pushes firms to improve their products and justify their prices in detail. In this case, the company can focus either on the seller's market or on the buyer's market. In a seller's market, the dominant position is occupied by the seller - the manufacturer of the product. In these conditions, it is easier for the company to operate, since its products are out of competition. In a buyer's market, the buyer dominates. And its well-being depends on how well the company can take into account the changing needs of the buyer and satisfy them in a timely manner.

Price competition affects the price of a product through factors such as industry characteristics of production (for example, capital- or labor-intensive); product life cycle (at what stage life cycle the goods are located); type of product (for example, serial or single); company image; volume of supplies; the relationship between the seller and the buyer (the nature of the relationship may be determined by the contract); conditions of payment.

- 5. State financial system, namely: the level and trends of income of the population, the purchasing power of the monetary unit, the level and dynamics of inflation, changes in the parity of the national currency, etc.

- 6. Participants in product distribution channels. They all strive to increase sales and profits and establish greater control over prices. The manufacturing company influences the price of goods using a system of monopolistic distribution of goods, minimizing the sale of goods through stores selling at discounted prices.

To achieve agreement among all distribution channel participants in pricing decisions, the manufacturer must: provide an appropriate share of the profit to each participant to cover its costs and generate income; provide guarantees for wholesale and retail trade in obtaining products at the lowest prices; offer special agreements, including discounts on prices for a certain period or a free supply of goods to stimulate purchases by wholesale and retail trade.

- 7. Consumers- an important factor that has a significant impact on prices. Any entrepreneur must see the deep relationship between price and how different consumers perceive it. The relationship between prices and the number of purchases made at these prices can be explained by two reasons: the influence of the laws of supply and demand and price elasticity and the unequal reaction of buyers of different market segments to price. It is these reasons that formed the basis for dividing all buyers according to their perception of prices and purchasing orientation into four groups:

- · buyers who show great interest when choosing a purchase in prices, quality, assortment of goods offered (advertising that reveals additional beneficial features this product), this is the so-called group of thrifty buyers;

- · buyers who have created for themselves an “image” of the product they want to own and are sensitive to all characteristics that bring them closer or further away from the “image” are personalized buyers; they require special attention and sensitive service;

- · buyers who support small companies with their purchases and make them according to a long-established tradition, this group of buyers is called “ethical buyers”; they are willing to pay a higher price for the goods sold in this store, sometimes neglecting wide range goods from other stores;

- · buyers who have little interest in prices are “apathetic buyers.”

Of all the previously listed factors, the main impact on price movements is exerted by the dynamics of the production price of goods. An increase in labor productivity, a decrease in the cost of tools and raw materials per unit of production cause a decrease in production prices, and vice versa. Therefore, one would expect that with the acceleration of the pace of scientific and technological progress, there will be a decrease in market prices. However, practice shows that in developed countries, achievements of scientific and technological progress do not lead to a reduction in the cost of goods in a number of industries. This is explained by the fact that the effect of other factors, such as monopoly policies and inflation, is stronger.

Price, as already noted, is the amount of money that is paid for a product. The value of money is determined by its purchasing power, i.e. what you can buy with them. In a market economy, changes in the purchasing power of money within certain limits occur constantly. A significant increase in prices occurs as a result of a sharp increase in inflation and other crisis phenomena, causing a significant deterioration in macroeconomic indicators and their derivatives, which include gross and national product, the country’s external and internal debt, deficit and real budget size, issue size, lending rates, quotes in stock and foreign exchange markets. Other factors also influence price growth: the level of sophistication of the tax system and development legislative framework, the existence of shadow business and corruption, crime, unemployment, level and life expectancy, ongoing political events, the state of the world economy, etc.

Setting a price is a difficult and complex process that requires consideration large quantity factors. One of the factors influencing price formation is the economic value of the product. In the sphere of pricing, the economic value of a good for the buyer or the value manifested in exchange is understood as the assessment of the desired good, which in monetary terms exceeds its price. From this point of view, value can be realistically measured on the basis of the ratio of utility and price of goods that are alternatives available to buyers. Thus, the total economic value of a product is understood as the price of the best alternative product available to the consumer (the price of indifference) plus the value for him of those properties of the product that distinguish it from this best alternative (the value of differences).

The formation of the overall economic value of a product for the consumer can be described using the following formula:

- total value = cost of indifference + positive value of differences - negative value of differences.

In other words, when determining the value of a product for himself, the buyer takes as a starting point the price of the best of the varieties of goods actually available to him from other companies that satisfy the same need. The procedure for calculating the economic value of a product can be quite strictly formalized and become the basis for reliable quantitative estimates. In practice, this procedure consists of four main stages: determining the price of indifference, establishing differences, assessing the significance of differences from the consumer’s point of view, summing the price of indifference with estimates of differences.

Stage 1- determination of the price (or costs) of that good (product or technology) that the buyer is inclined to consider as the best of the alternatives actually available to him. At this stage, it is necessary to functionally measure and determine the price that the buyer will pay if he purchases a functionally comparable quantity of goods offered by competitors.

Stage 2- determination of all parameters that distinguish a product both for the better and for the worse from the alternative. The most frequently analyzed parameters are:

- functioning;

- reliability;

- number (more or less) of useful properties;

- content of beneficial (harmful) substances;

- maintenance costs;

- commissioning costs;

- Maintenance.

Stage 3- assessment of the significance of differences between the parameters of a product and its alternatives from the buyer’s perspective. At this stage, the differences between the goods must be assessed in monetary terms. Such estimates can be obtained in different ways:

- as a result of a survey of experts and sellers;

- by conducting trial sales and customer surveys using special techniques;

- based on calculations economic efficiency(When we're talking about about product parameters that can directly reduce buyer costs).

It is necessary to remember that the scale of quantitative changes in the level of one or another consumer parameter of a product compared to the parameters of alternative products does not necessarily coincide with the scale of changes in the benefits from its use by the buyer and, accordingly, with the change in the amount of money that he agrees to pay to receive this product.

Stage 4- summing up the price of indifference and assessments of the positive and negative value of the differences between a product and its alternatives. In this case, it is usually recommended to set the price below the upper limit of economic value in order to increase consumer interest in the product.

In addition, pricing is influenced by numerous factors of the external and internal environment, therefore all other technical and economic parameters are analyzed and forecasted mainly to determine the price of goods and services produced. In real conditions, prices are formed under the influence of two groups of factors - internal and external. In other words, in the process of determining prices at an enterprise, it is necessary to take into account information about both the market (external factors) and costs (internal factors).

The price is influenced by internal and external factors.

Internal factors include organizational and marketing goals, strategies in relation to individual elements of the marketing mix, costs, and pricing organization.

From the point of view of the goals of marketing activities, the following approaches to pricing can be considered:

- · profit maximization in long term;

- · maximizing profits in the short term;

- · increase in market share indicator;

- · maintaining the status of a price leader in the industry;

- · preventing the emergence of new competitors;

- · maintaining loyalty on the part of resellers;

- · improving the image of the organization;

- · improving sales of “weak products”;

- · preventing “price wars”.

Price is one element of the marketing mix, so the choice of price is also determined by the choice of strategies relative to other elements of the marketing mix. For example, the price depends on the quality of the product, the cost of its promotion, and the stage of the product’s life cycle.

The price must cover all costs: production, distribution and sales associated with promotion, and bring a certain profit, taking into account the risk of obtaining it.

External factors include: type of market; assessment of the relationship between price and value of a product carried out by the consumer; competition; economic situation; government regulation; possible reaction of intermediaries.

In the end, it is the consumer who decides whether the price is right or not. Good pricing begins with identifying needs and assessing the relationship between price and value of the product. Each price determines a different amount of demand, which characterizes the consumer’s response to market supply. The dependence of price on quantity demanded is described using a demand curve.

A demand curve shows how much of a product will be purchased in a given market over a fixed period of time at different price levels for that product. In most cases, but not always, the higher the price, the lower the demand (an exception, for example, is the demand for prestigious goods). To determine the degree of sensitivity of demand to price changes, an indicator of price elasticity of demand is used, which is defined as the ratio of the percentage change in the quantity of demand to the percentage change in its price.

In general, the elasticity of demand is the dependence of its changes on any market factor. A distinction is made between price elasticity of demand and elasticity of demand based on consumer income (calculated similarly). Figure No. 2 shows two demand curves, and an increase in price from C1 to C2 (Fig. 2a) leads to a relatively weak drop in demand (from C2 to C1). In this case, demand is said to be inelastic. Examples include electricity tariffs and housing rents. A similar increase in price on the demand curve (Fig. 2b) leads to a significant increase in demand - elastic demand. This is how prices behave for non-essential goods, say, cars. Many people dream of buying them, and as soon as the price reduction for such goods makes it possible to do this, the purchase is made.

Figure 2. Price elasticity

The degree of elasticity of demand for a change in price is characterized by the coefficient of price elasticity of demand, which is defined as the ratio of the percentage change in the quantity of demand to the percentage change in price. For example, when the price increases by 2%, demand falls by 10% - this means that the elasticity of demand coefficient is - 5 (a negative sign means an inverse relationship between price and demand). This coefficient is usually, although not always, negative. Thus, the income received from the sale of goods with elastic demand, in some cases, can be increased by reducing the price of these goods within certain limits.

In general, the elasticity curve is curved, reflecting changes in demand depending on different price levels. It follows that the more prices rise, the more sensitive the buyer becomes to their changes; the same applies to price reductions.

For a number of goods, for example, prestigious ones, the price elasticity curve may have a special character. A decrease in the price of prestigious goods leads to an increase in demand only within certain limits. As soon as the price no longer corresponds to the image of a prestigious product, demand for it will begin to fall.

If there are no reliable statistics regarding the influence of the price level on sales volume, then it is possible to conduct special experiments to determine price elasticity. For example, in a test market, a five percent increase in the price of the product under study is introduced for a short period of time. If it turns out that this increase did not affect sales volumes, then it will be introduced in all markets,

Prices are also influenced by factors of competition, economic situation and government regulation. It is necessary to take into account the possible reaction of intermediaries - the prices set should enable resellers to receive their profit margin, help them become allies of the manufacturing organization, and help intermediaries effectively sell goods.

Definition of the term pricing

Target pricing

Methods pricing

Theoretical aspects of pricing management in an enterprise

Concept, types of prices and their classification

Main factors influencing pricing

Relationship prices and finance

Pricing management for enterprise

Pricing policy and process pricing for enterprise

Pricing methods for enterprise products

Improvement process establishing prices for products

Pricing: Survival Strategies

Pricing strategies in market analysis

Pricing strategies: if you don't cheat, you won't sell

Definition of the term pricing

Pricing is setting prices, choosing the final price depending on the initial cost of the product, competitors' prices, the relationship between supply and demand and other factors.

Pricing - setting prices, the process of choosing the final price depending on initial cost products, competitors' prices, the relationship between demand and offers and other factors. Basic approaches to setting prices:

Based on closed tenders, based on expected price offers competitors;

Based on perceived value, based on the consumer's perception of the value of the product;

Based on the current price level, based on the current prices of competitors.

Purpose of pricing. Ensure motivated, timely and sufficient price response in such a way as to obtain maximum sales volume with minimal loss of margin.

You need to understand that the pricing of this or that goods always depends on the goals that the organization sets. And the goals are very different:

Survival organizations. Those. it is necessary to set such a price for product which will allow companies survive in the competition. Obviously, such situations do not come from a good life;

Profit maximization;

Market expansion sales;

Positioning a product for a specific niche. For example, if it is luxury, then it may not always be justifiably overpriced if we talk about the costs of its production;

Stimulation sales;

Expansion of the share in the wound;

These are not all goals. If desired, this list can be seriously expanded. After all, all companies have their own goals at one time or another.

Pricing Methods. So, here are the main pricing methods:

1) Based on costs

This method is one of the most understandable and well-known. In this case, the price of the product is set depending on expenses for its production. Those. The cost of the product must cover the costs of producing the product and at the same time bring the organization a certain profit.

Obviously, a serious advantage in such an advantage will be gained by the one that is able to minimize its expenses. Indeed, in this case she will be able to establish more low prices for your products or get more profit. Finally, many believe that this method is quite transparent and fair to the end consumers of products who do not pay for air.

Naturally, this method also has certain problems:

In some cases, it may be quite difficult to calculate the cost of producing a product to establish its value;

If competitors have lower costs, then the company will face serious problems;

Costs may vary. Consequently, the price of the product will also jump;

2) Keeping an eye on competitors

In this case, the price of the product is set based on the prices of competitors. One of the most popular methods is to establish the average price for the industry, when the average price of a product is calculated between the most expensive and cheapest analogues. Finally, the price can be set either higher than that of competitors or lower. It all depends on how the organization wants to position its product on market what goals it pursues.

Of course, even using this pricing method, we must not forget about costs, so that a situation does not arise when the price of a product is simply set out of thin air, while expenses will not allow it to be sold at that price. This will simply not be beneficial to the organization.

3) For product positioning purposes

In this case, the price is set so as to emphasize the advantages of the product and its positioning. For example, if the goal is to make a product expensive and position it as a luxury product, then it is necessary to set a high price. If, on the contrary, a company wants to position a product as affordable, it needs to set the lowest possible price.

4) Based on demand

Everything is logical here. If the demand for a product is off the charts, then the price can be raised. If there is no demand, then it must be omitted. Naturally, you can try to calculate all this in advance using marketing research.

You can also highlight non-basic methods, such as: cost method; market method of consumer valuation; market method of following the leader; auction method; tender method; parametric method; method of specific indicators; method of structural analogy; aggregate method; point method; method of correlation and regression analysis.

Theoretical aspects of pricing management in an enterprise

Concept, types of prices and their classification. Specific pricing options largely determine the company's financial policy. Price is the object of vigorous competition, the results of which largely determine the financial results of market activity, which significantly increases the responsibility of company management for the quality of business decisions that are in one way or another directly or indirectly related to price management. As you know, price is an economic category, meaning the amount of money for which one wants to sell, and buyer ready to buy the product. The price of a certain quantity of a product is its value, hence the price is the monetary value of the product.

According to N.L. Zaitsev, the price is economic category, which makes it possible to indirectly measure the socially necessary costs spent on the production of a product work time. In commodity relations, price acts as a link between producer and consumer, that is, it is a mechanism ensuring balance between supply and demand, and, consequently, between price and value.

Price is a complex economic category. It focuses on almost all the main economic relations in society. First of all, this applies to the production and sale of goods, the formation of their value, as well as the creation, distribution and use of cash savings. Price mediates all commodity-money relations.

Pricing is the process of setting prices for goods and services. There are two main pricing systems: market pricing, operating on the basis of the interaction of demand and offers, and centralized state pricing - the formation of prices by government agencies. At the same time, within the framework of cost pricing, the basis for price formation is the costs of production and circulation.

The price system characterizes the interconnection and interrelationship of various types of prices, consists of blocks, which are considered both specific prices and certain groups of prices.

The first and most important feature of the classification of prices is their accordance with the serviced sphere of commodity circulation.

Depending on this feature, prices are divided into the following main types:

1) wholesale prices for industrial products are divided into 2 subtypes: the wholesale price of an enterprise is the price at which it sells its products to other enterprises; Wholesale price industry- the price at which the enterprise pays its products to supply and sales organizations;

2) prices for construction products. Construction products are valued at three types of prices: estimated cost - size limit construction costs of each facility; list price - the average estimated cost of a unit of final product of a typical construction project; negotiated price - the price established under the agreement between customers and contractors;

3) purchase prices for agricultural products - prices (wholesale) at which agricultural products are sold by farmers;

4) tariffs for freight and passenger transport - fees for the movement of goods and passengers collected by transport organizations from senders of goods and the population;

5) retail prices - prices at which trading companies sell products to the public;

6) tariffs for utilities and domestic services services provided to the population;

Prices serving foreign trade turnover (export and import prices). A similar classification of prices depending on turnover is highlighted by Sergeev I.V. V textbook"Enterprise economy".

Zaitsev N.L. Depending on the nature of the serviced turnover, he distinguishes three main types of prices for industrial products.

The wholesale price of an enterprise is the price that provides for reimbursement of current costs and profit. The enterprise wholesale price plays an important role in economic activity industrial enterprise, because provides him with reimbursement of current production costs and receipt of standard net profit.

Tsopt. prev.= Sp (1+Rcc),

where Sp is the full planned original cost units of production of the enterprise, rub.

Rсс is the level of profitability calculated at the initial cost, i.e. This is the amount of profit received from the sale of the annual volume of products per 1 ruble of annual operating expenses, which can be determined by the formula:

Rсс = (Rpr *PFсr) еСр,

where Rpr is the level of profitability of an industrial enterprise in fractions of a unit;

PFcr - average annual cost production assets, i.e. the amount of fixed and working capital;

Spr is the full planned initial cost of the annual volume of produced and sold products.

Wholesale price industry is formed on the basis of the wholesale price of the enterprise and the additional inclusion in the price of the item of trade, profit of sales organizations and value added tax:

Copt.industrial=Copt. prev.+(Ts.p.- MZ) *VAT+PRsb+TZsb,

where MZ is the actual or planned initial cost of material costs per unit of production;

PRsb, TZsb - and expenses of sales organizations.

The state retail price is the final price at which consumer goods and some instruments and objects of labor are sold through trading network. She represents wholesale price industry plus cost trade organizations and the size of the planned profit. It reflects the process of growth of socially necessary expenses at all successive stages of production of goods:

Tsr=Tsopt.ind.+TZr+Pr.,

where TZr, Pr. - current expenses and profits of retail trade organizations.

Depending on the scope of regulation, there are:

1) free prices that are set by producers of products and services based on supply and demand;

2) contractual prices established by agreement of the parties;

3) prices under conditions of partial or complete monopolization market, which force one or both parties to accept some kind of coercive conditions;

4) regulated prices by agreementpan> prices established under the control of states or individual subjects of the Federation. There are direct and indirect methods of regulation. Direct regulation is carried out by establishing fixed prices, maximum prices, markups, maximum price change factors, and maximum profitability levels. Indirect regulation involves influencing prices through changes taxes and interest rates.

Depending on the territory of action there are:

1) prices, uniform country or waist;

2) prices are regional (zonal, local).

Unified, or zone, prices can be set only for basic types of products, for which prices are regulated (fixed) by government agencies (rents, alloys, etc.).

Regional prices can be wholesale, purchase, or retail. They are established by enterprises, pricing bodies of regional authorities and management (prices and tariffs for the vast majority of housing, communal and personal services).

According to the method of establishing fixation, there are:

Investor Encyclopedia. 2013 .

Synonyms:See what “Pricing” is in other dictionaries:

pricing- pricing... Spelling dictionary-reference book

pricing- The process of forming prices for goods and the price system as a whole. In a free market, the process c. occurs spontaneously, prices are formed under the influence of supply and demand in a competitive environment. … … Technical Translator's Guide

PRICING- the process of formation, formation of prices for goods and services, characterized primarily by methods, methods of setting prices in general, relating to all goods. There are two main pricing systems: market pricing based on ... ... Economic dictionary

Pricing- pricing, the process of choosing the final price depending on the cost of production, competitors' prices, the relationship between supply and demand and other factors. Basic approaches to setting prices: based on closed bidding, based on... ... Financial Dictionary

To effectively organize a business, it is necessary to have a clear understanding of what price is, price-forming factors, and what are the principles for setting prices for goods and services. We will talk about how and what prices are made up of, what functions they perform and how to correctly determine the adequate cost of products.

Price concept

Basic element economic system- this is the price. This concept intertwines various problems and aspects that reflect the state of the economy and society. In the very general view price can be defined as the number of monetary units for which the seller is willing to transfer the goods to the buyer.

In a market economy, identical goods can cost differently, and price is an important regulator of the relationships between market participants and a tool of competition. Its value is influenced by many pricing factors, and it consists of several components. The price is unstable and subject to permanent changes. There are several types of prices: retail, wholesale, purchasing, contractual and others, but all of them are subject to a single law of formation and existence in the market.

Price functions

A market economy differs from a regulated one in that in it prices have the opportunity to freely realize all their functions. The leading tasks that are solved with the help of prices can be called stimulation, information, orientation, redistribution, and establishing a balance between supply and demand.

The seller, by announcing the price, informs the buyer that he is ready to sell it for a certain amount of money, thereby orienting the potential consumer and other traders in the market situation and informing them of his intentions. Most main function establishing a fixed price for a product is to regulate the balance between supply and demand.

It is through prices that producers increase or decrease the quantity of output. A decrease in demand usually leads to an increase in prices and vice versa. At the same time, pricing factors are a barrier to discounting, since only in exceptional cases can manufacturers lower prices below cost levels.

Pricing Process

Setting a price is a complex process that occurs under the influence of various phenomena and events. It is usually carried out in a certain order. First, pricing goals are determined; they are closely related to the strategic goals of the manufacturer. So, if a company sees itself as an industry leader and wants to occupy a certain market segment, it strives to set competitive prices for its products.

Next, the main pricing factors are assessed external environment, the features and quantitative indicators of demand and market capacity are studied. It is impossible to formulate an adequate price for a service or product without assessing the cost of similar units from competitors, so analysis of competitors’ products and their costs is the next stage of pricing. After all the “incoming” data has been collected, it is necessary to select pricing methods.

Usually the company forms its own price policy, which she adheres to for a long period. The final stage of this process is the final pricing. However, this is not the final stage; each company periodically analyzes the established prices and their compliance with the tasks at hand, and based on the results of the study, they can reduce or increase the cost of their goods.

Principles of pricing

Establishing the cost of a product or service is not only carried out according to a certain algorithm, but is also carried out based on basic principles. These include:

- Scientific principles are not taken out of thin air; their establishment is preceded by a thorough analysis of the external and internal environment of the company. Also, the cost is determined in accordance with objective economic laws, in addition, it must be based on various pricing factors.

- The principle of target orientation. Price is always a tool for solving economic and social problems, therefore its formation should take into account the assigned tasks.

- The pricing process does not end with the establishment of the cost of a product in a specific time period. The manufacturer monitors market trends and changes the price in accordance with them.

- The principle of unity and control. Government bodies constantly monitor the pricing process, especially for socially significant goods and services. Even in a free, market economy, the state is assigned the function of regulating the cost of goods; this applies to the greatest extent to monopolistic industries: energy, transport, housing and communal services.

Types of factors influencing price

Everything that influences the formation of the value of a product can be divided into external and internal environment. The first includes various phenomena and events that the product manufacturer cannot influence. For example, inflation, seasonality, politics and the like. The second includes everything that depends on the company’s actions: costs, management, technology. Price-forming factors also include factors that are usually classified by subject: manufacturer, consumers, government, competitors, distribution channels. Costs are included in a separate group. They directly affect the cost of products.

There is also a classification within which three groups of factors are distinguished:

- not opportunistic or basic, i.e. related to the stable state of the economy;

- market conditions, which reflect the variability of the environment, these include fashion factors, politics, unstable market trends, tastes and preferences of consumers;

- regulating, related to the activities of the state as an economic and social regulator.

Basic system of pricing factors

The main phenomena affecting the cost of goods are considered to be indicators that are observed in all markets. These include:

- Consumers. The price is directly dependent on demand, which, in turn, is determined by consumer behavior. This group of factors includes indicators such as price elasticity, buyer reactions to them, and market saturation. Consumer behavior is influenced by the marketing activity of the manufacturer, which also entails a change in the cost of the product. Demand, and accordingly the price, is influenced by the tastes and preferences of buyers, their income, even the number of potential consumers matters.

- Costs. When setting the price of a product, the manufacturer determines it minimum size, which is due to the costs that were incurred in producing the product. Costs can be fixed or variable. The first include taxes, wages, production service. The second group consists of the purchase of raw materials and technologies, cost management, and marketing.

- Government activities. In different markets, the government can influence prices in many ways. Some of them are characterized by fixed, strictly regulated prices, while others are characterized by the state only monitoring compliance with the principles of social justice.

- Product distribution channels. When analyzing price-forming factors, it should be noted that the activities of participants in distribution channels are particularly important. At each stage of product promotion from manufacturer to buyer, the price may change. The manufacturer usually strives to maintain control over prices, and for this he has various tools. However, retail and wholesale prices always differ; this allows the product to move in space and find its final buyer.

- Competitors. Any company strives not only to fully cover its costs, but also to extract maximum profit, but at the same time it has to focus on competitors. Because it's too high prices will scare away buyers.

Internal factors

Those factors that the manufacturing company can influence are usually called internal. This group includes everything related to cost management. The manufacturer has various opportunities to reduce costs by finding new partners, optimizing the production process and management.

Also, internal pricing factors of demand are associated with marketing activities. The manufacturer can help increase demand by advertising campaigns, creating excitement, fashion. Internal factors also include product range management. A manufacturer can produce similar goods or products using the same raw materials, which helps increase profitability and reduce prices for some goods.

External factors

Phenomena that do not depend on the activities of the manufacturer of the product are usually called external. These include everything related to the national and global economy. Thus, the external pricing factors of real estate are the state national economy. Only when it is stable is there strong demand for housing, which allows prices to rise.

Also to external factors include politics. If a country is in a state of war or protracted conflict with other states, then this will certainly affect all markets, consumer purchasing power and, ultimately, prices. State actions in the sphere of price control are also external.

Pricing Strategies

Taking into account various pricing factors, each company chooses its own path to the market, and this is implemented in the choice of strategy. Traditionally, there are two groups of strategies: for new and for existing products. In each case, the manufacturer relies on the positioning of its product and the market segment.

Economists also distinguish two types of strategies for a product that already exists on the market: sliding, falling price and preferential price. Each method of setting prices is associated with a market and marketing strategy.