The level of operating leverage is measured as a ratio. Production (operational) leverage. High leverage pressure

The term "leverage" translated from English literally means the action of a small force (leverage)

In economics, leverage means the leverage of certain indicators to change performance indicators.

Industrial leverage is characterized by the ability to influence the formation of profit from product sales by changing the volume products sold and relationships between variables and fixed costs. The latter means that as a result of an increase in the volume of production (sales) of products, the level of fixed costs is reduced, and therefore the profit per unit of product increases. This will have a corresponding impact on the structure and volume of the main and working capital and the effectiveness of their use.

The level of production leverage is determined by the formula:

Where. LP - production leverage;

DP - growth rate of profit from product sales,%;

DP - growth rate of product sales volume,%

Industrial leverage is essentially an elasticity coefficient; those. shows by how many percent profit will change when sales volume changes by one percent. In this way, the level of sensitivity to changes in production (sales) volume is determined. The greater the value of production leverage, the greater the production cost.

However, the change in profits is influenced not only production factors, but also the results financial activities, in particular, changes in the volume and structure of liabilities due to raised funds (long-term loans from the bank, bond issues, etc.). All this is connected with the payment of interest, i.e. certain expenses.

The impact on changes in profit from financial results is characterized by financial leverage

Financial leverage allows you to optimize the ratio between your own and attracted resources and assess their impact on profit

As the share of long-term loans increases, the amount of interest to be paid increases accordingly. This leads to an increase in the level of financial risk due to a possible lack of funds to pay

Financial leverage is calculated as the ratio of the change in net profit to total profit before tax:

Where. LV - financial leverage;

DP h - growth rate of net profit;

DP з - growth rate of total profit before tax

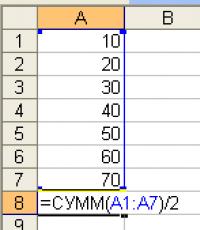

The data required to calculate leverage indicators is given in Table 610

According to Table 610, production leverage is:

![]()

. Table 610

. Initial data for calculating leverage indicators, thousand UAH

. Table continued 610

This means that during the period under study, for every percent increase in sales volume, sales profit grew by 3.4%. Financial leverage is:

![]()

The level of financial leverage shows that with a 1% increase in total profit before tax, net profit increased by 0.66%

A general indicator of leverage is production and financial leverage, which is defined as the product of production and financial leverage:

![]()

Where. LVF - production and financial leverage. Based on the above calculations:

Leverage indicators allow you to plan the optimal production volume, calculate the efficiency of raising funds, and predict production and financial risks.

The process of optimizing the structure of assets and liabilities of an enterprise in order to increase profits in financial analysis is called leverage. In the literal sense, “leverage” is a lever, with a slight change in which you can significantly change the results of the production and financial activities of an enterprise. Types of leverage: production, financial and production-financial.

Factor model of net profit (NP): NP = BP - IP - IF

where VR is revenue; IP, IF – production and financial costs, respectively.

Production costs are the costs of producing and selling products (full cost). Depending on the volume of production, they are divided into constant and variable. The relationship between these parts of costs depends on the technological and technical strategy of the enterprise and its investment policy. Investment of capital in fixed assets causes an increase in constants and a relative reduction variable expenses. The relationship between production volume, constant and variable costs expressed by the production leverage indicator.

Production leverage- this is a potential opportunity to influence the profit of an enterprise by changing the structure of product costs and the volume of its output. The level of production leverage is calculated by the ratio of the growth rate of gross profit DP% (before interest and taxes) to the growth rate of sales in natural or conditionally natural units (DVPP%): Kp.l. = D P% / DRP%

It shows the degree of sensitivity of gross profit to changes in production volume. When its value is high, even a slight decline or increase in production leads to a significant change in profit. Enterprises with higher technical equipment production. As the level of technical equipment increases, the share of fixed costs and the level of production leverage increases. With the growth of the latter, the degree of risk of shortfall in revenue necessary to reimburse fixed costs increases.

The second component is financial costs (debt servicing costs). Their size depends on the amount of borrowed funds and their share in the total amount of invested capital. The relationship between profit and debt-to-equity ratio reflects financial leverage.

Financial leverage is the potential ability to influence profits by changing the volume and structure of equity and debt capital. Its level is measured by the ratio of the growth rate of net profit (DP%) to the growth rate of gross profit (DP%): Kf.l. = DP% / DP%

It shows how many times the growth rate of net profit exceeds the growth rate of gross profit. This excess is ensured due to the effect of financial leverage, one of the components of which is its leverage (the ratio of borrowed capital to equity). By increasing or decreasing leverage, depending on the prevailing conditions, you can influence the profit and return on equity. An increase in financial leverage is accompanied by an increase in the degree of financial risk associated with a possible lack of funds to pay interest on long-term loans and borrowings. A slight change in gross profit and return on invested capital in conditions of high financial leverage can lead to a significant change in net profit, which is dangerous during a decline in production.

Leverage - means the action of a small force (lever), with which you can move fairly heavy objects.

Operating leverage.

Operating (production) leverage is the relationship between the structure of production costs and the amount of profit before interest and taxes. This operating profit management mechanism is also called "operating leverage". The operation of this mechanism is based on the fact that the presence of any amount of constant types in operating costs leads to the fact that when the volume of product sales changes, the amount of operating profit always changes at an even higher rate. In other words, fixed operating costs (costs), by the very fact of their existence, cause a disproportionately higher change in the amount of operating profit of the enterprise with any change in the volume of product sales, regardless of the size of the enterprise, the industry characteristics of its operating activities and other factors.

However, the degree of such sensitivity of operating profit to changes in the volume of product sales is ambiguous at enterprises that have different ratios of fixed and variable operating costs. The higher the share of fixed costs in the total operating costs of the enterprise, the more the amount of operating profit changes in relation to the rate of change in the volume of product sales.

The ratio of fixed and variable operating costs of an enterprise, meaning the level of production leverage is characterized by "operating leverage ratio" which is calculated using the following formula:

Where:

Kol - operating leverage ratio;

Ipost - the amount of fixed operating costs;

Io is the total amount of transaction costs.

The higher the value of the operating leverage ratio at an enterprise, the more it is able to accelerate the growth rate of operating profit in relation to the growth rate of product sales. Those. at the same rate of growth in the volume of product sales, an enterprise with a higher operating leverage ratio, other things being equal, will always increase the amount of its operating profit to a greater extent in comparison with an enterprise with a lower value of this ratio.

The specific ratio of the increase in the amount of operating profit and the amount of sales volume, achieved at a certain operating leverage ratio, is characterized by the indicator "operating leverage effect". The fundamental formula for calculating this indicator is:

Eol - the effect of operational leverage, achieved at a specific value of its coefficient in the enterprise;

ΔGOP - growth rate of gross operating profit, in%;

ΔOR - growth rate of product sales volume, in%.

The effect of production leverage (operating leverage) is a change in sales revenue leading to a change in profit

The rate of volume growth expressed in % is determined by the formula:

I is the change indicating the growth rate, in%;

P.1 – volume indicator obtained in the 1st period, in rubles;

P.2 – volume indicator obtained in the 2nd period, in rubles.

Financial leverage.

Financial leverage is the relationship between the structure of sources of funds and the amount of net profit.

Financial leverage characterizes the enterprise's use borrowed funds, which affects the change in the return on equity ratio. Financial leverage arises with the appearance of borrowed funds in the amount of capital used by the enterprise and allows the enterprise to obtain additional profit on its own capital.

An indicator reflecting the level of additional profit on equity capital at different shares of borrowed funds is called the effect of financial leverage (financial leverage).

The financial leverage effect is calculated using the formula:

EFL - the effect of financial leverage, which consists in an increase in the return on equity ratio, %;

C - income tax rate, expressed as a decimal fraction;

CVR - gross return on assets ratio (ratio of gross profit to average asset value), %;

PC - the average amount of interest on a loan paid by an enterprise for the use of borrowed capital (price of borrowed capital), %;

ZK - the amount of borrowed capital used by the enterprise;

SK is the amount of the enterprise's own capital.

The formula has three components.

1. Tax corrector of financial leverage (1 – C).

2. Financial leverage differential (KLR – PC).

3. Financial leverage ratio or “leverage” of financial leverage (ZK / SC).

Using the effect of financial leverage allows you to increase the level of profitability of an enterprise's equity capital. When choosing the most appropriate source structure, it is necessary to take into account the scale of current income and profit when expanding activities through additional investment, capital market conditions, interest rate dynamics and other factors.

Dividend policy.

The term "dividend policy" is associated with the distribution of profits in joint stock companies.

Dividend is part of the profit of a joint stock company, annually distributed among shareholders in accordance with the number (amount) and type of shares in their possession. Dividends are usually expressed as cash per share. Total amount net profit to be paid as a dividend is established after paying taxes, contributions to funds for expansion and modernization of production, replenishment of insurance and other reserves, payment of interest on bonds and additional remuneration to directors of the joint-stock company.

Dividend policy is the policy of a joint stock company in the area of using profits. The dividend policy is formed by the board of directors depending on the goals of the joint-stock company, and determines the shares of profit that: are paid to shareholders in the form of dividends; remain as retained earnings and are also reinvested.

The main goal of developing a dividend policy is to establish the necessary proportionality between the current consumption of profit by the owners and its future growth, maximizing the market value of the enterprise and ensuring its strategic development.

Based on this goal, the concept of dividend policy can be formulated as follows: dividend policy is component general policy profit management, which consists in optimizing the proportions between the consumed and capitalized parts of it in order to maximize market value enterprises.

The size of the dividend is influenced by the following factors:

Amount of net profit;

Possibility of directing profits to pay dividends, taking into account other costs;

The share of preferred shares and the fixed level of dividends declared on them;

Magnitude authorized capital and the total number of shares.

Net profit that can be used to pay dividends is determined by the formulas:

PPdoa = (PP × Dchp / 100) – (Kpa × Dpa / 100)

NPdoa – net profit allocated for the payment of dividends on ordinary shares;

PE – net profit;

DPP – the share of net profit allocated for the payment of dividends on preferred shares;

Kpa – face value number of preferred shares;

Dpa – level of dividends on preferred shares (as a percentage of par value).

Doa = (PPd / (Ka – Kpa)) × 100

Doa – level of dividends on ordinary shares;

NPV – net profit allocated for the payment of dividends on shares;

Ka is the par value of the number of all shares;

Kpa is the nominal value of the number of preferred shares.

Factors influencing the development of dividend policy:

Legal factors (payment of dividends is regulated by the Law of the Russian Federation “On Joint Stock Companies”);

Conditions of contracts (restrictions associated with the minimum share of reinvested profit when concluding loan agreements with banks);

Liquidity (payment not only in cash, but also in other assets, such as shares);

Expansion of production (restrictions on dividend payments);

Interests of shareholders (ensuring a high level of market value of the company);

Information effect (information about non-payment of dividends can lead to a decrease in stock prices).

Dividend policy directly depends on the chosen dividend payment method reflected in various types dividend policy (table).

Table

Related information.

The current activities of any company when implementing a specific investment project is associated not only with production (operational) but also with financial risk. The latter is determined primarily by the structure of the sources of its financial resources and, in particular, their ratio based on equity or borrowed capital. The situation when a company, to implement a specific investment project, is not limited to its own capital, but attracts funds from external investors, is quite natural.

By attracting borrowed funds, the investment project manager gets the opportunity to control larger flows cash and, therefore, implement more significant investment projects. At the same time, it should be clear to all borrowers that there are very specific limits to debt financing in general and investment projects in particular. These limits are determined mainly by the increase in costs and risks associated with attracting borrowed capital, as well as a decrease in the company's creditworthiness in this case.

When implementing a specific investment project, what should be the optimal ratio between own and attracted long-term financial resources and how will this affect the company's profits? The answer to this question can be obtained using the category of financial leverage, financial leverage, the strength of which is determined precisely by the share of borrowed capital in the total capital of the company.

Financial leverage – the potential opportunity to influence the net profit of an investment project (company) by changing the volume and structure of long-term liabilities; varying the ratio of own and borrowed funds in order to optimize interest payments.

The question of the advisability of using borrowed capital is directly related to the effect of financial leverage: increasing the share of borrowed funds can increase the return on equity.

The effect of financial leverage can be demonstrated quite convincingly and clearly using the famous DuPont formula (Dupont,) widely used in international financial management to assess the level of return on a company's equity (Return on equity , ROE):

where is the return on sales ratio; – asset turnover ratio; (Return on assets) – return on assets ratio; IL – financial leverage.

From this formula it follows that the return on capital ratio ( ROE) will depend on the amount of financial leverage, determined by the ratio of the company's own and borrowed funds. It is obvious, however, that with an increase in financial leverage, the return on capital ratio increases only if the return on assets ratio ( ROA) will exceed the interest rate on borrowed funds. Although this statement is understandable on a purely intuitive level, we will try to formalize the relationship between financial leverage and return on assets by answering the question under what conditions does financial leverage influence ROE turns out to be positive?

For this we introduce the following notation:

N1 – net profit; G.I. – earnings before interest and taxes (book profit – EBIT); E – own capital; D – borrowed capital; j – interest rate on capital; t – tax rate.

Or, taking into account that the quantity represents the so-called operating room (production ) profitability , we can write

where is the adjusted interest rate on capital for

after paying taxes.

The resulting expression ROE is very meaningful, as it clearly shows that the impact of financial leverage, the strength of which is determined by the ratio D to E, depends on the ratio of two quantities r And i.

If the operating return on assets exceeds the adjusted interest rate on debt capital, the company receives a return on its invested capital that exceeds the amount it must pay to creditors. This creates a surplus of funds distributed among the company's shareholders, and, therefore, increases the return on capital ratio (ROE). If the operating return on assets ratio is less than the adjusted borrowing rate, then the company is better off not borrowing these funds.

An illustration of the influence of the interest rate level on the company’s return on equity capital under conditions of financial leverage is given in Table. 6.14.

Table 6.14

Impact of interest rate onROE

|

Indicators for the investment project |

Investment projects |

|||

|

A |

B |

|||

|

Annual interest rate |

Annual interest rate |

|||

|

Amount of assets, thousand dollars |

||||

|

Own capital, thousand dollars |

||||

|

Borrowed capital, thousand dollars |

||||

|

Earnings before interest and taxes ( G.I. ), thousand dollars |

||||

|

Return on assets ratio ( ROA ), % |

||||

|

Interest expenses, thousand dollars |

||||

|

Taxable profit (G/), thousand dollars |

||||

|

Taxes (t = 40%), thousand dollars |

||||

|

Net profit (LU), thousand dollars |

||||

|

Return on Capital Ratio (ROE) % |

||||

As follows from the above, two components can be distinguished in the effect of financial leverage.

Differential – the difference between the operating return on assets and the adjusted (by the profit tax rate) interest rate on borrowed funds.

Shoulder financial leverage, determined by the ratio between debt and equity capital.

It is obvious that there is an inextricable, but at the same time contradictory connection between these components. When the volume of borrowed funds increases, on the one hand, the leverage of financial leverage increases, and on the other, as a rule, the differential decreases, since lenders tend to compensate for the increase in their financial risk by increasing the price of their “product” - loan rates. In particular, there may come a time when the differential becomes negative. In this case, the effect of financial leverage will lead to very negative consequences for the company implementing the corresponding investment project.

Thus, a reasonable financial manager will not increase the financial leverage at any cost, but will regulate it depending, firstly, on the differential and, secondly, on the predicted market conditions.

The method of assessing financial leverage discussed above, while remaining the most well-known and used, is not at the same time the only one. For example, the American school of financial management widely uses an approach that involves comparing the rate of change in net profit (GM) with the rate of change in earnings before interest and taxes ( TGI ). In this case, the level of financial leverage (FL) can be calculated using the formula

Using this formula, they answer the question by how many percent will net profit change if there is a one percent change in profit before interest and taxes. Designating – interest on loans and borrowings, a t – the average tax rate, we modify this formula into a more computationally convenient form

Thus, the coefficient FL receives another interesting interpretation - it shows how many times profit before interest and taxes exceeds taxable profit (67 – ). The lower limit of the financial leverage ratio is one. The greater the relative volume of borrowed funds attracted by the company, the greater the amount of interest paid on them (), the higher the level of financial leverage, the more variable the net profit, which, other things being equal, leads to greater financial instability, expressed in a certain unpredictability of the amount of net profit. Since the payment of interest, unlike, for example, the payment of dividends, is mandatory, then with a relatively high level of financial leverage, even a slight decrease in profit can have very negative consequences compared to a situation where the level of financial leverage is low.

Production and financial leverage

The considered production and financial leverage can be summarized by the category of production and financial leverage, which describes the relationship between revenue, production and financial expenses and net profit.

As a reminder, operating leverage measures the percentage change in earnings before interest and taxes for each percentage change in sales. And financial leverage measures the percentage change in net income relative to each percentage change in earnings before interest and taxes. Since both of these measures are related to percentage changes in earnings before interest and taxes, we can combine them to measure total leverage.

Total leverage indicator ( TL) represents the ratio of the percentage change in net income per unit percentage change in sales

If you multiply and divide the right side of this equation by the percentage change in earnings before interest and taxes ( TG1 ), then we can express the total leverage indicator through operating indicators ( OL ) and financial (FL) leverage

![]()

The relationship between operating and financial leverage indicators for a certain company, dollars, is given below:

The economic interpretation of the leverage indicators calculated above is as follows: given the current structure of sources of funds and conditions of production and financial activities in the company:

- an increase in production volume by 10% will lead to an increase in earnings before interest and taxes by 16%;

- an increase in earnings before interest and taxes by 16% will lead to an increase in net profit by 26.7%;

- an increase in production volume by 10% will lead to an increase in the company's net profit by 26.7%.

Practical actions to manage the level of leverage do not lend themselves to strict formalization and depend on a significant number of factors: stability of sales, degree of market saturation with relevant products, availability of reserve borrowed capital, pace of company development, current structure of assets and liabilities, state tax policy regarding investment activities, current and the promising situation on stock markets, etc.

Leverage(English – lever) is key factor the company's activities, a small change in which can lead to a significant change in performance indicators.

There are two types of leverage: production (or operating) and financial. Production leverage– the potential to influence sales profits by changing the cost structure and output volume. Production leverage is greatest in companies that have a high share of fixed costs in the structure of the cost of products (works, services). If a company has high operating leverage, then its sales profits are very sensitive to changes in sales volumes.

The effect of industrial leverage is that any change in sales revenue leads to an even greater change in profit. Impact force (effect) production leverage calculated by the formula

where EPL is the effect of production leverage; MD – marginal income(profit); – profit from sales.

If a company with an EPL value of 7 increases its sales revenue by, for example, 1%, then its sales profit will increase by 7%. Conversely, if sales revenue decreases by, for example, 3%, its sales profit will decrease by 21%. Thus, the effect of production leverage shows the degree of entrepreneurial risk. How more strength operating leverage, the greater the risk. In practice, the following dependencies appear:

- 1) if a company operates near the break-even point, it has a relatively large share of changes in profit or loss when sales volume changes;

- 2) for profitable companies with a large sales volume high profit can be observed even with a slight increase in profitability;

- 3) a company with high rate operating leverage, with sharp fluctuations in sales volumes is exposed to a significantly greater degree of risk than with stable sales volumes;

- 4) the greater the share of fixed costs in the company’s total costs, the higher the strength of operating leverage at a certain volume of production, the greater the risk when production volumes are reduced;

- 5) companies that provide significant sales volumes and are confident in the future stable demand for their products, work or services can work with high operating leverage.

In addition, financial leverage or financial leverage can be used to analyze the relationship between profit and debt equity ratio. Financial leverage allows you to potentially influence a company's profit by changing the volume and structure of equity and debt capital. It is calculated by the formula

where FL – financial leverage; – growth rate of net profit; – growth rate of gross profit.

The excess of the growth rate of net profit over the growth rate of gross profit is ensured due to the effect of financial leverage, one of the components of which is leverage. By increasing or decreasing leverage depending on prevailing conditions, you can influence profit and return on equity. Financial leverage ratios reflect the relative size of claims on a company's assets from its co-owners and creditors. Borrowed money allows you to increase the financial strength of the borrower by investing in projects that can bring profit. An increase in financial leverage is accompanied by an increase in the degree of financial risk associated with a possible lack of funds to pay interest on loans and borrowings.

where is the overall profitability of the enterprise, calculated as the ratio of net profit to the average annual amount of total capital and expressed as a percentage; – weighted average interest rate on borrowed funds; Pension Fund – financial leverage as the ratio of borrowed and equity funds.

The effect of financial leverage shows by what percentage the return on equity increases due to the attraction of borrowed funds into circulation:

![]()

The economic meaning of the positive value of the financial leverage effect is that increasing the return on equity can be achieved by expanding debt financing (restructuring capital and debts). At the same time, excessive borrowing can have both positive and negative consequences for the company.