High production volume will ensure. Volume of production and its analysis. Increase in production volume. Calculation of marginal profit in Excel based on the balance sheet

For the conditions of pure (perfect) competition, this law has a very important consequence.

Since under the conditions of this competition MR = P and MR = MC, then at the point of maximum profit MC = P.

The law and its corollary can be illustrated in Fig. 2

The graph in Fig. 2

Before the firm reaches maximum profit (point E) MC

marginal revenue (MR) is greater than marginal cost

After passing point E, the limit P MR

revenue is less than marginal cost

The law of profit maximization applies

not only in conditions of pure competition

but also in any other market structure

(monopoly, oligopoly, monopolistic Q

competition).

Despite the fact that perfect competition

marginal revenue (MR) is always less than price (P), the condition for maximizing profit MR=MC is nevertheless preserved.

In the long run, the firm seeks to increase production by increasing all factors. There is an effect of increasing scale of production.

This effect can be positive, constant, or negative when output grows faster, the same, or slower, respectively, than resource inputs.

One or another type of scale effect determines the minimum efficient size of an enterprise. The minimum efficient size of an enterprise is the size at which the volume of production allows minimizing average costs. Different industries have different minimum efficient plant sizes. Therefore, in the economy, along with large enterprises, there are many small firms operating.

Positive effect of increasing production scale - is to reduce average costs with increasing scale of production. It depends on a number of factors.

A certain impact on the dynamics of average costs is exerted by the advantages of the division and specialization of labor that have not yet been used by the company, the possibility of improving methods of organizing production, and temporary savings on costs associated with the maintenance of the managerial apparatus.

The effect of scale growth is most pronounced in large firms, where, in addition to the already mentioned reserves for increasing labor productivity and reducing average costs, new ones are added. In particular, the possibility of acquiring and effective use expensive and high-performance equipment, advantages when purchasing raw materials and selling goods in large quantities, advantages when obtaining bank loans, etc.

Test questions and assignments.

1. How does a firm differ from an enterprise?

2.What is the difference between an entrepreneur without education legal entity(PBOYUL) and a company with legal entity status?

3. How does a partnership differ from a society?

4.What is the difference between a general and limited partnership?

5.Name the main advantages and disadvantages of LLCs and JSCs

6.What do a general business partnership and a cooperative have in common?

7. How does a state-owned enterprise differ from a unitary enterprise based on the right of full economic management?

8. What is “capital” in the “broad” sense of the word?

9. How do accounting costs differ from economic costs?

10.Why is normal profit included in economic costs?

11.What do the terms “fixed” and “variable” costs mean?

12.Which costs have a parabolic shape on the graph?

13. At what volume of production does the firm receive maximum profit?

1.. Open joint stock company(OJSC) differs from a limited liability company (LLC) in that:

a) an OJSC can only include persons working at a given enterprise, but an LLC cannot;

b) an OJSC is characterized by unlimited liability of its participants for its debts, while an LLC has limited liability of its participants;

c) OJSC has the right to issue shares, but LLC does not;

d) there is double taxation in an LLC, but not in an OJSC.

2. Find the incorrect characteristics of a business partnership (HP) from the following:

a) HT is an association individuals;

b) HT is a legal entity;

c) the liability of persons included in the partnership is always unlimited;

d) HT may also include legal entities.

3. Three participants of the company are liable for its obligations with all the property belonging to them; for the other five, the risk of loss is limited to the amount of their contributions. The company is:

a) a business limited liability company;

b) a limited partnership;

c) a full business partnership;

d) a business company with additional liability.

4. Which of the following is characteristic only of a corporation:

a) involvement of hired managers in management;

b) division of profits between the owners of the company;

c) payment of dividends;

d) use of hired labor.

5..The difference between total revenue and external costs is:

a) accounting profit;

b) economic profit;

c) normal profit;

d) real profit.

6. In the short-term period of the company’s activities, all costs are:

a) alternative;

b) constant and variable;

c) implicit;

d) obvious.

7. Total costs at zero production volume are equal to:

a) fixed costs:

b) economic costs;

c) wages;

d) costs of raw materials.

8.What is the main factor underlying the classification of costs into fixed and variable:

a) labor costs;

b) quantity of products produced;

c) costs of paying for raw materials;

d) costs associated with the use of buildings and structures.

9 Which of the following formulas is correct:

a) accounting profit = total income – opportunity costs;

b) economic profit = total income - explicit costs;

c) normal profit = total income - implicit costs;

d) profit = total revenue – total costs.

10.Marginal revenue is:

a) amount cash receipts received by a company from the sale of a certain amount of goods:

b) receipts per unit of good sold;

c) the increase in revenue that arises from the sale of the next unit of production,

d) the difference between total revenue and total costs for a certain period of time.

11. The condition for maximizing profit is:

a) equality of marginal revenue to marginal costs;

b) the totality of the firm’s fixed and variable costs in connection with the production of products in the short term;

c) an increase in total costs caused by an increase in production by one more unit;

d) an increase in revenue that arises from the sale of another unit of production.

True/False.

- The total costs associated with production grow in direct proportion to the size of the product produced by the firm.

- The value of total fixed costs will not change if, within the short-term period, output increases or decreases.

- Marginal cost can be measured as the ratio of the increase in total variable costs per unit increase in output of this enterprise.

- The minimum efficient size of an enterprise is the size at which the volume of production allows minimizing the sum of total fixed and variable costs.

- Economic profit is the difference between total revenue from the sale of products and the amount of accounting costs and accounting profit.

- The larger the firm's production volume, the lower its fixed costs.

- For firms operating in perfect competition, the price of the product equals marginal revenue.

- Which of the following curves never takes a U-shape:

a) AVC; b) MS; c) AFC; d) ATS

Basic concepts and terms.

Individual entrepreneurship (without forming a legal entity) - a business owned by one person who bears unlimited liability (i.e., with all his property) for his debts.

Unitary enterprise.- commercial organization not endowed with the right of ownership of the property assigned to it. It is created only as a state or municipal one.

External (explicit, accounting) costs – the cost of expended resources, estimated at the current prices of their acquisition.

Implicit costs– opportunity costs of using resources owned by the owners of the company.

Economic costs- costs equal to the amount of income that can be obtained with the most profitable of all alternative ways use of expended resources.

.Fixed costs– costs, the value of which does not depend on the volume of products produced.

Variable costs– costs, the value of which varies depending on changes in production volume.

Average total costs– total costs per unit of production

Marginal cost– additional costs associated with increasing production per unit of output.

Short term– a period during which the volume of use of certain factors of production does not change.

Positive economies of scale– reduction of average costs as production volumes increase.

References.

- Guseva T.A. Business law: Textbook. Benefit. – M.: Publishing house RIOR, 2005. -80 p.

- Introduction to market economics: Textbook. allowance for economics specialist. universities /A.Ya.Lifshits, I.N. Nikulin and others. Edited by A.Ya.Lifshits, I.N. Nikulina. M., 1994.

- Kamaev V.D. and others. Textbook on the basics of economic theory (economics). M., 1994.

- Course of economic theory / Ed. ed. prof. M.N. Chepurina, prof. E.A. Kiseleva. Kirov, 1994.

- Organizationally – legal forms commercial activities in Russia (commentary to the Civil Code of the Russian Federation). – M., 1995.

- Fundamentals of economic theory: Textbook for grades 10-11. general images. establishment with in-depth study of economics / State. Univ. graduate School economics; Ed. S.I. Ivanova. - In 2 books. Book 1.- M.: Vita-Press, 1999.336 p.

Related information.

Under production volume(OP) is understood as the final outcome of an enterprise’s activity in the manufacture of a product and the provision of a production service.

Estimation of production volume

OP is assessed using the following:

- Natural indicator. It describes the nature of the product using its nomenclature, range, and quality.

- Cost indicator. It is used to assess the gross, marketable and sold product.

The main one is the sold product. It represents the price of only that portion of the manufactured product that has already been paid by the buyer. This indicator was given the name “sold shaft”.

Volume commercial product consists of a product already sold and the cost of that part of it that is in storage or has already been sent to the customer, but has not been paid by him.

The volume of gross product is the totality of the product produced for a specific period. It combines the position of a marketable product, the cost of increasing or decreasing the number of remaining semi-finished products in production.

OP is determined using:

labor indicators – wage fund, bonuses for workers;

indicators of the net product, represented by the difference between the gross product and material goods used in production (raw materials, materials, fuel, energy).

These points are not subject to the distorting influence that material intensity of production has in various industries.

With the use of such indicator systems, the calculation of the definition of OP will be more authentic and realistic.

Stay up to date with everyone important events United Traders - subscribe to our

5.6. Economies of scale and optimal enterprise size

In the long term, by expanding production space, installing additional equipment, increasing the amount of labor and materials used, etc. the firm increases its size, i.e. scale of production. Moreover, as the scale of production increases, long-term average costs may behave differently, i.e. they may increase, remain constant, or decrease. The dynamics of long-term average costs depends on economies of scale.

Economies of scale (returns to scale) are the coefficient of change in production volume when the quantity of all resources used changes. There are constant, positive and diseconomies of scale or constant, increasing and decreasing returns to scale.

Let us assume that the initial relationship between output (production volume) was described by the production function. If the amount of resources used increases by k times, then the new output volume will be:  .

.

P  permanent economies of scale

means that output increases in the same proportion as the number of factors of production, i.e.

permanent economies of scale

means that output increases in the same proportion as the number of factors of production, i.e.  . Since in this case output and resource costs grow in the same proportion, long-term average costs do not change as the scale of production increases.

. Since in this case output and resource costs grow in the same proportion, long-term average costs do not change as the scale of production increases.

Positive economies of scale

means that output increases in a greater proportion than the number of factors of production increases, i.e.  . Since output grows faster than resource inputs, long-term average costs decrease. In this case, we talk about economies of scale. Factors of economies of scale in production are: deeper specialization of resources, more efficient management, more rational use of capital (buildings, equipment, etc.). Thus, with positive economies of scale, as output increases up to a certain point, resource productivity increases and average costs decrease.

. Since output grows faster than resource inputs, long-term average costs decrease. In this case, we talk about economies of scale. Factors of economies of scale in production are: deeper specialization of resources, more efficient management, more rational use of capital (buildings, equipment, etc.). Thus, with positive economies of scale, as output increases up to a certain point, resource productivity increases and average costs decrease.

Diseconomies of scale

means that output increases in a smaller proportion than the number of production factors has increased, i.e.  . Since output grows slower than resource inputs, long-term average costs increase. The factors increasing costs in this case are mainly problems associated with the expansion of the management apparatus and the difficulty of coordinating the work of individual divisions of a large company.

. Since output grows slower than resource inputs, long-term average costs increase. The factors increasing costs in this case are mainly problems associated with the expansion of the management apparatus and the difficulty of coordinating the work of individual divisions of a large company.

Graphically, the effect of scale looks like this (Fig. 5.6.1).

If the distance between isoquants decreases, this indicates that the same increase in output is achieved through less and less use of resources, i.e. there is a positive effect of scale (Fig. 5.6.1b). If the distance between isoquants increases, then the same increase in output is achieved using more and more resources used. This means that there is a negative scale effect (Fig. 5.6.1c). Constant economies of scale are graphically depicted in Fig. 5.6.1.a.

Economies of scale and the dynamics of long-term average costs determine the optimal (efficient) size of the enterprise, which in turn determines the market structure of the industry. The optimal enterprise size is the enterprise size that ensures minimum long-term average costs.

In different sectors of the economy, due to the fact that the technology used in them differs, the volume of output at which the highest economies of scale are achieved differs, and the optimal size of enterprises differs.

Thus, there are industries whose technological specificity exhausts positive economies of scale and minimal costs already at small sizes enterprises (for example, the service sector, retail trade, baking industry, construction, etc. - Fig. 5.6.2.a).

For other industries, positive economies of scale operate over a fairly long period of growth in production volumes. This means that both small and large firms can coexist in these industries (production of food, clothing, furniture, textile industry etc. rice. 5.6.2.b).

There are also industries whose technological specificity is such that the larger the production volume, the lower the long-term average costs (large positive economies of scale). In such industries, the optimal size in terms of size will be large enterprises(metallurgy, automotive industry, etc. - Fig. 5.6.2c).

Production results of the enterprise. Concept. Main indicators and meters (units of measurement) of production volume. Analysis of the production results of the enterprise

Main results production activities

A) Technical results.

The quality of products supplied to the market (consumer, customer, client - to the buyer), is the most important result production activities. But quality does not exist on its own; it is embodied in products and depends on their quantity.

Here by product we mean any result of production activities: material products(raw materials, materials, substances, products, structures, etc.), energy(thermal, electrical), intellectual products ( information included in the documentation) services(transport, communications, consumer services, financial, consulting, etc.), work ( construction, installation, etc.), complex technical systems, for example, a thermal power plant or a chemical plant.

The output should be as much as the market needs, taking into account factors affecting the variability of demand. In this case, the products must be manufactured and delivered within the calendar time frame and frequency that satisfies the consumer.

So to quantity, quality and release dates products - interrelated results of production activities, which can be called technical results. They show how fully the organization satisfies the needs and expectations of consumers.

B) Financial results.

Production of products in the required quantity, of proper quality and within an acceptable time frame - an undoubted evidence of management effectiveness. But it is important what financial results. Let's choose from them:

Cost for the production of products, including the payment of taxes and other fees, for the reimbursement of current costs (salaries, purchases, rent, etc.), costs for the development and improvement of production, for solving the social needs of personnel and the surrounding society. Costs are directly determined by the design and actual level of quality of products.

Income (revenue) from the sale (sale) of products, which should not only reimburse costs, but make it possible to make a profit and pay dividends (for joint-stock companies). Sales volume depends on demand, demand depends on quality, price and marketing.

Price, which an organization can establish for its products. The price depends not only on costs, but also on quality . Monopoly sale of products with unique quality, which are in high demand, allows you to significantly increase the price.

The financial results of an organization are assessed not only by costs and income. For example, indicators such as labor productivity, profit or size dividends per share. But these indicators are secondary in relation to costs and income, which are more clearly related to quality.

B) Social results.

Interested in good financial results staff organizations, since the level of wages and social benefits depend on them; owners organizations, including shareholders, and society represented by the state, as tax revenues and opportunities for charity increase.

But there are other results that characterize the organization’s relationship with its own staff And society and which show how aware she is of her social responsibility and how fully it fulfills its obligations to them.

To these results, which we will call social, include: magnitude wages staff, condition working conditions and safety, the amount of deductions for social needs impact on environment, amount of various deductions to local and national budgets.

The costs associated with obtaining these results are determined financial results organizations that also directly or indirectly depend on the quality of their products

In a broad sense under the results of the enterprise's activities every consequence of the production process is understood, everything the cause of which is the production process. Such a broad concept of production results allows them to be classified into economic, social, political, environmental results, etc.

Under economy results mean production and financial results.

Production results refer to benefits.

Financial results mean the costs of production and sales of products, revenue from sales of products ( total amount cash or property in in monetary terms received by the manufacturer for sales of products), income, expenses and profit from other sales, non-operating income, expenses and profit.

Production results are products, works, services provided by the enterprise to third parties.

The production results of the enterprise are characterized by the nomenclature (list of names) of manufactured products, assortment (list of varieties, modifications of products of the same name), product quality (a set of properties characterizing the suitability of the product to satisfy needs in accordance with its purpose), production volume, delivery time.

Different types of goods and services are called nomenclature of the production program. The range of products contains the name of the product indicating quantity, quality and delivery dates.

Product range(services) characterizes the share of individual types of products in the production program.

When developing a production program, enterprises use natural, conditionally natural, labor and cost units of measurement. The system of indicators is used to organize planning, accounting and control of costs, sales volumes, nomenclature, assortment and labor intensity of manufactured products (works and services).

Natural meters(pieces, tons, meters, etc.) characterize the production specialization of the enterprise and its market share, are used to establish technological standards for the consumption of raw materials, energy, working time, cost calculation, calculation production capacity. Natural indicators most fully and correctly characterize the level of labor productivity.

Determining the volume of production in natural meters makes it possible to coordinate the production of certain types of products with the needs of the market, production capacity and the need for resources necessary for its production.

Conditionally natural meters used to characterize the volume of output of types of products that are identical in purpose, but have different consumer properties (fuel production is planned in tons of standard fuel, wall materials - in pieces of standard brick, production of canned food - in standard cans) and products of different labor intensity (in transport, given ton- kilometers). The volume of output in conventionally natural meters is determined by multiplying the volume of output in natural meters by a coefficient that takes into account differences in labor costs for the production of a given type of product.

Labor meters(hours and minutes of working time) are used to assess the labor intensity of products and production programs. Labor intensity or standardized working time costs are measured in standard hours. The labor intensity of a production program in standard hours represents the volume of production that must be completed by the team of the enterprise (shop). If the work is not subject to rationing, then labor intensity is calculated in man-hours. To measure the operation of equipment, a machine-hour meter is used.

Cost meters The production program is used simultaneously with natural and labor indicators. In monetary terms, such indicators as sales volume (sold products), commodity, gross, net, conditionally pure and standard-net products, gross and intra-production turnover are calculated.

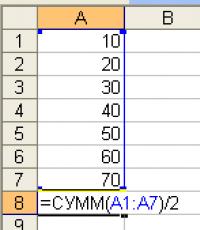

Sales volume (products sold) is the value of goods and services produced and sold by the enterprise for a certain period of time. Volume products sold V in value terms calculated by the formula:

RP = TP ± ?OGPN.P. ± ?OGPK.P.,

Where RP

- ?OGP N.P. - change in balances of finished products at the beginning of the period;

- ?OGP K.P. - change in finished product balances at the end of the period.

TP- commercial products.

Commercial products- this is the cost of finished products obtained as a result of the production activities of the enterprise, completed works and services intended for sale.

The volume of marketable products includes the cost of: finished products intended for external sales to one’s own capital construction and non-industrial farms of their enterprise, semi-finished products of their own production and products of auxiliary and ancillary production intended for sale to the outside, the cost of industrial work carried out on orders from other enterprises or non-industrial farms and organizations of their enterprise. The volume of marketable products is calculated using the formula:

TP = ?(O I · C I ) + ?U J ,

Where ABOUT I- volume of production in natural units;

C I- wholesale price of products;

U J- volume of services and works of an industrial nature.

Sold products are equal to marketable products if the balances of finished products in the warehouse at the beginning and end of the reporting period remained unchanged.

Gross output characterizes the entire volume of work performed by the enterprise for a certain period. Gross output includes marketable products and work in progress.

VP = TP ± ONP N.P. ± SNP K.P. ,

Where ONP N.P. , ONP K.P. - balances of work in progress at the beginning and end of the period.

Work in progress represents the cost of unfinished products at all stages of the production process. The size of work in progress depends on the duration of the production cycle, the volume of production, the nature of the increase in costs, and the technology of manufacturing products. Work in progress in physical terms represents a backlog or stock. In value terms, work in progress is valued at actual cost. The size of work in progress is determined by calculation or experiment.

In enterprises with a short production cycle, work in progress is maintained at a constant level. At enterprises with a long production cycle (construction, shipbuilding, etc.), these indicators vary significantly.

Clean products- this is the newly created value in the enterprise. It includes wages taken into account when determining the cost of production, accruals for wages(single social tax) and profit.

The use of the net production indicator makes it possible to eliminate the repeated counting of products and more accurately determine the efficiency of using enterprise resources.

PP = RP - MZ - A,

Where Emergency- clean products;

RP- products sold (sales volume);

MOH- material costs;

A- depreciation charges.

Conditionally pure products- this is net production taking into account depreciation charges.

Regulatory clean products represents part of the price of the product, including the basic and additional wages of personnel, the unified social tax and the profit of the enterprise.

Gross turnover represents the sum of the cost of production of all divisions of the enterprise.

Intra-factory turnover includes the cost of processing semi-finished products at the enterprise own production, cost of generating energy resources for technological purposes, lighting and heating production units, the cost of tools, parts, spare parts, and auxiliary materials of our own production used in production, the cost of materials of our own production, consumed in current repairs and equipment maintenance, etc.

Enterprises in market economy perform various types work, produce a variety of products and provide all kinds of services. Under the influence of supply and demand, taking into account existing production capacities, the enterprise forms a portfolio of orders (product portfolio) . Order portfolio- a set of external orders that an enterprise has at a given time or for a certain period of time. Product portfolio a set of products produced by an enterprise. The product portfolio must be balanced and include products at different stages life cycle, which ensures the continuity of the enterprise’s production and sales activities, constant profit generation, and reduces the risk of losses from the sale of products at the initial stages of the life cycle.

The efficiency of production activities can be analyzed according to the following aspects:

- - analysis of volumes, range and structure of production

- - analysis of the implementation of the production program;

- - analysis of the quality of manufactured products;

- - analysis of production rhythm;

- - analysis of the efficiency of using production capacity (marginal analysis of bottlenecks);

- - analysis of production factors

- - assessment of reserves for growth in production volumes

- - analysis of production costs

Purpose analysis of output and sales volume production is to identify reserves for growth in product output, forming a range of products sold, expanding market share with maximum use of production capacity, and drawing up a forecast for production development.

Industry specific features of individual industries determine the choice of sequence of actions, steps, stages of analysis and specific calculation methods.

A comprehensive targeted analysis of production and sales of products must be carried out to analyze the competitive position of the enterprise and its ability to flexibly maneuver resources when market conditions change. This general analysis is implemented by conducting the following specific analyses: analysis of the volume and structure of product output, analysis of the fulfillment of contractual obligations and product sales, analysis technical level and product quality, analysis of reserves for growth in production volumes, break-even analysis and stock assessment financial strength. The objects of analysis are shown in Figure 1.2.

Rice. 1.2.

As sources of information for analyzing the volume of output and sales of products can be used statistical reporting, as well as data accounting enterprises.

Analysis of the volume and structure of product output is carried out in several stages:

- 1. Study of the dynamics of gross and commercial output in comparison with the volume of products sold.

- 2. Analysis of the implementation of the production program by assortment.

- 3. Analysis of the product structure and the impact of structural changes on the implementation of the production program.

- 4. Assessment of the break-even point and margin of financial strength of the enterprise.

In the process of analyzing and evaluating production activities based on product characteristics, they resort to concepts such as:

- · gross output is the cost of all products produced and work performed, including work in progress;

- · marketable products - equal to gross minus the balances of work in progress and products produced for one’s own needs;

- · sold products.

The purpose of the analysis is to identify the dynamics, i.e. determination of the absolute (in rubles) and relative (in %) changes in production volume for any period (month) compared to the previous period or the beginning of the year. Analysis of dynamics is very important for identifying trends in the development of production volume and sales of products.

Analysis of the implementation of the production program by assortment allows us to evaluate:

- · degree of fulfillment of contractual obligations;

- · quality of planning;

- · quality of management.

Analysis of the implementation of the production plan allows us to establish the reasons for the ineffective use of production potential.

Assessment of the implementation of the assortment plan is based on a comparison of planned and actual production output for the main types of products included in the range.

Fulfilling the plan according to the structure means maintaining in actual output the ratio of individual types of products determined by the plan. A change in the structure of product production affects all economic indicators: the cost of commercial products, the level of profitability, the volume of commercial products in value terms. The volume of commercial and sold products may increase without an increase in the number of products in physical terms as a result of structural changes in the assortment, i.e. due to an increase in the share of more expensive products.

In the course of structural analysis, the impact of structural changes on the volume of output in value terms is usually calculated and the impact of structural changes on the change in average price is calculated.

When calculating the impact of structural changes on the volume of output in value terms, the volume of commercial output at actual output, planned structure and planned price and the volume of commercial output at actual output, actual structure and planned price are determined and compared. The resulting difference will show the impact of structural changes on the volume of commercial output in value terms.

The volume of production in value terms is determined as the sum of the products of the output of each type of product in physical terms by its share in the total volume and price.

Calculation of the impact of structural changes on changes in average prices is based on determining the weighted average prices under the planned and actual structure and multiplying the difference in the obtained values by the actual output.

An assessment of the break-even and financial strength of an enterprise includes:

- · analysis of fulfillment of contractual obligations for product sales

- · analysis of fulfillment of contractual obligations for product supplies

- · analysis of the technical level and quality of products.

The change in the volume of product sales is influenced by the following factors: shipment of products; balances of goods shipped; balances of finished products in the warehouse at the beginning of the period; release of commercial products; balances of goods shipped at the beginning of the period; balances of goods shipped at the end of the period; balances of finished products in the warehouse at the end of the period. Factors for changes in sales volume are calculated by comparison.

The analysis of product sales is closely related to the analysis of the fulfillment of contractual obligations for the supply of products. Analysis of the fulfillment of contractual obligations is carried out by employees of the sales department of the enterprise. It should be organized in terms of individual contracts, types of products, and delivery dates. At the same time, the fulfillment of contractual obligations is assessed on an accrual basis from the beginning of the year.

The sources of information for operational analysis of the progress of deliveries are primarily data from operational, technical and statistical accounting, and observational materials. Accounting can serve as a source of information, but to a more limited extent due to its lagging nature.

The use of information technology allows you to quickly receive information about shipments for each recipient in terms of assortment, as well as delivery times.

Analysis of the technical level is carried out by comparing the technical and economic indicators of products with the best domestic and foreign samples of similar equipment. In this case, the assessment is carried out according to the main technical and economic indicators characterizing the most important properties products.

At the same stage, an analysis of the use of the enterprise's production capacity is carried out.

Production capacity directly affects the volume of products that an enterprise can produce, i.e. on production program, and therefore is a powerful strategic tool in competition.

In general, production capacity can be defined as the maximum possible release products during the appropriate period of time under certain conditions of use of the equipment and production resources(area, energy, raw materials, living labor).

In practice, there are several types of production capacity: design; launcher; mastered; actual; planned; input and output; input and output; balance sheet

Production capacity, as a rule, is measured in the same units in which the production of this product is planned in physical terms (tons, pieces, meters, etc.).

The more fully the production capacity is used over time, the more products are produced, the lower its cost, the more short terms the manufacturer accumulates funds to reproduce products and improve the production system: replacement of equipment and technologies, reconstruction of production and organizational and technical innovations.

The amount of production capacity is determined by the level of production technology, the range and quality of products, as well as the peculiarities of labor organization, the availability of necessary resources, the level of specialization and cooperation, etc. The instability of factors influencing the value of production capacity gives rise to the multiplicity of this indicator, so they are subject to periodic revision. The leading factor influencing production capacity and determining its value is equipment.

Production capacity may change during each planning period. The longer the planned period, the higher the likelihood of such changes. The following main reasons for changes in production capacity are identified:

- · installation of new pieces of equipment to replace outdated or damaged ones;

- · wear and tear of equipment;

- · commissioning of new capacities;

- · changes in equipment productivity due to intensification of its operating mode or due to changes in the quality of raw materials;

- · modernization of equipment (replacement of units, blocks, etc.);

- · changes in the structure of source materials, composition of raw materials or semi-finished products;

- · duration of equipment operation during the planned period, taking into account rates for repairs, maintenance, and technological breaks;

- · production specialization;

- · operating mode of the equipment;

- · organization of repairs and routine maintenance.

To calculate production capacity, the following initial data are used:

- · list production equipment and its quantity by type;

- · modes of use of equipment and space;

- · progressive standards for equipment productivity and labor intensity of products;

- · qualifications of workers;

- · planned nomenclature and assortment of products that directly affect the labor intensity of products for a given composition of equipment.

When calculating production capacity, the following rules should be followed:

- · All available equipment is taken into account, regardless of its condition: operating or inactive due to a malfunction, being repaired, in reserve or undergoing reconstruction, idle due to lack of raw materials, energy, as well as equipment being installed. Backup equipment intended to replace equipment being repaired should not be taken into account when calculating power.

- · When commissioning new capacities, it is envisaged that their operation will begin in the next quarter after commissioning.

- · The effective maximum possible operating time of equipment under a given shift schedule is taken into account.

- · Advanced technical standards for equipment productivity, product labor intensity, and product yield standards from raw materials are applied.

- · Focus on the most advanced methods of organizing production and comparable measures of equipment operation and power balance.

- · When calculating production capacity for the planned period, we proceed from the possibility of ensuring its full utilization.

- · The necessary reserves of capacity are provided for a quick response to changes in product market demand.

- · When calculating the power value, equipment downtime that may be caused by shortages of labor, raw materials, fuel, electricity or organizational problems, as well as loss of time associated with the elimination of defects, are not taken into account.

The basis for calculating production capacity is the design or certified standards for equipment productivity and technically justified time standards. When the established standards are exceeded by workers, the power calculation is made according to the advanced achieved standards, taking into account sustainable achievements.

In the general case, production capacity M is defined as the product of the equipment’s rated productivity per unit of time H and the planned (effective) fund of its operating time T eff:

In turn, the effective fund of working time of equipment T ef is defined as the calendar fund of time T cal (length of the year - 365 days) minus weekends and holidays and time between shifts T non-working, as well as equipment downtime during scheduled preventive maintenance T etc. and equipment downtime for technological reasons (loading, unloading, cleaning, washing, etc.) T technical:

Determination of specific values of production capacity is carried out for each production unit (site, workshop) taking into account the planned activities. Based on the capacity of the leading group of equipment, the production capacity of the site is established, for the leading section - the production capacity of the workshop, and for the leading workshop - the production capacity of the enterprise. When installing production capacity, measures are developed to identify bottlenecks in order to achieve the best balance of production capacities of the enterprise’s production structures, incl. using parallel-sequential methods of product processing.

To determine the most optimal value of production capacity, it is necessary to justify it. The most common method economic justification production capacity is the critical point analysis. This method is successfully used in planning production capacity. When using this method, it is necessary to construct a graph of the dependence of costs and income on the volume of output based on the production data of the enterprise:

The purpose of the analysis is to find the point (in monetary units or units of output) at which costs equal revenue. This point is the critical point (break-even point), from which the profit area lies to the right and the loss area to the left. Critical point analysis is intended to justify capacity by selecting the volume of output that, on the one hand, will be optimal from the point of view of its sale on the market, and, on the other hand, will provide the lowest total costs while achieving the greatest result.

Many owners of manufacturing enterprises have rather limited financial resources and simply cannot afford to regularly purchase new, more powerful and modern equipment. However, issues of increasing production capacity must be resolved and preferably at minimal cost.

Product quality is analyzed using quality indicators. The following quality indicators are used in the analysis process:

- A) Generalizing. They characterize the quality of all manufactured products, regardless of their type and purpose, for example, specific gravity: new products in its general release; certified and non-certified products; products that meet international standards; exported products, including to highly developed industrial countries, etc.

- B) Individual (single). Characterize one of the quality properties: usefulness (for example, milk fat content); reliability (durability, trouble-free operation); manufacturability, reflecting the effectiveness of design and technological solutions (labor intensity, energy intensity, etc.); aesthetics of products.

- B) Indirect. These are fines for low-quality products, the volume and proportion of rejected products, the proportion of advertised products, losses from defects, etc.

In the process of analyzing product quality, it is necessary to:

- · evaluate the technical level of products;

- · identify deviations of this level for individual products in comparison with the basic level and theoretically possible;

- · analyze the structure of product output according to parameters characterizing the quality of its manufacturing and delivery;

- · identify factors limiting the growth of the technical level of products;

- · justify the possibilities of improving product quality, reducing defects and losses.

Sources of information for analysis can be patents, regulatory and technical documentation, test reports, data from laboratory control of physical and chemical parameters, information from departments technical control(QC), logs and schedules of defect-free delivery of products, etc.

To assess the implementation of the product quality plan, different methods are used:

- - point method: here the weighted average score of product quality is determined and by comparing its actual and planned levels the percentage of quality plan fulfillment is determined.

- - when assessing the implementation of the plan for a variety, the actual share of each variety in the total volume of production is compared with the planned one, and to study the dynamics of quality - with data from previous periods.

- - assessment of the implementation of the product quality plan is also carried out by the specific gravity of certified products, the specific gravity of rejected and advertised products. This analysis is carried out based on data on internal factory defects and external complaints about products.

Product quality indicators are analyzed by comparing actual data not only with data from previous reporting periods and the enterprise plan, but also with similar data from other related enterprises.

In addition to the listed assessment methods for manufacturing enterprises Typically, various quality control tools are used.

Of great importance when analyzing production activities is the assessment of actual output and sales within the production capacity, i.e. within the boundaries of "minimum - maximum" production volume. The break-even volume of production is the volume at which equality of income and costs is achieved. Comparison of the actual volume with the minimum (break-even, critical) volume will allow you to evaluate the “safety” zone of the enterprise and, if the “safety” value is negative, remove it from production individual species products or change production conditions.

Comparing the achieved output volume with the maximum volume determined by the production potential of the enterprise allows us to assess the possibilities of profit growth with an increase in production volumes if demand or the enterprise's market share increases.

During the break-even analysis, it is necessary to carry out:

- · comparison of break-even volume for several periods (or comparison with the plan);

- · assessment of the degree of “security” of the enterprise over time;

- · quantification influence of factors on break-even production volume;

- · calculation of the planned production volume for a given amount of planned (expected) profit.

The break-even volume of production can be calculated using a formula based on the equality of revenue from sales of products and the sum of fixed and variable costs, resulting from the definition of break-even:

where p is the price of a unit of production;

Q - number of units of produced (sold) products;

C F - fixed costs in unit costs;

C V - variable costs in unit costs.

- 1. The break-even volume of output in physical terms is calculated using the formula:

- 2. To calculate the break-even volume of output in value terms, the left and right sides of the expression are multiplied by the price.

- 3. Break-even sales volume can be calculated using the marginal income value. Marginal income MD is defined as the difference between revenue and variable costs. From here:

Closely related to the concept of “break-even volume” is the concept of “margin of financial strength” (safety zone), which is the difference between the actual and break-even volumes.

One of the most important areas of analysis and evaluation of production activities is also the assessment and analysis of the costs of production and determination of its cost.

Production costs: concept, essence, meaning

The production process from an economic and organizational point of view is a rather complex and multifaceted process that requires sufficient effort and labor from the enterprise. Any production is an expense or they are also called costs.

Definition 1

Production costs are the expenses that, one way or another, an enterprise incurs in the manufacture (production) of a product that is subsequently sold on the market.

But here it must be said that there are still small changes, since, for example, payments for housing and communal services, if there is no production, will be less during these periods of time, since there are less costs for electricity or water, wages may also be less, depending on the type of payment systems at the enterprise (if there is piecework payment, then the costs for the enterprise are lower).

If we talk about variable costs, they directly depend on the volume of production; the more products produced, the higher the variable costs. For example, to produce 100 units of products it is necessary to purchase raw materials for 50,000 rubles, and for 200 units 100,000 rubles.