Thesis on the topic “Formation and management of bank debt capital using the example of CJSC Bank “Sovetsky”” on the subject of finance and credit. Frolova V.B. Problems of forming the structure of borrowed capital of an organization Managing the loan capital of an enterprise for

IN modern conditions development of economic relations, the issue of attracting borrowed sources financing that forms the capital structure of organizations is becoming increasingly relevant. On the one hand, the emergence of an ever-increasing range of opportunities to attract capital gives a certain freedom to choose the source of activity, and on the other hand, the existing conflicts of interests of the opposing parties to loan relations, the advantages and disadvantages of one or another source, the characteristics of various areas of activity, instability external environment, limit the options for decisions made by the financial manager. The capital structure is the ratio of own and borrowed sources used by the organization in the course of its activities. Sources advanced/invested in assets take the form of capital.

The use of both equity and borrowed capital has positive and negative aspects for the organization, presented in Table 1.

Table 1. Advantages and disadvantages of using equity and debt capital

| advantages | flaws | |

| Equity (share) | Does not involve mandatory payments | Limited volume of attraction |

| Flexibility to exit the business | High cost compared to alternative debt sources | |

| Ensuring financial stability and solvency | Unused opportunity to increase the return on equity ratio by attracting borrowed capital | |

| Positive image | Right to participate in management | |

| Complexity of the organization | ||

| Borrowed capital | Wide range of attraction opportunities | Increased financial risk |

| Ensuring the growth of financial potential | Mandatory payments | |

| Opportunity to increase return on equity | Dependence on fluctuations in stock market conditions | |

| Fixed cost and term | Complexity of the recruitment procedure | |

| The amount of the fee does not depend on the organization’s income | Limiting conditions | |

| The usage fee reduces the tax base | Availability of collateral requirements | |

| Lack of right to control | Limitations on terms and volumes | |

| An increase in borrowed capital leads to a decrease in financial stability, as one of the criteria for creditworthiness |

Among the problems faced by domestic organizations is effective management borrowed capital.

Debt capital management is a system of principles and methods for developing and implementing financial solutions that regulate the process of raising borrowed funds, as well as determining the most rational source of financing of borrowed capital in accordance with the needs and development opportunities of the organization at various stages of its existence.

Economically, it is stipulated that the return on the use of this source of financing activities should exceed the cost of attracting it. In addition, an organization, when attracting borrowed capital, must take into account aspects of maintaining financial stability. Too much borrowing reduces the financial stability of the enterprise, but a small amount of borrowed funds does not allow the enterprise to develop. Thus, the creation of an effectively operating system for managing borrowed capital should be based on organizing the planning, formation and use of borrowed capital in such a way that the enterprise maintains financial stability on the one hand, and on the other, ensures an increase in profitability and economic development.

Currently, there are two models for borrowing capital in the financial market:

- Anglo-Saxon (system of exogenous money supply), which is characterized by borrowing through the stock market mechanism

- Continental (endogenous money supply system), which is characterized by active participation in the process of borrowing a bank loan.

The main forms of attracting borrowed capital currently include: bank loans, bond issues, accounts payable and leasing. Let's take a closer look at these forms.

Credit is the classic and most famous form of raising borrowed capital. A loan is money provided by a lender to a borrower on the terms of urgency, payment and repayment. A bank loan can be provided on both a short-term and long-term basis if the borrower meets the creditworthiness requirements. It is necessary to take into account high price loan for the borrower in modern Russian practice.

Another popular form of debt financing is a bond issue, which is a form of issue of bonds by an organization under certain, pre-agreed legal conditions. The feasibility of issuing bonds is determined by the demand for them on the securities market and the costs of issue. The interest rate on bonds (coupon) in practice is generally much lower than on a bank loan, but there are additional costs associated with the issue.

Accounts payable is the debt of an entity to other persons, which this entity is obliged to repay. Accounts payable is an exclusively short-term source of borrowed funds, and in accordance with the terms of the organization’s contracts, it can be either a paid (set percentage) or a free source of borrowed capital.

The needs of organizations for continuous technical re-equipment, implementation latest technologies, the expansion of the production of goods and services has led to the emergence of new forms of raising capital, one of which is the use of an instrument such as leasing, which is a specific form of lending used when enterprises purchase fixed assets. As a rule, the price of attraction is lower than a classic bank loan, in addition, the default security is the pledge of the purchased equipment.

It should always be taken into account that changes in the volume of funding sources, both in absolute and relative terms, will affect the financial stability of the enterprise. In addition, the structure of attracted sources of funds is influenced by life cycle company (for example, at the initial stage of development of an enterprise, it is not well known, and many difficulties often arise with attracting borrowed capital, but already at the stage of growth of the organization, the best and most acceptable way to form capital is to raise funds from financial markets). As new investment objectives and risks arise for a given organization, cash flow will become more volatile and difficulties in raising capital may arise. If an organization is investing in specific assets, then the risks will be higher and its own capital will be used to a greater extent.

By attracting borrowed capital, the efficiency of the organization's activities increases. Therefore, when managing debt capital, it is necessary to ensure the required volume financial resources, determine the optimal ratio of own and borrowed funds (from the side of risk and profitability), in general, form a certain financial strategy.

The company's need for borrowed resources will be based on the specifics of its activities. For example, business entities in the trading sector are characterized by a predominance of borrowed sources, and large organizations - by their own. It is necessary to take into account that long-term sources of financing in the analysis are equated to own sources.

As an example, we can analyze the capital structure of Moscow United Electric Grid Company OJSC (MOEK OJSC), which is one of the largest distribution electric grid companies in Russia and provides transmission services electrical energy And technological connection consumers to electrical networks on the territory of Moscow and the Moscow region.

Table 2. Capital structure of JSC MOEK

|

Index |

||||||

| in million rubles | in million rubles | in % of the total or in % of the group of liabilities | in million rubles | in % of the total or in % of the group of liabilities | ||

| Capital and reserves |

140 451,8 |

155 177,7 |

171 144,0 |

|||

| long term duties |

39 989,9 |

51 760,1 |

55 384,8 |

|||

| Bank loans | ||||||

| Loans | ||||||

| Other obligations | ||||||

| Short-term liabilities |

69 268,5 |

58 637,3 |

60 218,4 |

|||

| Bank loans | ||||||

| Loans | ||||||

| Accounts payable | ||||||

| Other obligations | ||||||

| Total |

249 710,2 |

265 575,1 |

286 747,2 |

|||

Table 2 shows that long-term and short-term liabilities occupy less than 50% of all sources, short-term liabilities slightly exceed long-term ones. In the structure of long-term liabilities, more than 60% are bank loans (see Fig. 1), and in the structure of short-term liabilities, accounts payable predominates, which is essentially a free source (see Fig. 2).

Rice. 1. Structure of long-term liabilities of JSC MOEK

Rice. 2. Structure of short-term liabilities of JSC “MOEK”

The share of loans is insignificant, however, when choosing a source of borrowing funds, one should take into account the following factors, demonstrating the advantages of loans and bond issues as the main options for attracting borrowed sources (see Table 3). Bond loans are more often used in banking practice.

Banks use to a greater extent borrowed capital attracted from clients – individuals and legal entities, as well as from other banks and the Bank of Russia, while the share of borrowed capital can be 80% of the total capital; Ordinary firms, in order to maintain financial stability, do not strive for a large share of borrowed funds and clearly calculate the purposes for which they will borrow and the ability to return funds to creditors.

Table 3. Advantages and disadvantages of using a bond loan and bank loan

When searching for a source of borrowed capital, difficulties also arise: if it is necessary to finance an investment project, then it may be risky and funds may not be returned to creditors, besides, the greater the risk, the greater the cost of such capital, and there are also low-profit industries, data organizations areas of activity constitute a risk zone for the lender.

Table 4. Capital structure of JSC VTB Bank

|

Index |

|||||

| in million rubles | in % of the total or in % of the group of liabilities | in million rubles | in % of the total or in % of the group of liabilities | ||

| Total liabilities, incl. | |||||

| Loans, deposits, etc. funds of the Central Bank of the Russian Federation | |||||

| Facilities credit institutions | |||||

| Client funds | |||||

| Financial obligations | |||||

| Debt issued | |||||

| Other obligations | |||||

| Reserves for possible losses on contingent liabilities | |||||

| Sources of own funds | |||||

| Balance currency | |||||

As we can see from the calculations, a large share in the bank’s capital is occupied by borrowed capital, that is, liabilities (more than 84%, despite the fact that own funds– just over 15%). (see Table 4) At the same time, in the structure of liabilities (see Figure 3), the largest share falls on customer funds (about 50%) and funds from credit institutions (about 31%).

Rice. 3 Structure of borrowed capital of OJSC VTB Bank

When determining the volumes and timing of funds raised, it is necessary to compare them with the need for the implementation of a particular project and future repayment possibilities, for example, in banks it is necessary to correlate sources and assets by timing and amount to ensure the sustainability and stability of activities; if an investment project is financed, then a long-term source is needed (long-term loan, issue of long-term bonds, leasing). In addition, lending is often carried out for a specific purpose, for example, a project, and accordingly, these funds cannot be used in another direction. The financial strategy should be designed to minimize risks for the company. The financial strategy must be consistent with the financial policy of the organization.

The main directions of this policy are the formation of long-term and short-term credit sources of financing the organization's activities.

In the process of forming financial policy, including the policy of attracting borrowed capital, the management of the organization faces a number of questions and problems that need to be resolved.

1) It is necessary to accurately determine the goals and directions of raising borrowed funds. Perhaps this will be the replenishment of some current assets, the acquisition of fixed assets, advertising campaigns, and the implementation of scientific developments.

2) Determining the optimal amount of borrowed funds. On at this stage The organization's management determines the level of financial leverage effect that ensures a reasonable level of borrowing.

4) Determining the form of raising borrowed funds. If the loan is from a bank, then funds will be raised in the form of a revolving or non-revolving line of credit, an overdraft or a classic form of lending.

5) Determination of acceptable conditions for raising borrowed funds. This includes the form and timing of interest payments, the amount of principal, the possibility of extension, changes in interest rates, etc.

When forming borrowed capital, it is also necessary to take into account that the company’s ability to attract the funds it needs depends on its reputation, on the availability of certain sources of financing, on the flexibility and stability of the company, its size, and when financing an investment project, also on its riskiness and profitability, social and economic significance.

Thus, in general, attracting borrowed financial resources increases financial risk, so the volume of attraction at optimal rates for the company is limited; the targeted nature of most borrowed resources does not provide freedom in disposing of funds, and therefore often leads to lost profits; it is necessary to provide security and these funds can only be used at a certain time, since it is necessary to return the borrowed capital.

At the same time, borrowed capital is necessary for the development of the company, increasing the return on equity, as well as reducing the cost of capital through the use of tax shields when calculating the weighted average price based on the WACC model; in addition, it is often impossible to implement an expensive and important investment project without the participation of investors and creditors (for example, banks that have investment units in their structure are now becoming more active in this area). Therefore, it is necessary to develop an optimal debt capital structure for the company and diversify various sources of raising funds. For example, in addition to credit sources, a company can use a bond issue. However, apart from positive aspects(low rates, lack of a strict purpose of use) this has its own problems. With the help of funds raised by issuing bonds, it is impossible to cover all the company’s losses; a lot of documents need to be prepared, and certain risks arise for creditors.

In order to determine whether the capital structure is optimal, there are various indicators such as the effect of financial leverage, return on assets, return on equity, and financial leverage ratio. The weighted average cost of capital is also calculated.

To summarize, I would like to note the fact that at present there is no established and only correct approach in the world community to solving the problem of forming borrowed capital. There are different views, such as the Modigliani-Miller theory, the traditional approach. However, each of them has its own shortcomings and controversial issues. As a result, the financial management of any organization will have to independently and individually, depending on the characteristics of the organization and its activities, determine the sources of financing activities and the structure of borrowed capital.

Obviously, depending on the specifics of the activities of a particular company, the capital structure will vary. In any case, it is necessary to take into account the need for borrowed capital and all emerging difficulties in raising funds, that is, to formulate an optimal financial strategy that will comply with the conditions of financial stability and minimize the cost of raising capital.

Number of views of the publication: Please waitCollection output:

INFLUENCE OF BORROWED CAPITAL ON THE FINANCIAL CONDITION OF THE ENTERPRISE

Pachkova Olga Vladimirovna

Ph.D. econ. Sciences, Associate ProfessorFederal State Autonomous Educational Institution of Higher Professional Education "Kazan (Volga Region) Federal University", Russian Federation, Republic of Tatarstan, Kazan

Gaptelkhakov Marat Rafkatovich

4th year student of the Federal State Autonomous Educational Institution of Higher Professional Education "Kazan (Volga Region) Federal University", Russian Federation, Republic of Tatarstan, Kazan

INFLUENCE OF BORROWED CAPITAL ON FINANCIAL CONDITION OF THE ENTERPRISE

Olga Pachkova

candidate of Economic Sciences, Associate professor of FSAEI HVE “Kazan Federal University”, Republic of Tatarstan, Kazan

Marat Gaptelhakov

4-year student, FSAEI HVE “Kazan Federal University”, Republic of Tatarstan, Kazan

ANNOTATION

The article discusses borrowed sources of financing for an enterprise. Since in its activities the enterprise is faced with the need to attract additional Money. The types of borrowed capital are considered, the effect of financial leverage is shown in detail, since effectively attracted borrowed capital must satisfy the conditions of reducing costs and increasing profits from the use of capital.

ABSTRACT

The article deals with borrowed sources of financing. Since the company faces the need to raise additional funds in its activity. The types of debt capital are considered; the effect of financial leverage is shown in detail, as effectively involved borrowed capital must satisfy the conditions to reduce costs and increase profits from the capital use.

Keywords: borrowed capital; Bank loan; bond loan; leasing; financial leverage effect.

Keywords: borrowed capital; bank credit; funded loan; leasing; effect of financial leverage.

As a business operates, the need for cash increases, requiring adequate capital gains financing. At the same time, if an enterprise lacks its own funds, it can attract funds from other organizations, which are referred to as borrowed capital. Borrowed capital refers to funds that are lent to an enterprise third parties to achieve the goals of its activities, as well as to make a profit.

The organization of debt capital has a significant impact on the efficiency of companies and is key if they are to make long-term and costly investments.

Among the advantages of using borrowed capital are the following: greater opportunities for attracting, especially with a high borrower rating; increase in return on equity; the possibility of using tax shields that reduce the cost of capital, since interest paid is included in the cost of production; accelerated development of the enterprise and others.

In addition, the use of borrowed capital also has disadvantages: attracting borrowed funds creates financial risks (interest rate, risk of loss of liquidity), the targeted nature of the use of borrowed funds, and the complexity of the procedure for raising borrowed funds.

Borrowed capital as a long-term source of financing is divided into such sources of financing as bank loans, bond loans and leasing. In a general sense, a loan is the provision of funds or other things by one party (the lender) to another party (the borrower).

The bond loan plays a significant role in terms of financing the company's activities. It is carried out through the issue and sale of bonds. The issue of bonds is designed to attract investment from a wide range of people, in contrast to a bank loan. With a bank loan, the lender is a bank or other lending organization.

According to Art. 665 of the Civil Code of the Russian Federation, leasing is the operation of acquiring ownership by the lessor (lessor) of the property specified by the lessee (lessee) from a seller specified by the lessee with the subsequent provision of it for a fee for temporary possession and use for business purposes.

Thus, leasing is a type entrepreneurial activity, which provides for the investment of financial resources by the lessor in the acquisition of property with its subsequent provision to the lessee on lease terms.

The leasing car market is developing rapidly in Russia. This is primarily due to the fact that the cost of expensive property can be completely written off in an extremely short period of time, while its consumer qualities do not actually change. But the market leader in terms of leasing at the end of 2014 is railway equipment, which occupies 42.2%. By comparison, leasing cars account for 21.7% of the market.

When choosing a method for raising borrowed capital, an enterprise should pay attention to the following key parameters:

1. volume of financial resources;

2. deadline for their provision;

3. level of interest payments for the resources provided;

4. type of rate for attracting resources (floating or fixed);

5. the need for collateral and its conditions;

6. terms of repayment.

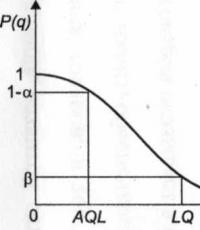

The indicator of financial leverage helps answer the question of how much borrowed funds are per ruble of own rubles. This is the ratio of debt to equity. The effect of financial leverage reflects the change in the return on equity obtained through the use of borrowed funds. It is calculated using formula 1:

The figure below shows the components of the financial leverage effect (Fig. 1).

Figure 1. Financial leverage effect

The tax coefficient (1-t) shows to what extent the effect of financial leverage is manifested in connection with different levels of income tax.

One of the multipliers is the so-called financial leverage differential (Dif) or the difference between the company's return on assets (economic profitability), calculated by EBIT, and the interest rate on borrowed capital. The financial leverage differential is the main condition that forms the growth of return on equity. To do this, it is necessary that economic profitability exceeds the interest rate of payments for the use of borrowed sources of financing, i.e., the financial leverage differential must be positive. If the differential becomes less than zero, then the effect of financial leverage will only act to the detriment of the organization.

The final component is the financial leverage ratio (or financial leverage - FLS). This ratio characterizes the strength of the impact of financial leverage and is defined as the ratio of debt capital (D) to equity capital (E).

The differential and the lever arm are closely interconnected. As long as the return on investment in assets exceeds the price of borrowed funds, i.e. the differential is positive, return on equity will grow the faster the higher the debt-to-equity ratio. However, as the share of borrowed funds increases, their price increases, profits begin to decline, as a result, the return on assets also falls and, consequently, there is a threat of a negative differential.

According to economists, based on a study of empirical material from successful foreign companies, the optimal effect of financial leverage is within 30-50% of the level economic profitability assets (ROA) with financial leverage of 0.67-0.54. In this case, an increase in return on equity is ensured that is not lower than the increase in return on investment in assets.

The effect of financial leverage contributes to the formation of a rational structure of the enterprise's sources of funds in order to finance the necessary investments and obtain the desired level of return on equity, at which the financial stability of the enterprise is not compromised.

For almost any company, borrowed sources of financing mean the possibility of more intensive development, largely due to the formation of an additional amount of assets. However, companies using borrowed capital are more exposed to financial risk and the threat of bankruptcy. Therefore, it is necessary to approach the issue of choosing sources of debt financing more carefully, taking into account all possible risks.

Bibliography:

1.Civil Code Russian Federation. Part 2 of January 26, 1996 No. 14-FZ // Collection of legislation of the Russian Federation. - 1996. - No. 5. - Art. 665.

2. Kovalev V.V. Financial management course: textbook. allowance. M.: TK Velby, Prospekt Publishing House, 2008. - 448 p.

3. Kovalev V.V. Financial management: theory and practice: textbook. allowance. M.: TK Welby, Prospekt Publishing House, 2007. - 1024 p.

4.Koltsova I. Five indicators for an objective assessment of your company’s debt burden // Financial Director. - 2006. - No. 6. - P. 16-21.

5. Market structure by leased items // Rating agency"Expert RA" [ Electronic resource]. - Access mode. - URL: http://www.raexpert.ru/rankingtable/leasing/leasing_2014/tab03/ (access date: 03/28/2015).

6. Effect of financial leverage (DFL) // Website analysis of the financial condition of the enterprise [Electronic resource]. - Access mode. - URL: http://afdanalyse.ru/publ/finansovyj_analiz/1/ehffekt_finansovogo_rychaga/7-1-0-222 (access date: 03/27/2015).

1Increasing business efficiency is impossible only within the enterprise's own resources. To expand their financial capabilities, enterprises resort to attracting additional borrowed funds in order to increase investments in own business, getting more profit. The issue of the formation, functioning and reproduction of capital by small businesses, which are not always easy to attract borrowed capital, is a pressing issue. An indicator of a company's market stability is its ability to develop successfully in conditions of transformation of the external and internal environment. In most cases, small businesses use a bank loan as a source of borrowing, which is explained by the relatively large financial resources of Russian banks, as well as the fact that when receiving a bank loan there is no need to publicly disclose information about the enterprise. To do this, it is necessary to have a flexible structure of financial resources and, when the need arises, to be able to attract borrowed funds, i.e., to be creditworthy.

small business

capital Management

lending

Borrowed capital

1. Guseva E. G. Production management at a small enterprise. Educational and practical manual. –M.: MGUESI, 2008. –114 p.

2. Kovalev V.V. Financial analysis: capital management, investment selection, reporting analysis. - M.: Finance and Statistics, 2007. –512s.

3. Sheremet A.D., Sayfulin R.S. Enterprise finance. Tutorial. –M.: Infra-M, 2007. –343 p.

4. Financial analysis of the company's activities. – M.: East service, 2009.

5. Holt Robert N. Fundamentals of financial management. - Per. from English - M.: Delo, 2010.

Currently, in the context of the existence of various forms of ownership in Russia, the study of issues of the formation, functioning and reproduction of capital in small businesses is becoming especially relevant. The possibilities for the establishment of entrepreneurial activity and its further development can only be realized if the owner wisely manages the capital invested in the enterprise.

Increasing business efficiency is impossible only within the enterprise's own resources. To expand their financial capabilities, it is necessary to attract additional borrowed funds in order to increase investments in their own business and obtain greater profits. In this regard, managing the attraction and effective use of borrowed funds is one of the most important functions of financial management, aimed at ensuring the achievement of high final results economic activity enterprises. This topic is especially acute for newly organized small businesses, which do not always have the opportunity to finance themselves.

The borrowed capital used by such enterprises characterizes the total volume of their financial liabilities. Sources of borrowed capital can be funds raised on the securities market and credit resources. The choice of source of debt financing and the strategy for attracting it determine basic principles and mechanisms for organizing the financial flows of the enterprise. The efficiency and flexibility of managing the formation of debt capital contributes to the creation of an optimal financial structure of the enterprise's capital.

Currently, the main ways to attract borrowed capital are bank loans, equity financing, and leasing. In most cases, small businesses use a bank loan as a source of borrowing, which is explained by the relatively large financial resources of Russian banks, as well as the fact that when receiving a bank loan there is no need to publicly disclose information about the enterprise. This eliminates some of the problems caused by the specifics of bank lending, which is associated with simplified requirements for application documents, with relatively short terms consideration of loan applications, with flexibility of borrowing conditions and forms of loan security, simplification of the availability of funds, etc.

Majority Leaders Russian companies do not want to disclose financial information about their enterprises, as well as make changes in financial policies. As a consequence, there is the fact that only 3% of Russian companies use equity financing.

According to a number of modern scientists, the concepts of “capital” and “financial resources” require differentiation from the point of view of financial management of enterprises. Capital (own funds, net assets) is the property of the organization free from obligations, that strategic reserve that creates conditions for its development,, if necessary, absorbs losses and is one of the most important pricing factors when we're talking about about the price of the organization itself. Capital is the highest form of mobilization of financial resources.

The following set of different functions of capital is distinguished:

production resource (production factor).

Object of ownership and disposal.

Part of financial resources.

Source of income.

Object of time preference.

Object of purchase and sale (object of market circulation).

Liquidity factor carrier.

The use of borrowed capital to finance the activities of an enterprise, according to many economists, is economically beneficial, since the payment for this source is on average lower than for equity capital. This means that interest on loans and borrowings is less than return on equity capital, which essentially characterizes the level of cost of equity capital. In other words, under normal conditions, debt capital is a cheaper source compared to equity capital.

In addition, attracting this source allows owners and top managers to significantly increase the volume of controlled financial resources, i.e. expand the investment opportunities of the enterprise.

Highlight various shapes attracting borrowed funds. Thus, borrowed capital is raised to service the economic activities of the enterprise in the following main forms (Fig. 1.1):

Fig. 1.1 Forms of raising borrowed funds.

According to the degree of security for borrowed funds raised in cash, which serves as a guarantee of their full and timely repayment, the following types are distinguished (Fig. 1.2.):

Fig.1.2. Types of borrowed funds in cash.

A blank or unsecured loan is a type of loan that is issued, as a rule, to an enterprise that has a good track record of timely repayment and compliance with all terms of the loan agreement. In financial practice, this category of enterprises is characterized by a special term - “first-class borrower”;

Thus, based on the composition of borrowed funds, in financial practice the main creditors of an enterprise may be:

- commercial banks and other institutions providing loans in cash (mortgage banks, trust companies, etc.);

- suppliers and buyers of products (commercial credit from suppliers and advance payments from buyers);

- stock market (issue of bonds and other securities other than shares) and other sources.

Another way to attract borrowed funds is to expand the practice of financial leasing. Leasing is used by an increasing share every year Russian enterprises. The attractiveness of financial leasing as a form of lending for commercial banks is associated with a lower degree of risk of investing funds in investments due to the fact that:

- credit resources are used to purchase the active part of fixed assets - equipment, the actual need for which is confirmed and its use by the lessee organization is guaranteed;

- The lessee organization decides to enter into an agreement only if all the necessary conditions are available for organizing production, including production space, labor, raw materials and supplies, except equipment.

Thus, capital management is a system of principles and methods of development and implementation management decisions related to its optimal formation from various sources, as well as ensuring its effective use in various types economic activity of the enterprise.

We can also summarize the focus of attracting capital, namely solving the following problems:

- Formation of a sufficient amount of capital to ensure the necessary pace of economic development of the enterprise.

- Optimization of the distribution of generated capital by type of activity and areas of use.

- Providing conditions for achieving maximum return on capital at the envisaged level of financial risk.

- Ensuring the constant financial balance of the enterprise in the process of its development.

- Ensuring a sufficient level financial control over the enterprise on the part of its founders.

- Ensuring timely reinvestment of capital.

The formation of borrowed capital of an enterprise should be based on the principles and methods of developing and executing decisions that regulate the process of raising borrowed funds, as well as determining the most rational source of financing of borrowed capital in accordance with the needs and development opportunities of the enterprise. The main objects of management in the formation of borrowed capital are its price and structure, which are determined in accordance with external conditions.

The structure of borrowed capital contains sources that require their own coverage to attract them. The quality of the coating is determined by its market value, the degree of liquidity or the possibility of compensation for raised funds.

Analyzing bank lending, we found that one of the main problems is the reluctance of banks to issue money to finance new enterprises that do not have a credit history. But it is precisely during this period that borrowed capital is especially important for such enterprises. In addition, the problem of high rates for new businesses is also difficult to resolve.

In other cases, attracting a bank loan is one of the most popular ways of financing an enterprise. The main feature of bank lending is a simplified procedure (with the exception of cases of syndicated bank loans and lending in relatively large volumes).

Correct application of the above recommendations allows enterprises to increase profitability by increasing production volumes and sales of products. The need to attract external sources of financing is not always associated with the insufficiency of internal sources of financing. These sources, as is known, are retained earnings and depreciation charges. The considered sources of self-financing are not stable, they are limited by the speed of cash turnover, the rate of product sales, the size current expenses. Therefore, free money is often (if not always) not enough, and an additional injection of it aimed at increasing asset turnover will be extremely useful for most enterprises.

Bibliographic link

Kravtsova V.A. POLICY FOR ATTRACTING BORROWED CAPITAL BY SMALL BUSINESS ENTERPRISES. // International student scientific bulletin. – 2015. – No. 1.;URL: http://eduherald.ru/ru/article/view?id=11974 (access date: 03/20/2020). We bring to your attention magazines published by the publishing house "Academy of Natural Sciences"

…………………………………………………………..………..….4

CHAPTER 1. THEORETICAL FOUNDATIONS OF MANAGEMENT OF DEBT CAPITAL OF AN ORGANIZATION…………………………………………………….………..…6

1.1. Economic essence and types of capital of the organization…………….6

1.2. Main sources of formation of borrowed capital, their composition………………………………………………………………………………….16

1.3. The organization’s policy regarding the formation (attraction) of borrowed capital………………………………………………………………………………21

1.4. Main stages of development and implementation of debt capital management policy………………………………………………………..27

CHAPTER 2. METHODOLOGICAL FUNDAMENTALS OF MANAGEMENT OF BORROWED CAPITAL OF AN ORGANIZATION…………………………………………………………….………33

2.1. Methods and techniques for managing debt capital………….….33

2.2. Cost of capital, incl. cost of sources of borrowed capital………………………………………………………………………………37

2.3. Estimation of the cost of short-term financing sources...44

CHAPTER 3. ANALYSIS OF PROBLEMS AND PROSPECTS FOR GROWTH OF EFFECTIVENESS OF MANAGEMENT OF DEBT CAPITAL OF AN ORGANIZATION, USING THE EXAMPLE OF PROTEX LLC………………………….54

3.1. Characteristics, assessment of the property and financial condition of Protex LLC according to the financial statements…………………54

3.2. Features of debt capital management in Protex LLC...67

3.3. Advantages and disadvantages of the existing debt capital management system at Protex LLC………………………………..72

3.4. Recommendations for improving the debt capital management policy at Protex LLC……………………………….….73

………………………………………………………………….84

LIST OF REFERENCES……………………….…………….88

APPLICATIONS……………………………………………………………………………….92

Introduction

The relevance of the research topic is justified by the fact that the management of an enterprise must clearly understand from what sources of resources it will carry out its activities and in which areas of activity it will invest its capital. Currently, the analysis of the formation and use of borrowed capital in organizations is particularly relevant, since the analytical services of organizations develop and apply analysis methods to determine the financial and economic situation. Analysis of the process of formation and use of borrowed capital reveals to interested users the whole range of advantages and problems existing in the enterprise. This is justified by the fact that the formation and use of borrowed capital has a significant impact on the efficiency of the organization and is one of the key aspects when making long-term costly investments. Analysis of the debt capital management system will give users up-to-date information about the amount of borrowed capital of the organization, the optimality of its structure, the feasibility of use. Thus, the relevance of studying the management of an enterprise's borrowed capital is justified by the fact that the data obtained as a result of the analysis will help in making certain management decisions aimed at improving and rationalizing the structure of borrowed capital, minimizing the influence of negative factors, profit growth, and effective and fruitful management of the organization's borrowed capital.

The relevance of the problem posed in the work allows us to determine the object, subject, purpose and objectives of the study.

Goal of the work– study of the effectiveness of managing an organization’s debt capital, using the example of Protex LLC.

Job objectives:

- consider theoretical basis managing the organization's debt capital;

— study the methodological foundations of managing the organization’s borrowed capital;

— assess the effectiveness of the organization’s debt capital management, using the example of Protex LLC;

— develop recommendations for improving the policy of debt capital management in the organization under study.

The object of the study is Protex LLC.

The subject of the study is the efficiency of debt capital management in Protex LLC.

When working on the problem posed, both general scientific methods of analysis and synthesis, comparison, and methods financial analysis.

The degree of development of the problem. Much has been devoted to the study of the theoretical and methodological foundations of analysis and management of an enterprise’s borrowed capital. scientific works, teaching aids, monographs and publications. In this work, we most actively used the works of I.V. when working on the problem posed: I.V. Afanasyeva, S.L. Zhukovskaya, M.S. Oborina, V.A. Kravtsova, E.R. Mukhina, O.V. Pachkova, A.I. Romashova, R.Yu. Sarycheva, V.B. Frolova and others. In general, placed in course work the problem is sufficiently developed in the scientific literature.

Practical significance consists of conclusions and proposals made based on the results of the assessment of the dynamics, structure and efficiency of debt capital management at Protex LLC. The developed recommendations are aimed at improving the policy of managing debt capital in the organization under study.

The work consists of an introduction, 3 chapters (theoretical, methodological and practical), conclusion, list of references and applications.

Bibliography

1. Civil Code of the Russian Federation in 4 volumes - M.: Yurist, 2017. - T. 1. - 624 p.

2. Tax Code of the Russian Federation (parts one and two with amendments and additions) - St. Petersburg: Peter, 2017. - 115 p.

3. Abaeva N.P., Iskakova G.I. Management of debt capital of an enterprise // Economy and Society” - No. 4 (23) - 2016.

4. Afanasyev I.V. The economic nature of capital borrowing relations in the financial market. // Bulletin of Chelyabinsk state university. - 2013. - No. 32 (323). — P. 10-17.

5. Blank I.A. Management of capital formation. - K.: "Nika-Center", 2000. - 512 p.

6. Borisova O.V. Capital structure optimization commercial enterprises in Russia: Monograph. - M.: RIA "VividArt", 2014 - 148 p.

7. Verkhovtseva E.A., Grebenik V.V. Capital structure management as a way to manage the value of a company // Internet journal “Science” - 2016 - Volume 8 - No. 1 (January-February).

8. Voloshin V.M. Criteria for selecting short-term sources of financing // Bulletin of the Murmansk State technical university— Issue No. 2 — Volume 16 – 2013.

9. Grigorieva T.I. Financial analysis for managers: assessment, forecast: textbook for masters. - M.: Yurayt Publishing House, 2016. - 462 p.

10. Danilina E.I. Reproduction of working capital using functional cost analysis: methodological aspects. Monograph. - M.: Finance and Statistics, 2014. - 256 p.

11. Endovitsky D.A., Dokhina Yu.A. Economic essence and legal regulation capital of the organization // Socio-economic phenomena and processes - Issue No. 5 - 2010.

12. Zhukovskaya S.L., Oborin M.S. Basic approaches to the analysis of sources of financing the activities of an enterprise // Fundamental Research. - 2014. - No. 6-5. - pp. 969-973.

13. Zhulina E.G. Long-term and short-term financial policy. — Engels: Regional Information and Publishing Center PKI, 2015. – 116 p.

14. Ivashkevich V.B. Accounting and analysis of receivables and payables. - M.: Publishing house "Accounting", 2014. - 192 p.

15. Kamenetsky V.A. Capital (from simple to complex). - M.: ZAO Publishing House "Economy", 2006. - 583 p.

16. Kovalev V.V. Control financial structure companies: educational-practical. allowance. - M.: TK Welby, Prospekt Publishing House, 2011. - 256 p.

17. Kovaleva A.M., Lapusta M.G., Skamai L.G. Company finances. - M.: Economics, 2003. - 496 p.

18. Kravtsova V.A. Policy of attracting borrowed capital by small businesses // International student scientific bulletin. - 2015. - No. 1.

19. Kreinina M.N. Financial management. – M.: Business and Service, 2016. – 400 p.

20. Krylov E.I., Vlasova V.M. Analysis financial results enterprises. - St. Petersburg: GUAP, 2015. - 256 p.

21. Kuznetsova N.N. Main criteria for choosing a source of financing for an enterprise // News of Tula State University. Economic and legal sciences. - 2013. - No. 4-1. — P. 90-96.

22. Kulizbakov B.K. On the principles of conducting in-depth financial analysis and making decisions on managing receivables and payables. — M.: IC of the Banking Territorial Institute professional accountants, 2015. – 756 p.

23. Kulizbakov B.K. On the principles of conducting in-depth financial analysis and making decisions on managing receivables and payables. - M.: Information Center of the Banking Territorial Institute of Professional Accountants, 2015. - 756 p.

24. Mamishev V.I. Capital structure and its impact on company value // Problems modern economy. — 2015. — No. 1 (53). — P. 91-95.

25. Martynova V.S. Quasi-borrowed capital: features and fair valuation // Contemporary issues science and education ( Electronic journal). — 2013. — № 2

26. Martynova V.S. Features of calculating the costs of attracting borrowed capital for Russian companies // Modern problems of science and education (Electronic journal). - 2013. - No. 6.

27. Mukhina E.R. Borrowed capital: the role of information in the accounting and analytical system // Humanitarian Scientific research. — 2016. — № 2.

28. Pachkova O.V. The influence of debt capital on financial condition enterprises // Economics and modern management: theory and practice. - 2015. - No. 4 (48-1).

29. Romanovsky M.V. Short term financial planning V commercial organizations. – M.: Finance and Statistics, 2015. – 367 p.

30. Romashova A.I. Effective use borrowed capital and its influence on the financial condition of the enterprise // Economic science today: theory and practice: materials of the III International. scientific-practical conf. (Cheboksary, December 26, 2015) - Cheboksary: CNS Interactive Plus, 2015. - pp. 83-87.

31. Ronova G.N. Management of attracting a bank loan // Current problems of the financial and credit sphere and financial management: Collection of scientific works of teaching staff, graduate students and masters of the Department of Banking and Financial Management. - 2015. - pp. 182-187.

32. Savitskaya G.V. Analysis of the economic activity of the enterprise. - Minsk: New Knowledge LLC, 2015. - 688 p.

33. Sarychev R.Yu. Modern policies for attracting debt capital // Scientific community of students: materials of the V International. student scientific-practical conf. (Cheboksary, July 27, 2015) - 2015. - pp. 126-127.

34. Snitko L.T., Krasnaya E.N. Managing the organization's working capital. – M.: Exam, 2015. – 311 p.

35. Stoyanova E.S. Financial management: theory and practice. - M.: Finance and Statistics, 2014. - 376 p.

36. Teplova T.V. Financial decisions - strategy and tactics. – M.: IChP “Magister Publishing House”, 2015. – 264 p.

37. Terekhin V.I. Financial management by the company. – M.: Finance and Statistics, 2014. – 411 p.

38. Trenev N.N. Financial management. – M.: Finance and Statistics, 2014. – 496 p.

39. Financial management / Ed. G.B. Polyaka – M.: Wolters Kluwer, 2014 – 608 p.

40. Frolova V.B. Problems of forming the structure of borrowed capital // Electronic scientific and practical journal “Modern scientific research and innovation” - No. 4 - 2014.

41. Chechevitsina L.N. Analysis of financial and economic activities. – M.: ICC “Marketing”, 2014. – 352 p.

42. Chmil A.L. The essence and types of capital of enterprises retail// Young scientist. - 2014. - No. 15. — P. 218-221.

43. Sheremet A.D. Enterprise finance: management and analysis. - M.: Finance and Statistics, 2014. - 315 p.

44. Shulyak P.N. Enterprise finance – M.: Finance and Statistics, 2015. – 648 p.

Overall volume: 92