What is profit - a detailed analysis of the concept. Calculation of marginal profit. What formula should I use? High specific marginal profit guarantees break-even production

Marginal profit is the difference between income from sales or sales of products and various variable costs. In this case, income is considered as the company's sales revenue excluding VAT. Concerning variable costs then everything is quite simple, from the final cost of the product the enterprise calculates: the cost of electricity costs, wages of working personnel, the cost of raw materials, fuel, various unforeseen financial investments etc.

Undoubtedly, margin is the main indicator of the capacity potential of an enterprise. The higher it is, the more there is financial resources to pay off variable costs, which increases the potential for the production plan.

It is quite profitable to produce large quantities of goods, since with large-scale production the cost of goods is reduced, which allows you to have a large marginal profit. This pattern in economics is called “economy of scale.” We'll talk about it later.

In business and retail, this concept is quite widespread. This is due to the fact that retailers can change the price of goods during market instability. Because in the laws Russian Federation There is no mention of a penalty for exceeding the margin rate. Permissiveness is restrained only by competition. When there is a shortage of goods, the margin tends to increase. This is a natural response of supply to demand.

Margin in retail- the main income of businessmen. They form the final cost of products on the market.

Calculation formula for calculating the margin rate

Gross marginal profit includes two fundamental indicators - revenue from sales of goods and variable costs.

As you know, margin is the difference between income and variable costs. Below you can consider the formula by which you can calculate the marginal profit.

Marginal profit = “price” minus “variable costs”.

The formula can be seen below.

Marginal profit per unit:

“Price” minus “Cost”.

For example: the price per liter is 50 rubles, and the cost is 20 rubles.

Calculation: 50-20=30,

30 rubles - marginal profit per unit of goods.

To find the total marginal profit, subtract variable costs from this cost (30 rubles).

If your income only covers the final expenses of the manufacturer, then it is at the “point of hopelessness”.

Marginal profit analysis is needed to calculate the critical volume of output that can cover variable costs 100%. It is quite common to call this the break-even point. It provides a guarantee for the feasibility and profitability of production.

The demand for products and the costs of their production are the main criteria for marginal analysis. When calculating it, all factors are taken into account, the influence of which may primarily affect the price. After all, price is the overwhelming criterion for selecting manufactured products on the market. It is a guideline for the buyer; the demand for the product and the success of sales depend on it.

Analyzing the technological capabilities of the enterprise, its payment tariffs wages, fixed and variable costs, taxes and various deductions, it will be possible to formulate the profitability of product production and set the minimum amount of output at which the manufacturer will make a profit.

If the marginal profit is equal to the cost of production, then the profit is zero.

Over the past 15 years, a list of products that have a biased margin percentage has been formed.

- Beverages. All retailers know that reselling drinks is a very profitable business. Another plus is that this product is in seasonal demand.

- Bijouterie. Products made from cheap plastics, glass and various metals are sold with a 300% markup. It's hard to argue that this is beneficial.

- Flowers. The cost of one flower is often 7% of the total cost. Do the math yourself.

- Hand-made products. There's a lot of people here. Prices for exclusive goods can differ in price by thousands, or even more times.

- Tea and coffee by weight. It is quite difficult to imagine that you can make a lot of money from this. But now, for example, purchasing in China at wholesale price tea or coffee and selling in your store at a 300% markup, you can achieve up to 70-80% margin.

- Cosmetics. This information will be useful for women. General statistics say that only 25% of the total price of cosmetics is its cost, and 75% is various markups from retailers.

- Sweets for children. Opening a point of sale for this product provides payback in just the first month. Because the price of the same popcorn, which at cost is equal to 5% of the total price, is inflated by at least 3-4 times, allowing you to get up to 90% of the margin.

Every businessman is interested in creating a business with maximum foreign exchange returns. Of course, no one wants to get involved in a business that will not generate profitable income. Also, no one wants to go into the red. For this purpose, products or offers are classified into:

- High margin;

- Average margin;

- Low margin;

What is a high-margin product? There are a number of reasons why this product is overpriced:

- It is in great demand on the market, but is sold in small quantities. This includes such types of goods as: jewelry, products made of precious metals, branded products for which demand is high throughout the year;

- Created a “wow” effect in the market. These can be different things: from socks to various gadgets. The margin on them increases sharply during periods of surge in demand. But, as a rule, these products hold a high standard only for a short time;

- Seasonal goods. Most people have heard at least once that winter clothes should be bought in the summer. This recommendation proves that the markup on a product increases sharply as its demand increases. Seasonal goods have an order of magnitude highest price than in the off-season. Take ice cream, for example. In winter, the price for this product is the lowest, since it does not cause a stir and the margin on it is about 15% of the real cost. Another situation is in summer period when the demand for a product increases hundreds of times. During this period, entrepreneurs increase their margin to 50-70%, and in some cases by more than 100-200%. For example, at resorts.

There are also high-margin service sectors: cafes, restaurants, etc. Institutions of this type have a high margin percentage (100-200%). In a restaurant, for example, you can sell one bottle of wine, which costs about 1,000 rubles, for 3,000 rubles. The price, as a rule, depends on the status of the establishment and the quality of services. But strangely enough, the demand for these services is growing over time.

Medium-margin goods. These products are often not for everyday use. The margin on them is less than on high-margin ones. Such products include: household appliances, building materials, various tools, electronics and even cars.

Sales representatives typically set a margin of 30-40%. The presented products also have some seasonality, but it is not so great as to be considered.

In business, this niche brings good income, since the balance between price and supply increases the number of sales.

Low-margin goods. As a rule, these are goods of everyday use, such as: household chemicals, non-food products, children's products, etc.

The margin on these goods cannot be higher than 10-20 percent. The benefit from sales of this group of products is due to high turnover.

As for the service sector, according to research data, the lowest income belongs to transportation- no more than 20%.

To date, the state has not yet established the maximum allowable margin for goods and services. That's why price policy is stable only due to market competition. And exceeding the price limit entails the loss of the most important component of market trading - the client.

It is most profitable to buy medium-margin and low-margin goods from wholesalers or close to production, if you have such an opportunity. The higher the wholesale purchase, the greater the discount the manufacturer or distributor gives. As a result, the amount saved partially or fully compensates for transportation or other costs, which reduces its cost.

In the harsh conditions of a market economy, the formation of the price of a manufactured product is influenced by many external and internal factors. Government policy is not always aimed at improving pricing for common market. Increasing tariffs and taxes entails a very large increase in the price of products. Therefore, production facilities are trying to put only some types of goods into large-scale production. This allows you to compensate for all fixed and variable costs and receive a large marginal profit. This is called “economy of scale”.

But the situation is worse with those goods that, although they are in demand, consumer market, but he is not very tall. It is not profitable to place such goods on a large production flow, since wholesale purchases are very small. Manufacturing can only be rational if its cost is high, since all taxation costs and production costs will be taken into account. Such a product is considered high-margin.

There are criteria by which a product is considered profitable for large-scale production:

- Great consumer demand;

- Profitability of implementation;

- Cyclical use of this product among customers;

- Technological accessibility;

- Consumer accessibility;

- Availability of multiple points of sale;

- Stability of implementation.

Compliance with the conditions guarantees that the product will be sold stably on the market, because it is stability that makes it clear that the product can be put into production by default. The demand for it will not fall for a long time and with this you can build long term plans on business diversification.

An important factor in rising product prices is variable costs. After all, they make up 40% of the cost of production. Reducing payments on them will reduce the final cost of the product and increase the margin.

Variable cost reduction methods:

- Implementation innovative technologies;

- Simplification technological process;

- Automation of production;

- Reducing the cost of raw materials and types of purchased fuel;

- Change in product range.

Concerning positive side margin, it’s like any other economic value, is beneficial only for sales representatives. Since the state has not approved the maximum permissible margin interest rate. A good opportunity for those who want to create a high-margin product or service.

The other side is consumer, since the buyer always has to overpay for the product. And it is unlikely that he will ever be able to find out real cost goods. This could become a kind of consumer revolt, which will provoke a decrease in the interest rate of the margin. This benefits no one.

Increasingly, consumers are receiving requests to the Ministry of Finance to distribute the maximum allowable margin for each type of product and service. A reform of this kind will make it possible to stabilize prices, expand the number of points of sale of goods, and significantly reduce the price of high-margin products.

In what cases can the state influence margins?

The state apparatus in Russia does not interfere in the market economy as long as the business is not a monopoly. If the enterprise has grown to such a scale that there are no competitors left in terms of market shares or production volume, the antimonopoly committee comes into play. This government structure created in order to restrain the ardor of a monopolist in a market where there is no competition for him.

If a monopoly begins to raise prices without good reason, the antimonopoly committee may appeal to the Supreme Court. Responsibility for non-compliance with the rules may be as follows:

- A fine, the amount of which is not limited. For example, in 2016, the court ordered Google to pay a fine of 500 million rubles for deliberately creating unfavorable conditions for other players in the monopolized mobile software market;

- Restriction on activities in the Russian Federation;

- Prohibition on price increases.

If a monopolized market belongs to one or two companies, the marginality of products and services on it is weakly related to the laws of a market economy. Consumers have no other choice but to use the goods or services offered by the monopolist. An example is the above-mentioned mobile market software, 80% of which is occupied by Google with its operating system"Android".

Competing with a monopolist is often pointless. A new player who wants to win market share must have almost unlimited cash injections, which will be aimed at reducing the cost of products or services for the end consumer. This must be done so that the new supply can compete with the monopoly on price. Obviously, in such situations, the new player has to work at a loss for years. Sometimes decades. Until the market share will provide exponential growth. Resources required for this great amount, so it is difficult to compete with monopolies. The only way to exist in the same market with large corporations is through the activity of the antimonopoly service or moving into other niches, meeting the needs of the audience in new ways or targeting a different target audience.

Marginal profit is the amount Money, remaining after deductions from sales income of expenses associated with the production of goods or their purchase. If we subtract all other types of expenses from it, we get the enterprise’s net income for the reporting period.

Formula for determining marginal profit

Total sales income - all expenses associated with the production of goods or their purchase/Total sales income

Thus, if a company earned 250 thousand rubles from selling goods that cost it 100 thousand rubles, then its marginal profit will be the difference between revenue and costs as a percentage:

250,000 - 100,000/250,000 = 0.60 or 60%

Why do you need to calculate marginal profit?

The closer your result is to 100%, the better. After all, the higher this indicator, the more money your company has to cover other types of expenses.

In most cases, the figure drops well below 100%: most likely you will get less than 50%.

Contribution margin can be used not only to calculate the profitability of a company, but also to calculate the profitability of each individual product or service line. This helps determine the feasibility of selling certain goods, as well as adjust their pricing. If the overall contribution margin is too low, the viability of the enterprise as a whole is called into question. However, if all other expenses are minimal, then it makes sense to continue the business. Additional adjustments in marketing and pricing are also welcome.

Improving the margin indicator

If the contribution margin is low, look at the fixed costs associated with the product: the cost of materials for production, shipping costs, and so on. Try to lower them, and also pay attention to a possible increase in the market price of goods or services.

The lower this figure, the more difficult it is to keep the business afloat. Don't be afraid to adjust different spending paths. Perhaps moving the company to another location with a lower rental rate or reducing the number of employees can increase your profit margin.

Russian microeconomics is replenished with indicators that reflect financial results functioning of the organization. Such indicators are necessary in unstable market conditions, because allow you to formulate a more flexible strategy and consider efficiency with different sides. One of the significant indicators in this group is marginal profit.

Marginal profit - what is this indicator and what does it characterize?

The indicator reflects the financial result for the period. Marginal profit is used when calculating the effect of production without taking into account fixed costs.

It characterizes the income of the enterprise after passing the break-even point. It is advisable to calculate the indicator if fixed costs are covered due to economies of scale.

Marginal profit depends only on the main activity and does not fit into Russian forms accounting statements.

Formula and example of calculating marginal profit

Contribution margin is calculated using information from the income statement. The indicator is calculated as the difference between income and part of expenses. In other words, marginal profit is the difference between revenue and average variable costs.

General calculation formula

IN general view net profit can be found using the following formula:

MP = TR – VC, Where

MP (marginal profit) – marginal profit, rub.;

TR (total revenue) – revenue, rub.;

VC (variable cost) – variable costs for the total volume, rub.

The above formula allows you to find the profit for the entire volume. Sometimes it is necessary to know the margin per unit of production, and in this case, use this formula:

MP unit = P – AVC, Where

MP units (marginal profit) – marginal profit per unit, rub.;

P (price) – price of a unit of production (revenue from one piece), rub.;

AVC (average variable cost) – average variable costs, rub.

Balance calculation formula

Russian accounting does not allow identifying variable costs by volume of production, therefore, for the purpose of calculating variable costs, technological production costs are taken. This cost indicator almost always consists of variable costs.

As a result of this amendment, the calculation formula is transformed:

MP = page 2110 – page 2120, Where

line 2110 – revenue, rub.;

line 2120 – technological cost, rub.

Calculation example

The company Ekran LLC is engaged in the production of drills for milling machines. Financial statements for the last 2 years contains the following data:

Then, as a result of the calculation, the marginal profit is:

MP 2013 = TR – VC = 115,000 – 50,000 = 65,000 rubles

MP 2014 = TR – VC =175,000 – 70,000 = 105,000 rubles

Importance of this indicator

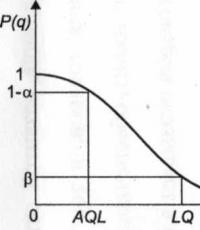

The indicator is significant for calculating indicators when planning production volumes. This is especially true for new types of activities or large investment projects.

Video - lecture “Marginal profit, break-even point and operating leverage”:

Without marginal profit, it is impossible to calculate the break-even volume of production and sales in monetary terms.

The break-even point is the sales volume at which revenues cover losses and profit from sales is zero. You can read more about this indicator in the article “What is the break-even point and how to calculate it.” At the break-even point, contribution margin will be equal to fixed costs.

Operating leverage reflects the ratio of contribution margin to revenue. In other words, the indicator expresses the share of marginal profit in total income. Operating leverage is also called the profitability threshold.

Marginal profit allows you to manage costs more effectively, since it takes into account only total variable costs. The indicator is used when producing several types of products to rationally assess the effect of each type of product.

Video presentation on the topic of marginal profit:

When compiling an income statement, an accountant traditionally calculates several types of profit: gross, from sales, before taxes and net. In management accounting, another type is used - marginal.

The formula for calculating marginal profit is simple, but its application is ambiguous. This is due to different understandings of foreign terms.

Where did profit get its name?

The indicator received the prefix “margin” due to the principle of subtraction, which is used for calculation and was originally incorporated into the essence of margin.

Margin is the difference between the selling price of a specific product (work, service) and its cost. It comes in two types:

- Absolute – in monetary terms as a financial result per unit of production;

- Relative – as a percentage of the sales price as a profitability ratio.

For example, in the banking industry, margin is the difference between interest rates on deposits and loans, and in marketing activities– extra charge.

To calculate margin, you can use several formulas:

- Margin = (Revenue – Cost) : Quantity products sold in natural units

- Margin = Price – Unit cost

- Margin (%) = (Price – Unit Cost) : Price

What is contribution margin and how to calculate it?

Marginal profit (income) is the part of the enterprise’s net income remaining after compensation for the variable costs it has incurred. In the future, marginal profit will be used to finance fixed costs and generate profits.

The calculation of this indicator implies a mandatory division of costs into two groups:

- Variables are costs that are linearly dependent on the scale of activity (the more products need to be produced, the larger they will be);

- Fixed costs are costs whose changes do not directly depend on production volumes. They will take place even if the company cannot produce or sell anything.

The separation method is determined by the accountant based on technological features enterprises and industries.

To determine the total amount of marginal profit, the formula is used:

Contribution Margin = Net Income – Variable Costs

If you need to determine its value per unit of production, then use the formula:

Marginal profit = (Net income - Variable costs) : Sales volume in natural units = Price - Variable costs per unit

Marginal profit ≠ Gross profit

Many accountants, when talking about profit, equate the concepts of “gross” and “margin”. In fact, they differ from each other in essence and in the calculation method.

Gross profit is revenue minus all production costs that relate to products sold in the reporting period.

Contribution margin is revenue minus all variable costs that were incurred to produce the products sold.

As you can see, to determine the gross financial result, you need to divide costs into production and non-production. This involves calculating the full production cost. To achieve marginal profit, you need to separate costs into variable and fixed. In this case, the variables will make up the cost of specific types of products. Constants, which depend not on the volume of activity, but on time, should be considered as period costs (not included in the cost price).

Sometimes an accountant believes that production costs are variables, and non-productive ones are constants. But that's not true. For example, production costs include depreciation and equipment maintenance costs, which are constant in nature. And non-production costs include salesperson bonuses as a percentage of sales and are definitely variable.

Therefore, in order to correctly find the marginal profit, it is important to divide all the costs of the enterprise into variable and constant parts, regardless of the stage at which they arose.

The relationship between contribution margin and profit

Contribution margin shows how much money a company has left to:

- Cover fixed costs;

- Make a profit (before tax).

Therefore, the indicator is also called coverage or contribution to coverage, which is reflected in the formula:

Marginal profit = Fixed costs + Profit

In fact, this is the upper limit of profit when the value of fixed costs changes over time, namely:

- The larger the fixed costs, the lower the profit;

- The company will incur losses if the level of fixed costs exceeds the marginal profit;

- Profit reaches its maximum when fixed costs tend to zero.

These patterns are very important for analysis in order to understand how changes in volumes will affect the financial result. Changes (Δ) of two indicators can be expressed as follows:

Δ MP = Δ BH – ΔZ AC and ΔOP = ΔBH – (ΔZ AC + ΔZ DC)

where BH is net income; Z variable – variable costs;

3rd post - fixed costs.

When the scale of production and sales changes, 3 post remain at the same level, that is, Δ3 post = 0.

Then we get a logical relationship:

ΔOP = ΔBH – (ΔZ variable + 0) = Δ MP

Conclusion: by assessing the dynamics of marginal profit, we can say how much the entire profit will increase or decrease.

Marginal profit ratio and its application

Marginal profit ratio (KMP) is the share of marginal profit in net income. It shows how many kopecks of profit each additional ruble of revenue will bring. Calculated using the formula:

(K MP) = Marginal profit: Net income

(K MP) = Variable costs per unit: Price

This indicator is important in making management decisions market oriented. It is a constant value and does not depend in any way on the volume of activity. With its help, you can predict how much the financial result will change if sales growth or decline is expected:

ΔOP = ΔBH × K MP

For example, if at KMP = 0.3 it is planned to increase sales volume by 120,000 rubles, then we should expect an increase in profit by 36,000 rubles. (120,000 × 0.3).

The break-even point (profitability threshold) is the level of production at which the enterprise's expenses are at the level of income and profit is zero.

By lowering production below this level, the enterprise receives a loss, and by increasing it, it begins to make a profit. To find this indicator in monetary terms, use the profit ratio:

Break-even point = Fixed costs: K MP

This formula is convenient in that it allows you to calculate the break-even level of sales even for enterprises that produce a wide range of products, since there is no need to take into account the price of each individual unit.

The coefficient (K MP) will allow the company:

- Determine the critical level of production and control it;

- When planning the expansion of activities, predict changes in profit with high accuracy;

- For negative financial indicators, calculate a new break-even point and adjust the production and sales plan.

The main disadvantage: this only works ideally when the products are fully sold, that is, there is no work in progress and no leftover finished goods at the end of the month.

Not all entrepreneurs who opened production studied at economic faculties. But sooner or later everyone comes across such a concept as “marginal profit”. What exactly this concept is and by what method it is calculated will be discussed below.

Terminology

Marginal profit (MP / coverage amount / margin) is the difference between sales revenue (excluding VAT) and the company’s incurred variable costs, which is understood as the share of expenses for the purchase of raw materials and production material, employee salaries, public utilities. MP directly depends on market conditions.

If sales volume covers the costs of the enterprise without increasing the level of revenue, then the marginal income is equal to fixed costs and the company is located in . If production profit exceeds all variable costs, we're talking about about the appearance of marginal profit.

The MP value shows what maximum profit the enterprise can realize. The bottom line is that the lower the variable cost indicator, the higher the marginal income, which means the greater the organization’s ability to cover its own costs. Therefore, the development of mass production and large-scale sales volume is the goal of any business.

Marginal Profit Formula

MP = D – PZ;

MP – marginal profit,

D – total income,

PV – variable costs.

In addition to calculating the MP for the entire production volume, there is one for each product separately. It helps identify economically unviable products. The structure of the formula is as follows:

MPed = C – C;

MPed – marginal profit of a single product,

C – selling price,

C – cost.

Example. The company produces cheese of three different brands: “Russian” (price 1 kg – 900 rubles, cost – 750), “Sovetsky” (price 1 kg – 1200 rubles, cost – 900) and “Domestic” (price 1 kg – 800 rubles, cost price – 950). It is necessary to calculate the MP for each of them and determine which cheese is not suitable for production.

MPed (Russian cheese) = 900 – 750 = 150

MPed (Soviet cheese) = 1200 – 900 = 300

MPed (Otechestvenny cheese) = 800 – 950 = -150.

Conclusion: A negative marginal profit indicator indicates that the production of Otechestvenny cheese is inappropriate. The remaining cheeses meet the “norm” criterion.

Summing up

Managing a company requires the entrepreneur to have professional erudition and large quantity time. The entire production process falls on his shoulders, in which the strengths and weak sides sometimes it becomes almost impossible. Analysis of marginal profit allows you to assess the situation in production, track the dynamics of production of a specific product, and make a forecast for the coming years. The “viability” of the entire business depends on how revenue indicators are checked.