Optimal warehouse stock. The art of inventory management. The need to optimize inventory

To provide effective activities Enterprises need to pay attention to reducing inventory storage costs. The best decision for this purpose - reduction of the enterprise's reserves. But this must be done correctly, otherwise problems cannot be avoided that will lead to a serious decrease in profitability due to the resulting deficit.

Why do you need to reduce your company's inventory?

Any product costs money, while those stocks that are in the warehouse and in which funds are invested can bring profit only in the long term, and you have to pay for their maintenance and rent of warehouses. This means that if you reduce the company's inventories to a minimum, you will be able to free up maximum funds for running your business.

Such savings are achieved due to three main factors:

- reducing storage costs,

- reduction of the wage fund and

- increasing product turnover.

First of all, the company will not have to rent or build extensive warehouse space, as well as ensure proper storage of goods, which can make its use unprofitable over long periods of time. In addition, servicing warehouses requires personnel, which can be reduced or repurposed if inventories are reduced. Additionally, with a decrease in inventories, the turnover of goods that come from suppliers or directly from manufacturers also increases.

Problems with inventory reduction

An incorrect approach to reducing inventories can bring quite significant losses instead of profits due to savings. In order to avoid falling into pitfalls, you need to know what difficulties may arise when reducing the company's inventory. The main problem is the high risk of shortages of goods. To avoid this, products should be subjected to ABC analysis, which will highlight the most popular groups that bring the highest and lowest profits. Accordingly, the largest order will need to be placed in the first category, and the smallest in the second. To make the analysis more flexible, a two-dimensional product classification structure is used. If this is not done, the level of customer service will inevitably decrease, and therefore their number. All this will lead to a decrease in profits at the enterprise and loss of competitiveness. That is, with the wrong approach, reducing inventories at an enterprise will worsen its performance, but if proper organization- this will significantly increase its profitability.

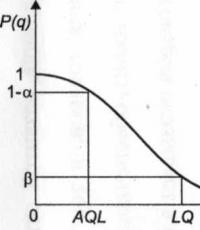

One of the tools to prevent shortages of goods on important items and reduce illiquid inventories is the level of service. The level of service shows the possibility of meeting demand for a product. The more important the product, the higher the level of service for it and the lower the likelihood of shortages. The less important the product, the correspondingly lower the level of service for it.

There are several ways to set the optimal service level.

The first, the simplest, is based on the results of cross-ABC analysis.

For example, conduct a cross ABC analysis on profit per unit - sales:

Rice. 1 Cross ABC (Profit/Unit - Sales, units) in the Forecast NOW program!

The result will be the formation of product groups for which different levels of service need to be established.

The service level is set by experts, see the figure for possible values:

Rice. 2 Basic service level values

A more complex method for calculating the optimal service level is available in software.

This model makes the following assumptions:

- the company loses lost profits due to shortages of goods

- the company bears the costs of storing goods in a warehouse

Accordingly, the optimal point will be the point at which the sum of losses from these two factors is minimized.

The search for this point can be carried out by selecting the service level. It is impossible to do this manually, but specialized inventory management programs can come to the rescue.

Rice. 3 Example of calculating the optimal level of service, performed in the programForecastNOW!

The figure shows that with a delivery lead of 30 days, storage costs + cost of alternative investments of 20%, the optimal level of service for the product will be 98%. If we increase the service level to 99%, then the losses on the cost of holding inventory will be greater than the compensated losses from shortages. And vice versa, if we reduce the service level to 97%, then the shortage will result in more losses than we save on storage.

This analysis can be carried out for all products:

Rice. 4 Optimal level of service in the programForecastNOW!

Proper organization of inventory reduction

To conduct a two-dimensional ABC analysis, products are combined into groups according to two main parameters. As a rule, the first parameter is the most profitable, and the second is the most popular goods, the demand for which is easy to predict. Experience shows that this is not always the same thing. For example, a product in the AC category will bring the greatest profit, but the frequency of its sales will be quite low and, what is very important, difficult to predict.

The main product groups in this analysis include:

- AA and BA are the goods in greatest demand, but since the demand for them, although high, is stable, there is no point in making a large safety stock, but it is necessary to ensure their stable supply.

- AB and BB have unstable demand, so the safety stock of this category of goods must be increased in case of a sharp increase.

- AC and BC are different high level profitability with very unstable and unpredictable demand. To ensure the inventory of this category at the proper level will require too much additional warehouse space. For each product of this type, you need to look for a separate solution, for example, ensure frequent deliveries, choose a supplier located in close proximity, etc. If this fails, then there is no need to make an excessive safety stock.

You need to pay special attention to goods of group C (by profitability), since they usually make up 70-80% of the entire assortment at the enterprise. When reducing the reserves of this group, you need to distribute them as follows:

- SA - use a system of standing orders, which will reduce safety stock and save significant funds.

- SV - is in unstable demand, so when ordering it, you can use a standing order system, but at the same time ensure a stable warehouse stock.

- SS - this category includes goods of spontaneous demand or new items that have appeared on the market. Therefore, this category is supplied to order, otherwise you may end up with illiquid balances leading to direct losses.

A significant part of the funds of a trading, as well as a production, organization is concentrated in warehouse stocks, which determines the need effective management warehouse The lack of optimal management in this area results in a decrease in business profitability and an increase in financial costs.

Optimization needed!

Among the reasons that are the basis for optimizing inventory management are the following:

- - large and growing range of products

- - frequent assortment updates

- - insufficient number of qualified personnel or, on the contrary, its excess;

- - a decrease in profits during a crisis in the company itself or in the economy of the entire country, as happened recently - this forces us to minimize costs in almost all business segments and, in particular, to optimize warehouse activities;

- - the owner or manager of the enterprise changes, who is interested in the transparency of business processes and their optimal organization;

- - the beginning of the enterprise’s work with foreign partners, which requires the organization of business to international quality standards and other reasons.

Optimization factors

The general optimization algorithm includes collecting data, processing it, developing a model or several optimization models, and implementing solutions based on the selected model.

The key task of optimizing warehouse stocks is to achieve such a minimum O A volume of inventory that would be sufficient to continuously ensure continuity of sales or production. Optimization, therefore, is a search for a compromise between seemingly contradictory requirements: a minimum amount of inventory and ensuring, in fact, a production or sales process that is not limited in time.

A complex optimization problem cannot be solved in one step. To carry it out, you need to carry out a series of sequential operations. First of all, it is necessary to carry out qualitative analysis warehouse operations and identify problem areas that significantly reduce the efficiency of inventory management. This may be insufficient competence of the staff, distorted or too slow transfer of information between warehouse departments, ill-conceived arrangement of goods on the shelves, inconvenient working hours, and so on.

As a rule, if optimization is conceived for the first time, then all aspects of the warehouse are not organized optimally and need correction. Problem areas can be accurately identified by monitoring warehouse processes and additionally clarifying the specifics with warehouse workers, while recognizing that some employees may not be at all interested in optimizing warehouse operations.

An important factor in optimizing inventory management is proper spatial organization. It is known that if warehouse space If organized incorrectly, up to 80% of order completion may take time to move goods around the warehouse.

Equally important is the rational practice of storing goods in a warehouse according to their demand, that is, according to the speed of their use - the more often a product is included in the picking, the closer it should be to the picking zone and the most accessible. In this direction, it is also necessary to pay attention to the possibility of simultaneously completing several orders and organizing the required minimum stock of goods in case of unforeseen disruptions in the supply of goods to the warehouse.

The product placement system is not created once and is not stable. It is influenced by market conditions, changes in supply and demand, seasonal factors, peaks in demand and decline. In accordance with these and other factors, it is necessary to review the location of goods in the warehouse for fast-moving goods every week, as well as every month, every quarter, or some other period, depending on the profile of the warehouse.

The use of special warehouse equipment for placing, picking, loading and transporting goods inside the warehouse significantly optimizes inventory management, while, although initial costs costs for equipment and its subsequent constant modernization can be high, but special equipment significantly speeds up all internal warehouse processes and ultimately pays for itself quite quickly.

Of particular importance in the direction of optimization is the implementation of programs complex automation warehouse, which allows you to organize and rationalize all functions of inventory management in the most optimal way. It is known that large enterprises spend up to 12% of their turnover on automation of various business processes. IN automated system numerous parameters are entered: nomenclature data, delivery times of goods, and a number of other values, which allows you to significantly simplify warehouse processes and obtain the following information: statistical information for each product item and for groups of items for the required period, broken down by the number of sales, purchases, unsatisfied demand, inventory balance, etc.; results of sales forecasts for the next reporting period; information on goods at the moment, taking into account warehouse standards, storage features, delivery times commodity items etc.; results of analytical calculations on volumes and terms of purchases for any of the goods and groups of goods; and much more.

Optimization of inventory management is also accompanied by such operations as changes to contracts with suppliers; checking with them the ordered goods and delivery dates; Carrying out an inventory of warehouse stocks. In terms of relations with customers, for faster turnover of goods, sales of illiquid or low-liquid, slow-selling goods from the warehouse are held.

results

The effect of using inventory management optimization is up to a 25% improvement in warehouse performance. Optimization allows you to: increase cost savings on organizing the delivery and storage of goods; rationalize the distribution of warehouse stocks by, on the one hand, reducing overstocking, and on the other, replenishing the shortage of goods in warehouses; reduce warehouse space and rent for their maintenance or rental; free up funds invested in low-profit products; ultimately, gain additional profit by increasing inventory turnover.

The implementation of a comprehensive information system brings particularly significant results, in particular, warehouse inventories can be reduced by up to 35% or more; the speed of goods turnover can be increased to more than 60%; overhead costs are reduced by up to 30%; delays in order processing are reduced by 10% -20%; labor productivity in the warehouse increases from 10% to 30%; automation ensures accurate planning and accounting of goods, without excess or shortage of certain goods; an optimal distribution of warehouse stocks is formed, loan amounts are minimized, financial resources are freed up, the decision-making process is unified, and the possibility of abuse by employees is reduced.

To ensure uninterrupted production process, and also in case of a sharp jump in demand, enterprises create reserves of raw materials and finished products.

However, without rational management of the quantity and storage of these reserves, it is impossible to imagine a successfully developing company.

Reducing the amount of stored inventory to the minimum required speeds up the turnover of inventory and makes it possible to significantly increase the profitability of the company.

Effective optimization of warehouse stocks, first of all, be clearly aware of what.

Effective optimization of warehouse stocks, first of all, be clearly aware of what.

Types of warehouse stocks

There are various criteria according to which these products are classified.

- With regard to trade or the production process, the following types of stocks exist:

- Preparatory. To use them in a company’s activities (whether trade or production), preliminary preparation is required.

- Rolling over from the end of one reporting period to the next. They ensure a non-stop production cycle until the next batch of raw materials is purchased.

- Inventories that are at the delivery stage at the time of accounting.

- Unliquid stocks are not used for a long time.

Regarding the period of use, the stored goods are:

- Seasonal. They arise at a certain time of the year and are caused by a temporary increased demand for a product at this time and, accordingly, the launch of production or trade during this period.

- Insurance. They exist in case of force majeure situations and guarantee the operation of the enterprise even during this time without stopping.

- Current. The main type of inventory serves for the uninterrupted operation of the company in the period of time from one delivery to another.

According to their purpose, reserves are divided into:

- Commodity, that is, finished products, either awaiting or already at the stage of being sent to the consumer.

- Industrial inventories intended for domestic production consumption.

In order to track the dynamics of fluctuations in the level of warehouse stocks, find out the reasons, increase their number and develop a strategy for bringing stocks to the required level, a warehouse analysis is carried out.

In order to track the dynamics of fluctuations in the level of warehouse stocks, find out the reasons, increase their number and develop a strategy for bringing stocks to the required level, a warehouse analysis is carried out.

Its sequence is as follows:

- Sorting by cost, brand and availability of popular product items.

- Identification of stocks that have not been in demand by consumers for a long time. Calculation of their cost.

- Calculation of the cost of inflated inventories as the ratio of the amount of inventory on hand to the number of items sold over the past six months.

Forecasting demand for a certain type of product (as well as the lead time of an order) is a difficult and thankless task. It is extremely rare to perform it efficiently for one reason or another. For these cases, stocks of goods are provided.

Forecasting demand for a certain type of product (as well as the lead time of an order) is a difficult and thankless task. It is extremely rare to perform it efficiently for one reason or another. For these cases, stocks of goods are provided.

Let's analyze the prerequisites for the occurrence of excess inventory in the warehouse:

- Acquisition by an entrepreneur of a obviously superior required quantities goods due to the risk of incomplete delivery or delays in transit.

- Availability of attractive promotional prices for wholesale quantities of goods

- Saving on transportation costs: it is much cheaper to bring a large shipment once than to bring small shipments several times.

Restocking entails financial investments. But how to achieve the optimal balance between the required level of inventory and costs? For these purposes, the economic order quantity is calculated using the formula:

EOQ = 2AD/vr, where:

D is the level of demand, A is production costs, r is warehouse costs, v is the value of specific production costs.

In addition, the following factors need to be taken into account:

- An abrupt increase in product demand throughout the entire period of its implementation.

- Inconsistency in terms of inventory replenishment.

- The policy pursued by this company in relation to serving its clients.

In addition to managing the quantity of inventory, rationalization is also necessary.

In addition to managing the quantity of inventory, rationalization is also necessary.

Analysis of the reasons for unsatisfactory warehouse performance

Possible disadvantages of warehouse operation:

- Missing an order deadline: difficult or even impossible to find the right product due to a disordered warehousing system.

- Lack of warehouse space, threat of overstocking with illiquid goods.

- Failure to comply with storage periods for goods, transportation and loading conditions.

- Imperfect, producing erroneous data regarding the quantity and availability of goods.

- Lack of mechanization and warehouse zoning.

Sequence of optimization of warehouse processes

Optimization of warehouse processes is carried out in the following order.

Analysis of a specific warehouse in order to identify its “vulnerabilities”. This refers to such shortcomings as ignoring the principles of compaction and consolidation with a small area of the premises, the lack of a separate room for quarantine goods, late write-off of already shipped goods, lack of accounting for receipts and a picture of the location of goods in the warehouse available to each employee, etc.)

Analysis of the interaction of warehouse and related processes (sales, procurement, delivery, Information Support) allows you to identify problems and rank them by importance, selecting the most the best way their elimination.

Redesigning warehouse operations

The goal is to improve quality and reduce costs for maintaining the functioning of the warehouse. Implemented using:

- Warehouse zoning.

- Mechanization and automation of warehouse processes.

- Implementation technological maps, reporting documentation, .

- Optimizing the use of space inside the warehouse (placement of a sufficient number of racks, shelves, ease of access to them).

It consists of creating an administrative and management structure and dividing zones between personnel.

It consists of creating an administrative and management structure and dividing zones between personnel.

This ensures greater transparency of warehouse processes, increases the productivity and efficiency of workers, and reduces the costs of warehouse processing of goods.

The final stage involves practical use solutions for optimizing the technology of storing goods.

The newly created system is tested and, if necessary, adjusted. Instructions for working in the warehouse are created for personnel, and supervision is carried out during trial operation.

Thus, optimization of warehouse processes and, directly, the quantity and types of goods is an inevitable component of warehouse logistics on the path to improving and increasing consistency in the work of the entire enterprise as a whole.

In modern economic conditions, warehouse logistics has acquired the features of an independent type economic activity. Properly organized warehouse logistics allows you to implement the latest solutions in the operation of the warehouse, in the management of all related logistics processes and minimize warehouse costs. High-quality work in this direction increases the competitiveness of business in market conditions.

Warehouse logistics as a concept

Warehouse Logistics belongs to one of the areas of management. The management process includes all movements of material assets within the warehouse and beyond. Warehouse logistics is also a composite concept. Its components can be considered:

The concepts of “warehouse” and “warehouse complex”, their types and functions;

Technologies that allow operations to be carried out in a specific area of the warehouse;

Technical means used in warehouse logistics;

Analysis of the need for warehouse space: determining the organization’s need for a warehouse, its type and size, layout;

Work on optimization and standardization of the constituent elements of warehouse logistics;

Organization of labor inherent in this type of activity.

It should be noted, that in warehouse logistics it is necessary to pay attention to two main categories: inventories and processes. Inventories are the remains of products, goods, material assets, for the storage, distribution and transportation of which warehouse logistics operates. Warehouse processes are groups of actions that are performed on inventories to ensure their receipt, storage, redistribution and transportation. It is ensuring the optimization of warehouse stocks and warehouse processes that makes it possible to increase the efficiency of logistics business processes, which are inextricably linked with the overall business processes of the organization.

Organization of warehouse logistics

Organization of warehouse logistics implies the creation of a unified effective warehouse system. To do this, you need to decide on the use of owned or leased warehouses, and also work out the main directions of the functioning of the warehouse system. These include:

Determination of the number of warehouse premises;

Determining the location of warehouse premises;

Creation of a warehousing system that will ensure the best placement of material flows and management of these flows.

Warehousing system includes several elements, each of which requires careful study. Determined best view storage, cargo unit, equipment suitable for servicing is selected, goods picking system.

Since the management process The flow of materials is closely related to the information flow; the information processing system requires special attention. Its elements are: generation of primary documents, processing of incoming documentation, data transfer, operational tracking of units of goods during movement. The information processing and management system in warehouse logistics is based on the application computer equipment and other technical devices.

Final decision on choice One of the options for organizing a warehouse is adopted on the basis of economic criteria. For example, the best option the one that provides the minimum cost per unit of goods will be recognized.

The need to optimize inventory

A significant part of the funds An organization, especially a trading one, is built on reserves, so their movement and presence in the warehouse requires close attention of management. With proper inventory optimization, you can significantly reduce company costs and increase profitability.

When should you think about optimizing your inventory? There are several reasons:

The product range is constantly growing or updated frequently;

Lacks skilled workers or observes an excess of such personnel;

Profit decreases;

The new manager or owner wants to make all business processes transparent;

It is necessary to bring the business organization into compliance with international standards.

To optimize inventory It is important to determine their volumes. If the company's sales volume corresponds to warehouse inventory, then warehouse logistics management is carried out effectively. Inventory planning is considered inextricably from company sales planning. The required amount of inventory can be calculated using the planned method or based on demand To maintain inventory in a warehouse, it is necessary to take into account three main factors: their type, quantity, and time of purchase. Their combination should provide a buffer stock of up to next purchase and maintaining sales at the same level.

Among the methods for optimizing warehouse stocks, the following should be noted:

Analysis of costs and search for ways to reduce them;

Search for strategic suppliers;

Reduced costs for goods;

Investing in e-procurement.

Optimization involves collecting data, analyzing it, forming models, and making forecasts.

Optimization of warehouse processes

Optimization of logistics processes involves providing the company's clients with the most comfortable level of service and achieving a certain level of costs. In order to optimize warehouse processes, it is necessary to clearly understand the directions of material flows within the warehouse and the list of actions of the working personnel that this movement of inventories ensures. That is, the processes of purchasing, transportation to the warehouse, receipt at the warehouse, movement within the warehouse and between warehouses, formation and completion of orders, transportation of orders, and the sales process itself are subject to optimization.

Each of the listed processes is provided with a certain staff of employees performing their functions, documentation, reflection of all transactions in the accounting system. Consideration of each element of all processes and detailed analysis allows us to arrive at an optimal model for organizing warehouse management. Optimization of warehouse processes includes the location of warehouses, inventory rationing, formation of a product range, staffing, unified system accounting and management.

Use of information systems and new technologies

Storage facilities cannot function without the use of special technical and information means. The choice of warehouse cargo handling technologies should be based on the applicability of these means in a particular business, and not on fashion trends. In addition to lifting and transport equipment, gravitational picking systems, conveyors, rotators and other means are used. Modern logistics is moving from the “person to product” principle to the “product to person” principle.

Creating an effective system warehouse logistics is impossible without the use software And information systems. Market software products offers a large assortment warehouse accounting programs that help not only to maintain inventory, but also to conduct analysis. With their help, you can generate various reports reflecting warehouse data in the required context, build graphs and analyze time series. Standard office programs allow the use of standard statistical methods of analysis. Optimization of all warehouse processes and stocks is possible only if there is high-quality analytical work management personnel.

Warehousing organization and optimization of the entire set of material flows existing in the warehouse is a rather painstaking task. Each decision is based on in-depth analysis using mathematical and statistical methods. Criteria for optimal organization warehouse logistics Each business may have different indicators: from costs per unit of production to the efficiency of using a square meter of warehouse space. Timely analysis of data on warehouse operations and optimization of warehouse processes help reduce business costs, increase profitability and stay ahead of your competitors.

96. Enterprise inventory management and optimization.

Inventory management policy represents part general policy management of current assets of the enterprise, which consists in optimizing the overall size and structure of inventories of inventory items, minimizing the costs of their maintenance and ensuring effective control over their movement. Stages of the inventory management process in an enterprise:

analysis of the enterprise's reserves in the previous period - the dynamics of the total volume of the enterprise's reserves, the dynamics of the share of reserves in the total assets of the enterprise are considered, the dynamics of the composition of the enterprise's reserves is considered in the context of: stocks of raw materials, supplies and semi-finished products, stocks of finished products. The turnover of the enterprise's inventories is studied, the profitability of the enterprise's inventories is determined and the factors determining it are examined. The composition of the main sources of financing reserves, the dynamics of their amount and share in the total volume of financial resources, investment in these assets are considered, and the level of financial risk is determined

determination of fundamental approaches to the formation of enterprise reserves: conservative approach, moderate, aggressive

optimization of enterprise inventory volumes: a system of measures is determined to reduce operational, production and financial enterprise cycles, the volume and level of inventories are optimized, the total volume of enterprise inventories for the coming period is determined

optimization of the ratio of constant and variable parts of inventories

ensuring the necessary liquidity of reserves

increasing the profitability of inventories, inventories must provide a certain profit when used in the activities of the enterprise

ensuring minimization of inventory losses during their use

formation of principles for financing certain types of reserves

formation of an optimal structure of sources of financing for reserves.

Development inventory management policies covers a number of sequentially performed stages of work, the main of which are:

Analysis of inventory inventories in the previous period. The main objective of this analysis is to identify the level of production and sales of products with appropriate inventories in the previous period and assess the effectiveness of their use. The analysis is carried out in the context of the main types of reserves.

Determining the goals of stock formation. The goals may be: ensuring current production activities (current stocks of raw materials); ensuring current sales activities (current inventories of finished products); accumulation of seasonal reserves to ensure the economic process in the coming period

Optimization of the size of the main groups of current inventories. For this purpose, a number of models are used, among which the most widespread is “ Model of economically justified stock size " It can be used both to optimize the size of production inventories and finished goods inventories. The calculation mechanism of this model is based on optimizing the total operating costs for the purchase and storage of inventories at the enterprise. These operating costs are pre-divided into two groups:

a) the amount of costs for placing orders (includes costs of transportation and receipt of goods)

OZ RZ = (OPP / RPP) x C RZ

OZ rz- the amount of operating costs for placing orders; WITH rz- average cost of placing one order; AKI– volume of industrial consumption of goods in the period under review; RPP– the average size of one shipment of goods.

From the above formula it is clear that with a constant volume of production consumption and the average cost of placing one order, the total amount of operating costs for placing orders is minimized with an increase in the average size of one shipment of goods.

b) the amount of costs for storing goods in a warehouse.

OZ HT = (RPP / 2) x C X

OZ xt- the amount of operating costs for storing goods in a warehouse; WITH X- the cost of storing a unit of goods in the period under review.

From the above formula it is clear that with a constant cost of storing a unit of goods in the period under review, the total amount of operating costs for storing inventory in a warehouse is minimized by reducing the average size of one shipment of goods.

Thus, with an increase in the average size of one consignment of goods, the supply of goods decreases and the supply of goods increases. This model allows you to optimize the proportions between these two groups of costs so that their total amount is minimal.

The optimal average size of production inventory is determined by the formula:

PZ 0 = RPP 0 / 2

The purpose of inventory management is to develop policies by which optimal investment in inventories can be achieved. Good inventory management minimizes inventory volume, reducing inventory-related costs and increasing return on assets. At the same time, the volume of reserves must be sufficient for the successful operation of the enterprise. Inventory management involves a trade-off between the costs of holding inventory and the benefits of holding it. The higher the volume of inventory, the higher the cost of storage, insurance, taxation, and the cost of paying interest on a loan to convert inventory. With their increase, the costs of maintaining appropriate sources of financing also increase; on the other hand, an increase in inventories reduces the risk of reducing production facilities due to lack of stocks of raw materials and supplies in the warehouse, as well as the risk of losing customers due to lack of stocks of finished products. In addition, large volumes of purchases lead to increased discounts on the sales price. The required amount of financial resources advanced for the formation of inventories of goods and materials is determined by the formula:

FS Z = CP x N Z – short circuit

FS Z– the amount of financial resources advanced to inventories, SR– average daily volume of inventory consumption, N Z– stock storage standard in days, short circuit– the average amount of accounts payable for the transformation of inventory items.

Calculation of the optimal size of the delivery lot, at which the minimum total of current costs for servicing inventory is economically justified quantity of stock (EOQ) method allows you to determine which size should be ordered

Where F– costs of placing and fulfilling one order, D– annual demand for reserves in units, H– costs of storing a unit of production inventory in rubles.

This model is based on the following assumptions: annual inventory requirements can be accurately forecast; sales volume is evenly distributed throughout the year; There are no delays in receiving orders.

Inventory management system - ABC based on the idea of selective control, i.e. Depending on their value, controls of varying degrees of severity are applied to different inventories held by the company. Inventory management involves determining an acceptable inventory control system. It is advisable to apply this method, according to which industrial inventories are divided into 3 categories according to the degree of importance of individual types, depending on their unit value.

The ABC method allows you to focus on controlling the most important species inventories (A and B), and thereby save time, resources and increase management efficiency.

Inventory Management represents a complex set of activities in which the tasks of financial management are closely intertwined with the tasks of production management and marketing. All these tasks are subordinated common goal- ensuring an uninterrupted process of production and sales of products while minimizing current costs for inventory maintenance. This section deals primarily with financial tasks and methods of inventory management in an enterprise.

Effective inventory management allows you to reduce the duration of the production and entire operating cycle, reduce the current costs of storing them, and release part of the financial resources from the current economic turnover, reinvesting them in other assets. Ensuring this efficiency is achieved through the development and implementation of a special financial policy for inventory management.

The development of an inventory management policy covers a number of sequentially performed stages of work, the main of which are:

Inventory management policy at the enterprise: main stages of formation and tools.

The formation of reserves is an objective condition of the reproduction process, ensuring its continuity, and at the same time means the temporary death of investments invested in them working capital. Thus, no new value is created from materials in inventories during the period of their storage. Therefore, the requirement for the total stock is to reduce it as much as possible while simultaneously increasing the degree of mobility.

The process of reserve formation is predominantly probabilistic in nature. This is a dynamic category and must be taken into account when solving an inventory management problem. For this purpose, specially developed methods for rationing production and inventory are used. Guided by them, enterprises determine inventory standards, which are used in balance sheet calculations and serve as the basis for monitoring and accounting for inventory levels and their operational management, and improving their structure.

The inventory management policy is part of the overall policy for managing current assets of an enterprise, which consists of optimizing the overall size and structure of inventories of inventory items, minimizing the costs of their maintenance and ensuring effective control over their movement.

Let us give a brief description of each stage.

1. Analysis of inventory inventories in the previous period has its own tools.

At the first stage The analysis examines the indicators of the total amount of inventory inventories - the rate of its dynamics, the share in the volume of current assets, etc.

At the second stage The analysis studies the structure of stocks in the context of their types and main groups, and reveals seasonal fluctuations in their sizes.

At the third stage analysis studies the effectiveness of use various types and groups of inventories and their volume as a whole, which is characterized by their turnover rates.

At the fourth stage analysis, the volume and structure of current costs for servicing inventories are studied by individual species these costs.

Since working capital is in the process of continuous circulation, it is practically impossible to separate one turnover from another, therefore, to assess the degree of use of working capital or the speed of their turnover, they resort to calculations based on indirect indicators.

The turnover of working capital is calculated in time, and it is characterized by the number of turns of working capital and their duration:

n = Cpn / Oc (1.1)

n - number of turnover of working capital;

Cpn -cost products sold;

Oc is the average amount of working capital for the period under review.

This indicator can also be defined as the turnover ratio, which is determined by the following formula:

Ko= R/S,(1.2)

Ko - working capital turnover ratio (turnover);

P - volume of products sold (thousand tenge);

This indicator characterizes how many turnovers the working capital makes during the reporting period. The more turnover the working capital makes, the better it is used.

The duration of 1 revolution can be determined by dividing the number of days in the analyzed period by the number of revolutions made by working capital for the same period of time (days).

T=360/n=Ox x 360/Cpn. (1.3)

Working capital turnover indicators are calculated based on the entire amount of average balances of both standardized and non-standardized working capital. However, the remains Money on the enterprise's bank account are excluded from the calculation, since the working capital released as a result of the acceleration of turnover is deposited in the current account.

Sometimes, to assess the efficiency of using working capital, the working capital load factor is used, which is the amount of working capital per one tenge of the cost of products sold. The lower the absolute value of this coefficient, the more efficiently working capital is used and the faster it turns over.

The working capital utilization ratio can be calculated using the following formula:

k3 =Oc / Cpn(1.4)

To characterize the efficiency of using working capital, an efficiency ratio can be used. It is calculated using the following formula:

Ke= P/S,(1.5)

Ke - working capital efficiency ratio (tiyn);

P - profit from the sale of commercial products (thousand tenge).

C - average balances of standardized working capital (thousand tenge).

This indicator characterizes how much profit falls on 1 tenge of working capital. The more profit per 1 tenge of working capital, the more efficiently working capital is used.

The result of improving the use of working capital can be their absolute and relative release.

The absolute release of working capital occurs when, due to the acceleration of their turnover with the same volume of products produced, the amount of working capital of the enterprise decreases. Relative release of working capital - the growth rate of the enterprise's working capital is slower than the growth rate of turnover for sales of products.

Relative release (increase) of working capital (in tenge): =E0 = Рд▲О, (1.6)

Рд - the amount of one-day sales of products in a given period;

▲О - decrease or increase in the duration of turnover in the same period, days.

One-day turnover for product sales: Рд = Qp / Тп (1.7) where

Qp - the amount of product sales for a given period;

Тп - number of days in a given period.

The condition for the uninterrupted operation of the enterprise is the complete provision of material resources. Need in material resources determined in the context of their types for the needs of the main and non-core activities of the enterprise and for the reserves necessary for normal functioning at the end of the period.

The need for material resources for the formation of reserves is determined in three estimates:

In natural units of measurement, which is necessary to establish the need for warehouse space;

In monetary (cost) assessment to identify the need for working capital and link it with the financial plan;

In days of availability - for the purpose of planning and monitoring the implementation of the delivery schedule.

2. Determining the goals of stock formation. Inventory inventories included in current assets can be created at an enterprise for different purposes:

a) ensuring current production activities (current stocks of raw materials);

b) ensuring current sales activities (current inventories of finished products);

c) accumulation of seasonal reserves that support the economic process in the coming period (seasonal reserves of raw materials, materials and finished products), etc.

In the process of developing inventory management policies, they are classified accordingly to ensure subsequent differentiation of management methods.

3. Optimization of the size of the main groups of current stocks. To optimize the size of current inventories of goods and materials, a number of models are used, among which the most widely used is the “Economically justified order size model”. It can be used to optimize the size of both production inventories and finished goods inventories.

The calculation mechanism of the EOQ model is based on minimizing the total operating costs for the purchase and storage of inventories at the enterprise. These operating costs are preliminarily divided into two groups: a) the amount of costs for placing orders (including costs for transportation and acceptance of goods): b) the amount of costs for storing goods in a warehouse.

Economic order quantity (EOQ), optimal order size, Wilson formula, EOQ model – the size of the delivery lot at which the total costs of inventory management are minimal.

The calculation of the most economical order quantity is carried out within the framework of an inventory management system with a fixed order quantity, which should be exactly equal to the most economical order quantity. To calculate the most economical order size G wholesale (unit), Wilson's formula is used:

![]()

where C issue – order fulfillment costs (monetary units); S d – demand for a given type of stock (natural units); C 3 – cost of a unit of inventory (monetary units / natural units); i – inventory storage costs (% of).

The above formula (1) is transformed in accordance with the specific conditions of the enterprise. For example:

if inventories are not replenished instantly, but over a certain period of time (as a rule, this case occurs when replenishing inventories through own production), then the following formula is used to calculate the most economical order size G wholesale (unit):

where is the volume of product output through which inventories are replenished (natural units).

![]()

where G wholesale is the most economical order size, calculated without taking into account the shortage using formulas (1) or (2) (unit); h – additional costs due to shortages (monetary units/natural units).

4. Optimization of the total amount of inventory inventories included in current assets.

Calculation of the optimal amount of reserves of each type (in general and for the main groups of their nomenclature taken into account) is carried out according to the formula: Зп = (Нтх * Оо) + Зсх + Зтн, (1.12)

Zp - the optimal amount of inventory at the end of the period under consideration;

Нтх - standard for current storage stocks in days of turnover;

Оо - one-day production volume (for stocks of raw materials and supplies) or sales (for stocks of finished products) in the coming period;

Зсх - planned amount of seasonal storage reserves;

Zin is the planned amount of reserves for other types of intended purposes.

5. Construction of effective systems for monitoring the movement of inventories at the enterprise. The main task of such control systems, which are an integral part of the financial controlling of an enterprise, is the timely placement of orders for replenishment of inventories and the involvement of over-formed types into economic circulation.

6. Real reflection in financial accounting of the cost of inventories of inventory items in conditions of inflation.

In a stable economic situation with minor inflationary processes and changes in the price level, inventories are accounted for at the cost of their acquisition. But when the situation changes towards the possible recognition of hyperinflation, as well as when market instability manifests itself in significant price fluctuations, the use of an assessment based on the actual cost (purchase price) ceases to provide an objective assessment of their real value and economic usefulness as a source of potential income.

Due to changes in the nominal level of prices for inventory assets in an inflationary economy, the prices at which their reserves are formed require appropriate adjustments at the time of industrial consumption or sale of these assets.

If such price adjustments are not made, the real value of the inventories of these assets will be underestimated, and the real amount of capital invested in them will therefore be underestimated. This will disrupt the objectivity of assessing the condition and movement of this type of asset in the process of financial management.

Almost all enterprises from time to time experience a shortage of working capital, which they are forced to cover with borrowed funds. At the same time, one of the typical reasons for the lack of working capital is insufficiently effective management of the enterprise's existing resources, in particular, inventory management. Working capital in inventory moves unevenly. Part of it may be in excess low-liquid stocks and remain almost without movement. On the other hand, some of the inventory may run out while there is still unsatisfied demand for it, which leads to lost profits.

Is it possible to maintain the current level of business on inventory that is smaller than what is currently available? If so, then the cash equivalent of the value of the inventory by which the warehouse will be reduced can be reinvested in the further development of the business or businesses.

A measure of the effectiveness of inventory management over a time interval is the inventory turnover in the warehouse, expressed in money, which is determined by a simple expression for the turnover ratio:

Turnover = Shipment / Warehouse, Where:

Shipment– the cost of shipped goods over a time interval;

Stock– average daily cost of balances in the time interval.

If the reporting time interval is a calendar month, then monthly turnover is often converted to a year:

Turnover = (Shipment / Warehouse) *12

Below we will use exactly the last expression, which shows how many times during the year inventory could be shipped at cost if the entire year inventory turnover was equal to the turnover in the reporting month. In other words, inventory turnover reflects how many times per year working capital passes through the warehouse. The higher the warehouse turnover, the less is needed working capital to maintain the current level of shipments.

Let's give a specific example. Let us assume that in order to maintain an average monthly sales volume of 30 million rubles at selling prices with an operating profit (margin) of 20%, the enterprise is forced to keep a warehouse at a cost of 60 million rubles of goods stored there. Then the current inventory turnover is:

Turnover = (30*0.8 / 60) *12 = 4.8 times per year;

Let’s say that after a year, due to the optimization of inventory, sales volume increased by 20%, and the average inventory turnover was raised to 9 times a year. Let's calculate the current warehouse size:

Warehouse = (Shipment / Turnover) * 12 = (1.2 * 30 * 0.8 / 9) * 12 = 38.4 million rubles;

Let's calculate what the warehouse size should be if the turnover ratio remained equal to 4.8 times a year:

Warehouse = (Shipment / Turnover) * 12 = (1.2 * 30 * 0.8 / 4.8) * 12 = 72.0 million rubles;

The financial efficiency of increasing the inventory turnover ratio can be assessed as follows:

72.0 – 38.4 = 33.6 million rubles;

This means that 33.6 million rubles were withdrawn from working capital without harm to business. An example was given for a warehouse of products ready for shipment to consumers, but the increase in turnover in warehouses of components and semi-finished products for manufacturing enterprises has an equally beneficial effect on reducing working capital.

Thus, there are two reserves for increasing inventory turnover: increasing the liquidity of stored inventories and increasing shipments by increasing inventories of those goods that were previously in short supply.

In addition to the withdrawal of funds from circulation due to an increase in inventory turnover, the Company receives four additional sources for profit growth:

the costs of maintaining warehouse space are reduced (warehouse space is reduced);

the costs of paying interest on loans and borrowed funds are reduced;

direct losses from write-off of expired goods are reduced (if the Company works with such goods);

return into circulation of funds from the sale of low-liquid goods (if the promotions for their sale were at least partially successful).

Principle of inventory optimization

The technique for optimizing inventory in a warehouse is in many ways similar to the technique for losing excess weight. In the latter case, diet and exercise are considered the most effective and safest for health, and the greatest effect is achieved when both methods are used simultaneously.

In the case of inventory optimization, the diet is orders to the main suppliers compiled by the iGATE.WM program. Only those items will be ordered whose stocks actually require replenishment. If the item is not included in the order, then it means that it is in excess quantity in the warehouse. Over time, due to natural loss, the stocks of such items will decrease and, in the end, their stocks will also begin to be replenished. And vice versa, if some item is in the warehouse in insufficient quantities (in short supply) and its insurance reserves are regularly close to exhaustion or running out, then the program will, over and over again, begin to increase its quantity in orders to suppliers, which means an increase in shipments. Thus, due to “diet and healthy eating,” there is a “reduction of body fat” in some products and an increase in “muscle mass” in others. At the same time, just as a harmoniously developed athlete is able to show higher athletic results compared to an overweight person, a warehouse optimized in composition will provide the enterprise with a higher level of business, even if external conditions have not changed.

“Physical exercises” in the case of inventory optimization should be applied to those items whose inventory reduction using the method of natural loss (“diet”) is too slow or does not occur at all. In this case, “physical exercise” includes sales, marketing promotions, supplier returns, etc.

The first task that needs to be solved here is to identify such items, and the iGATE.WM program does this by compiling reports in which non-liquid items and goods at risk of being written off due to expiration before sale are grouped in special sections of the report.

This is where the assistance of the iGATE.WM program in terms of “physical exercises” ends; it certainly cannot conduct sales and other actions aimed at selling illiquid and perishable goods. Here everything depends on the “willpower of the enterprise wanting to lose weight”; this problem should be solved not at the program level, but at the human level of changing the business processes of the enterprise. Here, the Enterprise will be assisted by consultants on the implementation of inventory management technology from iGate. It is very important to rebuild business processes so that actions for the sale of illiquid assets are not one-time, but have a regular nature and minimal dependence on the human factor of the performers. This is achieved by establishing the dependence of bonuses of performers on the level of non-liquid stock or inventory turnover, setting control points for checking the quality of work of supply departments, training personnel, etc. iGate consultants work in very close contact with the Enterprise’s employees and will propose a scheme for modernizing inventory management business processes that, in their opinion, will best suit each specific Customer and at the same time require the introduction of minimal changes to the usual operating pattern of the Enterprise.

Inventory optimization is a problem that arises in almost any company; this topic is especially relevant for trade organizations. Ignoring this issue leads to many problems: lack of working capital, irregular warehouse operations, the presence of expired goods, customer dissatisfaction. Optimization allows you to minimize safety stocks, but at the same time, the company must be able to fulfill incoming orders for products in a timely manner.

This is a complex and very complex problem, to solve which it is necessary to take into account the specifics of the purchase, storage and sale of each product, the influence of external factors, pricing policy and much more. When solving such a complex problem, the functions implemented in accounting systems are not enough; here, issues of data analysis become of particular importance.

The best solution is to use specialized analytical platforms such as Deductor:

Purchasing optimization. One of effective ways minimizing warehouse balances is purchasing optimization. The idea is quite simple: purchase exactly as much goods as will be sold before the next purchase. To do this, you first need to obtain a demand forecast. Deductor includes various forecasting algorithms that allow you to build predictive models taking into account trends, seasonality, inventory availability, demand for related products and other factors.

Calculation of optimal safety stock. Even the best forecasting algorithms do not guarantee an ideal result, because... It is impossible to take into account all factors. Actual sales will always differ from projected values. Based on Deductor, various strategies for calculating the optimal safety stock are implemented: maximizing profits, minimizing purchase volume, minimizing storage costs, increasing customer satisfaction...

Analysis of shortages and surpluses. Algorithms implemented in Deductor allow you to automatically detect shortages and surpluses of goods, identify factors influencing this situation, rank them in order of importance and minimize related problems.

Product line optimization. Deductor includes mechanisms that allow you to analyze interchangeable and related products, identify the most and least popular items, products with stable and chaotic demand. The presence of this information makes it possible to build an optimal product line, taking into account the availability of warehouse space, financial capabilities, demand for products and profitability.

Management reporting. The reporting mechanisms built into Deductor provide the ability for management to monitor key performance indicators; with their help, you can quickly respond to undesirable trends and warn about deviations from business goals.

A solution based on Deductor allows you to increase the efficiency of a warehouse: ensure the smooth functioning of company departments, avoid errors and inaccuracies, improve planning, increase turnover and reduce costs.

Assessment of material inventories FIFO method.

Inventory accounting methodology based on the assumption that inventories are used during the month (or other period) in the sequence of their acquisition (receipt), that is, the inventories that first enter production (sale) should be valued at the cost of the first ones in time acquisitions taking into account the cost of inventories listed at the beginning of the month. When applying this method, the assessment of inventories in stock (in warehouse) at the end of the month is carried out at the actual cost of the most recent acquisitions, and the cost of goods sold (products, works, services) takes into account the cost of the earlier acquisitions.

Valuation of inventories using the LIFO method

inventory accounting methodology based on the assumption that inventories that are the first to enter (write off) into production (sale) should be valued at the cost of the last in the acquisition sequence. When applying this method, the assessment of inventories in stock (in warehouse) at the end of the month is made at the actual cost of early acquisitions, and the cost of goods sold (products, works, services) takes into account the cost of late acquisitions.

Calculating the cost of inventories upon disposal in different ways

|

Indicators |

Price per unit, thousand rubles. |

Amount thousand rubles |

||

|

Balance at the beginning of the month | ||||

|

Received in a month: 1 batch 2 batch 3 batch 4 batch |

3000 2550 5700 8000 |

|||

|

Expense per month | ||||

|

Balance at the end of the month | ||||

|

Solution |

||||

|

Total cost of materials per month |

23750 = 4500+3000+2550+5700+8000 |

|||

|

Average cost estimate |

||||

|

Total number of materials per month |

1350 = 300+200+150+300+400 |

|||

|

Average unit cost | ||||

|

Cost of materials consumed |

21112 = 1200*17,6 |

|||

|

2639 = 150*17,6 |

||||

|

FIFO valuation |

||||

|

Material consumption per month: remainder and 1st batch: 2nd batch 3rd batch 4th batch Total consumption: |

7500 = 500*15 2550 5700 5000 = 250*20 1200 units in the amount of 20750 tr. |

|||

|

Cost of remaining materials at the end of the month |

3000 = 150*20 at last price |

|||

|

LIFO valuation |

||||

|

Material consumption per month: 4 batch 3 batch 2 batch remainder and 1 batch Total consumption: |

8000 5700 2550 5250 = 350*15 1200 units in the amount of 21,500 rubles. |

|||

|

Cost of remaining materials at the end of the month |

2250 = 150*15 for the first batch |

|||

|

Answer |

||||

|

Quantity |

Price |

|||

|

Average price | ||||