Average value of fixed production assets. Average annual cost of fixed production assets. Useful life

Introduction

Economics as a science began to actively develop in the 20th century due to changes in the political and socio-economic systems of the world. Determining such a parameter as the average annual value of fixed assets (abbreviated as SSOF) is necessary to identify the efficiency of use of property, which is very important for the successful functioning of the enterprise. average annual cost of fixed assets The size of the depreciation fund. In order to determine the annual size of the depreciation fund, it is necessary to combine fixed assets into groups for which the same depreciation rates are established. For each of these groups, the SSOF is determined. The resulting value must be multiplied by the depreciation rate (in percent).

Average annual cost of fixed assets

products extensiveness fund labor

The average annual cost of fixed assets is calculated by directly dividing their price by 12 and multiplying by the number of months of their operation on the farm. cost of fixed assets The average annual cost of fixed assets being retired is calculated in the same way, except that the multiplication is made by the number of months of their non-functioning on the farm. The average annual cost of fixed assets, calculated using this formula, will subsequently help determine the capital productivity parameter. Determination of norms for depreciation charges The Council of Ministers of the Russian Federation centrally determines norms that are the same for all industries National economy, are divided into groups and divided into types of fixed assets. They involve the calculation of depreciation for the complete and thorough repair of work equipment, as well as for their complete restoration. Profit from activities Practice financial planning enterprises where the planned year, in comparison with the reporting year, did not bring significant changes in the structure and composition of fixed assets, allows determining the SSOF in general for the enterprise and applying the average rate of depreciation that actually developed in the reporting year. average annual cost of fixed assets formula. If in the planned year this enterprise there are no capital investments, then these deductions are sent to finance capital investments of other subordinate enterprises in the order of redistribution of funds. An important resource for financing capital investments is profit from the main activity. The entire amount of profit, which will subsequently be used for financing, is revealed by calculations in the process of direct distribution of income, as well as development financial plan organizations. The average annual cost of fixed assets is needed to determine such important parameters as capital productivity, capital intensity and capital-labor ratio. Now, knowing how to calculate this parameter, you can correctly and successfully organize your business

The average annual value of fixed assets is determined as the quotient of dividing by 12 the amount obtained by adding half the value of fixed assets at the beginning and end of the reporting year and the value of fixed assets on the first day of all other months of the reporting year.

Relative indicators are:

- * The technical condition of fixed production assets is determined primarily by the degree of their wear and tear.

- * The depreciation rate of fixed assets (Kizn) is determined as of the beginning and end of the year using the formula

Kizn = Fizn / F,

where Fizn is the amount of accrued depreciation of fixed assets for the entire period of operation at the beginning (end) of the year, rub.;

F -- fixed assets at their original (book) value at the beginning (end) of the year, rub.

The wear rate is determined based on data accounting and reporting (form No. 20 “Report on the availability and movement of fixed assets”). Moreover, the lower the wear rate, the better the physical condition of fixed assets.

For example, the availability of fixed assets at the beginning of the year was 5,213 thousand rubles, at the end of the year - 5,543 thousand rubles. The amount of depreciation of fixed assets at the beginning and end of the year according to joint stock company respectively amounted to 1381 and 1386 thousand rubles, then the depreciation coefficient of fixed assets will be equal to:

at the beginning of the year 1381: 5213 = 0.265 or 26.5%;

at the end of the year 1386: 5543 = 0.250 or 25.0%.

Consequently, the physical condition of the enterprise's fixed assets has improved somewhat. Their depreciation coefficient at the end of the year compared to the beginning of the year decreased by 0.015 (0.265 - 0.250), or 1.5%.

Reducing the degree of depreciation of fixed assets is achieved through the commissioning of new fixed assets and the liquidation of old, demolished fixed assets.

When assessing the condition of fixed assets, the coefficients of renewal and disposal of fixed assets are calculated. The coefficient of renewal of fixed assets for the corresponding year is calculated by the formula:

Kobn = Fvved / Fk

where Kobn is the coefficient of renewal of fixed assets;

Fvved - the cost of newly commissioned fixed assets for the year (period), rub.;

FC -- value of fixed assets on the balance sheet at the end of the year, rub.

For example, in an organization in the reporting year, new fixed assets were put into operation in the amount of 570 thousand rubles, the availability of fixed assets at the end of the year was 5543 thousand rubles. The renewal coefficient was 0.103 (570: 5543), or fixed assets were renewed over the year by 10.3%.

The retirement rate of fixed assets for the analyzed year is determined by the formula:

Kvyb = Fvyb / Fn

where Kvyb is the retirement rate of fixed assets;

Fvyb - the cost of retired fixed assets for the analyzed year, rub.;

Fn -- value of fixed assets on the balance sheet at the beginning of the year, rub.

For example, in an organization, the disposal of fixed assets for the year amounted to 240 thousand rubles, the availability of fixed assets at the beginning of the year was 5213 thousand rubles. The retirement rate of fixed assets was 0.046 (240: 5213), or 4.6%.

To characterize the provision of fixed assets, indicators of capital-labor ratio and technical equipment of labor are determined at the beginning and end of the year (or on an average annual basis).

The capital-labor ratio (FL) is determined by the formula:

FV = F / Ch or FV = Fs / Chs

where F is the cost of fixed assets at the beginning (end) of the year, thousand rubles;

H -- number of employees at the beginning (end) of the year, people;

Fs - average annual cost of fixed assets, rub.;

Chs - average annual number of employees, people.

For example, in an organization the number of trade employees at the beginning of the year was 860 people, at the end of the year - 880. The cost of all fixed assets of trade at the beginning of the year was 5213 thousand rubles, at the end of the year - 5543 thousand rubles. Hence the capital-labor ratio is:

at the beginning of the year 5213 / 860 = 6062 rubles,

at the end of the year 5543 / 880 = 6299 rubles.

Consequently, the capital-labor ratio in the organization at the end of the year compared to the beginning of the year increased by 237 rubles. (6299 -- 6062), or 3.9%.

Problem 1

Based on the table data, determine the impact of the efficiency of use of fixed assets on the volume of output, using the methods of absolute and relative differences. Formulate your conclusions.

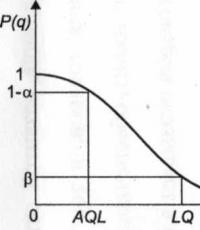

One of the general indicators of the level of use of fixed assets is capital productivity. Capital productivity is expressed as the ratio of the cost of products manufactured per year to average annual cost fixed production assets.

f - capital productivity

N - volume of production, thousand rubles.

F - average annual cost of fixed production assets, thousand rubles.

base = 22500 = 1.1780 rub.

f fact = 22500 = 1.2098 rub.

Let us analyze the influence of the resource use factor on the change in production volume using the absolute difference method.

We use a two-factor model that links the performance indicator (volume of output) with indicators of the use of fixed production assets:

The influence of a change in a factor on a change in the performance indicator:

DNF = DF xf0 = +200x1.1780 = +235.6 (thousand rubles)

ДNf = F1 x Д f = 19300 x 0.0318 = +613 (thousand rubles)

DNF + DNf = 235.6 + 613.74 = 849.34 (thousand rubles)

The calculation results allow us to draw the following conclusions: sales volume increased in the reporting period by 3.78%, which is 850 thousand rubles; fixed production assets were used quite efficiently; the growth in sales volume is partly due to an increase in their average annual cost (the influence of this factor amounted to 235.6 thousand rubles), but mainly the sales volume increased due to more effective use fixed assets, an increase in capital productivity led to an increase in sales by 613 thousand rubles.

You can also use the relative difference method. First of all, it is necessary to transform the model, replacing qualitative indicators with formulas for their calculation.

The influence of changes in the cost of general production assets and capital productivity on changes in the volume of output:

D NF = N0 x (kF - 1) = 22500 x (1.011 - 1) = +247.5 (thousand rubles)

D Nf = N0 x (kN - kF) = 22500 x (1.0378 - 1.011) = +603 (thousand rubles),

where kF is the coefficient of change in the average annual cost of open pension fund;

kN - coefficient of change in profit from sales.

Cumulative influence of factors:

DNF + DNf = 247.5 + 603 = 850.5 (thousand rubles).

Thus, the increase in sales volume is due not only to an increase in the cost of OPF, but also, to a greater extent, to an increase in the efficiency of using OPF. The calculations made indicate the predominant influence of the increase in the capital productivity of the open pension fund on the increase in sales volume (603 thousand rubles).

Problem 2

Calculate the quantitative influence of factors on the performance indicator using the method of chain substitutions. Based on the results of factor analysis, write an analytical conclusion.

Factors affecting the results of financial and economic activities are interconnected and interdependent. Calculation and assessment of the influence of factors on changes in performance indicators is called factor analysis.

Calculation of the influence of factors using the chain substitution method:

where MZ is the mass of harvested raw materials

N - product release

UR - specific material consumption

MZpl =8620*0.215=1853.3

MZf =8750*0.21=1837.5

Total change in production volume:

Including due to changes in the mass of harvested raw materials, the specific consumption of raw materials is 15.5 thousand rubles. (1853-1837)

To establish how material costs per unit of production have changed, you need to multiply the difference between the specific consumption of the replacement material (UR1) and the specific consumption of the replaced material (UR0) by the price of the replaced material (P0), and the difference between the price of the replacement material (P1) and the price of the replaced material material (C0) - by the specific consumption of the replacement material (UR1) and then add the results:

UMP=(UR1-UR0)*Ts0;

UMP=(Ts1-Ts0)*UR1.

UMP=(0.21-0.215)*7000=-35 (thousand rubles);

UMP=(7600-7000)*0.21=+126

126-35=+91 (thousand rubles)

Thus, the plan for the production of the product was exceeded due to a decrease in the specific consumption of materials (-35 thousand rubles), although at the same time the cost of materials increased. Material costs per unit of production changed by 91 (thousand rubles) Zf - mass of raw materials, t., actual raw materials

Zpl - mass of raw materials, t., planned raw materials

Zpl = VPf * UR

UR - consumption of raw materials for production 100 pcs. products, t

VP - planned product release

Salary = 8620*0.215=1853.3 t

Zf = 8750*0.21=1837.5 t

Total change in output

DVVPtot = 8750-8610 = +130 (thousand pcs.)

including due to changes in the mass of consumed raw materials

Zpl - Zf = 1837.5-1853.3 = -15.8 t

specific consumption of raw materials

UR = 0.21-0.215 = 0.005 t

- 1.8750 -8620=130 exceeding the plan;

- 2.0,215-0.21 =0.005 reduction in specific material consumption per 1000 pcs. products;

- 3.7000 -7600 = [-600] increase in cost by 1 ton from the plan;

- 4.12973.1 -13965 = [-99.9] increase in material costs for the entire production of the product from the planned one;

Despite the increase in the cost of producing 1 ton of material and the increase in material costs for the entire production of the product, exceeding the plan for the production of products according to the data in the table was achieved due to a decrease in the specific consumption of material by 1000 pieces. products.

Using the table data, we calculate the material productivity indicators using the formula:

where O is the volume of production for the year, M is material costs. Mo0 = O0 / M0 = 8620 / 12973.1 = 0.661 (rubles); Mo1 = O1 / M1 = 8750 / 13965 = 0.627 (rubles). Thus, the deviation from the plan will be in terms of material costs: M1 - M0 = 13965 - 12973.1 = 991.9 (thousand rubles); according to the material productivity indicator: Mo1 - Mo0 = 0.661 - 0.627 = 0.034 (rub.). Percentage of plan fulfillment in terms of production volume for the year: (O1 / O0) * 100% = (8750 / 8620) * 100% = 101.51%; for material costs: (M1 / M0) * 100% = (13965 / 12973.1) * 100% = 107.65%; in terms of material productivity: (Mo1 / Mo0) * 100% = (0.627 / 0.661) * 100% = 94.86%. The dependence of the volume of output on factors (material costs, material productivity) can be described using a multiplicative model: O = Mo * M. method of chain substitutions. O = Mo * M. Then the effect of changes in material costs on the general indicator can be calculated using the formula:

Ocondition1 = M1 * Mo0 = 13965 * 0.661 = 9230.87 (thousand rubles);

Ousl1 = Ousl1 - Oo = 9230.9 - 8620 = 610.87 (thousand rubles).

Ousl2 = O1 - Ousl1 = 8750 - 9230.87 = -480.87 (thousand rubles).

Thus, the change in production volume was positively influenced by an increase of 0.034 rubles. material productivity, which caused an increase in production volume by 610.87. The change in production volume was negatively affected by an increase of 99.9 thousand rubles. material costs, which caused a decrease in production volume by 780.87 thousand rubles. So, despite the increase in the cost of producing 1 ton of material and the increase in material costs for the entire production of the product, exceeding the plan for the production of products according to the table given was achieved due to a decrease in the specific consumption of material by 1000 pieces. products.

Problem 3

Determine the increase in production from the elimination of lost working time. The amount of lost time during the year amounted to 350 person-hours. The average hourly output of one worker is 800 rubles. Knowing the amount of lost working time in man-hours and the actual output (average hourly) of one worker, we can determine the amount of losses in holistic terms through the volume of non-fulfillment of services and in labor productivity, which will amount to 350 * 800 = 280,000 rubles. The increase in production from the elimination of lost working time is 280,000 rubles.

Based on the table data, calculate using the absolute difference method;

- 1) the impact on the deviation in the volume of production compared to the plan of changing the total number of days worked by workers;

- 2) the impact on the deviation in the volume of production compared to the plan of changes in the average daily output of the worker.

Based on the calculation results, write an analytical conclusion.

The dependence of product size on labor factors is mathematically formulated as follows:

VP = SCHR * SRDN * SRSM * PTC

VP = UDR * SRSM * SRDN * PTC.

where VP is output,

SCHR - average number workers,

SRDN - average number of days worked by one worker per year,

SRSM - the average number of hours worked by one worker per day,

HRP - hourly labor productivity,

UDR - the proportion of workers in the workforce.

We will calculate the influence of factors on the volume of production using the method of absolute differences. We calculate unknown characteristics based on the initial data:

1. The share of workers in the workforce

UDR = SChR/SCh,

where SCH is the average number.

UDR O = 200/235 = 0.852

UDR f = 195/240 = 0.813

DUDR = 0.039

UDRO O = 172/235 = 0.733

UDRO f = 176/240 = 0.733

where UDRO is the proportion of main workers in the workforce

DUDRO = 0.0

UDROR O = 172/200 = 0.86

UDROR O = 176/195 = 0.903

where UDROR is the proportion of main workers among all workers

DUDROR = 0.043

2. Hourly labor productivity

PFC = VP/HOUR,

where HOUR is the number of man-hours worked.

PTC O working = 320450/360 = 890.139 rub

PTC f working = 288975/ 342 = 844.956 rub

DPTCH = 45.183

PTC O working basis = 320450/314.61 = 1018.563 rub

PTC f working basis = 288975/318.003 = 908.718 rub

DPTCH = 109.845

3. Average number of days worked by one worker:

SRDN=DN/SChR,

where DN is the number of man-days worked.

SRDN r pl = 46000/200 = 230

SRDN r f = 43880/195 = 225.026

D SRDN working = 225..026-230 = -4.974

SRDN or pl = 40560/172 = 235.814

SRDN or f = 40490/176 = 226.201

D SRDN main working = 226.201-235.814 = - 9.613

4. Average working day

SRSM = HOUR/DAY.

SRSM or pl = 314.61/40.56 = 7.757

SRSM or f = 318.003/40.49 = 7.854

SRSM r pl = 360.00/46.00 = 7.826

SRSM r f = 342.0/43.88 = 7.794

5. Average daily output of a worker

DVpl slave = 320450:46.00:200= 34.832 (r.)

DVfact slave = 288975:43.88:195 = 33.772 (r.)

DVpl main slave = 320450:40.56:172 = 45.934 (r.)

DVact main slave = 288975: 40.49:176 = 40.551 (r.)

6. Days worked by one worker (one main worker per year (D):

Dplr = 46000: 200 =230.00

Dfr = 43880: 195 = 225.026

DD p = 225.026 -230.00 = -4.974

Dplor = 40560: 172 =235.814

Dfor = 40490: 176 = 230.057

DD or =230.057 - 235.814 = - 5.757

To analyze the influence of labor factors on the size of output, we use calculations.

We find the influence on the size of output using the original formula using the method of differences - we present the factor under study in the form of the difference between the actual indicator and the planned one, other characteristics of the formula must have planned values.

1. For example, we find the influence of the configuration of the number of main workers as follows:

VP = (SChRf - SChRpl) * SRDNpl * SRSMpl * PTChpl

2. Change in annual output when changing the number of days worked by one worker

DGVR = UDf *DD *DV pl =0.813* (-4.974) * 265.9574 = -1075.495 (thousand rubles)

DGvor = UDf *DD *DV pl =0.903* (-5.757) * 265.9574 = -1382.5984 (thousand rubles)

The volume of production is also determined by a number of factors:

VPpl = Krpl * Dpl * Ppl * SVpl = 200 * 195.75 * 7.76 * 890.14 = 27042.81 (t.r.)

VPkr = KRf * Dpl * Ppl * SVpl = 195 * 195.75 * 7.76 * 890.14 = 26366.74 (t.r.)

VPd = KRF * Df * Ppl * SVpl = 95 * 182.73 * 7.76 * 890.14 = 24626.47 (t.r.)

VPp=KRf*Df*Pf*SVpl=195*182.83*7.854*890.14=24924.78(thousand rubles)

VPsv=KRf*Df *Pf*SVf=195*182.83*7.854*844.956=23659.58 (thousand rubles)

DVPtot = VPsv - VP pl = 23659.58-27042.81 = -3383.23 (thousand rubles)

DVPkr = VPkr - VP pl = 26366.74-27042.81 = -676.07 (thousand rubles)

DVPd = VPd - VP cr = 24626.47-26366.74 = -1740.27 (thousand rubles)

DVPp = VPp - VP d = 24924.78-246262.47 = +298.31 (thousand rubles)

Total: -3383.23-676.07-1740.27+298.31=-5501.26 (thousand rubles)

A factor such as the number of days worked by one worker (-4.974) had a negative impact on the volume of production, and the average working day had a positive impact on the main worker (-9.613).

According to our data, the average daily output of a working enterprise is lower than planned.

VPor = (176-172) * 235.814 * 7.76 * 1018.563 = +7455541.4 rub

VPr = (195-200) * 235.814 * 7.854 * 890.139 = - 8243057.1 rub

According to our data, the average daily output of a working enterprise is lower than planned by 11.72%. It decreased due to a decrease in the share of workers in the total number of workers, as well as above-planned full-day and intra-shift losses of working time, as a result of which it decreased by 7.98, 8.64 and 4.97 thousand rubles, respectively.

Thus, analyzing the data in the table, we can draw the following conclusions: the increase in the number of main workers and the increase in labor productivity had a positive effect on the size of output. But the size of production could have been even higher if the proportion of workers in the workforce had not decreased, if the number of working days had not decreased compared to the planned indicator and the duration of the shift had remained at the planned level.

Problem 4

Using the data presented in the table, calculate the influence of the extensiveness and intensity of the use of labor on the dynamics of sales revenue. Factors can be calculated using any method of factor analysis. Based on the calculation results, write an analytical conclusion.

|

Index |

Unit |

Symbol |

Rates of growth, % |

||

|

1. Revenue from sales of products |

|||||

|

|

|

|

||

|

Material costs |

|||||

|

Main production assets:

|

|

|

|

||

|

Working capital |

|||||

|

Total costs (cost price) |

|||||

|

Costs per 1 ruble of products |

|||||

|

Product profitability |

|||||

|

Output per 1 worker |

|||||

|

Salary intensity |

|||||

|

Capital productivity |

|||||

|

Material efficiency |

|||||

|

Turnover working capital |

|||||

|

Cost return |

Factor analysis of profit:

Where P is profit

N - sales proceeds

S - cost

There are the following types of deterministic analysis models - additive models - models in which factors (xi) are included in the form of an algebraic sum. For example,

where S is the cost of production

M - material costs

U - labor costs

A - depreciation

Spr - other costs.

Spl=50228+11628+8311=70167 (thousand rubles)

Sф=52428+1190+8726=73054 (thousand rubles)

Multiple models are models that represent a ratio of factors, e.g.

Where Z is the cost per 1 ruble of production.

A mixed and additive model with a new set of factors can be obtained.

R - average number of employees

D - labor productivity of 1 worker (average annual production per 1 worker)

The size of the wage fund depends on three factors: the number of employees, output per worker and wage intensity.

Dpl=79700:381=209.186

Dfact=83610:382=218.874

Z capacity=11628:79700=0.146

Z capacitance = 11900: 83610 = 0.142

Let us analyze the influence of extensive and intensive factors of resource use on changes in production volume using the absolute difference method.

In accordance with the deterministic approach, we use two-factor models that link the effective indicator (sales volume) with quantitative and qualitative indicators of use labor resources, fixed production assets, materials and working capital:

Let's calculate the impact of changes in factors on changes in the performance indicator

D N R = DR x D0 = +1 x 209.186 = +209.186 (thousand rubles)

ДND = Rф x ДD = 382 x 9.688 = +3700.816 (thousand rubles)

DNR + DND = +209.186 + 3700.816 = 3910 (thousand rubles)

DNF = DF xf0 = 4231x1.072 = +4535 (thousand rubles)

DNf = Ff x D f = 78581 x -0.008 = -628.648 (thousand rubles)

DNF + DNf = 4535 -628.648 = 3906.32 (thousand rubles)

ДNM = ДМхN0 = 2200x1,587 = +3491.4 (thousand rubles)

DNm = Mf x Dm = 52428 x 0.008 = +419.424 (thousand rubles)

ДNM + ДНм = 3491.4 + 419.424 = 3910.824 (thousand rubles)

DNE = DE x l0 = 234 x 4.98 = +1165.32 (thousand rubles)

DNl = Eph x D l = 16241 x 0.17 = 2760.97 (thousand rubles)

DNE + DNl = 1165.32 + 2760.97 = 3926.29 (thousand rubles)

The calculation results allow us to draw the following conclusions: sales volume increased in the reporting period by 4.9%, which amounts to 3,910 thousand rubles; Due to the increase in the number of employees, sales volume increased by 209.186 thousand rubles. The increase in output per employee had a positive impact (+3910 thousand rubles) on the performance indicator, which indicates the efficiency of the use of labor resources;

fixed production assets were also used quite efficiently; the growth in sales volume is partly due to an increase in their average annual cost (the influence of this factor amounted to 4,535 thousand rubles), but due to less efficient use of fixed assets, a decrease in capital productivity led to a decrease in sales volume by 628,648 thousand rubles. An increase in material productivity and working capital turnover led to an increase in sales volume by 419,424 thousand rubles, respectively. and 2760.97 thousand rubles.

Typically, the average annual cost of fixed assets is calculated when calculating. In this case, the balance sheet data for the calculation will clearly not be enough. The average annual cost of fixed assets, determined from the balance sheet, is usually used for analytical purposes. For example, to calculate capital productivity, capital intensity, capital-labor ratio. How to calculate the average annual cost of fixed assets based on balance sheet data?

Calculation of the average annual cost of fixed assets based on balance sheet data

Fixed assets in the balance sheet are reflected in the asset section I “Non-current assets”, line 1150 “Fixed assets” (Order of the Ministry of Finance dated July 2, 2010 No. 66n). Let us recall that according to this line, fixed assets are reflected in the net valuation, that is, minus the regulatory value in the form of depreciation (clause 35 of PBU 4/99). Thus, the indicator of line 1150 as of the reporting date is formed according to accounting data as follows ():

Debit balance of account 01 “Fixed assets” minus Credit balance of account 02 “Depreciation of fixed assets” (except for depreciation of fixed assets accounted for on account 03 “Income-earning investments in tangible assets”)

Despite the fact that line 1150 is called “Fixed Assets,” fixed assets, strictly speaking, are also reflected in line 1160 “Profitable investments in tangible assets.” After all, profitable investments are also fixed assets. Their difference from “ordinary” fixed assets is that income-generating investments are intended exclusively for provision for temporary possession or use for a fee. That is why they are taken into account separately on account 03 “Income-generating investments in material assets” (clause 5 of PBU 6/01, Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Accordingly, the balance sheet indicator of line 1160 is formed as follows:

Debit balance of account 03 minus Credit balance of account 02 (except for depreciation of fixed assets accounted for on account 01)

Therefore, the answer to the question of how to find the average annual cost of fixed assets based on balance sheet data will depend on whether or not to include profitable investments in the calculation.

If you are only interested in fixed assets accounted for on account 01, the average annual cost of fixed assets (AC SG) according to the balance sheet is calculated as follows:

OS SG = (String 1150 N + String 1150 K) / 2where Line 1150 N is the indicator of line 1150 as of December 31 of the previous year;

Line 1150 K is the indicator of line 1150 as of December 31 of the reporting year.

OS SG = (String 1150 N + String 1160 N + String 1150 K + String 1160 K) / 2where Line 1160 N is the indicator of line 1160 as of December 31 of the previous year;

Line 1160 K is the indicator of line 1160 as of December 31 of the reporting year.

The concept of average annual price (hereinafter - AP) in economics is interpreted as a value that reflects the change in the price of fixed production assets (FAP) throughout the year as a consequence of their commissioning and liquidation. Calculation of average annual cost is necessary for analysis economic efficiency production is carried out taking into account the initial cost of funds. We will tell you in the article how the average annual cost of fixed assets is calculated, according to what formula and indicators.

Characteristics of the average annual price of fixed production assets

When making calculations, the accountant must be guided by the following documents in force in the Russian Federation.

| Title of the document | What does it include? |

| PBU 6/01 No. 26n | Accounting for general fund |

| Guidelines for accounting of fixed assets No. 91n dated 10/13/2003 | Rules for the organization of accounting for open pension fund |

| Letter of the Ministry of Finance of the Russian Federation No. 03-05-05-01/55 dated July 15, 2011 | On the average value of property on which property tax is calculated |

| Tax Code of the Russian Federation, art. 376 | Determination of the tax base |

Calculation of the average annual cost of fixed assets

There are several options for calculating the average annual cost of fixed assets. The accountant has the right to choose one or even a number of calculation methods depending on the goals pursued.

| SP calculation method | SP calculation formula | Characteristic |

| The month of input (withdrawal) of fixed assets is not counted | SP = (OPF price at the beginning of the year (January 1) + OPF price at the end of the year (December 31)) / 2; price of OPF at the beginning of the year + price of introduced OPF - price of written-off | The book price of OPF is involved in the calculation; this option is considered less accurate, since the month when the OPF was entered and withdrawn is not counted |

| The month of input (withdrawal) of fixed assets is counted | Formula 1 (for economic indicators of capital productivity, etc.): SP = price at the beginning of the year + number of months from the date of entry of assets - number of months from the date of withdrawal of assets until the end of the year; Formula 2 (intermediate level): SP = (price at the beginning of the first month Price by the end of the first month Price at the beginning of the second month Price by the end of the second month, etc... Price at the beginning of the last month Price by the end of the last month) / 12; Formula 3 (definition of SP for taxation in the tax period): SP = (residual price at the beginning of the first month Residual price at the beginning of the second month, etc. Residual price at the beginning of the last month when calculating an advance for half a year, 3, 9 months, a denominator is taken equal to the sum of months and units | A reliable method, since all proposed formulas take into account the month of withdrawal (input) of assets, in addition, the method makes it possible to use several calculation options |

Data for calculation is taken from available documents:

- balance sheet (asset value);

- balance sheet according to account. “Fixed assets” (cost of introduced assets);

- credit turnover on account "Fixed Assets"

Of the described calculation options, taking into account the month of input (withdrawal) of funds, the formula for calculating the average level is recognized as the most accurate. This formula 2, by which the average chronological one is calculated, is also recognized as the most reliable. As for the calculation of SP for property tax calculations, Formula 3 is considered the only acceptable one for this type of calculation. Other calculation options are not used to calculate property taxes.

Example 1. Calculation of the average annual cost of fixed assets, taking into account the month of their entry (write-off)

The results of this calculation option look more convincing, since the calculations take into account the month of input (withdrawal) of assets. The following values are used for calculations:

- price at the beginning of the year (10 thousand rubles);

- the price of introduced OPF (150 thousand rubles - March, 100 thousand rubles - June and 200 thousand rubles - August);

- the prices of written-off general purpose pension funds are 50 rubles (250 thousand as of February, October).

So, the calculation is carried out according to the formula: price at the beginning of the year + (number of months from the time of entry / 12 * price of entered OPF) - (number from the time of withdrawal / 12 * price of written off OPF).

According to the SP calculation, it turns out: 10,000 + (9/12 * 150 + 6/12 *100 + 4/ 12 * 200) - (10/12 *50 + 2/12 *250) = 10,000 + (112 + 50 + 66) - (41 + 41) = 10,146 rubles. This is the value of the SP of the main assets.

Example 2. Calculation of the average annual cost of fixed assets without taking into account the month of their entry (write-off)

This is a simplified method of calculation, less accurate than that used in the previous example. SP calculation is made using the formula: (OPF price at the beginning of the year (January 1) + OPF price at the end of the year (December 31)) / 2.

The cost at the end of the year is calculated as follows: the price of the general fund at the beginning of the year + the price of the introduced general fund - the price of the written off general fund. For calculations, the digital data given in example 1 is used.

Analysis of the values obtained when calculating the average annual value of fixed assets in examples 1 and 2 So, in the two examples given, the same digital values were used. These data show that the entry and write-off of assets was carried out unevenly throughout the year. Thus, OPF were introduced in March, June and August, and write-offs were made in February and October.

SP calculation was carried out by two different ways: without taking into account the month of entry (write-off) of assets and taking it into account. The option for calculating SP, described in example 1, takes into account the month of entry (write-off) of fixed assets. It is complex, but more reliable. In example 2, a simplified calculation method was used for calculation (without taking into account the month of entry and write-off of assets). But it was he who gave the inaccurate result.

The difference in the obtained digital totals for the SP when calculating in the two examples is obvious. The value of the SP in the first and second examples is slightly different (10,145 rubles and 10,075 rubles). The difference is 70 rubles. Thus, if the input (output) of fixed assets is uneven, calculation of SP can be carried out in any way, but the one that takes into account the month of entered and written-off assets will be more accurate.

Common errors related to calculating the average annual value of fixed assets

Enough common mistake- inclusion of the value of land plots on the balance sheet in property tax calculations. Firstly, property tax is not deducted from plots of land. Secondly, only those lands that are the property of the organization are classified as OPF.

Another error is observed when calculating SP. When calculating for property tax calculations, the cost indicator of fixed assets is taken, the tax base of which is determined as the cadastral value. At the same time, the price of such funds does not need to be taken to calculate the residual value of assets when calculating SP.

Economic indicators characterizing the efficiency of using fixed assets

The degree of effectiveness of the application of OPF is determined by core economic indicators - capital productivity, capital intensity, capital-labor ratio. Thus, capital productivity reflects the ratio of finished products per ruble of general fund. Capital intensity is the amount of funds for each ruble of finished products. Capital ratio indicates the degree of provision of working organizations with assets.

The analysis of the economic indicators under consideration is aimed at finding, eliminating and preventing problematic situations in relation to the profitability of enterprises. To carry out calculation operations for these indicators, the SP of fixed assets is used. Calculations are carried out using different formulas:

- For capital productivity: volume of manufactured products / SP of fixed assets.

- For capital intensity: SP of fixed assets / volume of production.

- For capital equipment: SP of fixed assets / average number of employees.

The dynamics of these economic indicators throughout the year characterizes the consistency of the use of funds with different sides. Thus, the positive development of the capital productivity indicator, that is, its increase, indicates the effectiveness of using the general fund. Low capital intensity indicates sufficient efficiency of equipment use. In relationship, both indicators manifest themselves as follows.

The capital intensity increases, but the capital productivity decreases, which means that the organization is using irrational funds. Accordingly, measures should be taken urgently.

For research on the use of fixed assets, the dynamics of changes in each indicator are taken into account separately. Thus, the inconsistency in the use of resources is also indicated by an increase in the capital-labor ratio with low growth in labor productivity in comparison with the indicator.

Since the technical condition of the assets depends on the degree of their wear and tear, the relative wear rate is also of no small importance for the characteristics of fixed production assets. The depreciation coefficient is calculated as follows: the credited amount of depreciation during use (end, beginning of the year) / initial price of the general fund (beginning, end of the year). If the calculation turns out that the depreciation rate at the end of the year is less than the figure at the beginning of the year, it means that the condition of the assets has improved.

Answers to questions on calculating the average annual cost of fixed assets

Question No. 1. How do capital productivity and average annual cost relate to each other?

Capital productivity is considered by economists as a general economic indicator that shows the effectiveness of the application of general fund. High level capital productivity exceeding the industry average indicates that the organization is highly competitive, and vice versa. The level of capital productivity below the industry average indicates the organization’s non-competitiveness.

Question No. 2. How does capital productivity (fixed assets) affect profit?

When OPF and capital productivity exceed the amount of production and sales expenses, profits will also increase. As capital productivity increases, economic stability also increases, as does the efficiency of using funds. When the level of capital productivity falls, these characteristics decrease.

All calculations for the average annual price are carried out according to the standard formulas given. Nevertheless, it is more appropriate to use the exact calculation method given in example 1. If a number of general financial assets were entered and written off in a year, then the SP is calculated for each asset, taking into account the period of use. As a result, the results are summarized.

Question No. 4. How to correct accounting errors made last year (period) in the data that was used to calculate property tax?

Standard counting options:

- OPF input coefficient = price of entered OPF for the period / price of OPF on the balance sheet at the end of the year.

- OPF write-off ratio = prices of written off OPF by period / price of OPF on the balance sheet at the beginning of the year.

Fixed production assets (FPF) are means of production for long-term use: buildings, structures, machinery and equipment, etc.

To calculate depreciation charges and indicators of the efficiency of use of fixed production assets, their average annual cost is calculated.

We calculate the average annual cost for each type using formulas depending on the initial data.

For transmission devices, a disposal of 17,900 thousand rubles is planned. in the 1st quarter, the average annual cost of OPF is planned according to the formula

where F is the average annual cost of open pension fund, thousand rubles;

F 1.01 -- cost of OPF at the beginning of the year, thousand rubles;

FN.S.G. -- cost of OPF at the beginning next year, thousand roubles.;

F 1.02, ..., F 1.12 - the cost of the general fund at the beginning of each month, thousand rubles.

For machinery and equipment, it is planned to commission 84,300 thousand rubles. from June 1, the average annual cost of OPF can be calculated using the formula

where F VV is the cost of the OPF put into operation, thousand rubles;

F CHOICE - cost of decommissioned OPF, thousand rubles;

t 1 -- the number of full months remaining until the end of the year from the date of putting the OPF into operation;

t 2 -- the number of full months remaining until the end of the year from the date of disposal

OPF out of operation.

For vehicles, it is planned to retire 2800 thousand rubles. in August, the average annual cost of OPF can be calculated using formula 5

enterprise revenue costs profitability

Since the input time is 1620 thousand rubles. is not planned for computer technology, then the average annual cost of OPF can be calculated using the formula

F NG + SF BB - SF SELECT,

where F NG is the cost of OPF at the beginning of the year, thousand rubles;

F VV - cost of the OPF put into operation, thousand rubles;

F CHOICE - cost of decommissioned OPF, thousand rubles.

5300 + = 6110 thousand rubles.

We calculate the structure for each type OPF using machines and equipment as an example:

where is the average annual cost of OPF by element, thousand rubles;

Total average annual cost of OPF, thousand rubles.

We summarize the calculation results in Table 2.

Table 2 -- Average annual cost and structure of open pension fund

According to this RUES, the active part includes machinery and equipment, transmission devices, computer equipment, tools and vehicles, and make up 63.8% of the total cost of OPF. The passive part of the general public fund includes buildings and constitutes 36.2% of the total cost of the general public fund. In general, according to this RUES, the structure of the OPF is rational

During operation, fixed production assets (FPAs) gradually wear out, and their value is transferred to manufactured products.

Classification

To classify OPF, two criteria are used - the degree of participation in production process and the function being implemented.

Within the framework of the implemented function, the OPF is divided into:

- Building. Industrial premises, warehouses, offices, buildings, etc. Buildings can accommodate personnel and production equipment.

- Facilities. Facilities for obtaining and storing natural resources. For example, quarries, mines, tanks for storing raw materials, etc.

- Equipment. Machine tools, units, measuring instruments and computers used to convert raw materials into finished products.

- Tools. Inventory with a service life of more than one calendar year.

- Transport. Cars and special equipment for transporting raw materials, materials and finished products.

- Transfer devices. They deliver heat, electricity, gas or oil products.

All main production assets are reused during operation and retain their shape.

Grade

The structure and composition of the OPF affects:

- cost of finished products;

- the possibility of introducing new production technologies;

- the feasibility of privatization and rental of funds.

When assessing OPF, three methods of calculating cost are used:

- Initial. Calculation of the necessary costs for putting the fund into operation.

- Restorative. Determining the cost of an object taking into account current prices.

- Residual. Cost calculation taking into account wear and tear.

Types of wear

Deterioration of the OPF can be moral and physical.

Obsolescence

Reducing the cost of OPFs makes their use inappropriate due to the emergence of new technologies and equipment samples.

Physical deterioration

Material wear and tear of funds and their deterioration technical characteristics due to thermal, chemical and mechanical impact during operation.

Result of use

The result of the use of fixed production assets reflects:

- capital intensity;

- capital productivity.

Capital intensity is the ratio of the cost of the open investment fund to the cost of the volume of production. Capital productivity is the ratio of the cost of the volume of manufactured products to the cost of the general operating fund. You can increase the return on use of fixed assets by:

- hiring qualified employees;

- increasing the intensity of use of OPF;

- conducting high-quality operational planning;

- increasing the share of equipment in the structure of the enterprise;

- carrying out technical modernization.